The U.S. government just admitted we can’t feed ourselves.

Last month, they quietly added potash to the Critical Minerals list.

It’s the same designation as lithium and the same panic level as rare earths.

Here’s what they’re not saying out loud: 86% of the fertilizer that grows your food comes from other countries.

And the biggest suppliers aren’t exactly our friends.

The 4X Trade That’s Setting Up Again

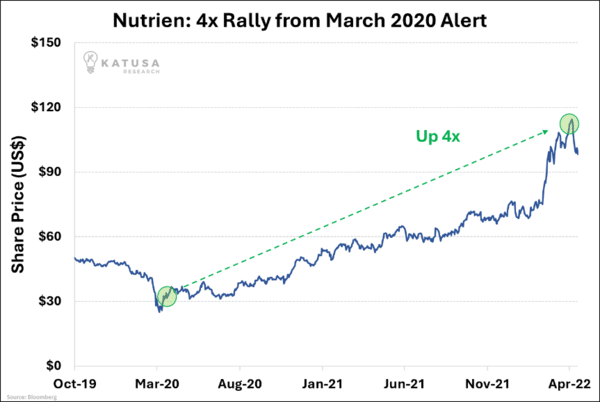

The last time I wrote about fertilizer, Nutrien was left for dead.

I targeted my first buy just below where it bottomed. The stock ran from its lows to almost 4X higher in two years.

When governments panic about supply chains, boring commodities explode. And right now, Washington is panicking about fertilizer.

Here’s What Washington Won’t Say Out Loud

America plants 227 million acres of corn, soybeans, wheat, and rice.

Those acres need 40-45 million metric tons of fertilizer every single year.

Three nutrients keep those crops alive:

- Nitrogen (57% of what we use)

- Phosphate (25% of what we use)

- Potash (18% of what we use)

Now here’s the problem Washington just woke up to:

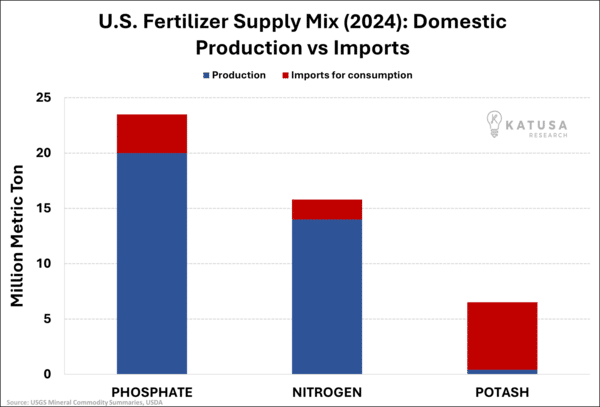

America barely produces any potash.

This imbalance matters because fertilizer is not something you can stockpile for long.

Fields need it every spring. Any disruption in trade flows can leave farmers exposed at the worst time of year. And unlike price swings, physical shortages have no substitute.

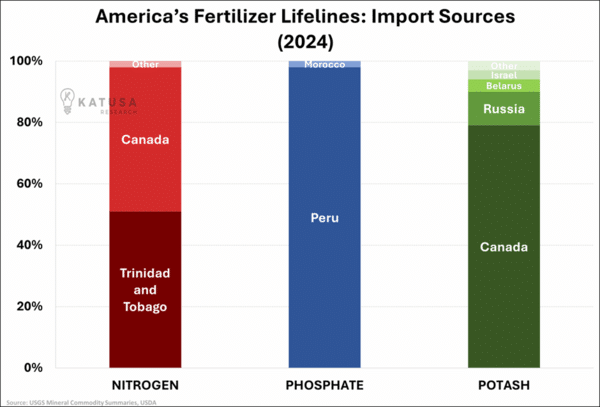

Russia and Belarus control global potash markets. China pulled back phosphate exports. Canada is basically America’s only lifeline for potash.

The United States produces just 9% of the world’s nitrogen and 8% of global phosphate. In potash? It barely registers.

