To: CEOs and shareholders of North American oil and gas companies

Subject: Don’t let this huge opportunity to create shareholder value pass you by

Date: August 25, 2017

______________________________________________________________________________________________________________________________________

When a CEO takes the reigns of a company, he/she becomes bound by something called “fiduciary duty.”

The vows of fiduciary duty are like marriage vows. They can mean different things to different people, but they come down to the broad concepts of “doing right” and acting honorably.

In the business world, CEOs are married to shareholders. CEOs are trusted and expected to look after their partners’ best interests. CEOs are expected to stay loyal to shareholders and act as stewards of their capital. To most folks, this means focusing on two things…

One, don’t lose shareholder money (“don’t do dumb things’).

And two, do your best to capitalize on opportunities that will increase shareholder wealth (“do smart things and grow the company”).

I believe surging North American shale production will keep the price of oil lower for longer than most analysts expect. This means oil and gas executives will have a very small margin of error when making capital allocation decisions. They will not have soaring oil prices to bail them out of bad moves.

Smart executives will focus on areas with liquid rich production. These areas offer the highest returns on investment in the oil patch. A mergers and acquisitions (M&A) rush has started for premier liquid rich assets. Much of this M&A activity has been focused on the liquid rich Permian Basin in the U.S.

Unfortunately, all this interest has made the Permian very expensive. The majors are now consolidating land within the Permian, and the majors always pay a premium. On the other hand, the Montney Shale in Western Canada has metrics equal to or better than the Permian. Yet, projects in the Montney trade at a fraction of what similar projects in the Permian are currently trading at.

This value disconnect will change. The main reason the Montney is trading at such a large discount to the Permian is because of the lack of takeaway capacity. However, that is changing. Currently, there are proposals for five major processing facilities to handle the liquid rich production of the Montney. Smart buyers are getting in now. M&A in the Montney is starting to heat up.

But what premier liquid rich assets in the Montney are available?

With all this in mind, I’m writing this letter to all North American oil & gas CEOs, specifically ones with a focus on Canada.

To get right to my message for CEOs:

If you’re not seriously considering purchasing the phenomenal assets of premier small cap oil & gas operator Blackbird Energy and adding them to your company’s asset base, you are in danger of violating your fiduciary duty to shareholders. You are in danger of letting an incredible opportunity to intelligently allocate capital and create shareholder value pass you by.

Since CEOs should be judged by those they have a duty to, this letter is also for shareholders – big and small – of those companies. If you are such a shareholder and you want to see your wealth grow safely and substantially, please make sure your “partners” – the executives in charge of your holdings – receive a copy of this letter.

Below, I detail why Blackbird Energy (ticker BBI in Canada) is among the highest-quality oil and gas operators in North America. I’ll detail its phenomenal assets and show how a conservative appraisal of its value shows it is worth well over 300% of its current market value.

If you’re familiar with the enormous potential of the Montney Shale, please skip ahead to the section “Blackbird Energy’s Incredible Position and Potential.” If you’d like a quick overview of the Montney, please read the following section.

The Next Great Shale Field

Over the past seven years, the U.S. shale oil boom has lifted U.S. oil and gas production levels to their highest in decades.

During this time, the names “Bakken,” “Eagle Ford,” and “Permian” have become synonymous with oil wealth creation, and fixtures in the mainstream press. These are the names of the three biggest, richest U.S. shale oil fields. Untapped by oilmen for decades, they are now staggering in size and richness.

Together, the Bakken (in North Dakota), the Permian (in Texas), and the Eagle Ford (also in Texas) produced 4.7 million barrels of oil per day today. This total would make them the world’s 4th largest oil producer… bigger than Iran or Canada.

These three fields revolutionized United States oil production in a short amount of time. And of course, they’ve made some people very rich.

At the Katusa Research office, we monitor over three dozen shale formations that could eventually be labeled “bigger than the Bakken” or “better than the Permian.”

We keep a proprietary database on these formations, most of which are unknown to even most professional investors. Very little modern exploration work has been performed on them. You could say that all of our tracking and site visits amount to “hunting elephants.”

All the time and money we’ve spent hunting elephants has paid off. We now know exactly where the next shale boom will occur: The Montney Shale in Western Canada.

The Best Place to Find Large Shale Fields

The best place to look for a giant shale field is near a giant conventional oil field. For example, the Permian and Eagle Ford shales are both in Texas, where many large conventional oil fields have been discovered over the years.

