DISSEMINATED FOR URANIUM ROYALTY CORP (NASDAQ:UROY).

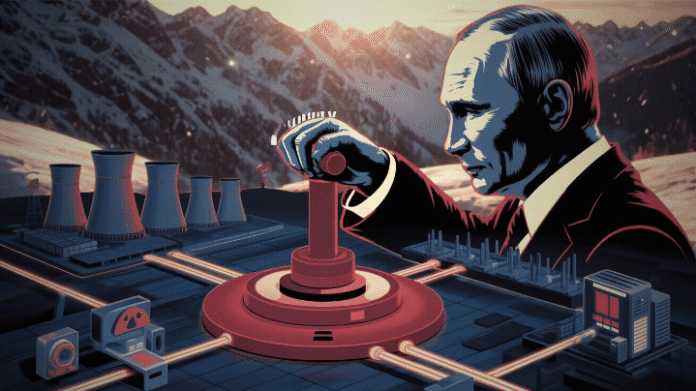

Vladimir Putin has a potential “off switch” for the deployment of American AI.

Not through cyber warfare. Not through sanctions. Through something far more sinister…

Right now, America buys 27% of its enriched uranium supply from Russia.

And it’s a full 50% in uranium when you include Russia, Kazakhstan and Uzbekistan.

One phone call from Moscow could cripple some of the nuclear plants feeding Silicon Valley’s AI revolution.

And Putin can potentially turn off the tap whenever he wants.

Microsoft knows. Amazon knows.

That could be a reason why they’re spending billions of dollars to not just resurrect past producing nuclear power plants like Three Mile Island, but also the vertical integration of the nuclear fuel sector.

America’s Achilles Heel: We’re Nuclear Junkies in Denial

95%.

That’s how much uranium America imports. And it produces 677,000 pounds, while consuming 45 million.

Where does it come from?

Kazakhstan (22%), Russia (12%), Uzbekistan (10%). Nations that are traditionally in Moscow’s sphere of influence.

For context: At peak Middle East dependence, we imported 60% of our oil.

We’re 95% dependent on foreign uranium for a new supply.

But here’s the real nightmare: Russia is the current source of 27% of our enriched uranium – the processed fuel that actually powers reactors.

- Russia controls one-third of global conversion capacity and half of all enrichment.

In May 2024, Congress banned Russian uranium imports. The ban kicks in fully by 2028, unlocking $2.72 billion for domestic production.

Three years to rebuild an industry some would say the country let weaken over four decades.

America needs a fuel line… and fast.

Microsoft Paid $1.6 Billion to Resurrect a Dead Nuclear Plant

Training GPT-4 consumed 50 gigawatt-hours of electricity and the cost was over $100 million. Time: months of continuous processing on thousands of synchronized chips.

Any power interruption corrupts the entire run. Months of work, hundreds of millions of dollars – vaporized.

Now multiply that problem: ChatGPT handles billions of prompts a day.

The average query uses about 0.34 watt-hours, about what an oven would use in a little over one second.

By 2028, individual AI training runs will require 1 gigawatt of continuous power. By 2030? 8 gigawatts.

That’s about eight full nuclear reactors equivalent for a single AI model.

This may be a reason why:

- Microsoft is spending $1.6 billion to restart Three Mile Island’s 835 MW reactor.

- Amazon committed $500 million to X-energy for up to 5 GW of nuclear capacity.

- Google signed its first nuclear deal with Kairos Power for 500 MW.

For AI workloads that can’t tolerate a millisecond of downtime, it’s apparent that only nuclear works.

America needs uranium.

One company is ready to oblige…

HIGH RISK: **Disseminated on behalf of Uranium Royalty Corp**

Uranium Royalty Corp.

(NASDAQ:UROY | TSX:URC)

Uranium Royalty Corp (UROY) owns over 2 million pounds of uranium inventory above ground and royalties on projects ranging from exploration to production.

It has 25 interests in 22 uranium projects at various stages, including large producers such a McArthur River and Cigar Lake.

These are projects globally in various stages of development, including 6 strategic US assets.

From royalties on producing assets to a 10% gross royalty on New Mexico’s Churchrock Project –

That’s one of America’s largest undeveloped deposits with 50.8 million pounds of uranium.

For perspective: US production just increased from 50,000 to 677,000 pounds in a single year – a 13-fold increase.

And this is just the start.

Energy Secretary Wright asserted in a speech to the International Atomic Energy Agency in Vienna recently…

That the US strategic uranium reserve needs to be continued and expanded.

All because of America’s dependence on foreign, even adversarial, sources.

The Inevitable Collision

Data centers currently consume 3% of US electricity. By 2030: an expected 8% based on Goldman Sachs estimates. Most of that growth will largely come from AI.

Between five and six US facilities now produce uranium. Four more on standby could add 7.8 million pounds of capacity.

Even at full capacity, we’d only meet approximately half our reactor needs.

The infrastructure gaps are staggering.

There is only one uranium conversion facility (Honeywell’s Metropolis Works). It was built in the 1950’s and running well its historic capacity.

