Nearly 15 years ago we began an incredible global fiscal experiment.Banks got a little too adventurous with risky debts and had assets that were pretty much a mystery in value.This mix almost crashed the entire banking system.It was wild – big names in banking, ones we thought were untouchable, crumbled within months. Remember these?

- Lehman Brothers

- Merrill Lynch

- AIG

- Washington Mutual

- Fannie Mae and Fredie Mac

- Royal Bank of Scotland

- Bradford & Bingley

- Alliance & Leicester

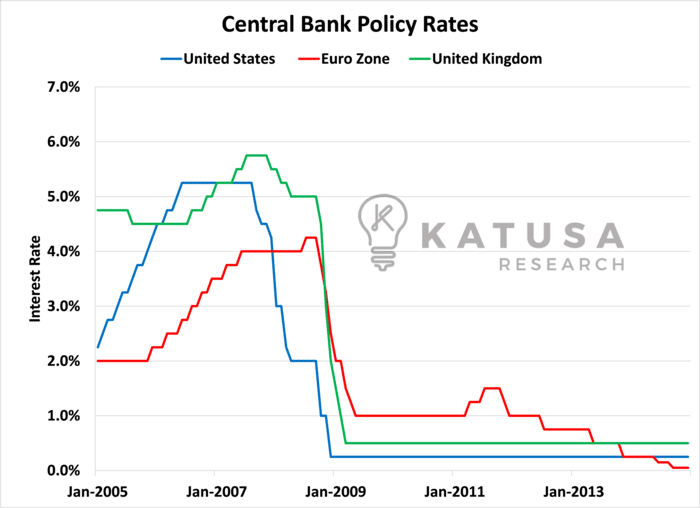

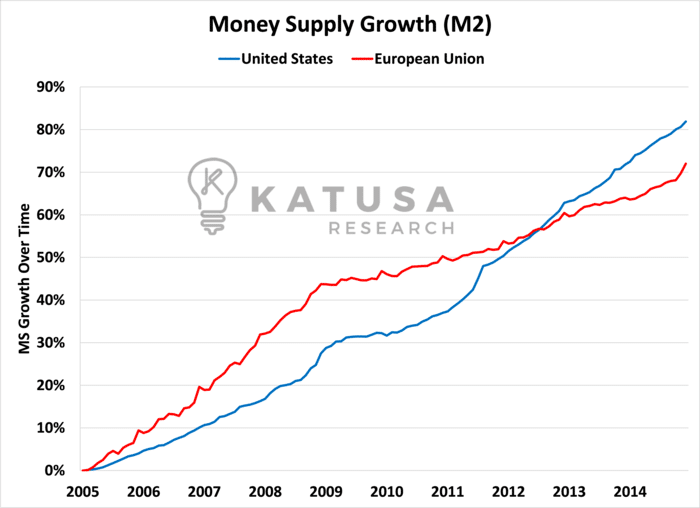

These were the giants of finance, and they either went bankrupt or were scrambling for a bailout.These bailouts paved the way for what would become the largest fiscal and economic experiment in generations.Governments stepped in with what turned into the biggest money experiment we’ve seen. It’s called quantitative easing.Basically, central banks slashed interest rates to almost nothing and increased the money supply into the economy, all to kickstart growth.

In the span of 10 short years, the Federal Reserve and the ECB had nearly doubled the money in circulation.

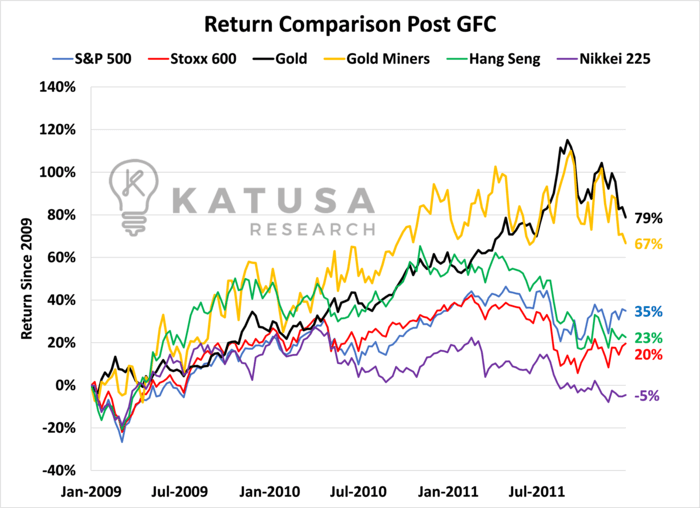

Coming out of the depths of the financial crisis, you would have expected that the combination of exorbitant money supply growth in combination with ultra-low rates would pave the way for gold to scream higher.And for a short period, this was the case.Gold rose spectacularly from $850 ounce in early 2009 up to $1900 by mid-2011.In fact, relative to major indices, gold and gold stocks were the number 1 performers around the world.

