The creator of the wildly popular junior gold stock ETF has a 4 billion dollar problem.

Although the mainstream media is reporting on this big problem, it’s missing the story’s most important detail… one that could help you make large capital gains over the next 12 months.

I believe that very soon, a major issue with the junior gold stock ETF will create an opportunity to buy some of the world’s most valuable junior gold companies for pennies on the dollar… all thanks to a coming tsunami of selling that has nothing to do with the companies themselves.

And it’s all thanks to a developing story in the popular VanEck Junior Gold Miner ETF (symbol GDXJ).

I expect the opportunity around the corner will be so big that I’m getting millions of dollars of my own money ready to deploy. You could say I’m “amassing troops at the border.”

This situation is urgent. It’s going to arrive quickly and play out quickly. And as I’ll explain, what’s coming in just a few short months may be the last great gold stock buying opportunity you get for a decade.

How ETFs Could Create a Big Gold Opportunity in Less than 2 Months

Over the past decade, ETFs have become one of the world’s most popular investment vehicles.

Investors love idea behind ETFs: Buy and sell broad baskets of stocks with “one click” ease. This area of the market now holds over $2.5 trillion worth of assets.

One particular ETF, the VanEck Junior Gold Miners ETF (GDXJ), is a big hit with gold stock investors.

It’s a one click way to buy a basket of small cap (aka “junior”) gold exploration, development, and production companies.

Investors reckoned that by holding GDXJ, they get “juice” on the upside, but not the downside risk associated with owning just one or two gold juniors.

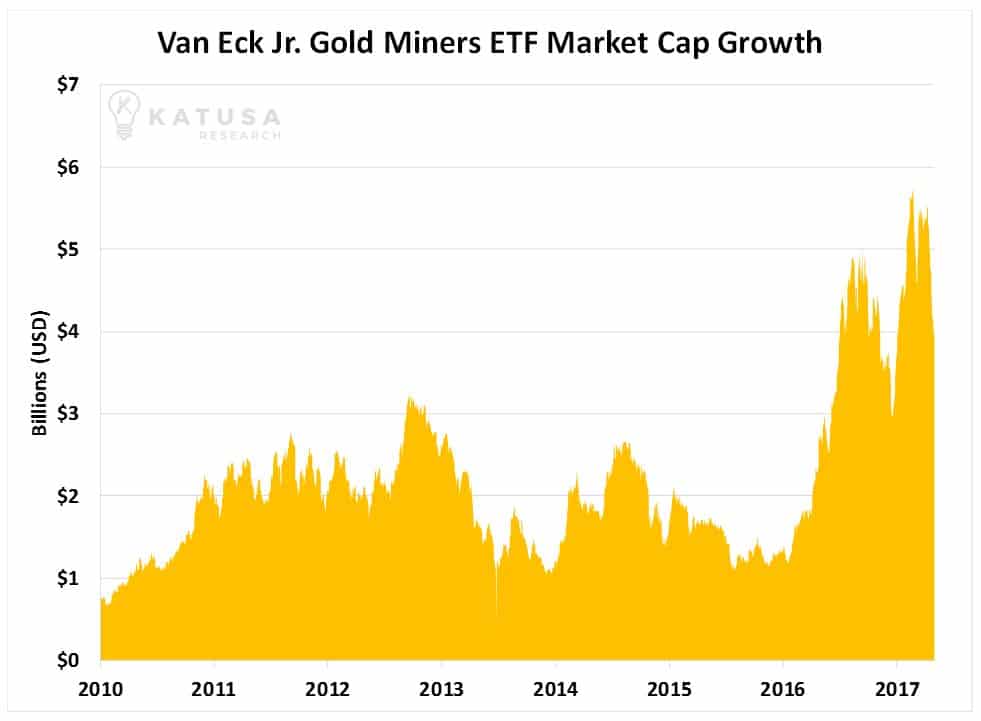

The chart below shows the growth in market capitalization for GDXJ. From January 2010 to May 2017, the market capitalization of GDXJ grew by 480%. At one point, the fund amassed more than $5 billion in assets.

