Alligator Investing traces its roots all the way back to 1980.

A geologist named Walter Alvarez and his father, the Nobel Prize-winning scientist Luis Walter Alvarez, put forth an outrageous idea.

In what is now known as the “Alvarez Hypothesis,” the father and son team claimed dinosaurs went extinct due to the effects of a large asteroid striking the earth. The impact caused huge tidal waves and earthquakes. It threw up a dust cloud that blocked sunlight, killing most of the planet’s species…including all the dinosaurs.

At the time, most in the scientific community thought the idea was absurd. They believed dinosaurs had gone extinct over a long period of time.

But years of close examination of the evidence, combined with the discovery of a massive impact crater off the coast of Mexico, put the debate to rest. About 66 million years ago, a large asteroid struck Earth with a force millions of times greater than any atomic bomb and caused the greatest extinction event in the planet’s history.

It is estimated that more than 75% of all species were killed off by the strike. Only the hardiest species survived. You can probably guess one of the survivors: The cockroach.

But you may not know that “Crocodilians” are members of this elite survivor club as well. This is the order of predatory reptiles that includes the alligator and the crocodile.

That’s right: Alligators survived what the dinosaurs could not. Over sixty million years later, they’re still going strong.

There are various theories as to why alligators have survived and thrived for so long. They’re cold-blooded, which means they don’t have to eat very often. They live in fresh water, not salt water, which seems to have increased their chances of surviving the asteroid strike. They have incredible immune systems.

But one huge thing alligators had–and continue to have–in their favor is their brilliant and efficient hunting strategy.

Alligators are “ambush predators,” as opposed to “pursuit predators.” They don’t spend their days chasing gazelles or monkeys. They don’t expend lots of energy sprinting after their prey.

Instead, alligators take a patient “sit and wait” approach to hunting. They spend long periods of time doing nothing but waiting in the water for the perfect time to strike at obvious opportunities. When unsuspecting prey approaches the water, alligators spring forward with awesome speed and force.

The alligator’s ambush hunting strategy is very efficient. It allows the alligator to get huge returns on the energy he invests in hunts. It has helped the alligator become one of the most resilient, successful species in the history of the planet.

I know you don’t read Katusa Research for nature lessons. I’m telling you all this because I believe The Way of the Alligator is one of the great secrets for achieving investment success.

The Counterintuitive Way to Make Big Money by Alligator Investing

When we were kids, we’re taught that if we work hard enough at anything, we’ll achieve success.

More hard work in the gym means performing better at sports. Working hard on your studies means getting into the right schools. Working long hours means getting ahead in business.

Working hard has its rewards. It’s a great way to get what you want in life. But “hard work” and its corollary “staying busy” actually works against investors. Staying busy typically translates into losing money instead of making money.

Most people who have earned enough money to invest have the natural urge to “do something” and “stay busy.” That’s how we got the money in the first place.

But unless you’re a skilled, lightning-fast day trader, the market does not reward frequent activity. In fact, it penalizes it.

The urge to “do something” leads you to be impatient and less selective with your investments. It forces you into mediocre opportunities. Said another way, the quality of your investments typically moves inversely to the quantity of your investments.

For investors who look to hold positions for months and years, the market simply does not serve up truly great opportunities every day.

Sometimes, we only get two or three per year. Just like doing nothing and waiting for a great opportunity is often the right move for an alligator, it’s also often the right move for investors.

To many investors, having a large cash balance in an investment account feels like having a wad of cash in a casino. Why let it sit there and do nothing when you can “play” with the money? Why not at least take a shot at something?

This amateur thinking is why casinos earn billions of dollars in profit at the expense of impatient, probability-ignorant gamblers. Doing nothing, staying patient, and waiting for a no-brainer opportunity is often the right move.

