What I’m about to show you is frightening to some people…

And will become lucrative to a select few others. So there’s no way to sugar-coat this.

The mining industry loaded itself up to the gills with low-cost debt when commodity prices were a lot higher than they are today.

This was in an attempt to advance their assets towards production.

The Secret Investment Vehicle of the Ultra Rich – Debt

Here’s something critical in the hierarchy of a company’s capital structure that you need to know…

The rights granted to the debt holder supersede the rights of the shareholder.

Let’s use the example of a producing mining company that has debt on the balance sheet and pays a dividend in a falling commodity environment…

In simple terms, if costs stay the same while the commodity price goes down, the business will generate less free cash flow.

The company must either pay interest on the debt or default on the debt.

And debt always gets paid before the dividend.

If the company can’t pay the debt, then the debt holders have rights to the value of the asset before the shareholders.

Debt holders and management always get paid before shareholders.

If there’s less cash available for the dividend, the dividend will get reduced or cut completely.

This is why I always say…

Debt holders’ claims to the assets almost always supersede shareholders’ claims to the assets of the company.

Before we go on, let me quickly define some terminology I’ll use.

Equity: Shares in a company that were raised from an equity offering such as a Private Placement, IPO, etc.

Bond: A debt security that pays a coupon, with the principal repaid at a predetermined date in the future (maturity date).

Coupon: The nominal interest rate paid on a bond (5% coupon pays 5% interest annually).

Why are Debt Deals Rarely Talked About in the Media?

…Or even in newsletters and at investment conferences?

When a mining or energy company goes out to issue a large bond (say $200 million–$1 billion), they go to the big banks like Goldman Sachs, Credit Suisse, or Deutsche Bank.

You will rarely see the brokerages that are well known for raising equity in the “junior” or even mid-tier mining sectors like Haywood, Sprott, GMP, Canaccord, etc., run the book on bond issues.

Big banks like Goldman Sachs have a very specific list of bond/debt investors who invest in bond issues.

These deals are pre-marketed to these “special” bond clients.

Rarely will a fund, family office or retail investor get a piece of the action.

That is, unless they are somehow connected to the company or firm running the book on the bond issue.

But pay attention and I just might show you how you can participate…

Pay Your Debts or Pay the Price

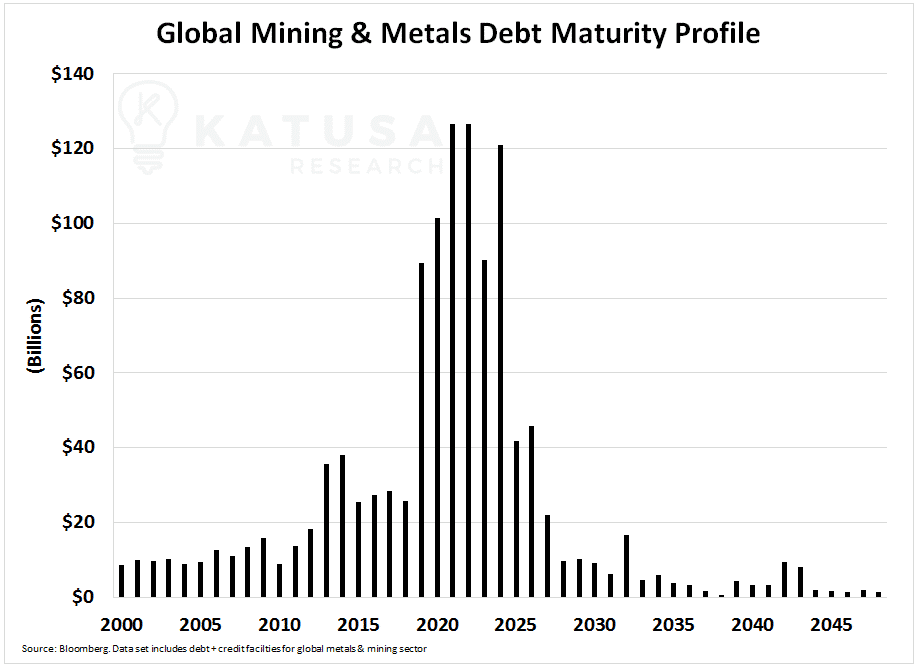

The chart below is frightening…

It shows how much debt is due every year for every mining company in the world combined.