Believe or not, this tremendous growth is a problem for the ETF company…

GDXJ buys and sells companies according to changes in an underlying index created by VanEck called the MVIS Global Junior Gold Miners Index. The fund essentially mirrors the activity within the index fund, or at least it did until recently.

By definition, junior gold stocks don’t have large market caps and their shares don’t have tremendous trading liquidity.

GDXJ grew in popularity so much so that it had too much cash and not enough places to put it.

Many junior gold stocks are Canadian. As soon as an entity owns more than 20% of a Canadian-listed company ,regulations restrict its trading ability and make holding the position a general pain in the behind unless you are in it for the very long haul.

VanEck didn’t want to own 20% of any gold stock.

So, it restricted itself to ownership stakes in individual names to “just” 19.9%.

This is important because it essentially caps how much VanEck can invest into each gold company… and would eventually cause it to run out of stocks to buy.

No sane financial firm will willingly turn down cash to manage and collect fees on. So, instead of leaving the cash on the sidelines, Van Eck used the cash to invest in companies with larger market caps, known as the mid-tiers.

GDXJ was created to give investors exposure to juniors, but because so much capital flowed in, the “Gold Junior ETF” became more of a “Gold Mid-Tier” ETF.

The GDXJ most notably began to deviate away from the index in September 2016 when it began purchasing shares in the large mid-tiers (+$1 billion market cap), while its underlying benchmark index MVIS Global Junior Gold Miners Index did not.

The MVIS Global Junior Gold Miners Index is set to be reviewed and rebalanced on June 9th 2017.

Between now and then, I expect there to be significant volatility in all the sub $1 billion market cap junior and mid-tier gold companies. Companies’ shares will be sold by GDXJ so the new ETF can become a “large mid-tier to small major” gold ETF.

Once this is done, and the new positions are bought, the GDXJ will rebrand itself accordingly. Then, within 12-24 months, a new ETF for juniors to replace the demand of the old GDXJ will be created. This “reshuffling of the ETF deck” will create a great opportunity for informed gold stock speculators.

Understanding Company Selection for GDXJ

To qualify for inclusion into GDXJ going forward, companies must meet a new set of requirements. The goal of these new requirements is to “tilt” the fund away from very small companies and in the direction of mid-sized companies.

To qualify for GDXJ, companies must have a market cap of at least $150 million.

Also, a stock’s average trading volume each day must be at least $1 million per day over the course of the past 90 trading days.

Furthermore, to avoid any company having more pull than the others, the weighting of each company in the fund itself is capped at 8%.

The index will be reviewed every quarter to make sure the index is working properly.

This quarter’s rebalancing is so important because the index is allowing larger companies to be included.

By increasing the maximum size allowed into the index, mid-tier companies such as Yamana Gold, Pan American Silver and Eldorado Gold will be included in the index.

To free up cash to pay for these new investments, holdings in every other company within the index will need to be reduced.

Small gold companies that don’t have enough size or liquidity to be included in the new fund will be hit with massive amounts of selling. Again, the GDXJ fund owns more than 19% of some juniors.

When 19% of a small company’s “float” is sold, it can send its stock price down 20%… 30%… even 50% in a month. I know this might sound crazy, but it happens often in thinly-traded junior resource stocks.

Here’s why I believe this could create an epic gold buying opportunity (perhaps the last one we see for a decade).

The Chain Reaction I Love to See

The forced selling I expect to see in many junior gold stocks will force share prices much lower.

Add in the hedge funds that are short selling before the GDXJ starts selling its position, and this will create extra selling. This will create an incredible opportunity, but only after the selling pressure of the hedge fund short positions and the GDXJ subsides.

It also goes much deeper than just the index itself rebalancing. Other ETFs which benchmark against the MVIS Global Junior Gold Miners Index will also be forced to reposition themselves accordingly or change their fund mandate, including other funds hitting stop losses, and the selling will provide an ideal environment for alligator buying.

