SPONSORED BY GOLDMINING INC.

In this email:

- This gold stock has our full attention in the gold sector

- Katusa Issues Special Situations Alert on GoldMining Inc (GLDG:NYSE)

LEGAL NOTE: Please read important disclaimers at the end of this email.

Dear reader,

We’ve been keeping an eye on one $165M market cap company.

Right now, the stock trades for under $1 on the NYSE-American.

The company holds around USD$119M in cash and equity holdings (based on market value of public company shares as of April 30, 2024) and has NO debt.

And, so far, their stock price hasn’t moved.

GoldMining Inc. went public in July 2011.

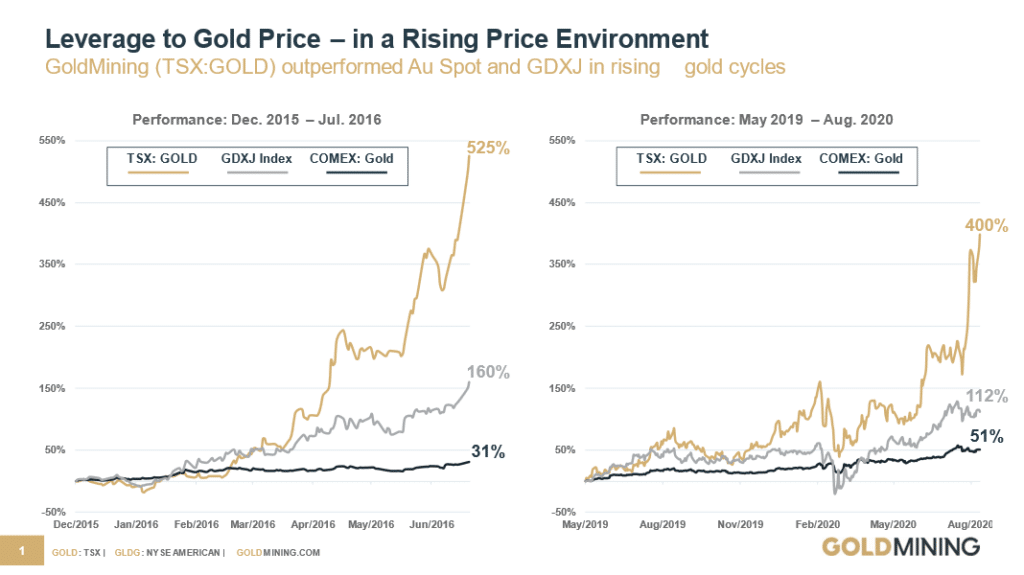

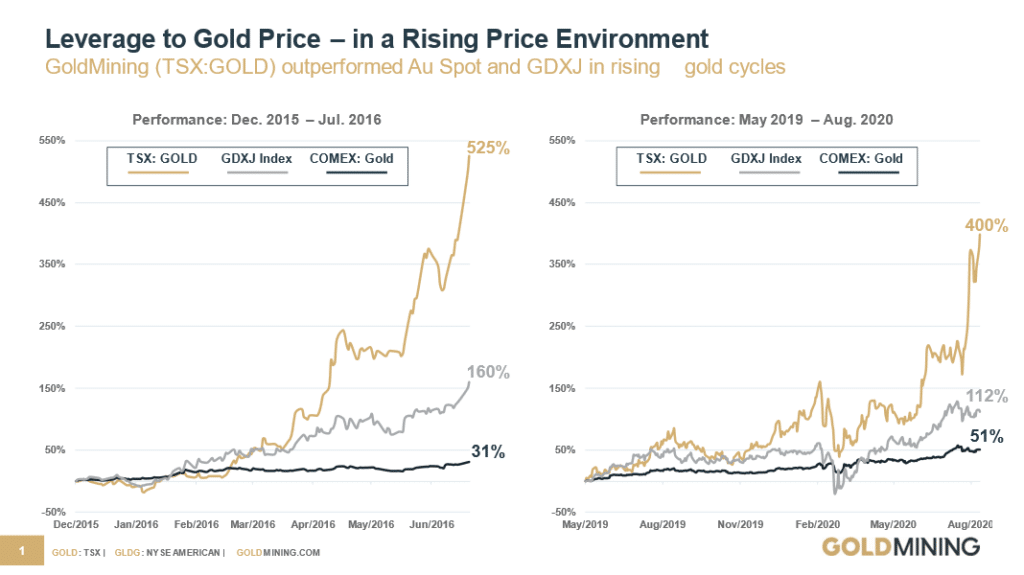

Since then, during times when gold has seen a breakout spike (see the chart below…

GoldMining (GLDG:NYSE) has seen their stock appreciate as much as 525% and 400% to former highs during those last two gold bull markets.

