Key takeaways:

- Palantir Technologies posts a 48% year-over-year revenue jump to $1 billion in Q2 2025, significantly beating market expectations.

- The company lands a landmark 10-year U.S. Army contract valued at up to $10 billion, consolidating 75 prior contracts into a single streamlined agreement.

- Recent operational milestones mark Palantir’s strongest government sector expansion to date, underpinning its strategic position in federal software procurement.

- Stock price movement reflects strong investor response, while analysts remain positive, forecasting steady EPS and revenue growth through 2026.

Palantir’s Q3 Triumph: Earnings Beat and a $10 Billion Government Win

Palantir Technologies has reached an inflection point, combining operational strength with a historic contract win. In its Q2 2025 earnings report—released August 4—Palantir posted revenue of $1.00 billion, a 48% year-over-year leap, well above the consensus estimate of $939.29 million. Net income translated to an EPS of $0.16, outperforming the projected $0.12 by 33%. This growth is attributed to increased demand for Palantir’s artificial intelligence-powered data platforms among both commercial clients and government agencies, solidifying its standing in the data analytics space.

The standout achievement, however, is Palantir’s freshly awarded 10-year Enterprise Service Agreement with the U.S. Army, valued at up to $10 billion. Announced in early August, this deal consolidates 75 individual contracts—15 where Palantir served as prime contractor and 60 as subcontractor—into a single, streamlined contract. The scale allows the Army to leverage buying power for significant software discounts and reduces administrative burdens. Notably, this is Palantir’s largest contract vehicle to date, further anchoring its relationship with the Department of Defense and reflecting a strategic evolution in how the federal government approaches software procurement.

U.S. Army Mega Deal: What It Means for Palantir’s Future

The U.S. Army contract is not just sizable in dollar value but transformative in scope. It marks a new era for how military technology is bought and deployed, moving away from fragmented, short-term buys to coordinated, long-term partnerships. As underscored by Army officials, this approach is expected to bring greater efficiency while maximizing the government’s leverage for cost savings over the contract’s 10-year span. While the full $10 billion isn’t guaranteed at signing—the Army is only required to fulfill a minimum purchase—the agreement paves the way for Palantir to expand its portfolio of federally-backed AI, analytics, and battlefield management solutions. Operationally, the announcement is evidence of Palantir’s D.C. ascendancy and signals the Pentagon’s growing reliance on agile, data-driven firms.

This federal momentum builds on Palantir’s already deep government ties. Since 2008, the company has secured over $1.9 billion in U.S. federal contracts, with the Army being its single largest client. The new deal cements Palantir’s leadership, particularly as AI becomes central to both national defense and enterprise IT strategies.

Stock Surge: Analyzing the Price Moves and Analyst Sentiment

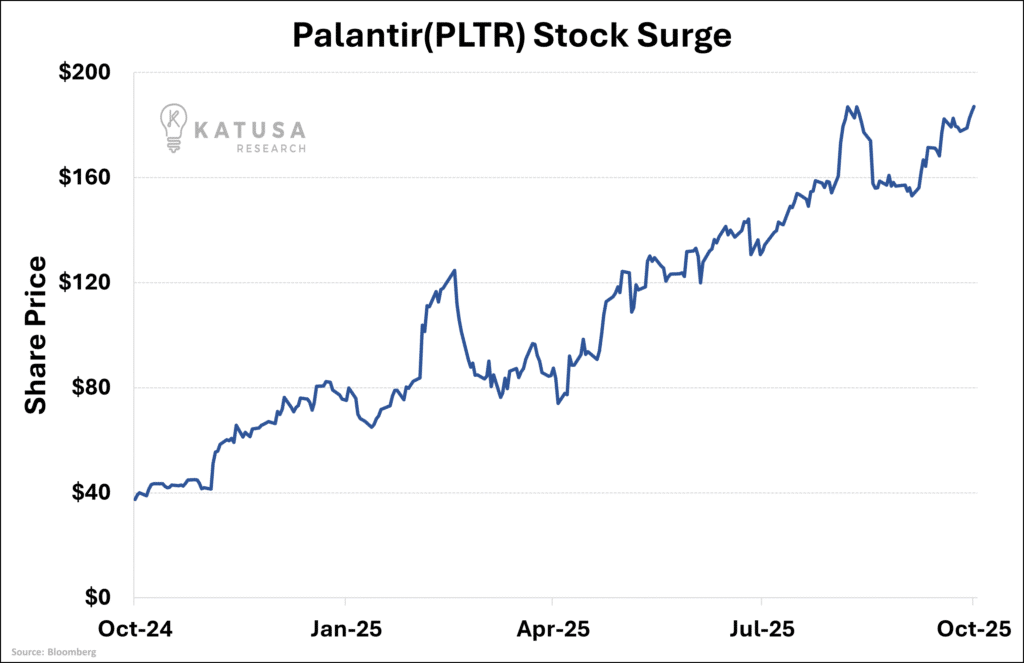

Following the dual news of the earnings beat and Army contract, Palantir’s stock witnessed pronounced swings as both retail and institutional investors recalibrated their positions. While after-hours and opening trading reflected bullish momentum, the broader trend has been toward consolidation, mirroring the company’s shift from speculative growth stock to a more established defense technology leader. As of August, Palantir held a trailing EPS of $0.30 and a notably high P/E ratio of over 620. For Q3 2025, analysts expect EPS in the $0.12–$0.14 range, with revenue targets near $1.1 billion—a continuation of its upward trajectory.

Consensus analyst ratings remain moderately positive, citing steady earnings growth (forecasted at 9.7% for the next fiscal year) and improved revenue visibility due to the Army contract. However, high valuation metrics are flagged as a point of caution, with some experts recommending cautious accumulation versus full allocation. The market response indicates growing confidence in Palantir’s operational execution and its long-term prospects in government tech contracts.

What’s Next: Strategic Vision and Growth Outlook

Looking ahead, Palantir’s future rests on the successful execution of its current commitments and continued innovation in AI-enabled analytics. The Army agreement provides a predictable foundation for growth and intensifies Palantir’s competitive moat against both legacy defense contractors and new software entrants. The company’s pipeline now extends beyond defense—with expansion initiatives in healthcare, finance, and global commercial markets—while maintaining its core focus on high-value, mission-critical federal work.

For investors, Palantir’s Q3 performance and recent federal win position it as a key player in the intersection of technology and government. In an environment where data and intelligence are vital, Palantir’s scale, government backing, and ability to consistently beat expectations create compelling reasons to monitor its trajectory closely.