In this week’s Investment Insights:

- Unveiling Uravan: From secret Manhattan Project mine to modern ghost town.

- Resilient and Radiant: How Uravan’s past fuels America’s Nuclear future.

- Investment Alert Coming: How rising uranium prices are pushing a new era of mining opportunities.

Dear reader,

The people of Paradox don’t want your pity.

This small town in Western Colorado is home to former uranium mining and mill workers and their children.

They’re dying of cancer and lung disease. They buried many loved ones over the years.

Some of them can barely breathe and depend on oxygen tanks.

It’s a common story in rural America today.

But when a public hearing was held on whether a former uranium mine was allowed to reopen near Paradox, the only critics were activists from outside of town.

The people of Paradox want to get back to work.

And after an 8-year ban on uranium mining in Colorado, a judge finally lifted the ban in 2019, which opened up 31 former mines.

Colorado was once the epicenter of the uranium mining industry. And the most infamous mine was dug out around the town of Uravan, Colorado.

It was here that the Manhattan Project set up a secret uranium mine to help them create the atomic bombs that were dropped on Hiroshima and Nagasaki.

The miners of Uravan didn’t find out about the role they played in history until much later. They had stable jobs, and they were proud to produce what was needed.

After the Manhattan Project ended, and the nuclear arms race began, Uravan turned into one of the biggest uranium mines in the country.

Federal agencies built backcountry roads and set up towns for the miners and their families to live in.

The Atomic Energy Commission set a guaranteed price for uranium to incentivize companies to keep digging for the ore.

It was the first (and last) government-sponsored

minerals rush in history.

Today, Uravan is a ghost town.

Following the Cold War and nuclear incidents worldwide, uranium from down blended Russian nukes caused demand for US-produced uranium to plummet, leading to the closure of its mine.

Displaced residents received compensation for unsafe working conditions, using these funds for new homes and medical bills.

Yet, despite health challenges, former miners carry no regrets, understanding their risks and discussing uranium with expert-level knowledge.

They recognize that poor mine safety, not uranium itself, led to their illnesses.

Today, many still display uranium and yellow cake in their homes, a nod to their proud, complex legacy.

After decades of research, it turns out the Uravan residents were right…

As public sentiment and laws evolve, a 2020 Department of Energy report introduced initiatives to bolster U.S. nuclear capabilities, including establishing a Uranium Reserve and a Nuclear Industrial Base.