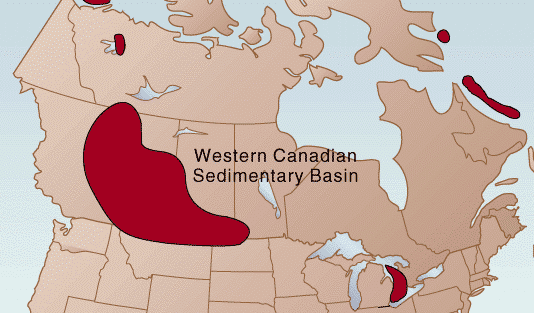

That’s why it’s no surprise the next great shale field is located Western Canada, an area that has yielded massive quantities of oil in the past. Specifically, this field is located in the oil-rich province of Alberta… in a huge geological formation called the Western Canadian Sedimentary Basin (WCSB).

The WCSB is home to rich oil and gas reserves that have created many fortunes, such as the one for T. Boone Pickens.

But despite the success people have had in the WCSB, large swaths (think layers) of it remain relatively unknown. Of the parts that are known, very little has been drilled with the latest technology, which is light years ahead of where it was just five years ago.

The next giant shale field, called the Liquid-rich Montney formation (more on this name in a moment) is a part of the WCSB. While U.S. shale fields like the Eagle Ford or Permian get most of the press, the Montney will be like the Permian… but on steroids.

And although you might have heard about the Montney before, it’s not a prolific field right now.

Thanks to its unique geology, it has taken drillers a long time to “unlock’ the Montney’s potential. It has required different drilling techniques than other shale fields. And the infrastructure needed to transport its production is just now being financed and built.

But very recently, drilling teams discovered the “key” to unlocking the Montney’s potential… and now we know it is capable of incredible production.

As someone who makes his living investing in natural resources, I can say that I love the Montney. I believe future drilling will show that it’s a formation just as good or better than legendary fields like the Eagle Ford or the Permian.

Why?

Because the best part of the Montney formation contains natural gas that can be split apart to unlock an extremely valuable substance called “condensates.”

You see, hydrocarbons “chain” together. The more carbon atoms in the chain, the heavier the compound is, and the more “liquid rich” the gas is. The more “liquids rich” it is, the more valuable it is.

These heavier hydrocarbons are called condensates.

You know some of these condensates.

Condensates are the building blocks used to produce plastics, kerosene, and even jet fuel. Without condensates to act as a diluent, the heavy oil from Canada’s tar sands couldn’t be transported via pipeline. Condensates are also used in the ethanol blends you may use at your local gas station.

Condensates are so useful and valuable to society that a barrel of condensates is worth more than the best oil coming out of the Bakken or Eagle Ford shales.

Condensates sell for a premium over the benchmark price you always see for crude oil.

You could say condensates are the “King of Hydrocarbons.”

The Montney contains a huge stretch of condensate-rich shale that I call the “Super Liquid Rich Condensate Corridor.” Tapping the Super Liquid Rich Condensate Corridor is going to create tremendous wealth for shareholders.

According to estimates from the United States Geological Survey, the Bakken field contains 3 billion barrels of recoverable oil… and the Eagle Ford contains just under 3 billion barrels of recoverable oil.

I believe the Montney could contain more than 10 billion barrels of the King of Hydrocarbons, condensates.

I believe this field will become as productive as the legendary Permian Basin, which if it was a country, would be the world’s 10th largest oil producer after Kuwait. The companies that find and produce from its richest areas stand to see their revenues soar 2,000%… 5,000%… even 10,000%+… just like companies in the U.S. shale fields did.

And thanks to a “glitch” at the world’s largest and most expensive oil complex, companies that produce condensate in the Montney have an extraordinary market for their products.

There’s a Glitch in the World’s Biggest Oil Complex

A civil war in Syria. ISIS running amuck in Iraq. Iran working on a nuclear bomb…

These are all major worries in the land we call the “Middle East.” This region is home to the world’s richest oil deposits. But unfortunately, the region is plagued by constant war and terrorism.

That’s why the Western world covets large, safe, secure oil deposits… far away from the Middle East. Such deposits are among the most valuable assets on Earth. Our modern economy runs on oil. We don’t want our livelihoods held hostage by the Middle East’s war of the week.