I am one of the few in the mining sector who holds this belief:

Over the next 24 months, Interest rates paid by mining companies will be significantly higher than the rates paid when the big debt was piled on.

And we’re starting to see this happening in real time.

Eldorado Gold’s most recent note offering at 9.5% was a 55% higher cost than their previous note of 6.125%.

The fact is, mining companies used debt as part of their operational business plan. Think of this like cheap financial heroin while commodity prices were high instead of issuing equity (dilution).

Sadly, many companies now have lower equity prices and a lot of debt.

There’s a harsh reality that no mining CFO wants to talk about. It’s that the cost to extend or replace the existing debt on their balance sheets will rise -substantially.

If you believe commodity prices are headed lower, this puts an even larger strain on the sector.

Remember, debt holders and management salaries get paid first.

So it’s the equity shareholders that will suffer.

First I’m going to show you why, and then I’ll show you how I will position myself and subscribers to profit.

A Real World Example…

Since I’m Canadian, let’s pick on Canada’s largest diversified miner, Teck Resources (NYSE:TECK and TSX:TECK.A/B).

Teck’s borrowing cost, pre-global financial crisis, was 6.13%.

At the peak of the mining boom in 2012, the debt cost 5.2%. Both debt issues were 30-year bonds.

In 2016, the debt cost rose to 8.5% for an 8-year coupon.

It’s common that a longer duration bond will have a higher interest rate. If Teck is paying 8.5% interest on an 8-year bond, investors should reconsider what the debt for lower-quality miners would cost.

A counterargument to my example is this: 2016 was a much worse commodity pricing environment than 2012 or 2005.

To that I say… who says 2020 or 2021 won’t be worse?

The point is, the cost to borrow money from investors increased 63% for Teck Resources between 2012 and 2016. This is Canada’s largest miner – one of the top ten globally.

But let’s not stop there to prove our point.

My friends at Taseko Mines (NYSE:TGB, TSX:TKO), Canada’s second largest copper producer, are another example of this…

So even though the Taseko bond was at 8.75%, the yield to maturity now trades at a little over 11%.

- That is a 42% higher cost of capital than in 2011.

Now, before people start thinking I’m taking a swing at Taseko because I’m one of the founding directors of Copper Mountain (TSX:CMMT), a direct competitor to Taseko (Copper Mountain is Canada’s third largest copper producer)…

I am not.

The chairman of Taseko Mines, Ron Thiessen, is a close friend of mine. He’s probably one of the smartest men in mining and I respect him greatly.

I believe the debt for all other mid-tier copper producers will be higher than it was when they did their original debt financings over the last 7 years.

The point I am making here is that the cost of capital for all mining companies is going higher.

For the most part, the mid-tiers will be paying interest rates in the double digits.

We have many more examples confirming from our thesis of higher costs to borrow.

Here’s How I Plan to Profit With an Immediate Opportunity…

After months of due diligence, we’ve just released terms on our newest private placement.

The terms are very lucrative and I will be backstopping 50% of the offering. This means I will be taking a very large position.

All KRO subscribers are provided the opportunity to invest at the same time and terms as me and employees of Katusa Research.

As always, ZERO fees and ZERO commissions are paid to me, Katusa Research or anyone. This is 100% skin in the game, which is my mantra.

I believe this is one of the best structured financings in the market.

I just sent out a full analysis with the details of the company to my subscribers and showed why I am taking so much of the financing.

All the information on how to participate is in the Members Area.

And you’ll think of this structure as getting paid until the stock pops.

If you’re not yet a subscriber to Katusa’s Resource Opportunities and you want to get on board, learn how to become a member right here.

This opportunity will fill up fast.

But there will be a lot more exclusive opportunities to come. That’s the Katusa Advantage.

Regards,

Marin