Gold just had its best year since 1979. Silver more than doubled.

Then both sold off hard, right when the reasons to own them were getting stronger.

Liquidity is breaking down in corners of the financial system most people aren’t watching.

Two multi-billion dollar companies collapsed last September on fake invoices and double-pledged collateral.

JPMorgan, Jefferies, and Barclays all had exposure but none of them caught it in time.

In early 2008, nothing felt broken either. Leverage, funding, and trust between institutions were already cracking beneath the surface. Then the whole system came apart, but not as a stock crash… it was liquidity collapse.

The same conditions are forming again.

A World Built on Leverage

Modern economies run on leverage.

Governments borrow to roll deficits; corporations borrow to fund growth and funds borrow to amplify returns.

Even conservative strategies depend on short-term funding staying available.

For more than a decade, that structure worked because liquidity stayed abundant. Rates stayed low. Risk stayed hidden.

After 2008, banks pulled back and regulation tightened. Something else stepped in.

Private debt.

Private credit funds started lending directly to the borrowers banks wouldn’t touch. Middle-market firms. Auto lenders. Roll-ups. The loans don’t trade often, don’t get marked daily, and offer higher yields in exchange for opacity.

At first, private debt filled a gap.

Over time, it became essential.

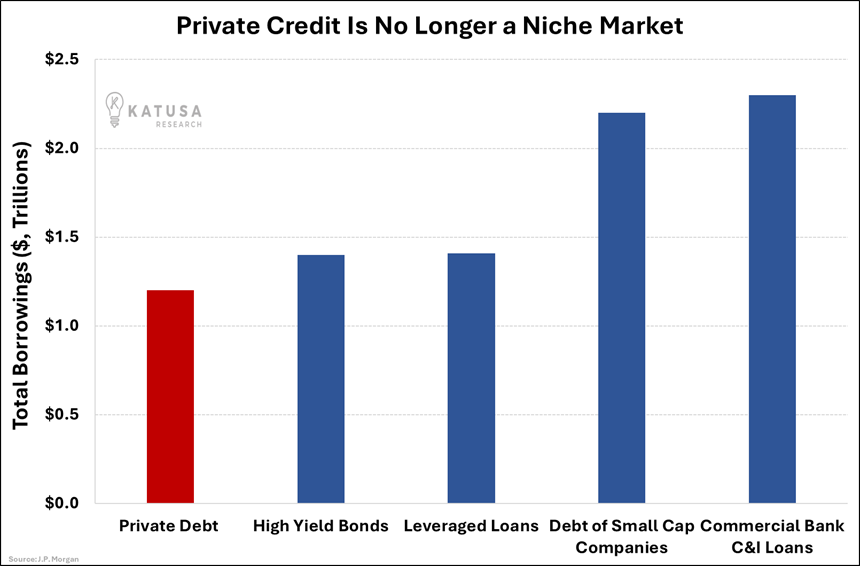

J.P. Morgan estimates private credit assets at around $1.2 trillion, and the growth rate explains why it now sits at the center of the system.

- Over the past decade, private credit expanded at roughly 14.5% per year, while traditional bank lending grew closer to 3%.

Banks now lend hundreds of billions to private credit managers, private equity firms, and BDCs.

Pension funds allocate to them. Insurance companies rely on them for yield. The credit risk moved off bank balance sheets. The funding links didn’t.

The system doesn’t just touch private debt. It leans on it.

In Leveraged Systems, Failures Rarely Arrive Alone

Jamie Dimon said it best last year…

“If you see one cockroach, there are more behind the wall.”

First Brands, a $5 billion-revenue auto parts company, grew by borrowing aggressively and refinancing constantly.

Prosecutors allege executives used fake invoices and pledged the same collateral multiple times.

When it filed for bankruptcy in September, it had $12 million in cash and over $9 billion in liabilities.

Tricolor collapsed the same month. It ran subprime auto loans — already one of the more fragile corners of consumer credit. Prosecutors allege executives manipulated loan data and double-pledged collateral to multiple lenders at once.

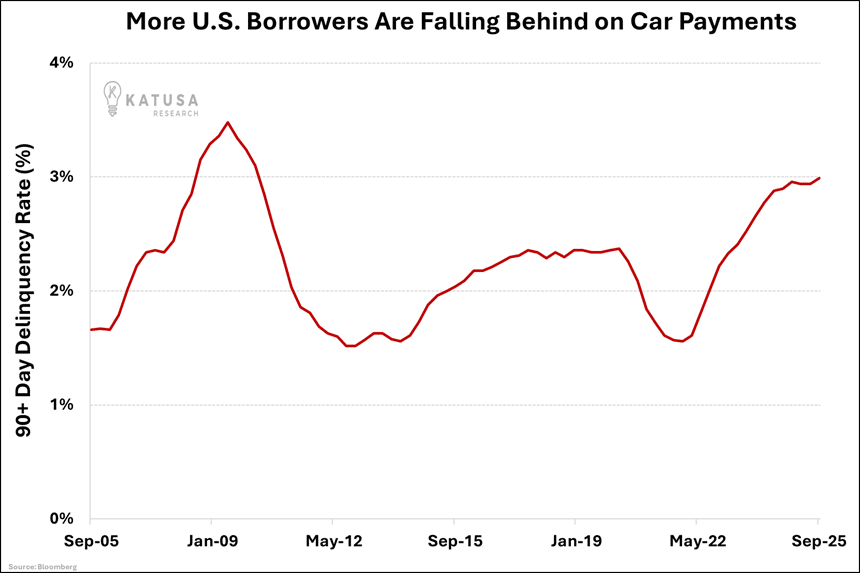

Auto loans often reveal financial stress before it spreads.