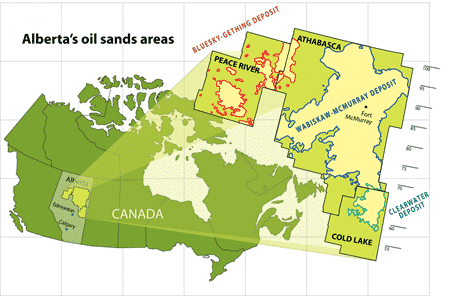

One such large, very safe deposit is the legendary Canadian Oil Sands.

Located in Western Canada, the Canadian Oil Sands is one of the world’s largest deposits of crude oil. Its reserves are estimated to be 166 billion barrels. Just two other countries, Saudi Arabia and Venezuela, have larger reserves.

Thanks to this massive deposit, Canada is the United States’ largest supplier of foreign oil. Canadian oil does not have to be shipped over an ocean. It is not located under 15,000 feet of water or in a war zone. You’re more likely to encounter a roadside moose than a road side bomb in oil sands country.

Because of its enormous size and strategic importance, the Canadian Oil Sands region is the largest, most expensive oil complex on Earth. More than $250 billion has been invested there over the past 40 years.

Nearly every major oil company has had an investment in the oil sands. Some investors there include ExxonMobil, Chevron, Royal Dutch Shell, and BP. Even U.S. oil refiners have invested billions in the oil sands. They all wanted to secure safe Canadian oil for their refineries.

The massive oil sands complex is connected to the thirsty U.S. market by a large pipeline system. You could say a large portion of America’s economic lifeblood flows through those pipes.

Yet… there’s a “glitch” in this extremely important, extremely expensive system.

The oil that comes from the Canadian Oil Sands is “heavy” oil. It doesn’t flow through pipelines very well. That’s a huge problem when it comes to getting oil from point A to point B. If you can’t transport your oil to where it is needed, it’s virtually worthless.

The solution to this problem is condensates. As I mentioned, condensates are extremely valuable compounds. Condensates blend perfectly with heavy oil to make a mixture that flows through pipes quickly and smoothly.

Canadian oil sand producers need a stupendous amount of condensates to keep their oil flowing to the United States. Canadian oil sand producers currently demand over 500,000 barrels of the stuff per day. This is enough to fill 2,858 trucks like you see below every day.

Remember, this is the largest, most expensive oil complex on Earth. It’s more expensive than the projects of Saudi Arabia, Iraq, and Kuwait combined. When it needs something, it needs A LOT of it.

However, the region around the Canadian Oil Sands only produces about 300,000 barrels of condensate per day.

As a result, Canadians end up importing over 175,000 barrels of condensate per day from the United States. Condensate from the Eagle Ford shale in Texas is piped north to Canada, blended with Canadian heavy oil, and then shipped back south to refineries on the Gulf Coast… some of which are located in Texas!

I know it sounds crazy… but it’s absolutely how things are working right now.

As you can imagine, this process is expensive. Canadian Oil Sands producers would much rather buy local condensate and save money. This is why companies operating in the Montney Shale have such a fantastic profit outlook.

The condensate from the Montney will come from the same province as the oil sands (Alberta). It has to travel less than 1/5 the distance of imported condensate.

When you factor in transportation costs and the weak Canadian dollar exchange rate, Canadian oil sand producers can get local condensate for as much as 40% less than imported condensate. It’s a gigantic cost savings.

The development of the Montney is exactly what the Canadian Oil Sands – the world’s largest, most expensive oil complex – needs. The Montney Shale is essentially next door to the Canadian Oil Sands. Montney condensate producers will find very large, very willing buyers for their production.

You could think of an ownership stake in a Montney condensate producer like you would owning a beef operation that supplies the majority of McDonald’s hamburgers… or owning the company that supplies Apple with phone screens. There’s a giant system that depends on your product. There’s a very large buyer who wants what you are selling.

This “glitch” in the Canadian Oil Sands complex is a huge plus for Montney producers. I love the fact that I can own a Montney producer that will play a critical role in the Canadian/U.S. oil partnership. The partnership ensures a large and consistent demand for my condensate… and high prices to boot.

Blackbird Energy’s Incredible Position and Potential

Founded in 2009, Blackbird Energy is a small cap oil and gas company based in Grand Prairie, Alberta, a town right on top of the Montney Shale. Current market value is C$235 million.