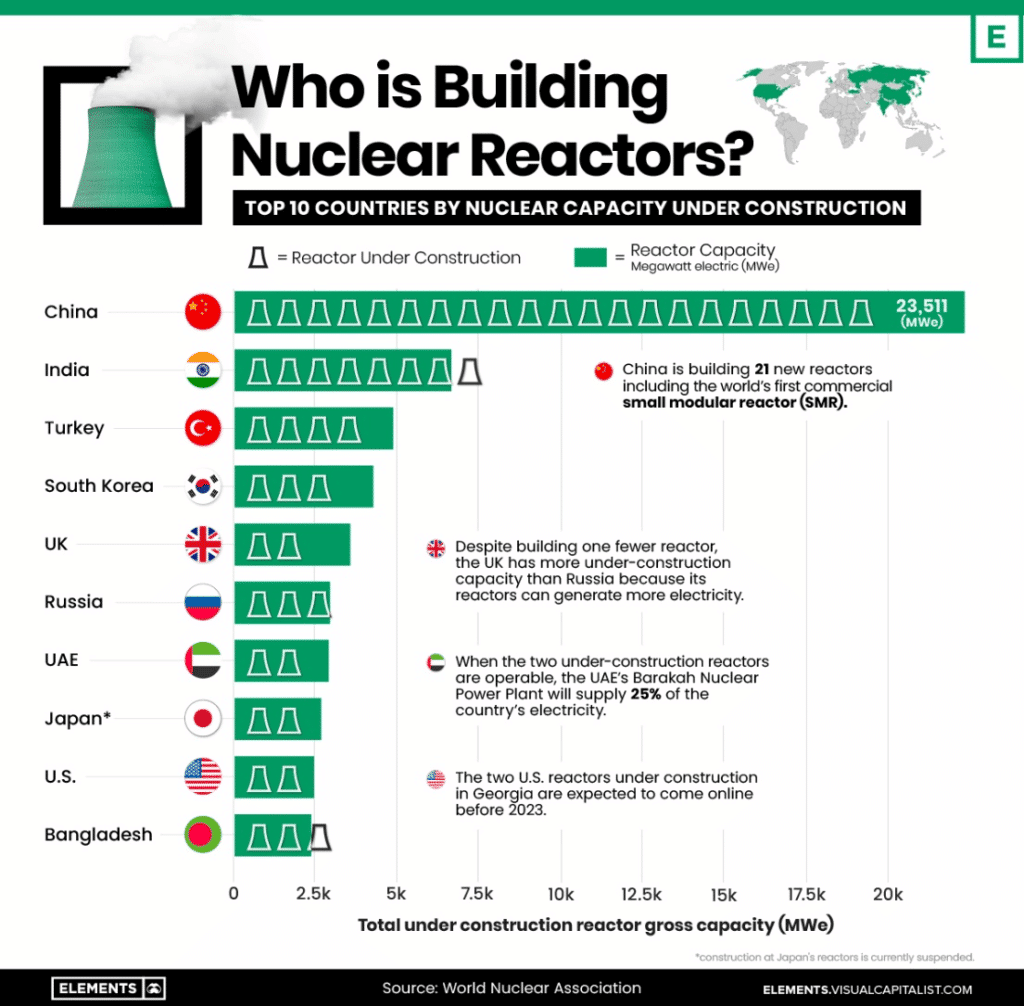

While U.S. nuclear development has stalled, nations like China, India, and Saudi Arabia are expanding their nuclear activities.

Despite global growth in nuclear energy, valued at $36 billion, the U.S. still imports over 95% of its uranium due to earlier mine closures, including Uravan’s.

Uranium is Trending UP…

Just like the U.S. ramped up domestic production of oil and natural gas in the early 2000s, which made America truly gas-independent…

The government is starting to feel the pressure of geopolitical tensions that could threaten the supply of uranium to meet our energy needs.

The Democratic push towards renewable energies and away from fossil fuels will only add to this pressure.

However, only 21% of energy comes from renewables compared to 60% from fossil fuels, despite billions of dollars in investment.

It’s clear that it won’t replace fossil fuels anytime soon.

Right now, the only viable alternative to dirty coal isn’t clean coal or the hope of renewables overnight. It’s nuclear energy.

Which is why the industry is expected to grow to almost $50 billion by next year.

This could turn into a tailwind for a

“Twin Engine” company I’m looking at right now…

In fact, its partner is one of the largest producers of uranium in the world.

They are well-connected uranium professionals, who government officials ask their opinion on nuclear matters.

The uranium price recently hit a 16-year high.

This high uranium price is throwing jet fuel into an already accelerating mining industry. And the company I’m looking at is positioned to capitalize from this trend.

I’ll admit, I’ve invested in quite a few resource opportunities in my life… Single-asset companies typically carry a lot of risk.

If the asset in question doesn’t work out, or the government strongarms itself into a free interest, company valuations can diminish overnight.

With multiple projects that were selected during the depths of the bear market by a management team that knows what they are doing, investors get optionality, with less risk through diversification.

Right now, I see exactly that…

A company, that I believe, is positioned to profit from the current demand for resources in the ground the company currently holds.

Regards,

Marin Katusa and the KR Special Situations Team

P.S. We just published on a nuclear sector company that saw its stock jump 13% in the days after we published it.

If you want to be first to the story, consider becoming a member of Katusa’s Resource Opportunities – my premium research service, today.

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.