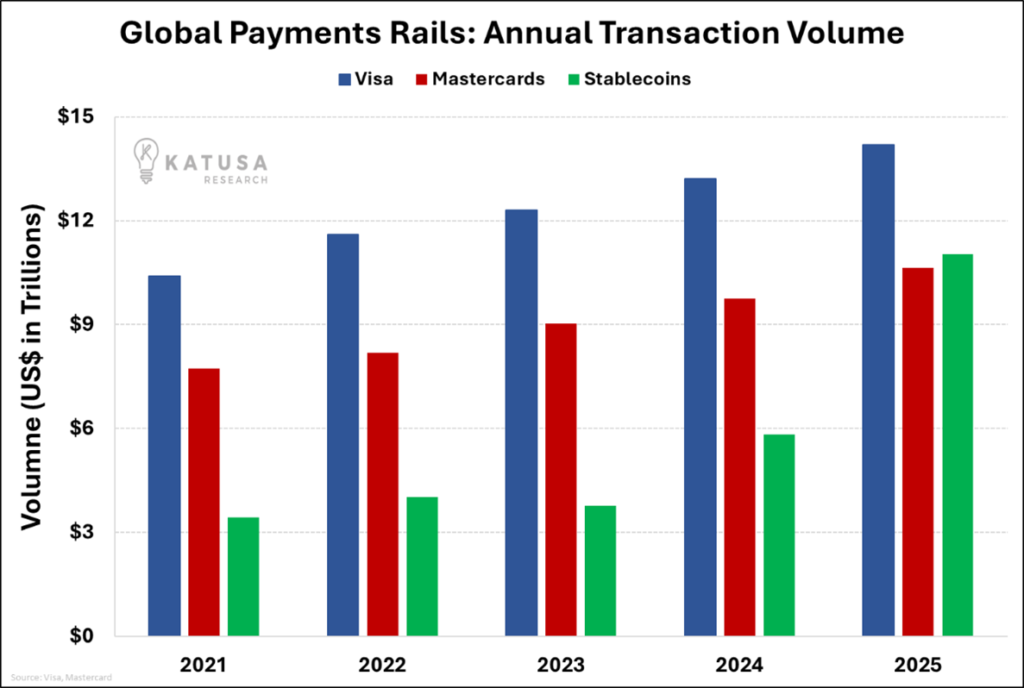

A financial network you’ve never used settled $11 trillion.

That’s Visa’s entire annual volume.

Almost nobody in traditional finance noticed. No banks were used. No wire transfers. No SWIFT codes.

But the company behind it noticed. And then they did something that won’t make sense to you yet.

They started buying physical gold. Tonnes of it.

Every single week.

I’ll explain why, but first you need to understand what stablecoins are. Because without that, the rest of this letter is gibberish.

The global financial system is fundamentally broken.

Three billion people don’t have access to banking, they’re too poor for their deposits to matter. Billions more use ever-weaker currencies, watching inflation eat their money alive.

Then there’s SWIFT, the international payments network. It’s excruciatingly slow, charges fees, and has become highly politicized.

The dream is a currency that replaces all of these, providing:

- A stable store of value

- A free means of payment

- Borderless monetary transactions

Bitcoin was supposed to be the answer. Then it turned out to be extremely volatile and costly in fees.

So, a decade ago, a tiny company created USDT, the first stablecoin.

USDT is a digital token “tethered” to the value of the U.S. dollar, the strongest fiat currency in the world. Making its value extremely stable.

Unlike Visa, Mastercard, or Bitcoin, USDT has no transaction fees.

Stablecoins appear to be the final, most beneficial iteration of crypto.

And for years, they met with crickets.

Stablecoins Light Up the Old Financial Order

Then in 2020, global currencies began to break under the strain of COVID recovery.

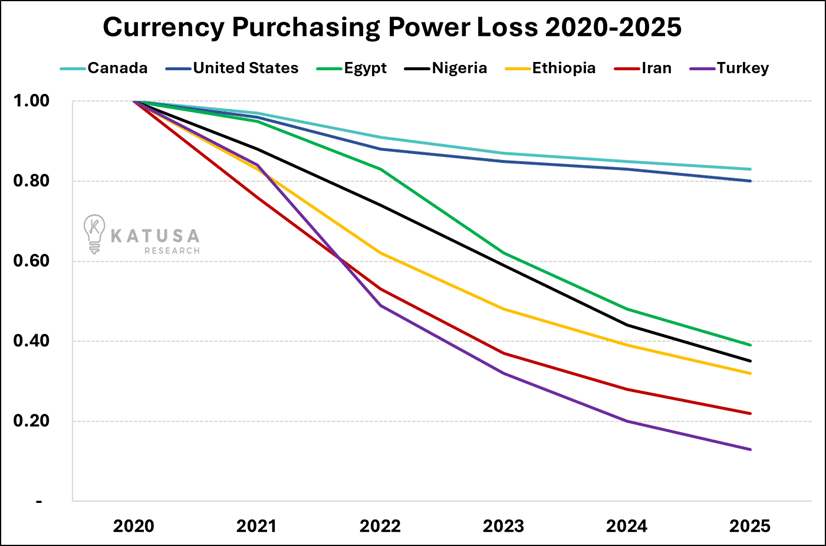

Hugely populous countries like Turkey, Iran, Ethiopia, Egypt, Nigeria… saw their currencies lose as much as 80% of purchasing power.