Blackbird Energy is the brainchild of CEO and large shareholder Garth Braun. Garth is a native of the Grand Prairie area. He comes from an entrepreneurial family that has done business in and around Grand Prairie for a century.

Garth is extremely familiar with the Grand Prairie area and its people, so he was among the first to recognize the Montney Shale’s liquids-rich condensate potential. The region has been a prolific oil and gas producer for decades. But its layers of shale were never tapped.

With no fanfare, Garth bought Blackbird’s land position for pennies on the dollar. He managed to secretly buy up tens of thousands of acres at much, much lower prices than what multi-billion-dollar companies paid for equivalent quality land.

Blackbird now has 109 “net sections” (around 69,000 net acres) of land located right in the liquid-rich corridor of the Montney. In other words, the land is in the best part of one of best shale fields on Earth. Blackbird has no debt, so you can be sure that it owns 100% of the land. Banks don’t own it. Creditors don’t own it. Garth and his shareholders (of which I am one of) own it. The company also has C$65 million in cash. It’s a key part of Blackbird’s extremely strong balance sheet.

What is all the prime real estate on that balance sheet worth? A recent appraisal acts as a guide…

Every year, oil and gas companies must report their oil and gas reserves to government regulators. This information comes in the form of “51-101” reports… or “Reserve Reports.”

These reserve reports are not prepared by the companies themselves. They must be completed by independent third-party engineering firms. Reserve Reports can serve to separate the pretenders from the guys with real assets. Bankers, CEOs, and major fund managers make billion-dollar decisions based on reserve reports.

In the oil and gas world, reserves are broken down into Proved plus Probable reserves. They are broken down based on the confidence level the third-party engineering firm believes is accurate for determining how much oil and gas is held within the oil and gas formation.

“Proved” reserves mean engineers have a very high confidence level that the oil and gas can be extracted.

“Probable” reserves are a lower confidence level. But additional drilling or further engineering work can increase the confidence in this resource.

Taking the Proved plus Probable reserves a step further, the engineering firm calculates a monetary value for these reserves. The engineering firm uses a cash flow model to determine this monetary value of the reserves. This model is known as a “Net Present Value” or NPV model.

Earlier this year, Blackbird released its 2017 reserve report. To produce the report, Blackbird employed a very experienced, highly-regarded engineering firm called McDaniel & Associates Consultants Ltd. This firm does the reserve estimates for big oil and gas firms like Encana, Seven Generations Energy, and many other large energy companies operating in the Montney.

In Blackbird’s 2017 Reserve Report, McDaniel & Associates placed a Net Present Value with a 10% discount (NPV10%) of C$455 million on Blackbird’s Proved plus Probable reserves. It’s 10 times more value than was placed on Blackbird’s reserves the year before.

Here’s an important fact to understand. The same engineering firm that booked the reserve estimates for Blackbird did the same analysis on the most respected oil and gas producers in the Montney such as Encana and Seven Generations.

What’s even more important to the story, is that the engineers only used 11.9% of Blackbird’s total acreage to come up with that value of C$455 million. As I mentioned earlier, Blackbird’s current market value is C$235 million. In other words, just 11.9% of Blackbird is worth more than the whole company is selling for on the market. Buyers at current prices can buy that small slice at a discount and get the rest of the acreage for free.

I want to stress how important this report by McDaniel & Associates is to Blackbird shareholders. Blackbird has drilled eight wells to date, with another eight to be drilled over the next 12 months. Eleven wells will have production results announced over the next 12 months.

A big reason why I believe Blackbird will be a huge success lies in something called “multi-stack potential.”

Think of a shale formation like layers of a cake. Each layer represents oil and gas that the company can target for extraction. The more layers of cake you have, the more potential recoverable oil and gas there is. The liquids-rich section of the Montney that Blackbird calls home fits this analogy to a T.

Furthermore, you can target each of these layers from the same spot at surface. This means you can drill six or eight wells instead of just one from the same spot. From the picture below, you can see Blackbird will be able to target four layers of oil and natural gas from one well pad.

Moving an oil rig takes days and costs tens of thousands of dollars. If you drill eight wells from the same spot, that is much less often you need to move equipment. This is a huge cost savings and the direction that the future of oil is going.

