Driven by huge increases in connectivity and computing power, technology is advancing at an exponential rate. This means that not only is conventional change is occurring… but the rate at which it is occurring is also speeding up.

Depending on where you stand, this is either thrilling and lucrative… or confusing and harmful.

For example, think about the ride-sharing service Uber. Uber caused a massive change in an entrenched industry in just a few years.

One day, the taxi business is big and powerful. The next day, it’s road kill.

You also have Netflix gutting movie-rental chain Blockbuster in just a few years.

Those kinds of tectonic industry shifts used to take a lot longer to play out. Sometimes decades.

But when you spot a technology that is surfing on the wave of change, you need to pay attention. Especially in the resource markets.

Because it could be the edge that sends one stock soaring while the other ones remain stagnant.

Much Wiser Uranium Technology

The last time the Uranium sector had a significant technology that was a game changer was the implementation of ISL (In-Situ Leaching) in the U.S. in the late 1960’s.

I may be dating myself, but it wasn’t until after my first rodeo in the uranium cycle that ISL was renamed to ISR (In-Situ Recovery). Why? It had nothing to do with any advancements in technology. Instead, the industry players got together and it was a result of the “promoters” believing ISR as a name would be better received by the public than ISL.

Isn’t the industry clever?

Leaching vs. Recovery. It’s the same technology, just different words.

The only major improvement to ISL uranium production since its inception was the evolution to W-ISR (Warm ISR) production. (pronounced – wiser).

I’ve written and spoken about the advantage of WISR since 2013.

It’s shallower, has no concrete foundation header houses, zero miles of insulated and buried water piping connecting the injection wells to production zones and then to the header house, and no radioactive concrete facilities to reclaim. This results in cheaper uranium production costs.

Yes, for the record, the industry didn’t get together and come up with WISR. It was me because it was easy to understand. WISR = Warm ISR = The “Wiser” way of profiting from uranium.

I digress. Back to my thesis.

When I first started in Uranium, Kazakhstan produced less Uranium than Slovenia and nobody talked about Kazakhstan.

It was a combination of ISR and WISR that took Kazakhstan from a 0 producer to producing 40% of global uranium production in two decades.

ISR was a game changer in the uranium production industry. No different than fracking in the oil patch.

The Newest Uranium Technology in the Prolific Athabasca Basin

Most fund managers, newsletter writers, and speculators are taking guesses on what the effects of Section 232 will be on the uranium sector. The results will be positive. So rather than postulating, I’m having my subscribers focus on world class assets with the lowest quartile of production costs.

The Athabasca Basin in Canada holds the highest-grade uranium and some of the lowest cost producer in the world.

Every sound uranium investor should have exposure to the Athabasca Basin.

And the Athabasca Basin is ripe for a new technology that could accelerate uranium extraction and movement.

Introducing SABRE (Surface Access Borehole Resource Extraction) Technology

It’s a mouthful for sure.

But it’s a new technology that can bring down uranium mining costs big time in the worlds highest grade uranium basin. This opens up projects that otherwise wouldn’t come into production because of their size.

To be clear, the current version of SABRE will not be applicable to most U.S., African, and Eurasian deposits. But, the current version will make its mark on Athabascan Basin uranium production.

Future versions of SABRE may be applicable to other regions. But for now, I’m focused on what SABRE can do for me today.

SABRE is a promising new technology that can keep the mills on the Eastern side of the basin running at full capacity from various smaller, shallow satellite uranium deposits.

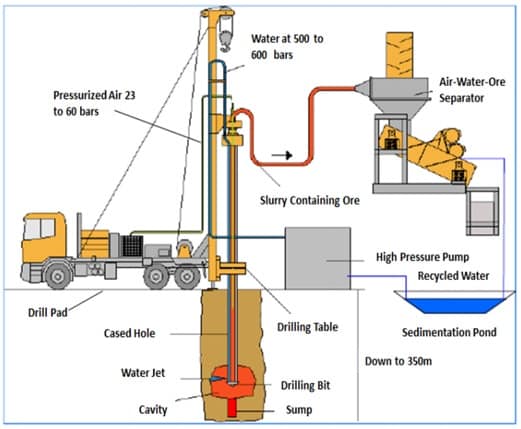

At its core SABRE combines surface drilling & hydraulic borehole mining.

