The stock market runs on two different operating systems simultaneously, and most people can only see one at a time.

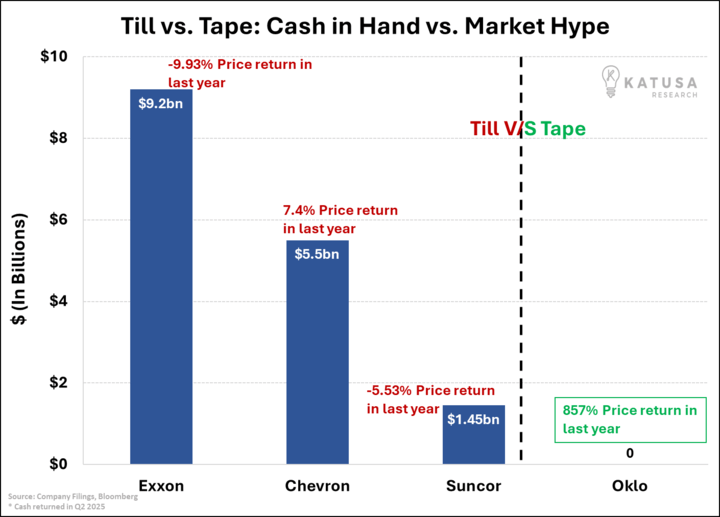

This month, investors bid up tiny nuclear start-up Oklo Inc. (OKLO) to over $80 per share, up 850% in the last year, weeks after it won a contract to power an Air Force base in Alaska.

Here’s the kicker: Oklo has no revenue, no certified reactor, and years of permitting ahead. Yet its scorching tape still pulled in tens of thousands of new eyeballs from Robinhood accounts.

Welcome to the split personality of modern markets…

A stock can add a billion in market cap before lunch on a headline that barely fills a tweet.

No permits. No product. No paying customers.

But the price rips, volume explodes, and by 3 p.m., the company is selling new shares at the higher price to fund the dream.

That’s tape money at work – the market voting on itself.

Months later, the engineers are still wrestling with physics, the lawyers are wrangling permits, and the accountants are staring at a revenue line stuck at zero. The only thing that pays salaries, interest, taxes, and dividends is the till – real cash from real customers.

That’s till money and it wins the endgame.

Most investors get hurt because they confuse the two. Some even pick a side and make it a religion. The winners speak both dialects and know when to switch.

Two markets inside one ticker

On the surface, a ticker is a single story: up, down, or flat.

Underneath, two currents run in opposite directions.

Tape money chases attention. It feeds on price, options flow, short positioning, and fresh narratives. It loves scarcity, sizzle, and speed. It can turn a press release into a moonshot and a rumor into a rout.

Till money funds operations. It shows up in purchase orders, service contracts, gross margin, and repeat business. It scales slowly… until it doesn’t. The till is steel, quiet and load-bearing.

Both are real. Both can make you rich. They just answer different questions.

- Tape asks: What will someone pay me tomorrow?

- Till asks: What will this enterprise earn for years?

If you don’t understand which river you’re swimming in, you’ll get swept away by the current, either from FOMO or from clinging too long to a “great story” that never ships product.

Why The Till Feels Boring… Until It Pays Off Your Mortgage

The till is slower because it has to be. Factories get built. Interconnects get scheduled. Customers are trained; service teams hired; working capital tied up. None of it trends on social media. All of it matters.

Then one quarter the lights come on: recurring revenue, widening margins, a balance sheet that funds itself. The tape crowd says you’re “late.” The accountants say you’re “on time.” And investors who showed up when the story became a system get paid for a decade.

Meanwhile, the till doesn’t trend, it pays.

In Q2, Exxon generated $11.5B CFO and $5.4B Free Cash Flow, returning $9.2B to owners. Chevron mailed back $5.5B and hit record Permian output. Suncor delivered $2.7B AFFO and $1.0B free funds flow with $1.45B returned.

Compounding is the quietest miracle in finance. The till is where it lives.

Making Money: How Pros Actually Switch Gears

Phase 1 – Story Stage:

When a company lives on slides, treat it like tape money. Rent, don’t own. Use strict position sizing. Trim into strength. Let the market pay you to watch the narrative unfold.

Phase 2 – Milestone Stage:

Watch for the story to earn dates, dollars, and documentation. Permit filings on schedule. Binding contracts with creditworthy counterparties. Committed project financing. Real engineering milestones.

Phase 3 – Business Stage:

When narratives become systems, recurring revenue, predictable margins, self-funding growth, convert trading gains into core positions you’d hold through a bad quarter. Let the till fund your wealth.

The Market is a Beauty Contest

You’re not paid for guessing what a company is worth.

Price isn’t moral, it’s information, like when Oklo trades at $80 with zero revenue, that’s not “madness.” That’s the market saying this narrative has enough momentum to become self-reinforcing due to future expectations of value milestones.

High stock prices create cheap currency for growth. Growth can retroactively justify high prices. The beauty contest becomes beautiful.

But cash flow is a consistent winner. Hype raises capital; only the till keeps companies alive when sentiment shifts and market sentiment changes.

The sophisticated investor reads both signals: Let the beauty contest fund your research, let the cash register fund your wealth.

Stop moralizing price action and start translating it.

I Don’t Sneer At Tape

It’s a signal, and on the right day, a gift. But I don’t marry it either.

If a name doubles on narrative, I’m happy to take a Katusa Free Ride and let the house’s money ride, only if the calendar fills with real milestones.

- In the latest edition of Katusa’s Resource Opportunities – Investors are sitting on 257% gains and taking a big free ride on one of their gold positions.

If the milestones slip and the story reverts to sizzle, I treat it like a rental and move on.

If a company graduate on time from prototype to operations, with capital committed and customers who pay, I’ll size it like a business and let compounding do the heavy lifting. That’s the whole playbook, just proper sequencing.

Every bull mints tape millionaires. But only the smart ones stay rich, because they graduate to the till.

Keep this in mind…

Let the tape invite you to the party and let the till pay for the house.

Regards,

Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.