The numbers are staggering, and the industry is not going away.

The U.S. possesses the most extensive gas pipeline delivery network in the world.

More than 189 million Americans and 5.6 million American businesses use natural gas.

And America’s natural gas utilities invest $33 billion every year in capital and maintenance projects for distribution and transmission systems.

So, to understand and profit, follow the money.

Let’s dig in…

Could Trump Kickstart a Sleepy LNG Sector

Liquefied Natural Gas (LNG) is likely to benefit the most under a second Trump administration compared to a Biden continuation.

Biden’s stricter environmental regulations have halted new LNG projects due to environmental concerns, a shift following the recent classification of natural gas as a transitional fuel at the COP Summit.

Under a Trump Administration for example, these LNG projects could quickly gain approval for several reasons:

- They create many jobs, reducing unemployment.

- These positions offer high wages in both construction and operation.

- Once operational, they provide significant, stable corporate tax revenue.

- They align with Trump’s goal of energy dominance.

The U.S., currently the top LNG exporter worldwide, owes much of this status to Trump’s 2016 energy policies.

These policies, coupled with low-interest rates, enabled companies like Cheniere, Sempra, and Energy Transfer Partners to start building LNG infrastructure.

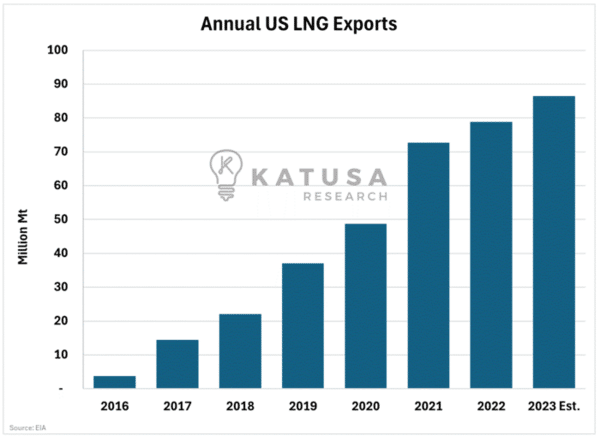

The chart below illustrates the sharp rise in U.S. LNG exports.

The challenge for Trump is if he hits China with tariffs, naturally, China is going to retaliate.

One of the ways China may do that is by refusing to buy US LNG. However, currently, China is not one of the USA’s largest consumers of US LNG.

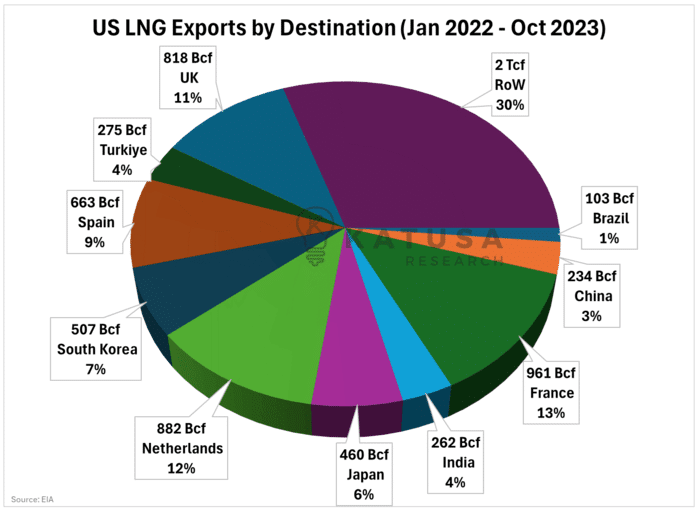

The chart below shows total American LNG exports from Jan 2022 through to October 2023.

As you can see, the US has directed the vast share of its LNG to Europe and the UK.

This means that tariffs or bans on US LNG cargo would not be catastrophic for the US LNG industry. It is likely that cargoes could be rerouted.

