It’s over. Welcome to The Rise of America.

The votes are in, and the people have spoken: Donald Trump will be the 47th U.S. President.

So far, the markets have reacted positively to this news, as they usually do…

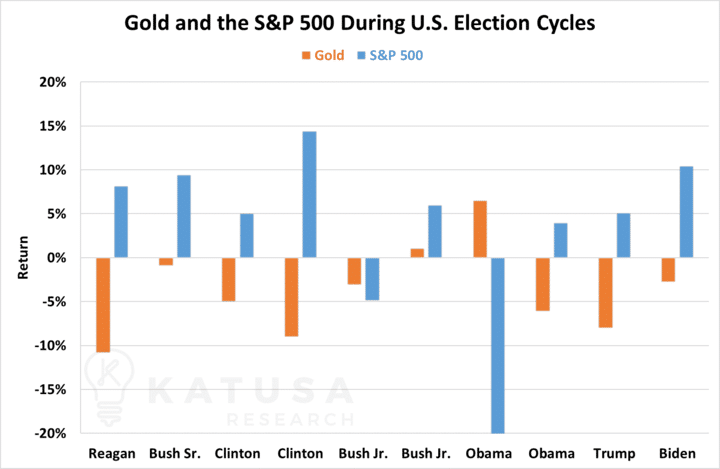

Historically, U.S. stock markets have rallied during the two months before and after presidential elections.

In contrast, gold typically retreats from September to January in election years.

But there have been two notable exceptions:

- George W. Bush’s first term began just as the dot-com bubble burst in March of the election year.

- Barack Obama’s first term kicked off shortly after the Global Financial Crisis, with Lehman Brothers’ colossal bankruptcy occurring mere weeks before the election.

Here’s the bottom line: Presidents usually have minimal direct impact on stock market performance.

It’s the Federal Reserve’s policies and Congressional fiscal legislation that hold significant sway over the economy and markets.

Take Bush Jr., for example. He wasn’t directly responsible for the subprime mortgage crisis that triggered the Great Recession—even if a congressional committee later deemed it avoidable.

Yet, it’s human nature to blame the person in the Oval Office when markets tank and credit them when markets soar. They’re the face of the nation, after all.

So, let’s dive into how the markets—and key commodities—have actually performed under the last few presidents.

The Buck Stops with the President

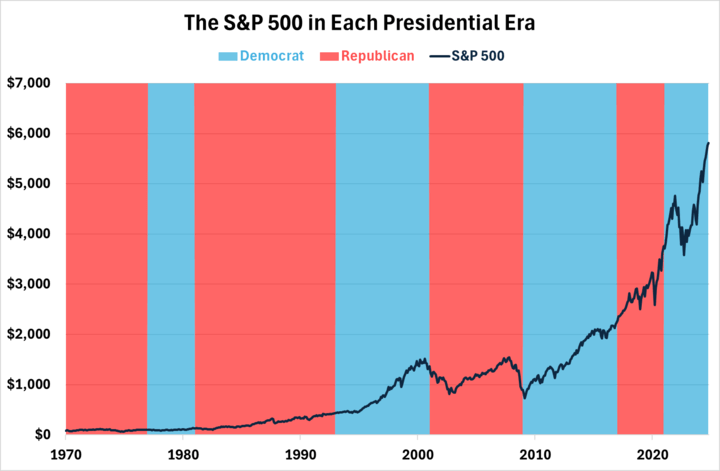

Let’s start by seeing how the S&P 500 has performed through each series of administrations.

Over the years, the relentless growth of the markets has largely ignored who’s in the Oval Office. Recessions have typically been driven by prevailing economic factors, not presidential policies.

An exception was the 1980s, when Reaganomics—national economic policies led by President Reagan—took center stage. This direct presidential influence on economic policy was rare; the last time we saw something similar was with FDR’s New Deal.

While the benefits and drawbacks of Reaganomics are still debated, the economy did recover strongly from stagflation and moved forward until the Black Monday crash of 1987. The response to that crash was largely credited to the Federal Reserve, not the president.

The early 1990s recession under Bush Sr. was triggered by the oil price shock from Iraq’s invasion of Kuwait, compounded by tight Fed policy and a weak economy. This downturn directly contributed to Clinton’s 1992 election win.

Clinton had the good fortune of taking office as the tech boom began—quite the contrast to his successor, Bush Jr., whose two terms both started and ended with recessions caused by bursting bubbles.

Despite these challenges, growth was steady between those recessions.

Markets have largely carried on through the Obama, Trump, and Biden administrations, even in the face of the COVID-19 pandemic and the 2022 bear market.

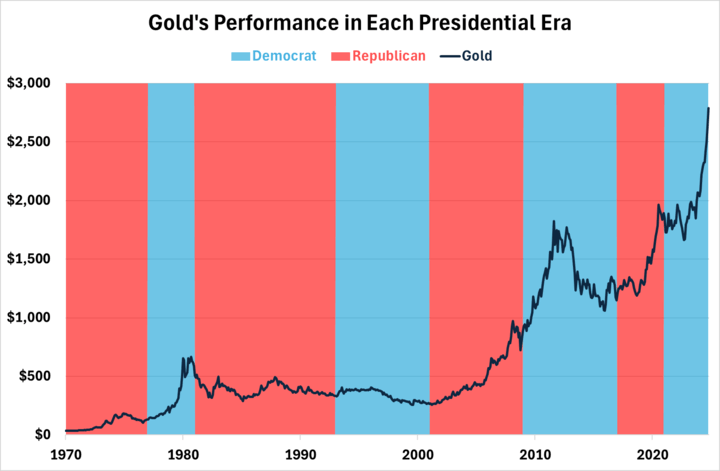

Now Let’s Look at Gold…

Gold’s journey has been rockier than the stock market’s, mainly due to geopolitics and inflation.