For comparison on how the future focus of companies will be multi-stacked layers, let’s compare Blackbird to Nuvista Energy, which is a Montney-focused oil and gas company with acreage close to Blackbird’s acreage.

Nuvista had to drill 100 wells to get to a C$1 billion NPV10 on land that didn’t have the multi-interval potential. Blackbird is almost at a half a billion-dollar NPV10 with just five wells.

Nuvista has a market capitalization of over USD$1 billion, and is increasing its focus on the acreage close to Blackbird. The time it takes to drill 100 wells and the cost is staggering. The future of the profitable shale business will be focused on multi-interval liquid rich corridors. The entire industry is zoning in on this “multi-stack potential” and Blackbird is right in the middle of it.

Blackbird’s Future Looks Very Bright

In the oil patch, it’s rare to find a junior company with exceptional assets, zero debt, and plenty of cash. Blackbird is one such rarity.

Any large company that buys Blackbird will be purchasing an asset that is “self-funding.”

Again, Blackbird has C$65 million in cash. It has another C$43 million in cash available from warrants that are currently in the money. That’s enough cash to fund the development of Blackbird’s land base. The development of the land base would produce more cash, which could be used to develop even more of the land base. In other words, it would create a “self-funding” program of resource development.

Applying the math that the independent engineers applied on the first 10% of the drilled land, there could be well over $5 billion of un-booked upside in delineating the asset.

That means, a major buying this asset could potentially pull off a 20 bagger for its shareholders. That is the type of value the liquid rich Montney holds.

There is no other asset I know of that can produce over 40,000 boepd in five years without any new capital at a growth rate of 40% per annum at the valuation Blackbird is trading at. And this would only represent 10% of the land that Blackbird holds.

The only place in the world that can compete with this type of growth is in the Permian, which is the hottest area in the world today. Wall Street analysts and oil executives rave about how great the Permian is. Top-tier acreage in the Permian is currently selling for US$27,500-UD$50,000… while top-tier acreage in the Montney is selling in the range of US$1,850-$13,800. Blackbird is currently valued at US$3,300 per acre.

In other words, Blackbird’s acreage is as good as or better than Permian acreage, but you can buy it for more than an 80% discount.

Even better, the company that buys out Blackbird can pay back the total purchase price for Blackbird from the cash flow in less than four years, and get thousands of drill locations and decades of liquid rich condensate production growth for free.

Again, there is no other junior oil and gas company in North America that I know of with that offers such incredible potential for an acquirer.

Who Could/Should Buy Blackbird?

Understating your exit is critical when investing in natural resource stocks. I believe an exit in Blackbird would most likely be the result of a sale to any company looking for the following (which is every player in the Montney):

- Self-funded production to 40,000 boepd by 2022 with no debt on balance sheet. Blackbird would bring $105 million and no debt to the transaction. This makes Blackbird one of the most cashed-up junior E&Ps in North America. It has the cash to cover all capital requirements to not only delineate the land over four years of drilling but also grow production to 40,000 boepd by 2022.

- Over 300 drill locations (currently, but it will get to over 1,000) that makes up less than 20% of the land using only six wells per section. (Encana, on land adjacent to Blackbird, uses 28 wells per section – so I am being conservative).

- Annual production growth rate of 40% in Alberta, Canada which is a politically-stable jurisdiction. And infrastructure and take away are in place (I believe GHA-gas handling agreements will be in place within 12 months to demonstrate the secure future of Blackbird’s production).

- Capital Intensity – Looking at total well cost divided by EUR (Estimated Ultimate Recovery) and 1yr EUR, Blackbird is as competitive as the best wells in the Montney. Blackbird’s Capital Intensity is under $15/boe whereas the Wapiti is $21/boe and areas run by well-known large oil and companies of the Montney are above $30. By this metric Blackbird is in the lowest quartile.

- Reserve Replacement – Liquid-rich producers must replace declines in production with equally-focused liquids rich reserves. Remember oil, gas and condensate all decline at different rates and the liquids decline the fastest. That means that the liquid rich condensate producers must work even harder to keep its liquids production at the same levels. Blackbird’s acreage provides the larger liquid rich condensate producers the ability to tap into liquids rich production immediately.