This forced selling will cause some gold stock investors to hit stop losses and dump shares… which will create more forced selling… which will cause more stop losses to be hit and more share dumping… which will create more forced selling… and so on… Eventually an “avalanche” of selling will hit the market… and it will have absolutely nothing to do with the underlying values of the gold companies themselves.

The selling avalanche will strictly be a function of a market warped by robotic, unthinking computer programs.

This selling will exhaust itself in a final “last gasp” puke out… where the final few dozen desperate, ignorant sellers sell their shares with no regard to their intrinsic value…

And that will create an incredible stock market anomaly….

Where VALUE decouples from PRICE…

Where SMART operators buy assets from DUMB operators.

Where you can buy DOLLARS for 50 CENTS.

Those words should be music to your ears… because that is the kind of opportunity any investor worth his salt looks for in the market.

Again, what is coming our way is a self-reinforcing cycle of forced, ignorant selling that will feed on itself and cause a panic in some of the world’s best small cap gold stocks.

In a matter of days, the share prices of high quality junior gold stocks could plummet 25% – 50%… leaving them absurdly undervalued… and opening awesome windows of opportunity.

I doubt these windows of opportunity will stay open more than a month in individual stocks. Some windows will be open for just a few days. That’s because at the bottom, a small group of very well-funded, very well informed investors will be there waiting… ready to scoop heaps of bargain gold shares into their baskets.

And when normalcy returns to this panicked market, artificially depressed shares could easily rally 50% – 100% in a matter of weeks. It will be a true windfall for smart operators. History shows us what is possible here.

Changes in the Junior Gold Stock ETF: How to Triple Your Money After a Panic

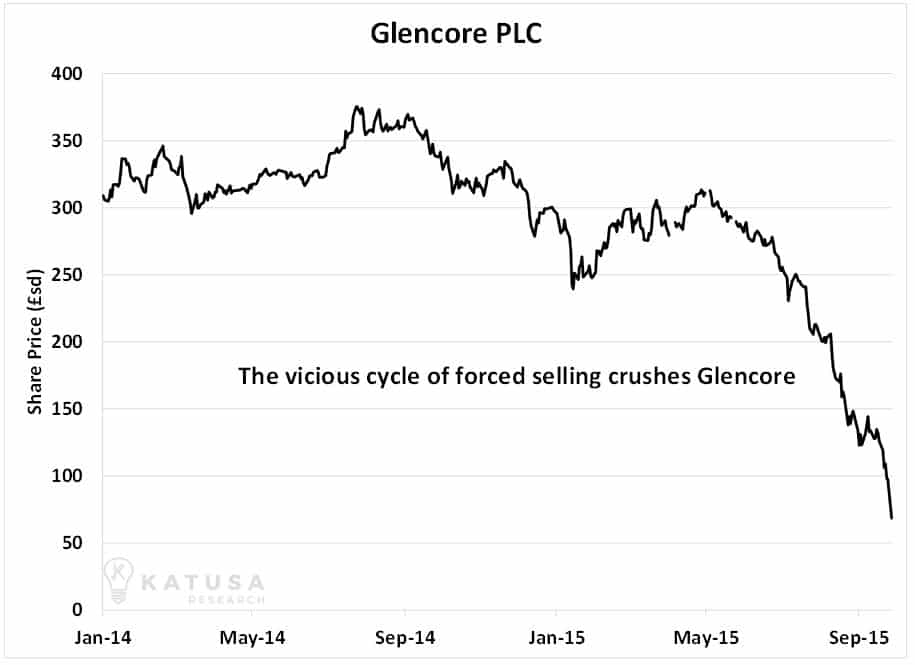

To give you an idea of how self-reinforcing liquidation cycles create great opportunities in the resource market, we can look at the story of Glencore…

Glencore is one of the world’s biggest commodity companies. It owns mines, refining facilities, and transportation networks. It deals in commodity trading. It’s a giant company that has a hand in almost every resource you can think of.