FULL DISCLAIMER: There is no guarantee that that will happen again.

The first case — from December 2015 to July 2016, GoldMining Inc. (when it was GOLD: TSX) appreciated 525%.

That was in just 8 months.

From May 2019 – August 2020, GoldMining also caught the attention of investors in a big way. Meanwhile, GDXJ (tracks a basket of junior mining stocks) only went up 112%.

Here are the comparisons to see how big the moves were:

This isn’t here twice as an error – it has our full attention…

With gold breaking out once again…

It is our very biased opinion here at Katusa Research this diversified portfolio of gold focused resources provides a strong opportunity for shareholders.

What many investors don’t know is that GoldMining Inc. has ALREADY made BIG MOVES to maximize shareholder value…

KR SPECIAL SITUATIONS STOCK ALERT:

Gold Mining Inc.

(GLDG:NYSE)

Note: It goes without saying that this is a high-risk investment. If you have interest, you should definitely review the company’s disclosures under its profiles at www.sedarplus.ca and www.sec.gov for important information regarding the company and its assets.

GoldMining Inc. had 14 mining projects on their books at the end of 2021.

By 2024, two of those assets have been part of transactions to unlock value. So, what happened?

- It IPO’d the Whistler Project, Alaska, into a separate public company that trades on its own on Nasdaq.

- It completed the option sale of the Nutmeg Mountain Project for total share consideration and potential contingent payments of 14X what it initially paid resulting in it now owning 28% of the project indirectly.

Now, there are 12 mining projects left for it to try to monetize and pull value from… with the intent of extracting value like the previous two transactions.

If you look at GoldMining’s stock price…

And consider the current market value of their existing cash and publicly traded equities…

- Then these 12 remaining mining projects could present tremendous opportunity and

- Contain a cumulative total of 12.5 million gold-equivalent ounces measured and indicated and 9.7 million gold-equivalent ounces inferred.

(NOTE: Please refer to GoldMining’s website for further information regarding its resource estimates and technical reports.)

We believe this diversified portfolio of gold focused resources provides a strong opportunity for shareholders.

The market cap of the stock is about $165M.

As GoldMining seeks to unlock more value from its projects… it could daylight additional value from an extensive portfolio of gold focused projects.

GoldMining (GLDG) holds 12 other projects outside of its $119M in cash and other equity holdings.

La Mina in Colombia that has a Preliminary Economic Assessment (PEA).

- This PEA included an estimate of pre-tax net present value (NPV) of $447.3 Million using a 5% discount rate using a $1,750 gold price (based on a 2023 technical report).

- The gold price today is above $2,300 per ounce.

| Refer to the technical report titled La-Mina-PEA with an effective date of 2023-09-07 for further information regarding the La Mina Project and the PEA. The PEA is preliminary in nature, and there is no certainty that the reported results will be realized. Mineral Resources used for the PEA include Inferred Mineral Resources which are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the projected economic performance will be realized. The purpose of the PEA is to demonstrate the economic viability of the La Mina Project, and the results are only intended as an initial, first-pass review of the Project economics based on preliminary information. |

An example is the Yellowknife Gold project in Canada.

“Yellowknife” sits in one of the HIGHEST GRADE past producing gold belts in the country.

GoldMining scooped up the project in 2017 as gold prices floundered around $1,200/ounce — gold today is over $2,320 per ounce.

- The prior owners had already invested over $60 million into the project,

- GoldMining acquired the project for approximately $5 million in GLDG shares – A good deal for GoldMining’s shareholders.

(See GoldMining news release dated May 10, 2017 announcing the transaction and consideration.)

On that same belt was the Con Mine gold project, now partially owned by Newmont.