- Significant value to any acquirer on both a NAV and peer comparison basis. This is called NAV accretion. Using a 10% discount rate, $50 per barrel WTI and a 1.25 USD/CAD exchange rate, Blackbird has a Net Asset Value of C$1.3 billion. In comparison to its Enterprise Value of C$163 million, Blackbird is considerably undervalued.

- Capital Intensity Efficiencies: Paybacks of less than 12 months. That is a top tier payback period, and wells could be paid back as quick as seven months at $45 oil. A key fact for any acquirer is minimal shareholder dilution to replace liquids-rich reserves with significant upside potential.

- I have another 12 metrics that can show the value of Blackbird. Any CEO that would like my in-depth analysis, by all means please email us at katusa@katusaresearch.com and I will personally walk you through my analysis in person or via conference call.

In Summary and Full Disclosure

To be completely transparent, I have a big dog in this fight.

I’m not a journalist and I’m not a stock promoter. I’m an investor. I have received zero compensation from Blackbird for sharing my thoughts on the company. I will receive zero compensation from Blackbird in the future.

I’m simply a large Blackbird shareholder who knows the company inside and out. An increase in Blackbird’s value is the only way I can benefit from this situation.

In my role as a positive activist investor, I’ve spoken to Garth Braun about Blackbird’s execution and business plan more than 100 times over the years. In fact, it’s no secret I urged Garth in 2013 to drop all his other assets and solely focus on the liquid rich areas of the Montney. I believed the area had huge potential. To Garth’s credit, he did exactly that.

However, I have no interest in encouraging a deal where one side wins and one side loses. I have an interest in playing the very “long game” and encouraging deals where both sides win. Looking at a potential Blackbird acquisition through this lens, I can confidently state that a purchase up to C$0.90 per share would be a great win for both an acquirer’s shareholders and Blackbird’s shareholders.

Also, I believe in the liquids-rich Montney so much, that I do not want cash for my shares. I want shares in the larger entity because I believe a buyout will create a “double bump” in shareholder value. One bump would come in the form of a premium price for Blackbird shares. A second bump would come from the development of the phenomenal assets.

Blackbird Energy owns tremendous assets in one of the world’s great shale fields. It is trading for 75% less than a conservative appraised value of those assets. It has no debt and can internally fund 100% of the development of its large land base. Any oil and gas CEO with an interest in Canada – and a fiduciary duty to shareholders – should seriously consider purchasing the company.

I believe the decision would go down as a brilliant capital allocation move that will create shareholders value for many, many years.

Regards,

Marin Katusa

CEO, Katusa Research

Large shareholder of Blackbird Energy

Disclosures and Disclaimers

Marin Katusa, Katusa Research Inc. (“Katusa Research”), and/or the other principals, partners, directors and officers of Katusa Research (the “Katusa Research Team”) own securities positions in, and are long on, the following companies mentioned above: BBI

Additionally, members of the Katusa Research Team currently intend to acquire securities in the following companies mentioned above: BBI

No members of the Katusa Research Team have received any commission or other compensation to feature any company mentioned in this newsletter nor are they party to any financial arrangement regarding the securities of such companies or any person who has any interest in such securities. The information contained in this publication is not intended and does not constitute individual investment advice and is not designed to meet your personal financial or investment situation or needs. Neither Marin Katusa nor Katusa Research are registered broker-dealers or financial advisors. Never make an investment based solely on what you read in an online newsletter, including this newsletter, especially if the investment involves a small, thinly-traded company that is not well known. Past performance is not indicative of future results. You should independently investigate and fully understand all risks before investing. When investing in speculative stocks, it is possible to lose your entire investment. Information contained in such publications is obtained from public sources believed to be reliable, but its accuracy cannot be guaranteed. Further, the views expressed herein are of Katusa Research as of the date hereof, are subject to change and the Katusa Research Team does not undertake any obligation to update such information or views. None of the members of the Katusa Research Team shall be liable for any damages, losses, or costs of any kind or type arising out of or in any way connected with the use of this newsletter. The information in this publication reflects the current opinion of the publisher, is subject to change, and may become outdated. The publisher undertakes no obligation to update any such information.

Unauthorized Disclosure Prohibited. The information provided in this publication is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. Katusa Research reserves all rights to the content of this publication and related materials. Forwarding, copying, disseminating, or distributing this report in whole or in part, including substantial quotation of any portion the publication or any release of specific investment recommendations, is strictly prohibited.

Click the link to review the detailed Terms and Conditions.