These were not fringe businesses.

Auto parts. Auto loans. Ordinary consumer credit. They didn’t fail because demand vanished overnight. They failed because leverage met weak oversight while funding conditions tightened.

Late-cycle failures always look like this.

Why This Resembles the Start of 2008

The 2008 crisis did not begin with Lehman’s collapse. It began when lenders stopped trusting collateral.

Funding markets seized. Repo desks pulled back. Margin calls cascaded. Assets that looked stable got liquidated. That same mechanism is visible again.

The global repo market — the overnight funding system that allows banks and hedge funds to borrow cash against government bonds — now totals roughly $16 trillion, with close to 60% tied to the U.S. market.

That concentration increases fragility.

Repo works on confidence. When it cracks, leverage unwinds quickly.

- Hedge funds that rely on daily refinancing must sell immediately when funding tightens.

Now connect that to private debt. Private credit depends on confidence, rollover, and valuation stability.

When liquidity tightens, the weakest credits surface first. Documentation gets questioned. Fraud surfaces. And lenders start pulling back.

This is how systemic stress begins.

Markets Are Already Sending Warnings

You don’t wait for defaults to confirm a liquidity problem.

You watch behavior.

Capital has been moving away from risk for months. Valuations across growth sectors have reset. Capital moved from growth toward safety. The pattern is consistent: money looking for shelter.

Precious Metals Feel Liquidity Stress First

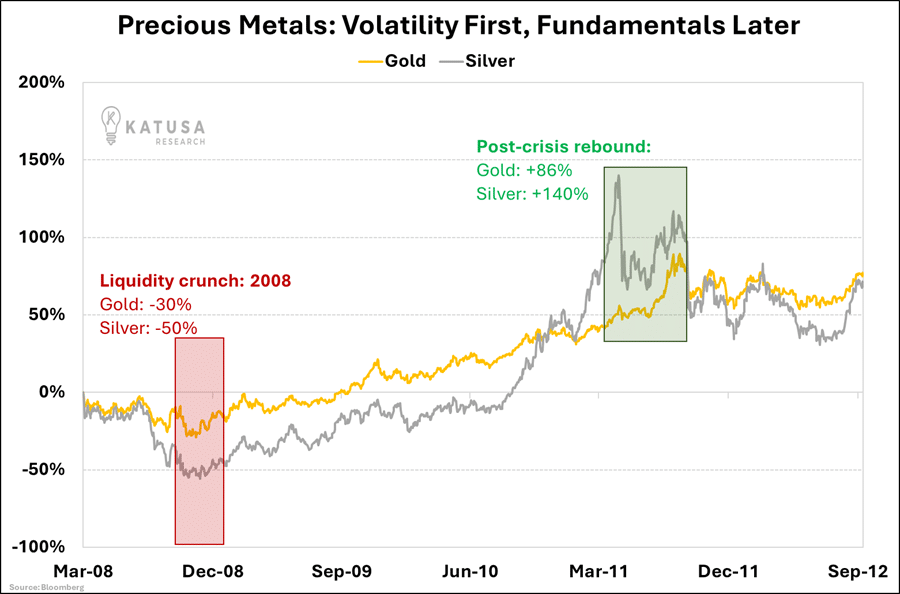

When liquidity tightens, even safe havens sell off early. At the peak of the 2008 crisis, gold fell roughly 30%. Silver collapsed more than 50%. Those declines had nothing to do with long-term value.

Everything was sold to raise cash.

Only later did gold and silver surge. The same setup is happening now.

- Since December 2025, CME has raised margin requirements on gold and silver multiple times.

Then switched to an entirely new percentage-based model in January.

Each hike forces traders to post more cash — and in stressed markets, that cash comes from selling positions.

That’s why gold and silver corrected sharply even as the reasons to own them got stronger. Silver took the worst of it because the U.S. silver market runs on paper.

When margins spike, paper positions unwind first.

Physical demand catches up later.

How Contagion Builds

Liquidity stress doesn’t blow up all at once. It builds. Repo tightens. Private credit strains. Risk assets sell off. Margins rise. Forced selling spreads.

Then correlations spike. Everything sells together. And differentiation disappears.

That’s when fear shows up.

Why Physical Gold and Silver Matter in the End

Liquidity crises punish leverage and they reward durability.

Physical gold and silver don’t rely on refinancing. They don’t face margin calls. They don’t depend on counterparties staying solvent.

Demand for physical exposure is already rising.

Across Asia, gold and silver accumulation continues to grow — a bet on assets that sit outside the credit system entirely.

Gold and silver rarely move straight up in these moments. They sell off early as margin calls force liquidation and that phase feels confusing, even bearish. It never lasts.

Once leverage clears and confidence breaks, capital stops chasing returns and starts seeking refuge.

That’s when physical assets reassert their role. Not as trades. As balance sheets outside the system.

Volatility now is not a warning sign for gold and silver.

It’s the setup.

And I’m positioning my portfolio accordingly.

Regards,

Marin Katusa

Get real-time alerts right away. Follow on X: @KatusaResearch and @MarinKatusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.