As large and powerful as it is, Glencore was in crisis back in late 2015. In the years prior, Glencore had borrowed massive amounts of money. Then, commodity prices plummeted from 2014 levels, which crushed profit margins and impaired Glencore’s ability to service its debts.

Some industry experts believed it was headed for bankruptcy. With these concerns in mind, large investors began to sell Glencore shares.

The share price fell from 300 pence (this is what British shares are quoted in) per share to 250 pence per share in one month. The share price decline caused other Glencore investors to hit stop losses and dump their shares, which created more selling pressure.

Glencore shares fell another 50 pence to 200 pence per share.

This decline caused more investors to hit stop losses and dump more shares… which in turn set off more stop losses and created more forced selling. It was a chain reaction that fed on itself. Short sellers, who bet on falling prices, jumped into the market and created even more selling pressure.

Soon, Glencore shares hit 120 pence… then 100 pence… then 80 pence. It was a vicious cycle with seemingly no end in sight. Everyone was selling because everyone was selling.

Eventually, the last few “weak” holders gave up the ghost and sold their shares in the fall of 2015. They couldn’t take any more pain… they couldn’t take any more losses. This final climactic “puke out” sent shares below 70 pence per share. It was a 78% decline from the 2015 high.

At this deeply depressed level, the fire sale was on. Smart investors stepped in and started buying Glencore. These investors realized the company would find a way out of its dire situation. The horrible commodity market would get less horrible. Glencore would somehow raise more capital, keep going, and make it through the valley of death.

After the smart money accumulated heaps of bargain shares, the rest of the market caught on. Depressed like a coiled spring by the self-reinforcing liquidation cycle, Glencore shares rebounded spectacularly.

Shares leapt 50% from their lows to hit 100 pence… and then leapt another 50% to hit 150 pence… and then leapt another 50% to hit 225 pence… and eventually hit 300 pence per share. Shares climbed 385% off their depressed levels in just 14 months.

Of course, Glencore was going through a tough time. But the self-reinforcing liquidation cycle forced the share price much, much lower than the fundamentals merited. People had to sell because other people had to sell.

This caused Glencore’s real business value to “decouple” from its market value. That’s when smart operators bought from dumb operators. When a bit of normalcy returned to Glencore shares, they rebounded spectacularly and produced huge returns for alligators waiting at the bottom with cash.

The global financial crisis of 2008 provides another example of how self-reinforcing liquidation cycles create big opportunities…

Why You Should Learn to Appreciate a Good Crisis

If you remember the 2008 financial crisis, you remember it was a time where most people sold first and asked questions later. Asset prices of all kinds were marked down quickly and suddenly.

The junior resource sector was particularly hard hit.