All of this had happened before. But this time, there was a way for people to convert their weakening currency into something strong: USDT.

Stablecoin usage has exploded since then.

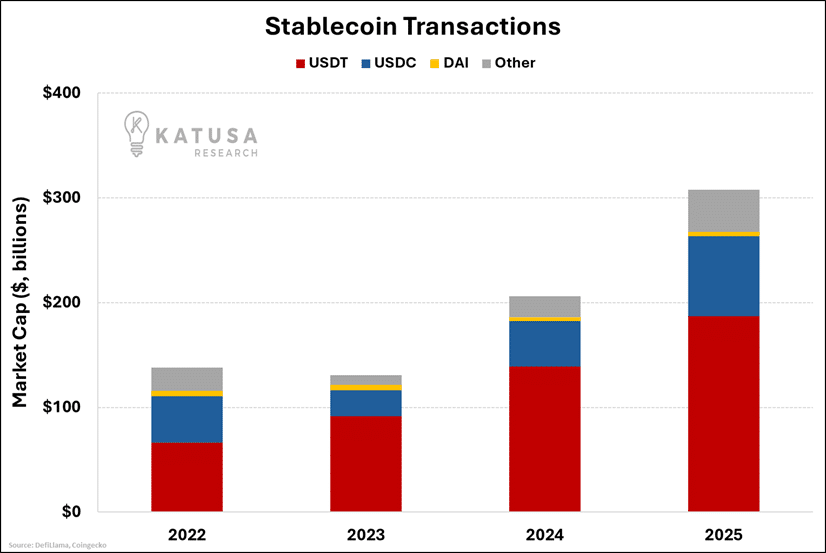

Their total market cap is now $300B+, up 60x from five years ago.

Volume in the last two years has tripled.

Stablecoins have ripped transaction value away from every other on-chain currency, including Bitcoin, hitting nearly 80% of crypto transactions by 2023.

Stablecoins now rival Visa and MasterCard’s trillion-dollar volumes.

They are a full-fledged parallel global payments system and settlement network.

USDT is 60% of the market, and its market cap and volume continue to blow up. It’s grown by $48B in 2025 alone… more than its entire market cap in 2021.

More than 500M users in emerging markets transact in USDT.

USDT now has more users than the combined populations of the United States and Canada.

The U.S. Treasury Secretary expects the stablecoin market to expand to $3T by 2030.

In other words, it could 10x from here.

That creates a mammoth problem for the tiny company that created USDT.

The Re-Dollarization of the World Has a Flaw

USDT is bringing about an end to the global financial system as you know it.

Stablecoins bypass all the gatekeepers: SWIFT, credit card networks, capital controls, and correspondent banks.

Meanwhile, it’s a boon for the USD. Nearly 100% of stablecoins are denominated in U.S. dollars.

So just as central banks are pulling back support…

- USDT is singlehandedly re-dollarizing the world.

The US Dollar is a strong currency. But since it was taken off the gold standard, it has been unbacked by anything except global trust in the dollar.

But now the world’s trust in the dollar is evaporating faster than DC can raise the debt ceiling.

BRICS nations will refuse to use USDT, or any other stablecoin based on the USD. So, the next evolution of money must be anchored outside the geopolitical system.

The company that created USDT saw this coming.

And they’ve built a new financial instrument: a stablecoin that is a perfect store of value, infinitely portable, and has no fiat backing.

A true, sovereign-neutral monetary unit.

This time, it’s based on gold.

The world’s future runs on stablecoins. The only question is whether those coins are backed by worthless paper, or by the oldest money on Earth.

Predictably, people ignored gold-backed crypto at first. Now it’s begun reshaping the global financial system.

And the company that created it stands the chance to build the first private global reserve currency in history.

I call it The Parallel Reserve

A monetary system operating completely outside government control.

No voters. No Congress. No permission required.

Backed by physical gold sitting behind Cold War blast doors in a Swiss nuclear bunker.

The man running it is 41 years old. Italian.

When Bloomberg asked why he’s hoarding gold at a pace that rivals central banks, his answer should stop you cold: “We believe the world is going towards darkness.”

This isn’t some gold bug on YouTube. This is the CEO of a $186 billion financial institution, a company that processes more transaction volume than Visa.

And he’s not just buying bullion.

He’s quietly acquiring stakes in the companies that produce gold. FOUR so far.

The regulatory filings contain the same phrase that translates to:

“Intends to propose changes to ownership structure and operations.”

That’s acquisition language. And I’ve identified exactly which companies are next.

And it’s already happening, right now.

Tomorrow, I’m going to show you the full blueprint.

What the Parallel Reserve is, how it works…

- And the three specific gold investments I believe could deliver 200% to 500% returns as this plays out.

This is the biggest and most exciting opportunity I’ve seen in 20 years of financing resource deals.

I don’t say that lightly.

Watch your inbox.

Regards,

Marin Katusa

Founder, Katusa Research

Get real-time alerts right away. Follow on X: @KatusaResearch and @MarinKatusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.