Alligator Investing – A Real World Example

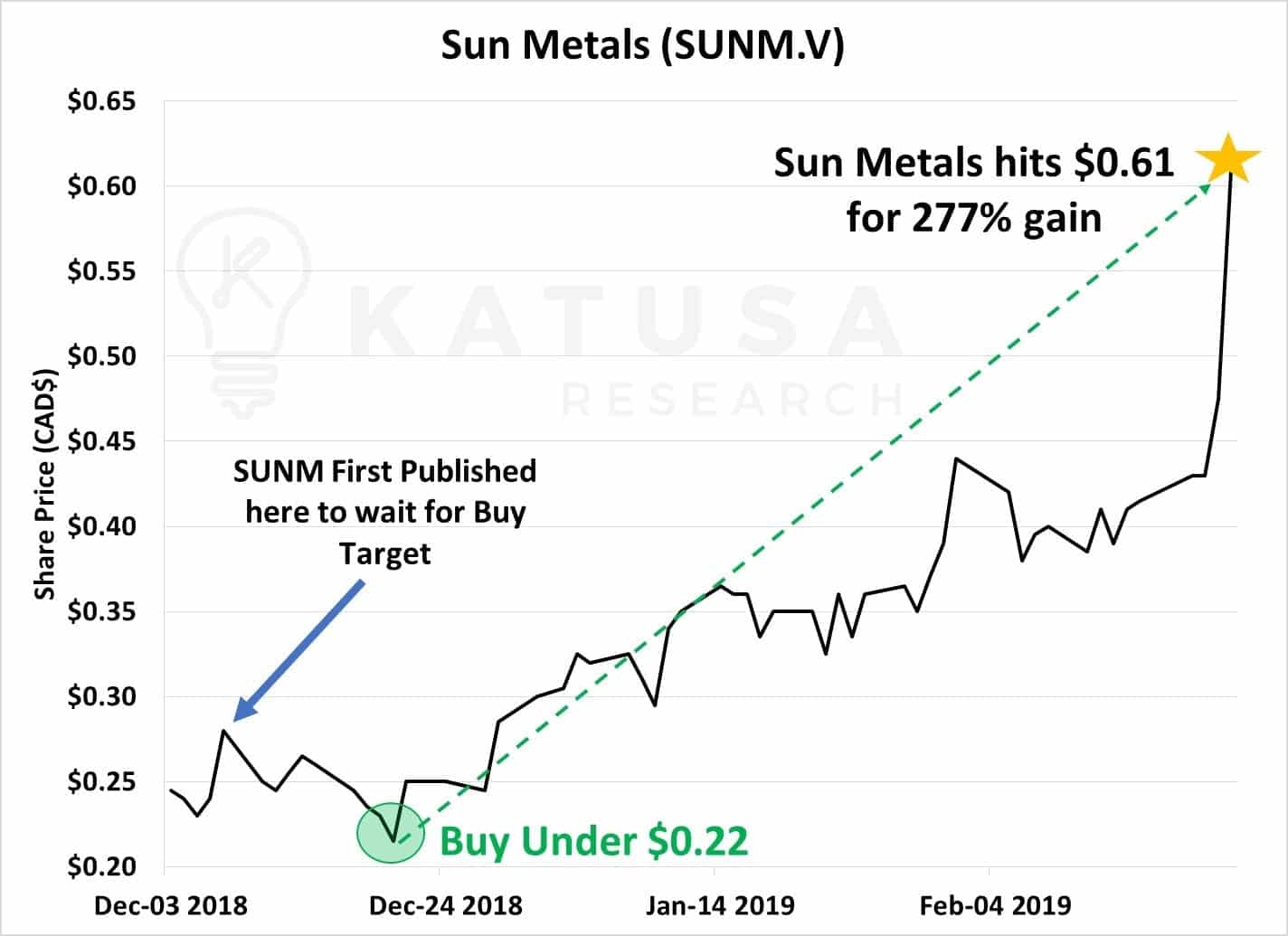

When I first published an investment idea I had on a junior gold and copper explorer, I told subscribers to be patient. Like an Alligator.

The company announced some news that investors bought hand over fist. They were “chasing the stock”.

I had a certain price I wanted to scoop up shares and I would wait on the sidelines to do so.

Once the shares hit my target, I pounced like an alligator. Here’s what happened…

Many investors aren’t patient enough for the strategy.

But one of the most famous alligator investors has used it to make billions.

The Ultimate Alligator Investor, Warren Buffett, on Waiting for the “Fat Pitch”

The investment legend Warren Buffett makes a great point about patience with a simple baseball analogy.

Buffett says investing is like playing a baseball game where there are no called strikes. You don’t get penalized for not swinging. You can stand at the plate for a year and not have to swing. So, it makes a lot of sense to stay patient and selective and only swing at “fat” pitches.

You only need to swing when the odds are overwhelmingly stacked in your favor.

One of your ultimate goals as an investor is to buy assets for less than they are really worth.

Said another way, your goal is to buy bargains.

However, true bargains are rare. The financial market correctly prices most assets most of the time. Most of the time, stocks, bonds, and commodities trade for approximately what they are worth.

But every so often, there is a crisis in some market somewhere in the world. During a crisis, investor emotion overwhelms investor reason. Terrified investors sell first and ask questions later. They sell assets with no regard for their underlying value or ability to produce cash flow. I often say that during crashes, the price of assets becomes “unhinged” from the value of assets.

If you’re impatient and you’re always “doing something,” you won’t have the cash to buy up bargains during a crash. It’s the financial equivalent of not bringing your helmet if you were to play in the Super Bowl.

I like to put my money to work as much as anyone.

I love the game of investing.

But I always keep The Way of the Alligator in mind.

I see my cash as “big returns in waiting.”

There’s a reason the alligator survived the biggest extinction event in history. There’s a reason he has thrived for more than 60 million years. He’s nature’s ultimate patient opportunist.

By staying patient and only acting when the odds are overwhelmingly in your favor, you’ll survive and thrive in the investment world.

Regards,

Marin Katusa