The global “reopening” trade continues as economies surge on improving consumer demand.

Let’s just hope the delta variant doesn’t shut things down in the fall again.

Today we’re going to look at some current data on everyone’s favorite debate: Inflation. And then talk about what it means for gold.

I get a kick out of experts, fund managers, talking heads and nearly everyone I meet arguing, debating and trying to convince others on their views of inflation, stagflation, transitory inflation, deflation and everything in between.

I bet that “transitory” is the most searched economic term of 2021.

Hell, even doctors are using ‘transitory’ now to explain lingering side effects from the different vaccines.

Most of what you’re watching and reading is verbal diarrhea.

Always question what you’re watching and reading with this simple filter – “What kind of skin in the game does this person have.”

If you don’t have your own money on your thesis, then chances are you’re going to lose my interest quickly.

Now let’s get to it…

Cross-flation

Around the world, inflation is the key focus. With enormous amounts of stimulus and a red-hot economy, inflation in many parts of the economy will happen. I coined the phrase in my book, “cross-flation”.

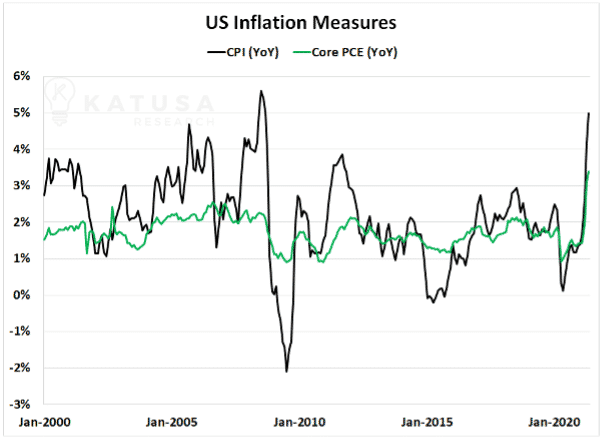

In the U.S, there are two core measures of inflation.

- The Consumer Price Index (CPI) and

- The Core Personal Consumption Expenditure.

You can argue that both methods are rather outdated, but they are bell-weather metrics that politicians and the US Federal Reserve use to help in their decisions.

By either measure, inflation is evident as shown in the dramatic spike over the past 2 months…

However, one should tread carefully because the baseline is data from shortly after the pandemic when economic activity was very low.

So, it is easy to juice these numbers and expect inflation to be worse than it appears.

The true test of how inflationary things are will come later in 2021 when Sept-Dec 2021 data is compared to Sept-Dec 2020 data.

In Europe, the CPI shows a similar spike, though the 2% range would be considered healthy under normal economic conditions.

Looking at sources of alternative measures, such as the IMF World Food Price Index, shows major increases in the global price levels of food.

In the real world, you’re seeing everything from gas prices to luxury purses increase in price.

In short, there are certainly inflationary pressures.

But at this point, nothing that requires central banks to alter their course of stimulus packages and interest rate policy.

Golden Hedge for Inflation

Gold has long been argued as an inflation hedge.

Dramatic inflationary conditions can lead to a loss of confidence in the nation which can cause a currency death spiral.

This leads to a very weak domestic currency, while real assets such as gold, art, and real estate will appreciate.

- However, a littleinflation is bad for gold. The reason is that inflation is mainly controlled through interest rate policy.

To curb inflation, central banks raise interest rates.

Higher interest rates incentivize domestic and international investors to buy domestic bonds. This increases the demand for the domestic currency, leading to a higher valued currency relative to its peer nations.

- In this case, if the US Federal Reserve were to raise rates, the US Dollar would rise and because gold is priced in US Dollars, it would fall.

Do I think the Federal Reserve fears inflation and will raise rates in a big way this year?

No, I don’t. For several reasons:

First, the US is not back to full employment. The economy can continue to expand at an above-average pace so long as the country is below full employment.

Second, the era of double-digit interest rates or even 5% money is a long way away.

We are in the realm of low-interest rates (and NIRP) and these policy stances are not going away.

Raising rates to 5% would cause enormous stress on the system and likely lead to catastrophic failure locally and financial contagion.

Will History Repeat Itself?

For the last 20 years, relative to its peer nations, the US economy has emerged stronger from economic collapses.

This can be measured in many ways, such as GDP growth. And another very useful, but not so often mentioned tool is interest rate determination.

Central banks raise interest rates when economic conditions are strong and cut interest rates when conditions are weak.

As you’ll see in the next chart, through the tech bubble, the global financial crisis, and the Coronavirus pandemic the US always had the highest interest rates compared to its peers.

This is especially evident since 2008 when after a brief stint, the EU was forced to cut its interest rates to zero, while the US raised rates a handful of times.

As we look at the global economy, most nations are worse off today than they were pre-pandemic.

For example…

Japan cannot change from the zero-interest-rate policy it struggled with over the last two decades. The EU has negative interest rates, a struggling banking system and many highly indebted member nations. It’s hard to see them as a pillar of economic strength right now.

Canada is a major trading partner of the United States, it will try to closely mimic its interest rate policy. Being a commodity-driven nation, high commodity prices will also justify higher rates in Canada. Given the economic outlook abroad, it is hard to see any developed economy strengthening relative to the United States.

The BRICs (Brazil, Russia, India, China) will show strong economic growth, but none have shown themselves capable of being a responsible global leader when it comes to trade or central banking activity.

US Dollar Importance

- On a global basis, I remain firm in my US Dollar position.

There is a lot of negativity surrounding the demise of the dollar, death of the dollar, destruction of the dollar, and all other fear-driven narratives. I’m not in that camp.

As I’ve said many times before: The US Dollar only has to be the strongest currency relative to its peers.

I see no reason for the US Dollar to lose its reserve currency status. Below is a chart which shows the US Dollar versus a basket of global currencies.

Gold and Potential Headwinds

Gold has struggled for most of the year as investors have bought risky assets and sold safe-haven assets.

This past June was the worst-performing month for gold since November 2016.

- While we may not always like it, we must respect the price action in gold.

Inflationary conditions are not rampant, and US bond prices have weakened sending yields higher. This puts pressure on the gold price.

Below is a chart which shows the gold price versus the real return of the US 10-year bond. You will see that as real yields bottom, gold has a tendency to peak.

At this time a year ago, I was pitched more gold deals, financings and projects than in the previous 3 year combined.

When you start to see the “rounders” coming back into gold after being in crypto and cannabis, still flogging the same exploration moose pasture…

…you know it’s starting to get a little overheated.

That – along with many other underlying factors – led me to take Katusa free rides and profits off many gold positions and rotate into other opportunities with more upside in mid to late 2020.

It wasn’t a popular move, which made me all the more confident about it.

I like to make moves well in advance of others, to take advantage of liquidity and sell into periods of relative strength. And buy in periods of relative weakness.

I anticipated a correction, which now allows me to scoop up shares at a massive discount to last summer’s prices.

While gold was (and still is to some degree) retreating and consolidating, many of my subscribers to Katusa’s Resource Opportunities and I still made money on our gold picks.

One such company is up nearly 5x our money in just over 12 months.

And now the Way of the Alligator is working in real time and I’m methodically buying new tranches in my favorite gold stocks.

If the gold stocks correct further, I am ready, like an alligator to attack. My subscribers who followed my guidance are now strongly positioned with lots of attack capital.

My long-term bullish view of gold is intact. But I’ll use any weakness in the short term to build my positions.

You can read the exact moves I’m making by becoming a member of my premium research letter – Katusa’s Resource Opportunities.

I hope you’ll join me and all the other alligators.

Regards,

Marin Katusa