The world’s largest undeveloped gold and copper deposit just got a lot closer to becoming a mine.

And short sellers are about to get trampled.

On Monday, Northern Dynasty Minerals announced that giant mining firm First Quantum Minerals had agreed to acquire an option to buy a 50% stake in its Pebble project for $1.5 billion.

The Pebble project, located in Alaska, is an asset I’m very familiar with. It is a world-class deposit in every sense of the term. I’ll never visit a bigger one in my lifetime. Over one million feet of drilling has proven over 100 million ounces of gold, over 70 billion pounds of copper, and over 500 million ounces of silver. It simply does not get bigger than Pebble.

Pebble is also a controversial project. Environmentalists have fought tooth and nail against its development because of the misunderstanding of the impact of the project to the area’s salmon hatcheries.

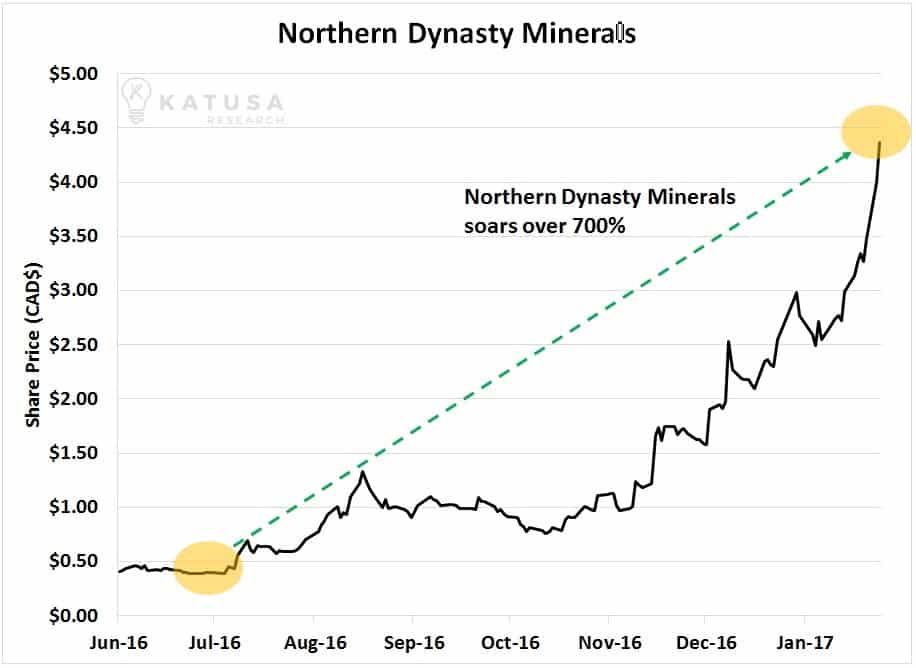

After analyzing the project’s potential upside and risks, I recommended Northern Dynasty to readers of my research service in July 2016 (Full disclosure: I am still a large shareholder as well). Just after I issued a “buy” on the company, shares soared more than 700% and traded hundreds of millions of dollars’ worth of stock.

Of course, any controversial stock that soars more than 700% in months will draw its shares of detractors. In early 2017, some very vocal short selling groups shorted Northern Dynasty while issuing what I believed were very misleading and misinformed “research reports.”

The short sellers ignorantly claimed Pebble wouldn’t be economic or permittable, and therefore would not attract a major miner with deep pockets to come in as a partner. Every step of the way, I publicly stated the short sellers were wrong … and I put my money where my mouth was.

You see, unlike most everyone who bet against Northern Dynasty, I’ve visited the deposit and met with management many, many times. I’ve read through all the geological and environmental reports. I know the company’s founders and executives. I visited the site with legendary geologist David Lowell (read his positive thoughts on Pebble right here). Like David, I believe Pebble is a world-class deposit, is economically viable, will be put into production, and will be an incredible multi-generational asset.

Photo from the August issue of Katusa’s Resource Opportunities and taken on July 24th, 2016.

From left to right: Doug Casey, David Lowell, Marin Katusa and Bob Dickinson standing over top of Northern Dynasty’s Pebble deposit.

