When U.S. military officials learned their night vision goggles relied on the same metal fueling Bill Gates’ newest clean energy bet, alarm bells rang in Washington.

That metal is Antimony—and China just weaponized its control over the global supply.

According to U.S. Army Major General (retired) James Marks, antimony, a critical metalloid, is a key element of the American war machine…

It’s essential for communication equipment, night vision goggles, explosives, ammunition, nuclear weapons, submarines, warships, optics, laser sighting and more.

China’s calculated move blindsided Western markets…

Beijing announced sweeping export controls on antimony products starting September 2024, sending prices skyrocketing to $29,250 per metric ton – more than double last January’s levels.

Today, prices hover near $44,000 per metric ton.

The timing couldn’t be worse for the U.S. Antimony is now the linchpin of next-generation energy storage and vital defense technologies.

- America’s stockpile? Just 1,100 tons—covering barely 5% of annual demand.

Long overshadowed by better-known minerals, antimony has emerged as a critical component in the green energy revolution and defense technologies.

A Critical Mineral with a “Military Metal” History

Antimony has been used for centuries, but it became a true game-changer during World War II…

At that time, up to 90% of U.S. antimony demand was met by domestic production.

Today, the U.S. doesn’t mine antimony at all… relying entirely on imports, primarily from China.

Despite this, antimony’s list of uses has expanded far beyond its wartime role.

Antimony’s unique properties, especially its ability to harden and strengthen metals, make it a cornerstone of several industries. Its application in military technologies, from night vision goggles to explosive formulations, underscores its significance for national security.

- Antimony is crucial for flame retardants, lead-acid batteries, and radiation shielding.

But it’s not just in traditional industries where antimony is leaving its mark…

The global economy is moving towards cleaner energy sources and advanced technologies, and that’s where antimony is becoming a pillar of emerging energy storage systems and green technologies.

Who Dominates the Antimony Supply Chain?

For the past 25 years, China has dominated the antimony market.

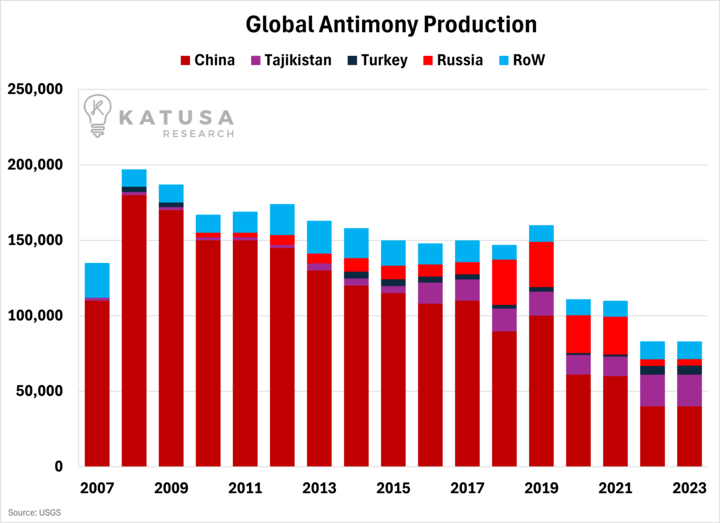

- 2000-2010: China dominated with 75–83% of global antimony supply. Global production averaged 140,000 MT annually.

- 2010-2020: Stricter regulations, illegal mining crackdowns, and Russian-Tajik competition cut China’s share to 50–60% by 2020. Global output ranged from 115,000 to 150,000 MT annually.

- No Russian antimony: Sanctions on Russia have reduced Russian production by 82% from 2021 levels. Russia accounted for 20,000+ tonnes of annual antimony supply.

Recently: As of 2023, China’s share had decreased to 48%, and global production continued to fluctuate around 100,000-140,000 MT annually, with Tajikistan increasing its production significantly.

Dependence on Chinese processing poses severe disruption risks, similar to rare earth elements and cobalt.

Global Supply Constraints and the China Factor

Despite its growing importance, the global production and supply of antimony are highly concentrated, leading to significant market risks.