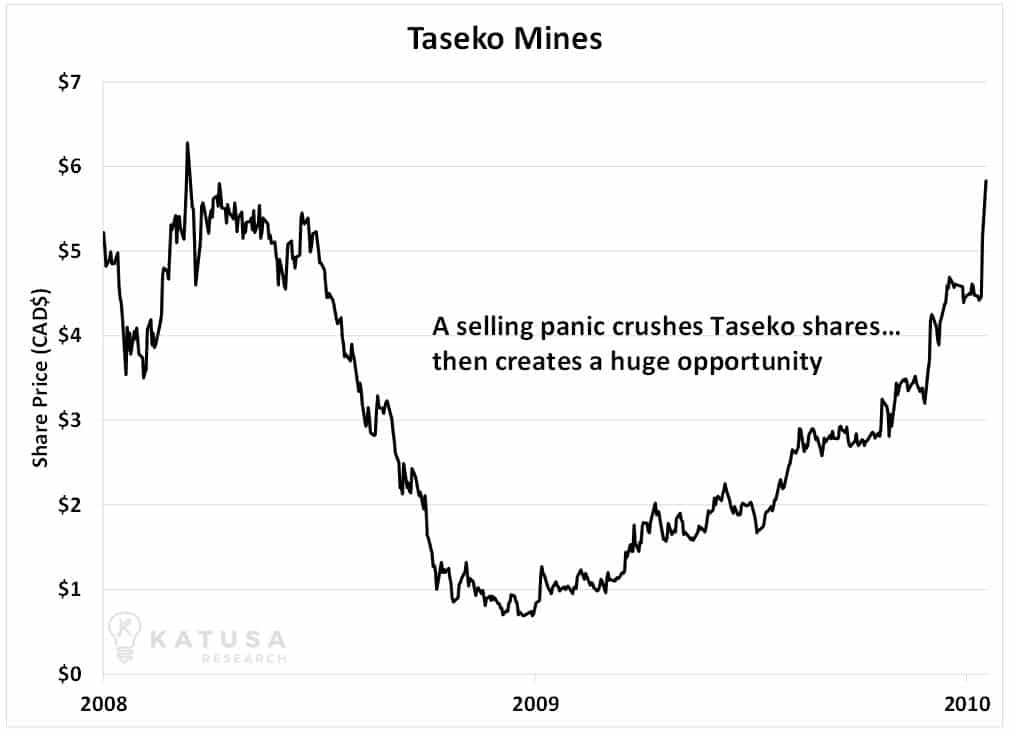

Take small cap copper miner Taseko Mines for example. Taseko owns the open pit copper-molybdenum Gibraltar mine in Canada. Its management team is experienced and well respected in the industry. Its mine is among the largest copper producing mines in North America. But that didn’t count for much in 2008. As you probably recall, it was an epic case of everyone selling because everyone is selling.

Taseko went into the financial crisis with a share price of CAD$5.50 per share. But once investors began selling all kind of stocks and bonds, Taseko shares declined to CAD$4 per share.

The decline in Taseko and the rest of the sector triggered stop losses and massive fund redemptions, which produced more selling. This forced selling sent Taseko down to CAD$3 per share… then CAD$2 per share. The selling fed on itself until a final climactic “puke out” sent shares below CAD$1.

Around this time, smart operators stepped in to buy bargains in the junior resource sector, including Taseko. Just like Glencore, Taseko was going through a tough time. But the self-reinforcing liquidation cycle forced the share price much, much lower than the fundamentals merited. People had to sell because other people had to sell. So, the company’s intrinsic value decoupled from its market value. You can guess what happened next…

As investors realized the world wasn’t really falling apart, Taseko shares rallied 100% off their lows to reach CAD$2… and then to CAD$3… then to CAD$4… then to CAD$5. Shares rallied more than 400% of their lows in just over a year.

Again, the self-reinforcing liquidation cycle depressed the shares like a coiled spring. When the horrible conditions abated, shares soared.

How Much Pain and How Much Gain is Ahead?

In addition to pressure from the forced investor selling I just described, shares face pressure from a group of market players called “short sellers.”

Short sellers are traders who bet on stocks falling, rather than rising. When they see shares falling, they often “pile on” and push weak shares even lower. Their actions can crush the share prices of thinly-traded stocks. These traders will increase selling pressure and the speed at which stock prices break down.

To be clear, I’m not saying what’s ahead for the junior gold sector will be a repeat of the 2008 financial crisis. I’m sharing these stories to show you what’s possible when companies are sold to levels far below what the fundamentals merit.

Could junior gold stocks decline 33% – 50% in a weak gold market marked by large amounts of forced selling? Absolutely.

Are we guaranteed to see declines of this size? Absolutely not.

There are no guarantees in the market. But there are situations you need to stay informed on and be prepared for. This is one of them. In just a few months, we could see some of the world’s best junior gold companies go on sale. Given the never-seen-before levels of government around the world, the never-seen-before amount of central bank credit creation around the world, and the huge political wildcard of Donald Trump, I believe we are very likely to see $2,000 gold in the next five years.

This means the coming fire sale in junior gold stocks could be the last great gold stock buying opportunity we see for many years.

Here’s how I’m preparing… and how I suggest you prepare as well.

