LEGAL NOTE: Please read important disclaimers at the end of this article.

In today’s missive:

- A key market indicator I get every boom cycle

- GROY’s incredible rally

- Three major catalysts and charts to pay attention to

Dear Reader,I’ll tell you a little secret…This one indicator never fails and happens every market cycle.When I get calls from reporters and other media outlets for a quote on the sector or company – it’s never for something under the radar.The producer or editor wants clicks and views, giving the audience what they want in the markets that are making front page news… that will generate views for their internal data analytic quotas.That’s one strong signal to me that the easiest (and fastest) gains in a sector are in the rear-view mirror.Right now, there is no doubt there is still a lot of money to be made from uranium, but my phone is off the hook asking for interviews.I’m seeing an incredible amount of lacklustre projects from 20 years ago being repacked to be sold to the investor world looking for uranium exposure.Hint, if that same project didn’t work 20 years ago, what’s changed? Usually, nothing.When investors ride the FOMO train, they usually end up with a major loss.Most investors don’t have patience nor can they spot deeply undervalued plays and park it on the shelf until the eventual turnaround.Back when nobody cared, I took heat for backing up the track in uranium.But I didn’t care.I could sit pretty and wait to see if those bets paid off… which they did.So, when I find an idea that I think has merit, I pay close attention.What you’re about to read is not personal investment advice and it’s high risk. I’ve put up a lot of my own money buying this stock in the open market and I am severely biased for many reasons.But I think you need to pay attention to Gold Royalty Corp (GROY) right now…

On the Cusp of Positive Free Cash Flow

In 2019, after completing the largest gold merger ever at that point…David Garofalo had a light bulb moment.Precious metal financing was already dry-as-a-bone pre-2020…Now, higher interest rates have only made funding new gold mines even harder.Staying in the ‘development and exploration’ space was a dangerous game to play. And David knew it.Cannibalization in the industry is already happening…… Gold mining projects delayed… Mega mergers (one he just completed)… even miner bankruptcies…David saw an opportunity to be in the ‘picks and shovels’ of the mining space.

David Garofalo believes investors can have a double gold play:

- Investing in cash-flowing mining assets with future size upside at no cost.

- Invest in up-and-coming projects that have the potential to be cash-flowing over the long term that aren’t on the radar of the established royalty companies.

And if a project in the portfolio achieves production, it can produce reliable cash flow passively over the long term.Gold Royalty’s portfolio…This is music to a value and growth investor’s ears.

Katusa Special Situations Company Alert:

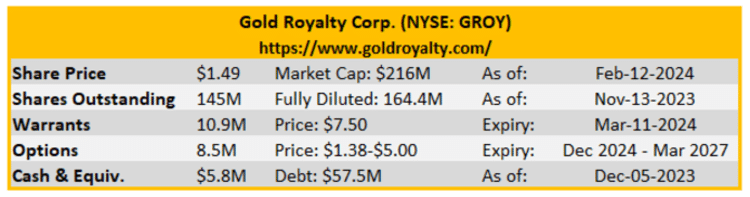

Gold Royalty Corp.(GROY.NYSE)

This is a highly speculative stock that comes with significant investment risk. If this bothers you, do not invest. Before making any decision you should review the company’s disclosure under its profiles at www.sedarplus.ca and www.sec.gov for important information regarding it and its assets.

So now let’s get to the exciting stuff…

CATALYST #1: Value Proposition

The current analyst consensus Price-to-Net-Asset-Value (P/NAV) is less than 0.5X.This is based off analyst consensus estimates.

That means GROY is trading for less than 50% of the net asset value of the assets in its portfolio.

CATALYST #2: Potential for Revenue Growth

Under David’s leadership, Gold Royalty acquired three existing royalty companies.As GROY acquires more… it increases the interests that could increase its potential revenue base along with additional royalties that are already produced.Based on operator mine plans, Gold Royalty has projected strong organic cash flow growth potential in the next several years.The following are analyst consensus estimates for future revenue based on existing projects and mine disclosures.

As additional projects ramp up production, cash flows to GROY from these projects could increase. It is important to understand that mining is an inherently risky business.This makes Gold Royalty’s diversified portfolio an important part of the story.

CATALYST #3: Project Pipeline

Below is a chart which compares the current Gold Royalty Corp share price to the average consensus Net Asset Value per share.You will see that the total net asset value estimated by analysts surpasses the current market cap. by a considerable margin.Below is a chart which compares analyst consensus P/NAV valuations for a selected group of other mid-royalty companies.You can see Gold Royalty Corp is trading at the largest discount to Net Asset Value based on analyst consensus P/NAV.

