One major mistake I made in 2017 was selling Kirkland Lake (KL.T) too early.

Today it is by far the best performing North American listed gold producer from a share price perspective. I recommended Kirkland Lake to my subscribers at $7 per share. Last month, the stock cracked $30 per share.

Kirkland Lake Gold is a company that I am very familiar with.

And I have owned it several times.

The company started out like most do. Several management teams and ideas came together at the right time. And in the right sequence.

The first meeting the new management team at Crocodile Gold had in 2015 was with me in my Vancouver office. After the meeting, I bought 10 percent of the company.

The first report published when I opened the doors of Katusa Research was on this company. In fact, the first institutional level report published on their new business plan with Crocodile Gold becoming Newmarket Gold was the report I published. Newmarket Gold merged with Kirkland Lake Gold, and under Tony’s leadership, Kirkland Lake has become the $5 billion powerhouse it is today.

Then in the November 2017 issue of Katusa’s Resource Opportunities titled “Get Ready to Buy: Bargain Season is Coming”, I recommended Kirkland Lake Gold to my subscribers.

The market failed to recognize the cash flow generation of the newly merged company, and the incredible assets that came from the Newmarket side of the transaction.

A company with such high-quality assets and cash flow should have been trading at a premium. Instead, it was trading at a significant discount.

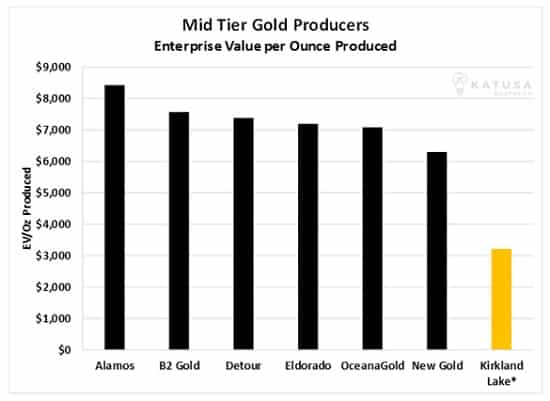

One of my favorite peer comparison metrics is the Enterprise Value per Ounce multiple. It’s an apples to apples comparison between a company’s Enterprise Value (Market Cap + Debt – Cash) and its gold production. At the time it had an enterprise value per ounce of gold produced much lower than its peer group…

This was just one of many comparables I published in the report to my subscribers.

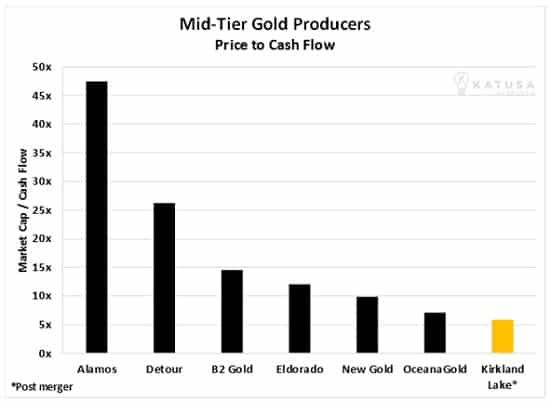

Another comparable I used was the company’s cash flow per share compared to its peer group. The chart below shows the Price to cash flow of the intermediate gold producers from 2016.

At the time of that Nov 2017 publication, the stock was trading at CAD$8.29.

But I was not comfortable buying at those prices. I wanted to buy it like an alligator under CAD$7.00.

And that’s the guidance I wrote to my subscribers:

There is no need to rush out and buy a full position and wait for the repricing back to the peer group. This will take alligator-like patience. Accumulate stock slowly and always buy on weakness; do not overpay for the stock.

A couple of weeks later, patience prevailed.

We were able to purchase the stock under the buy target. My investment thesis was proving correct over the next several months as the market started to wake up to Kirkland’s potential. Take a look…

Months later, Kirkland Lake Gold was the top performing gold stock in the first quarter of 2017. We closed our position with a big gain.

Yes, I sell too early. I know. My wife tells me all the time. So does Doug Casey. But they have both done incredibly well with me.

To succeed in resource stocks, you must be willing to stalk assets and wait for exactly the right time to buy. When the stars align and we get a great price on one of our stocks, we strike.

As I often say, you are the alligator. Your list of assets is your prey.

By “stalking,” you’ll get them at the right time, at the right price.

Now it’s Kirkland Lake’s Turn to Justify its Share Price

Today, Kirkland Lake is Eric Sprott’s largest publicly disclosed resource position.

He owns 22 million shares, roughly a CAD$560 million piece of the company.

Other companies have seen their share prices depreciate in these tough precious metals markets. Meanwhile, Kirkland Lake shares have appreciated sharply.

Given this unique situation, I believe Kirkland Lake should backfill their share price. It’s a polite way of saying that Kirkland Lake is expensive relative to its peers. Eric, Tony, and the crew at Kirkland Lake are smart. I believe they will use their “currency advantage”, aka expensive stock, to buy an undervalued gold producer.

Management know this.

I know this.

Investment Bankers know this.

And now you know this.

So, why am I focusing on Kirkland Lake?

Because the share price is ahead of itself.

And management, being smart, will use their “expensive share price paper” to take over an “undervalued” producer and improve the value of Kirkland Lake.

Below, I detail my methodology for finding these next takeover targets.

Who Will Kirkland Lake Buy? Katusa’s Gold Producer Takeover Methodology

I called a meeting of the Katusa Research brain trust and we got to work. For those readers that want to know the criteria that we used, here you go.

First, you want to identify single producing projects that are:

- Not owned by majors;

- Located in non-AK47 nations;

- Producing at least 75,000 ounces of gold per year.

I’ll save you some time and tell you this. There are over 600 producing gold mines in the world.

I ran the criteria above through more filters and cross-referenced my mining database. I then eliminated the following:

- Low-grade projects;

- Projects with short mine lives (less than 8 years with no exploration potential);

- High-cost mines (cash costs of more than $800 per ounce; general rule of thumb – if cash costs are $800, all-in sustaining costs could be as high as ~$1,200 per ounce).

Again, I’ll save you the time. I came up with a list of 89 potential mines.

From the remaining list, we combed through each individual project. This is the criteria that we used:

- Who would it be a good fit for?

- Does mining the deposit need a unique skill set which discourages many potential suitors?

- Are there any potential synergies with mines operating nearby?

- Is there some low-hanging fruit to be plucked which creates extra value for the buyer?

Kirkland Lake Gold has the market cap (CAD$5.3 billion) and the cash (CAD$400 million) to make significant waves in the gold sector.

I believe gold is going lower and gold equity prices will drop with it. I also believe that tax loss season (just a few months away) will add to the selling pressure, and that this will happen to even the most likely takeout candidates.

If you’re a director or on the management team of a gold company, you need to know if you’re on their radar.

I’m ready.

My subscribers are ready.

Are you ready for the coming race for the best undervalued gold assets in the world?

Regards,

Marin

P.S. From the original list of 600 possible mines, I’ve targeted four companies that I believe could be acquired by Kirkland Lake. And I’ve just published those names and tickers to subscribers of my premium research service, Katusa’s Resource Opportunities. To learn more about becoming a subscriber – click here.