In the early ’80s, the 1979 energy crisis from the Iranian Revolution and tight fiscal policy led to double-digit inflation, pushing investors into gold as a safe haven.

Gold remained quiet for years until after 9/11, when prices began climbing, reaching new highs post-Global Financial Crisis.

A new price floor emerged in the mid-2010s, but COVID-19 and escalating Middle East tensions propelled gold even higher.

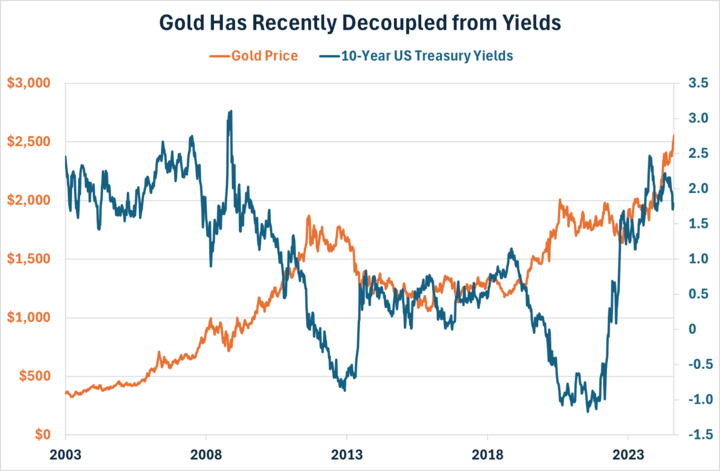

The historical inverse relationship between gold and real yields highlights geopolitics’ significant impact on gold prices.

However, over the past year, this well-known inverse relationship between gold and real yields has broken down.

The main culprit?

Geopolitical uncertainty from the Iran-Israel conflict, along with doubts about the U.S. election outcome.

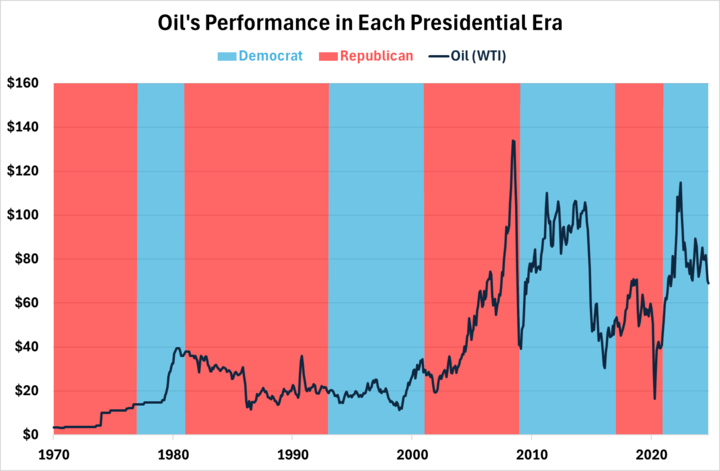

Let’s take a look at oil next…

Oil is the commodity most tied to geopolitical risk, thanks to OPEC’s grip on global supply.

Events like the 1979 oil crisis, Gulf War spikes, the COVID-19 demand shock, and Russia’s invasion of Ukraine have dramatically reshaped oil’s supply-demand balance.

Given these factors, it’s tough for any president to control oil prices—unless they start wars in the Middle East.

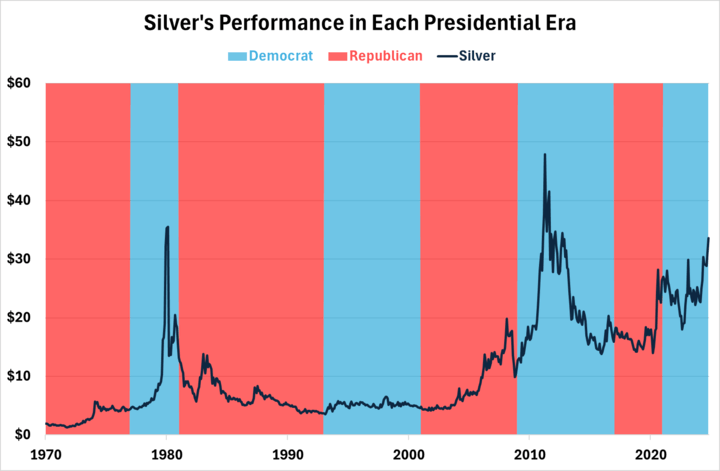

Now, let’s look at silver…

Silver’s chart mirrors gold’s, with two major peaks: 1980’s Silver Thursday caused by the Hunt brothers and the 2011 U.S. debt ceiling crisis.

Recently, COVID-19 pushed prices higher, and both metals have maintained momentum through 2024.

Keep Calm and Invest On

- Bottom line: In the long run, who’s in the White House rarely impacts commodity prices and markets.

Some sectors might feel the administration’s influence—think of Trump’s vs. Harris’s stances on crypto regulation and the energy transition—but overall, things balance out.

Remember, if the U.S. lags, the rest of the world may not.

EV adoption is slow in the U.S., but with 60% of new EV sales in 2023 from China and 25% from Europe, global EV growth remains strong.

In the end, even with a familiar face returning to the White House, nothing has changed for investors. Fundamentals are the same: the energy transition and net-zero goals are coming.

Click here to see what I’m doing with my own money in my premium research letter – Katusa’s Resource Opportunities.

Regards,

Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.