That’s why those just hit the Critical Minerals list.

Washington finally admitted what farmers have known for years: We’re one supply shock away from a food crisis.

The Pattern That’s About to Repeat

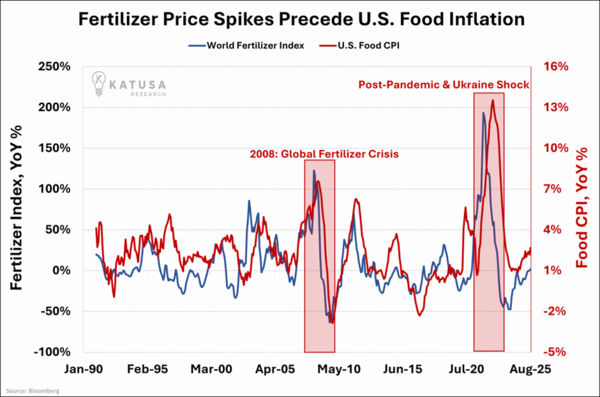

Look at this chart, then look at your grocery bill.

In 2008, fertilizer prices exploded. Food inflation followed months later.

After COVID and Ukraine? Same story. Fertilizer hit records. Food CPI went double-digits.

The lag is consistent. When fertilizer spikes, your grocery bill follows.

Right now, fertilizer prices are still bouncing around. But the setup is building:

- Russia and Belarus still control potash

- China has pulled back phosphate exports

- Energy costs are swinging wildly

- And farmers can only skip fertilizer for so long before yields collapse

Spring’s Hard Deadline

Corn needs more nitrogen than any other major crop. It’s the most fertilizer-hungry plant we grow at scale.

Farmers can skimp on fertilizer once, maybe twice. But soil nutrients deplete. Yields drop. Eventually, you either buy fertilizer or accept smaller harvests.

The problem is that no new U.S. potash production is coming to save us right away.

Canadian mines are running at capacity with no room to expand. The logistics mess from COVID never got fixed, and supply chains are still cracking under pressure.

When that spring buying season hits, we’re going to see exactly what happened in 2008 and 2022. Fertilizer prices spike. Food costs follow. CPI jumps.

Except this time, Washington sees it coming and that’s why potash made the Critical Minerals list.

The Phosphate Problem

Here’s what should really worry you: In 2024, America uses mostly phosphate products (52% of total fertilizer volume).

This matters because phosphate products like DAP and MAP are less concentrated than nitrogen fertilizers. We need more tons to get the same nutrient value.

And guess who controls phosphate exports? China.

They’ve already pulled back. If they cut more, we have a serious problem.

Phosphate could be next on the Critical Minerals list. When that happens, phosphate stocks will do what lithium stocks did.

The Trade Setting Up Right Now

In my October issue of Katusa’s Resource Opportunities, we detailed:

- Which of the three nutrients (N-P-K) offers the best risk/reward

- The companies positioned to benefit from Critical Mineral status

- Why one producer trading at a massive discount is my top pick

This is about positioning before a government-driven restructuring of an entire industry.

When Washington declares something “critical,” money follows. There are tax breaks, fast-track permits, protected status and guaranteed contracts.

We saw it with lithium and we’re seeing it with uranium. Fertilizer is next.

Fertilizer Wildcards Nobody’s Watching

While everyone chases the majors, I’ve identified four junior fertilizer plays that could deliver explosive gains.

After screening dozens of ghost projects and paper mines, only two passed our strict criteria…

One U.S.-based potash play with some of the highest-grade intercepts ever drilled.

And another with the tightest funding profile in the sector.

- In October’s issue of Katusa’s Resource Opportunities, I reveal which junior trades at just 5% of its net asset value despite having Washington’s new “critical mineral” tailwind at its back.

Plus, why one Utah project could be the next Nutrien-style runner.

The fertilizer sector is about to wake up. These juniors will move first.

Because this time, it’s about securing America’s food supply.

And there’s nothing more critical than that.

Regards,

Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.