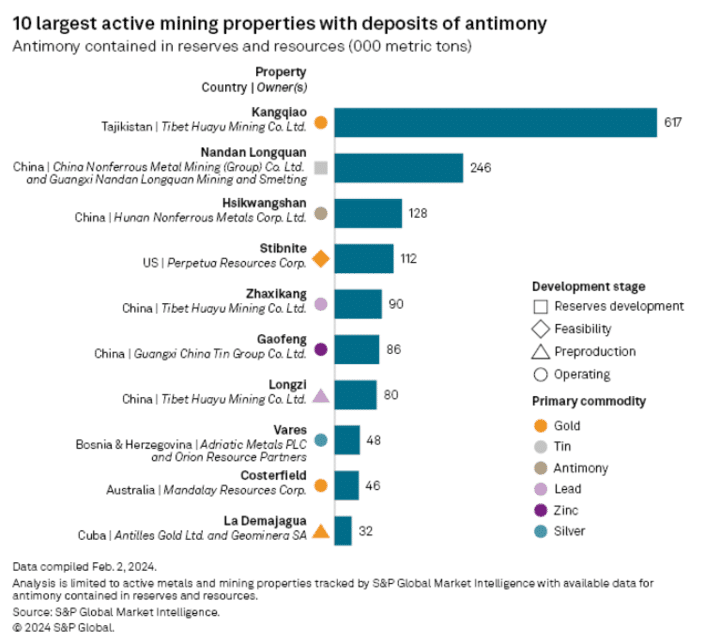

- Chinese companies own five of the 10 largest active mining properties with deposits of antimony.

The Case for U.S. Antimony Production

Because it’s so critical, the push to restart U.S. antimony production is gaining traction…

Historically, deposits of antimony have been found in the Western U.S.—Idaho, Montana, Utah, Nevada and Arizona—though environmental challenges have limited production.

- The most famous site, the Sunshine Mine in Idaho, once the largest producer of antimony in the U.S., has long since closed.

Currently, foreign sources of Antimony account for 82% of US antimony requirements. Antimony sourced from China satisfies 63% of US antimony consumption. While domestic recycling accounts for 18%.

And if you thought maybe the US had a big stockpile to lean on in case the Chinese really got angry, think again.

The US stockpile of antimony is a paltry 1,100 tons, compared to the 23,000 tons consumed in 2023. (Source)

BONUS: Solving Renewable Energy’s Biggest Challenge

Antimony is becoming essential to cutting-edge industries, from solar panels and defense systems to advanced batteries. As global supply chains falter and prices climb, securing reliable antimony resources has never been more critical.

While renewable energy is the cheapest form of electricity to generate, its true challenge lies in storage—what happens when the wind stops or the sun sets?

Antimony is poised to play a key role in addressing this crucial energy storage need.

- One of the most promising developments in this space is the Liquid Metal Battery (LMB)—a next-generation battery technology that has the potential to revolutionize grid-scale energy storage.

From NATO to North America: A New Antimony Player Emerges

The global antimony crisis is unfolding, and one forward-thinking company is stepping up to fill the gap.

With antimony prices skyrocketing 200% this year to $44,000 per ton—and China cutting off exports—the U.S. is scrambling to secure reliable supplies of this critical mineral.

A little-known player has quietly secured high-grade antimony deposits in NATO territory, far from the geopolitical risks of China.

This company is poised for a breakthrough with its promising antimony and gold project.

With grades exceeding the global average, the company is taking significant steps to modernize its resource estimates and position itself as a leader in addressing the critical mineral supply chain crisis.

This company has just secured a property in a past producer in Nevada, a site with a history of antimony and gold deposits.

Just 12 kilometers from Kinross’s Round Mountain gold mine, the property shows signs of untapped resource potential.

Antimony is indispensable for defense technologies, renewable energy, and critical infrastructure.

American manufacturers use more than 50 million pounds of antimony each year for fireproofing compounds, batteries, ammunition, electronics, specialty glass, and other products, according to MetalTech.

With zero U.S. production, only 17 days of strategic reserves, and China controlling 48% of global supply, the market is desperate for new players.

The story is just beginning…

Prices just hit $44,000 per ton, making this one sector to pay attention to.

Tomorrow, we’ll reveal a company in this niche market…

Stay tuned,

Anthony Ford

Publisher, Katusa Research

Sources:

2. https://www.csis.org/analysis/chinas-antimony-export-restrictions-impact-us-national-security

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.