It seems First Quantum, one of the world’s best mine builders and mining companies, agrees with me, and not the short sellers.

In First Quantum, Northern Dynasty has attracted a powerful joint venture partner who will ultimately spend $1.5 billion to earn into 50% of the Pebble Mine, and then the two are 50-50 on a moving forward cost basis.

First Quantum will pay $37.5 million as the first step. Then, over the next four years, First Quantum will pay $112.5 million to fully earn into the option which gives First Quantum the right to spend another $1.35 billion to earn into 50% of the project.

If First Quantum only spends a total of $1.49 billion and walks away for whatever reason, 100% of the project stays with Northern Dynasty and First Quantum gets nothing.

First Quantum must advance another $1.35 billion over years five and six to earn the 50% of the Pebble project and to build the mine. The remaining cost of building the mine is based on a 50-50 basis between Northern Dynasty and First Quantum.

Basically, the framework is structured such that if the Pebble Mine does not get the permit to build the mine over the next four years, First Quantum loses its $150 million and has no right to the project and Northern Dynasty will retain 100% ownership of the project.

It’s very important to emphasize that First Quantum is one of the top mine building companies in the world. It’s managed by very smart people who do their homework and have built much more challenging mines than the Pebble Mine in much more difficult places than where Pebble is located.

I pride myself on going the extra mile for my subscribers and doing the due diligence others won’t do or are capable of doing. That’s why immediately after seeing the press release at 5am PDT time on Monday, I asked Northern Dynasty CEO Ron Thiessen to come into my studio for the first interview after the deal was announced.

The first public interview Ron Thiessen has done regarding the deal is with Katusa Research. After watching this video, you’ll have a good idea of the lengths that I’ll go to when I perform due diligence on one of my core holdings.

I hope you enjoy the video we put together. If you’d like to understand more details behind the deal, then make sure to watch the whole thing.

Northern Dynasty has delivered a joint venture deal that exceeded my own expectations. This is a great deal for Northern Dynasty shareholders and the project is now significantly de-risked.

What’s Next?

The only argument left for the short thesis is that a permit will not be issued to the Pebble Mine. The permit decision will not happen for a couple of years at the earliest and many of the shorters will be looking to cover. Looking to cover means the shorters will want to exit their short positions. To do so, they will have to buy back the shares they shorted (adding fuel to any rally).

As of Monday, over 30 million shares of Northern Dynasty are held in a short position. This is around 10% of the company’s outstanding shares. It’s a large amount of “buy tickets” that will have to be filled as Northern Dynasty’s share price rises.

I believe this First Quantum deal is a major step forward for the Pebble project. I believe the Trump administration will approve this project, which will create huge value for the citizens of region close to the mine, the whole of Alaska, and all of America. I believe it’s absolutely possible to develop this deposit while being mindful of the surrounding environment.

Short sellers just lost a major battle. However, no mainstream media wants to talk about it because its sexier to talk about bitcoin and the latest cryptocurrency darlings. Call me long and stubborn, but ask yourself what Warren Buffett would do?

Even Warren Buffett would be intrigued with the inherent deep value proposition of Northern Dynasty now that First Quantum plans on becoming a joint venture partner.

It’s not just me who thinks Northern Dynasty will have a strong 2018. Major conservative mining banks such as BMO have recently come out and initiated Northern Dynasty as a market outperformer while increasing their Net Asset Value estimates by over 30% on the company post First Quantum news.

I’ll enjoy watching Northern Dynasty’s shares climb higher and higher as the shorts turn tail and run. For their own sake, I hope they run towards a mining college and hit the books.

Regards,

Marin

P.S. You might want to read this carefully…

In early 2018, I will publish a research report that will be dwarf the potential of Northern Dynasty. I expect this to be the largest ever investment I have directly ever made into one company.

And, as usual, I am the first to this story. Before the big banks. Before any other newsletter. Before any brokerage house. You will have the opportunity to be first in line in what I believe has the greatest investment potential of any deal I have ever participated in.

You’ll get all the details as a member of Katusa’s Resource Opportunities. Click here to learn more about becoming a member.