The advantages are many. It’s not capital intensive (meaning it’s cheap to implement). Production volumes can be flexible. And the environmental footprint is small (that is a good thing).

There are a few basic things that must happen to make SABRE work:

- The uranium deposit must be less than 300m from surface;

- There must be competent rock around the deposit;

- Logistics to the uranium mill must be economic.

Photo provided by AREVA Resources Canada

Which Uranium Companies Will SABRE Technology Work For?

Using my Athabasca Basin database and countless site visits to the different deposits in the basin, I’ve created my own set of metrics that would work for SABRE. I’m left with 35 known and drilled out uranium deposits that make up over 300 million pounds of uranium that I believe geologically meet the requirements for SABRE.

Nobody has ever published this before.

And if you hold any uranium stocks in your portfolio, you need to ask yourself this: “how does SABRE affect my uranium holdings?”

Of the 35 uranium deposit candidates, 10 don’t meet the logistical distance and the surrounding rock competence to make SABRE work.

That still leaves a little over 200 million pounds of uranium within 25 deposits that can be streamlined using SABRE. More importantly, what I like about SABRE is that it minimizes the permitting time, upfront capex, and surface disturbance and minimizes the surface footprint. SABRE is more like an oil well rather than a mine. And it has a cool name to boot!

How much Uranium would be produced from deposits as a Satellite Deposit using SABRE?

Today, very little production (other than uranium produced from “testing” the technology) occurs using SABRE. But, it’s very close to becoming a “new” method. With a great shot at becoming the new “norm” in the Athabasca Basin.

By 2022, I think it’s sound to suggest that around 1 million pounds a year, per year, is possible in the Athabasca basin using the technology. And that’s just in the first few years.

Just like any technology, it takes time to implement and integrate into the field. But by 2030, I can see a combined ~10 million pounds a year being produced via SABRE. And that’s on various different “satellite” deposits that are within 300km of a mill.

Interesting enough, the minimum time (being very optimistic) to get a uranium mill permitted in the basin would be 5-7 years. But realistically, it’s closer to 10-15 years.

Could SABRE push out the need for big standalone deposits like NexGen’s ultra-high-grade world class Arrow deposits? It’s an interesting thought exercise, and something I would really be paying attention to if I was a NexGen or Fission investor. (Full disclosure, I do not own any of either company. But have been a previous shareholder and sold both for a profit).

Almost all of the 25 SABRE qualifying projects are owned by either Cameco, Orano (formerly known as Areva), or the Japanese consortiums meaning they have an incentive to implement SABRE.

I did find a way for us to profit from SABRE.

There is a pair of uranium juniors that do have projects which could use the technology. Right now, I wouldn’t give those companies any additional dollar value for their SABRE potential, but I don’t need too because they are very cheap on a fundamental value basis. But it’s phenomenal blue-sky potential.

We aren’t in a market where I need to pay for potential. I have been to the projects and to the mills close to them. And more importantly, I’ve been on the roads that connect the two. I have known management for years and they are the largest shareholders of their company. (This is also another great sign of skin in the game and that they’re aligned with their shareholders).

Understanding the logistics is key to picking the right SABRE contenders.

Building a Uranium Plant is Expensive, SABRE is not

How would the market react given the following scenario…

Why build a multi-billion-dollar capex project that would require 5-10 years of permitting on top of finance and construction delays. Instead, bring a low cost, small footprint, quick to permit, SABRE uranium production project online. Which, by the way, can be economic sub-$40/lb uranium.

Are those multi-billion-dollar projects economic at $40 uranium? Look up the details of the price assumptions used in their NPV calculations to answer that question.

I know of two companies that would both become immediate takeover targets. We own one of them, which has a sub $200M market cap, in our Katusa’s Resource Opportunities portfolio.