But regardless of who wins the election…

The Pacific Gas Wars are Here

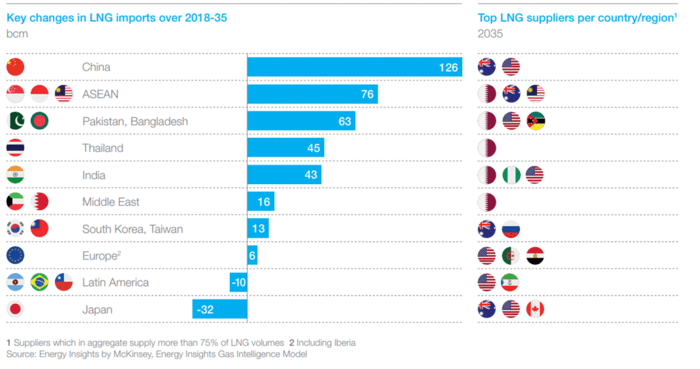

Asia is the true growth engine for LNG for the next 15+ years and China will be a key demand driver. It’s expected that China could represent up to 40% of future LNG demand out to 2035.

- The challenge for China is that domestic gas producers currently provide ~55% of total natural gas consumption.

By 2035, domestic gas production is expected to be in the 40% range.

Russia, Australia, and the US are expected to be large suppliers of natural gas to China.

Trump’s term can only last 4 years, but damaging an already delicate relationship with China could present a challenge later in the decade.

The LNG sector is incredibly complex with many moving pieces. Here is an example of a real scenario that could occur.

- A company sources natural gas in Canada.

- Transports the gas across North America.

- Compresses the gas in Texas.

- Ships the gas to Asia.

- De-compress the super-chilled natural gas for the user, who then…

- Transports it via pipeline to its final destination.

You’re likely thinking, jeez that sounds complex, lots of moving parts and expensive. Frankly, you’re not wrong.

Leasing a boat will cost upwards of $50,000/day!

Pipeline costs vary considerably depending on whether the contract is spot or part of a long-term arrangement but could easily fetch $1/MMbtu. And insurance for the LNG (once it’s on the water) also costs money.

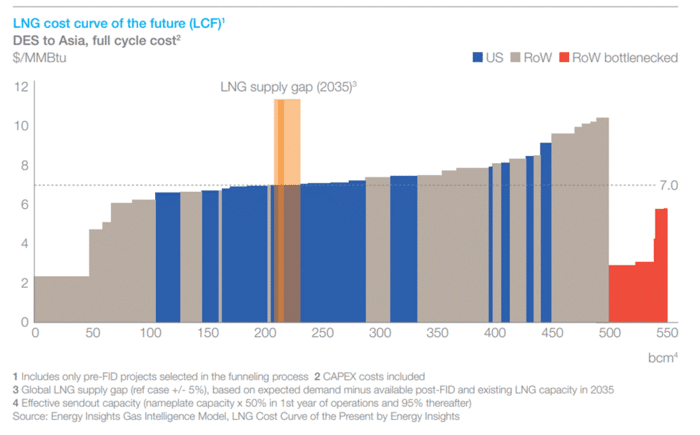

Below is the cost curve to ship LNG to Asia, as you can see in blue, much of the U.S. LNG is in the bottom half of the cost curve.

For reference, the current selling price of LNG in Japan is $9.57/MMbtu. Meaning almost all American LNG is profitable.

I believe Biden’s actions could create selling pressure on U.S. LNG names.

This could create a solid trading opportunity to buy on negative news and then use Trump’s reinstatement of projects as a positive catalyst for the sector.

Spotlight on a Mysterious Energy Giant…

We’re tracking a major player in the liquefied natural gas (LNG) market right now.

This U.S. leader, also a global frontrunner, is set to dominate over 50% of America’s LNG exports in 2024, and becoming Europe’s top supplier…

The real winner of Europe’s anti-Russian stance in many ways…

Dominating as the top LNG supplier to Europe, which makes up 10% of Europe’s total natural gas imports.

Founded in the 1990’s as an oil and gas firm, it pivoted from LNG importing to exporting after 2008, aligning with the shale gas boom.

However, the shale gas revolution spurred a dramatic pivot, transforming it from an importer to a leading exporter of LNG.

By 2010, this company was making bold moves, initiating LNG export infrastructure development at its flagship facility.

- By 2023, it completed 3000 shipments, investing over $34 billion in LNG infrastructure.

Expansion has been a key theme for this company.

And now with two major ports, it can export up to 45 million tonnes of LNG yearly, driving significant revenue.

The identity of this LNG giant?

That remains our little secret for now for our subscribers to Katusa’s Resource Opportunities.

Keep a keen eye on this one.

Regards,

Marin Katusa and Rob Fuhrman

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.