And only one commercial enrichment facility (URENCO USA).

It’s in New Mexico, but not sufficient to meet all US needs, especially in a hyper-growth phase.

No US facility can produce HALEU (high-assay low-enriched uranium) for next-generation reactors. Though there is HALEU capacity under development in the USA.

Russia is currently the world’s only commercial supplier of it.

The Dots You Need to Connect

In 1954, Lewis Strauss predicted nuclear energy would be “too cheap to meter.”

He was wrong about the timeline.

But he might be right about the destination.

Because AI changes everything. When a single training run costs $500 million in electricity, nuclear economics flip.

When national security depends on AI supremacy, and the power narrative turns to nuclear, uranium becomes desirable.

Russia knows this. That’s why they’re squeezing supply.

China knows this. They’re locking up global uranium mines.

Silicon Valley knows this. They’re moving to invest in reactors.

Uranium Royalty Corp (NASDAQ:UROY) doesn’t need uranium to hit $100/pound to soar.

They just need production to scale or projects they hold interests in to move towards production or scale up meaningfully.

Which is happening. Right now.

The Russian ban created a countdown clock. Tech giants created insatiable demand.

We like Uranium Royalty Corp and are extremely biased.

Regards,

Marin Katusa and the KR Special Situations Team

P.S. You should review UROY’s most recent Annual Information Form and other filings under its profile at www.sedarplus.ca and www.sec.gov for important information on UROY’s business, royalties and other assets.

IMPORTANT DISCLAIMER & DISCLOSURES

Investing in stocks is HIGH RISK. You could lose All of your investment.

Katusa Research, as a publisher, is not a broker, investment advisor, or financial advisor in any jurisdiction.

Please do not rely on the information presented by Katusa Research as personal investment advice.

If you need personal investment advice, kindly reach out to a qualified and registered broker, investment advisor, or financial advisor.

The communications from Katusa Research should not form the basis of your investment decisions. Examples we provide regarding share price increases related to specific companies are based on randomly selected time periods and should not be taken as an indicator or predictor of future stock prices for those companies.

Uranium Royalty Corp is a paid sponsor of this report.

The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted Securities, in the United States or to U.S. Persons. Securities may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and applicable U.S. state securities laws or pursuant to an exemption therefrom.

Any public offering of securities in the United States may only be made by means of a prospectus containing detailed information about the corporation or entity and its management as well as financial statements. No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter. Katusa Research nor any employee of Katusa Research is not registered with the United States Securities and Exchange Commission (the “SEC”): as a “broker-dealer” under the Exchange Act, as an “investment adviser” under the Investment Advisers Act of 1940, or in any other capacity. Katusa Research, its owners, directors, and employees are also not registered with any state securities commission or authority as a broker-dealer or investment advisor or in any other capacity.

HIGHLY BIASED:

In our role, we aim to highlight specific companies for your further investigation; however, these are not stock recommendations, nor do they constitute an offer or sale of the referenced securities. Katusa Research partner company, New Era Publishing Inc. has received cash compensation in the amount of $1.25M from Uranium Royalty Corp and is thus extremely biased. It is crucial that you conduct your own research prior to investing. This includes reading the company’s SEDAR and SEC filings, press releases, and risk disclosures. The information contained herein regarding Uranium Royalty Corp. has been derived from its SEDAR+ and SEC filings, including scientific and technical information regarding its royalty assets which has been reviewed and approved by Darcy Hirsekorn, its Chief Technical Officer and is a professional geoscientist in Saskatchewan and a qualified person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects and is registered as a professional geoscientist in Saskatchewan. Information regarding the projects underlying Uranium Royalty Corp.’s interests has been derived from the publicly available disclosure of the underlying operators and owners, including where referenced herein.

Katusa Research, and its directors, employees, and members of their households directly own or may own shares of Uranium Royalty Corp (UROY/UROY.TSX). Therefore, Katusa Research is extremely biased. Measures are in place such that no shares will be sold during the active awareness campaign.

HIGH RISK:

The securities issued by the companies we feature should be seen as high risk; if you choose to invest, despite these warnings, you may lose your entire investment. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures.

NOT PROFESSIONAL ADVICE:

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. While Katusa Research strives to provide accurate and reliable information sourced from believed-to-be trustworthy sources, we cannot guarantee the accuracy or reliability of the information. The information provided reflects conditions as they are at the moment of writing and not at any future date. Katusa Research is not obligated to update, correct, or revise the information post-publication.

FORWARD-LOOKING STATEMENTS:

Certain information presented may contain or be considered forward-looking statements. Such statements involve known and unknown risks, uncertainties, and other factors that may cause actual results or events to differ materially from those anticipated in these statements. There can be no assurance that any such statements will prove to be accurate, and readers should not place undue reliance on such information. These statements are subject to known and unknown risks including those set forth in Uranium Royalty Corp.’s most recent annual information form and other public filings available at www.sedarplus.ca and www.sec.gov. Neither Katusa Research nor Uranium Royalty Corp. undertake any obligations to update the information presented or to ensure that such information remains current and accurate, except as required under applicable law.