But, I doubt there will ever be a big (+10 million pounds) SABRE producing single mine over the next 10 years.

I believe SABRE will work well with satellite projects (in a hub and spoke manner). This is where, for example, 5 projects each feed half a million pounds to the mills in a “Hub & Spoke” strategy for a combined 2.5 million pounds to be blended with the ”anchor” mine that feeds the operating mill.

Let’s use a realistic scenario:

This could work at the world’s largest operating mill of its kind, the McLean Lake uranium mill in the Athabasca Basin. Cameco’s Cigar Lake uranium production would be making up the “bulk” of the uranium supply that feeds the McLean Lake mill. Then the satellite uranium deposits, perhaps some owned by a “junior” using SABRE and delivering the uranium in a “Hub & Spoke” like manner would make up the remainder of the uranium that feeds the mill to operate at full utilization. (This is a hint for the stock sleuths that don’t want to pay for my service and want to do the research on their own – or you could save your time and subscribe to the best right here)

SABRE should be viewed as something that will help keep the mills on the east side of the basin full when its ore is blended with the existing built and permitted mega mines (like Cigar Lake or McArthur River when it comes back online).

In theory, the satellite production from SABRE can delay Cameco and/or Orano’s need to buy a world class asset that is non-producing deposit from NexGen or Fission for years. (Note: I have nothing but respect for both geological teams who made incredible discoveries on both NexGen and Fission – so it’s not like I am trying to bring any negative attention to their projects. I am not. I am just being pragmatic).

Now, I’m not being theoretical here. I’m being realistic.

SABRE requires no underground miners. Actually, it requires no miners at all. It only requires a couple of drillers on the drill pad and a few truck drivers delivering the productions to the mill.

Today’s technology allows most of the hard decisions to be made remotely (like in the oil patch) using ultra-fast and sophisticated computers. And the engineers can operate and moderate the production remotely from a central command post. This is no different than what happens at a frac field in the oil patch.

Success of SABRE is New, But SABRE is Not a New Uranium Technology

I first came across SABRE back in 2013. At the time I found it interesting, but it was still a science project back then. Because of my experience in fracking, I took note, but I knew it would take many years.

Over the last 5 years, there have been many modifications and SABRE 3.0 is currently underway and production results have been positive. And it’s actually producing uranium, albeit in small quantities (less than 500,000 pounds from one project this year).

This is how technological progress happens in any resource extraction industry – it takes many years. Remember, it took the shale oil and gas sector twenty years and hundreds of billions to get to Fracking 2.0.

We are still in SABRE’s early days. It’s the first year of implementation and many more improvements will come). And to put it into context, we are in the time where fracking was at in 2000.

Only the die-hard uranium guys know about it, and those who do know about it, do not have the business savvy to profit from it. We are the first investment letter to discuss the details of SABRE publicly.

And more importantly, which public companies have exposure to and will profit from the technology called SABRE.

And now it’s on your radar too.

Regards,

Marin

P.S. Uranium is starting to get a lot of attention as the spot price is up over 14% this month. Expect numerous promotions from newsletter “guru’s” promising 1,000% gains if you subscribe to their secret uranium formulas. Be uber careful who you listen to on uranium. The sector has been so down for so long that there are only a handful of individuals who really know the sector and how to profit from it. If the guru was promoting marijuana or crypto a few months ago and is now promoting uranium, stay away. Especially stay away from the “guru” whose firm doesn’t allow the “guru” to invest alongside you—they have no skin in the game.

Over the last 15 years, I have been a major financier of companies within the uranium exploration, development, and production sector. I know for a fact I was the first to publish the absolute best way to play the uranium sector on a risk to reward basis. That company was in the July issue of Katusa’s Resource Opportunities.

Katusa subscribers have exposure to SABRE for free. We have written on the best value plays that have considerable upside which we get for free. One of the companies I own in my Katusa’s Resource Opportunities portfolio is my favorite way to take advantage of the SABRE technology. To learn the name of the uranium company I can see rising 200-500% in short order with any sharp rise in uranium prices, click here to sign up.