However, with the company on track to go cash flow positive this year based on royalties on mining operations that are ramping up and should add revenue based on the current operator projections.These are the types of potential catalysts that can move share prices.

Too Long, Didn’t Read (TLDR)?

Here are the key takeaway messages:

- Gold Royalty Corp has assembled an excellent, highly experienced management team with a demonstrated track record of success.

- A large and diverse portfolio of top-notch royalties located in safe jurisdictions,

- Shareholders in GROY benefit from commodity price exposure with relatively minimal exposure to inflationary costs typically found in traditional mining operations.

- Strong revenue growth potential

If this company is not on your radar, I think you should look into it further.Regards,Marin Katusa and the KR Special Situations Team

DISCLOSURES/DISCLAIMER

IMPORTANT DISCLAIMER: Katusa Research, as a publisher, is not a broker, investment advisor, or financial advisor in any jurisdiction. Please do not rely on the information presented by Katusa Research as personal investment advice. If you need personal investment advice, kindly reach out to a qualified and registered broker, investment advisor, or financial advisor. The communications from Katusa Research should not form the basis of your investment decisions. Examples we provide regarding share price increases related to specific companies are based on randomly selected time periods and should not be taken as an indicator or predictor of future stock prices for those companies.Gold Royalty Corp. has reviewed and sponsored this article. The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted Securities, in the United States or to U.S. Persons. Securities may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and applicable U.S. state securities laws or pursuant to an exemption therefrom. Any public offering of securities in the United States may only be made by means of a prospectus containing detailed information about the corporation or entity and its management as well as financial statements. No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter.Katusa Research nor any employee of Katusa Research is not registered with the United States Securities and Exchange Commission (the “SEC”): as a “broker-dealer” under the Exchange Act, as an “investment adviser” under the Investment Advisers Act of 1940, or in any other capacity. He is also not registered with any state securities commission or authority as a broker-dealer or investment advisor or in any other capacity.HIGHLY BIASED: In our role, we aim to highlight specific companies for your further investigation; however, these are not stock recommendations, nor do they constitute an offer or sale of the referenced securities. Katusa Research has received cash compensation from Gold Royalty Corp. in the amount of $250,000 in Nov 2023 and second payment of $250,000 in Dec 2023 and is thus extremely biased. Members of Katusa Research also own shares in Gold Royalty Corp.It is crucial that you conduct your own research prior to investing. This includes reading the companies’ SEDAR and SEC filings, press releases, and risk disclosures.The information contained in our profiles is based on data provided by the company, extracted from SEDAR and SEC filings, company websites, and other publicly available sources.HIGH RISK: The securities issued by the companies we feature should be seen as high risk; if you choose to invest, despite these warnings, you may lose your entire investment. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures.NOT PROFESSIONAL ADVICE: By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. While Katusa Research strives to provide accurate and reliable information sourced from believed-to-be trustworthy sources, we cannot guarantee the accuracy or reliability of the information. The information provided reflects conditions as they are at the moment of writing and not at any future date. Katusa Research is not obligated to update, correct, or revise the information post-publication.FORWARD-LOOKING STATEMENTS: Certain of the information contained herein and in the Company’s disclosures referenced herein constitutes “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian and U.S. securities laws (“forward-looking statements”), which involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance and achievements to be materially different from the results, performance or achievements expressed or implied therein. Forward-looking statements, which are all statements other than statements of historical fact, include, but are not limited to, statements respecting the Company’s strategies, expectations regarding gold markets, expectations regarding the operations and results of the operators of the projects underlying the Company’s interests and expectations regarding future production and revenues from the Company’s royalties. Forward-looking statements are based upon certain assumptions and other important factors, including assumptions relating to commodities prices and the business of the Company. Forward-looking statements are subject to a number of risks, uncertainties and other factors which may cause the actual results to be materially different from those expressed or implied by such forward-looking statements, including those set forth in the Company’s Annual Report on Form 20-F and its other publicly filed documents under its profiles at www.sedarplus.ca and www.sec.gov. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking statements, except in accordance with applicable securities laws.Readers should review Gold Royalty’s public disclosures at www.sedarplus.ca and www.sec.gov for important information regarding it and its assets.