The Ultimate Gold Stock Shopping List for Summer 2017

A major decline in junior gold stocks will create panic with many gold stock investors, but smart operators will use this panic to their advantage.

The ideal set ups will occur if GDXJ selling pressure forces lots of other investors to sell as well… creating self-reinforcing liquidation cycles… which leaves shares very cheap.

To capitalize on the forced selling I expect we’ll see, I’ve taken the list of GDXJ holdings and created my own method for analyzing their assets, liquidity, market values, and various other qualities.

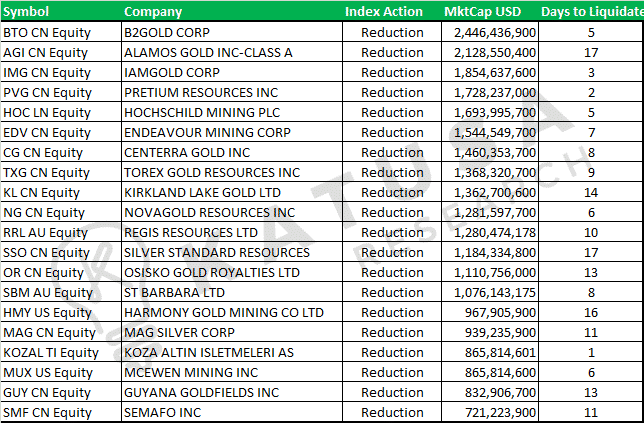

A key part of my team’s analysis is something called the “Days to Liquidate Position” number.

This is the number of days it would take to sell the fund’s entire position in a stock based on the number of shares the fund owns and the stock’s average daily trading volume of the past 90 days.

To be clear, the fund won’t liquidate or reduce positions based on the time frames in our table. This is just a measure of how much of a stock the fund owns in relation to its typical trading volume. You can think of it as a measure that factors in how much water needs to be drained out of a bathtub and the size of the drain.

This measure is critically important to our analysis because simply looking at a GDXJ’s holding’s market value in a vacuum doesn’t tell you enough. We need to know how much of it GDXJ owns and what kind of trading liquidity it has.

The higher a stock’s Days to Liquidate Position number, the more selling pressure from GDXJ that stock will experience, should GDXJ make a major move in it.

We expect stocks with very high Days to Liquidate Position ratings will get hit the hardest.

For reference, here is a snapshot of how our spreadsheet looks for 20 GDXJ holdings that are expected to be reduced:

In addition to using Days to Liquidate analysis, I’m also tracking the actions of the short sellers I described above. I plan on using these guys as my allies and I will use their negative energy and short dollars to my advantage. I am tracking the short positions in every gold company in the GDXJ fund and I update this data constantly.

In addition to the analytical tools cited above, we use good old fashioned security analysis to pinpoint the best opportunities. As longtime Katusa Research readers know, the people running the business is the most important factor in my analytical process (read all about it here).

In Summary

Although some of the holdings in GDXJ have sold off recently, I believe the biggest and most important selling phase is ahead of us. I believe it will play out over the next 120 days.

The GDXJ is a multi-billion-dollar fund making large moves in a small sector. These moves will create big swings in junior gold stock share prices. Again, I believe share prices could decline as much as 50% in the months ahead, which will open windows of great opportunities for smart operators. This will be one of those rare market opportunities where values become decoupled from prices.

I doubt these windows of opportunity will stay open more than a month. Windows in some individual stocks will be open for just a few days. That’s why we need to be armed with information in advance, prepared to profit, and be ready to scoop heaps of bargain gold shares into our baskets. I expect to make big moves for myself and my subscribers in the coming months.

Regards,

Marin Katusa

P.S. To make sure you’re armed with the right information and you receive critical “buy” updates when quality junior gold companies go on fire sale, consider coming on board as a member of Katusa’s Resource Opportunities. Click here to learn more. Again, the coming fire sale in junior gold stocks could be the last great gold stock buying opportunity we see for many years.