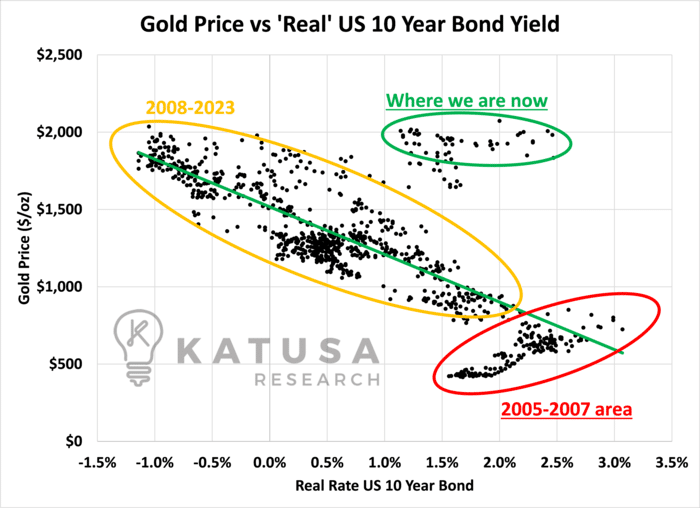

A key driver in explaining the performance of gold was not the demise of the US dollar like many incorrectly called for.But in fact, the “real rate of return” became an integral explanatory variable for gold price movement.

Gold Enters the 4th Dimension

Real yields are bond yields which are those that are adjusted for inflation impact.For 15 years there has been a correlation between the gold price and the real yield. As you can see in the chart below there are 3 distinct bubbles.

- In red, is the 2005-2007 pre-GFC area. This interestingly showed that higher real rates tended to be paired with higher gold prices.

- In yellow, from 2008 through to early this year, there was a strong correlation between low or negative real rates of return and high gold prices.

If the past 15 years are any indication, gold prices are massively overbought using this real rate analysis.However, at least in the short term the tide seems to have shifted.This past week, gold albeit briefly, ripped to new highs all the way up to $2146 per ounce.Yet typical drivers of gold price action were muted.The US Dollar is essentially unchanged relative to other major currency pairs, interest rates have soared, and inflation has cooled off.Theory says that this should be a bearish environment for gold, but recent price action says otherwise as gold is up close to $200 per ounce for the year.

Bearish Trading Setup in Gold

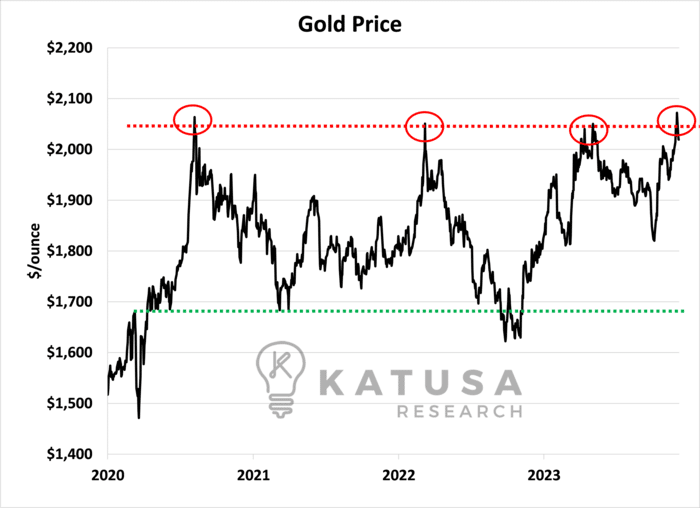

The recent trading patterns for gold at these upper levels are not particularly favorable.We have approached the top end of the recent range for now a 4th time.And each of the past 3 attempts to breakout concretely through 20050 has been met with ferocious resistance.

Is this the head fake that shoots us to $2,500 per ounce and forces consolidation above this level?Perhaps.And our portfolio and picks in Katusa’s Resource Opportunities are prepared for that scenario.But that is not my base case scenario and probably shouldn’t be yours either.

Gold Stock Party Invites Got Lost in the Mail

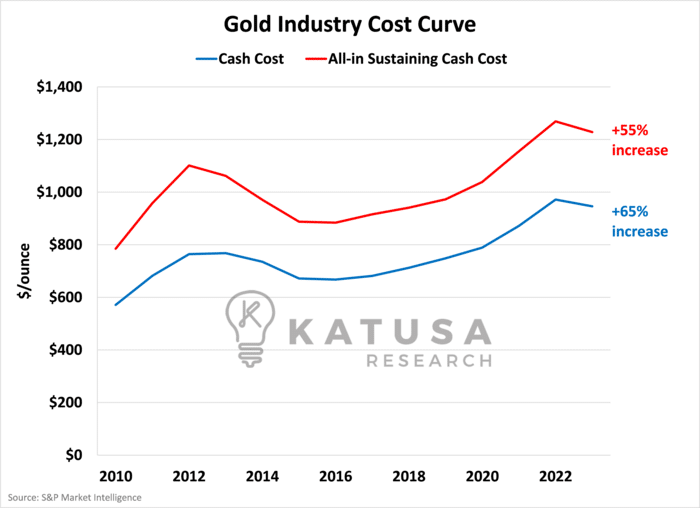

Interestingly, gold miners have not participated at all this year.Gold is up 10% for the year, yet miners are actually negative, down 1%.

- The Achilles heel of the gold miners continues to be construction and operational cost control.

Below is a chart which shows the steep rise in costs over the past decade.

One of my go-to phrases is “fortune favors the bold” but I do believe this is a time where being bold is to be very careful.Loading up on the expectation of continuation of soaring gold prices seems overly aggressive.Rather, I am hawking several world-class businesses that have been crushed.These are companies that have generational assets and world-class management teams. KRO subscribers just found out about my latest idea 4 days ago and know exactly how I am going to play it.I do believe 2024 is going to be a challenging but fruitful year, and it will provide significant opportunities – but many death traps as well.Prepared investors can do well but I do not believe a rising tide will lift all boats.Let us help do a lot of the heavy lifting, research, site visits, board room visits, and analysis for you…It’s all found behind the curtain in my premium research letter – Katusa’s Resource Opportunities.Regards,Marin

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.