In its lifetime, the mine produced over 6.1 million ounces of high-grade gold.

GoldMining’s Yellowknife project is a different project and has its own geological characteristics, risks, etc., so Con Mine is not indicative of the potential it has, but it certainly has a great address.

And Yellowknife is just 1 of 12 investments still in the portfolio.

GoldMining is in an ideal position to continue to unlock value from their portfolio of assets.

CEO Alastair Still says, “It’s harvesting time,” for the 15-year-old explorer.

As gold prices stay high… it’s time to pay attention to GoldMining Inc. (GLDG).

Click here to read our full company report

Regards,

The KR Special Situations Team

P.S. Of course, you should do your own research, including reviewing the Company’s Annual Information Form and other filings at www.sedarplus.ca and www.sec.gov.

DISCLOSURES/DISCLAIMER

IMPORTANT DISCLAIMER: Katusa Research, as a publisher, is not a broker, investment advisor, or financial advisor in any jurisdiction. Please do not rely on the information presented by Katusa Research as personal investment advice. If you need personal investment advice, kindly reach out to a qualified and registered broker, investment advisor, or financial advisor. The communications from Katusa Research should not form the basis of your investment decisions. Examples we provide regarding share price increases related to specific companies are based on randomly selected time periods and should not be taken as an indicator or predictor of future stock prices for those companies.

GoldMining Inc. has reviewed and sponsored this article. The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted Securities, in the United States or to U.S. Persons. Securities may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and applicable U.S. state securities laws or pursuant to an exemption therefrom. Any public offering of securities in the United States may only be made by means of a prospectus containing detailed information about the corporation or entity and its management as well as financial statements. No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter. Katusa Research nor any employee of Katusa Research is not registered with the United States Securities and Exchange Commission (the “SEC”): as a “broker-dealer” under the Exchange Act, as an “investment adviser” under the Investment Advisers Act of 1940, or in any other capacity. He is also not registered with any state securities commission or authority as a broker-dealer or investment advisor or in any other capacity.

HIGHLY BIASED: In our role, we aim to highlight specific companies for your further investigation; however, these are not stock recommendations, nor do they constitute an offer or sale of the referenced securities. Katusa Research has received cash compensation from GoldMining Inc. in the amount of $1.25M Dollars for a multi-month marketing campaign, and is thus extremely biased. Members of Katusa Research may also own shares in GoldMining Inc. and benefit from any volume, activity or share price change.

It is crucial that you conduct your own research prior to investing. This includes reading the company’s SEDAR and SEC filings, press releases, and disclosures including ‘risk factors’ as outlined in the Company’s Annual Information Form.

HIGH RISK: The securities issued by the companies we feature should be seen as high risk; if you choose to invest, despite these warnings, you may lose your entire investment. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures.

NOT PROFESSIONAL ADVICE: By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. While Katusa Research strives to provide accurate and reliable information sourced from believed-to-be trustworthy sources, we cannot guarantee the accuracy or reliability of the information. The information provided reflects conditions as they are at the moment of writing and not at any future date. Katusa Research is not obligated to update, correct, or revise the information post-publication.

FORWARD-LOOKING STATEMENTS: Certain of the information contained herein and in the Company’s disclosures referenced herein constitutes “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian and U.S. securities laws (“forward-looking statements”), which involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance and achievements to be materially different from the results, performance or achievements expressed or implied therein. Forward-looking statements, which are all statements other than statements of historical fact, include, but are not limited to, statements respecting the Company’s strategies, expectations regarding gold markets, expectations regarding the operations and results of the operators of the projects underlying the Company’s interests and expectations regarding future production and revenues from the Company’s royalties. Forward-looking statements are based upon certain assumptions and other important factors, including assumptions relating to commodities prices and the business of the Company. Forward-looking statements are subject to a number of risks, uncertainties and other factors which may cause the actual results to be materially different from those expressed or implied by such forward-looking statements, including those set forth in the Company’s Annual Report on Form 20-F and its other publicly filed documents under its profiles at www.sedarplus.ca and www.sec.gov. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking statements, except in accordance with applicable securities laws.

Readers should review the GoldMining Inc public disclosures at www.sedarplus.ca and www.sec.gov for important information regarding it and its assets.