In 2019 I talked a lot about Quantum Economics.

What is Quantum Economics?

It’s the new world we live in. Negative interest rates, high bond prices, strong US dollar, and a stronger gold price.

When I was on a panel at a large resource conference 5 years ago… I stated in the coming years we would have further negative interest rates and higher bond prices. The other panelists and “gurus” stated that was “metaphysically impossible”.

Well, it’s exactly what happened and we are now in an era of Quantum Economics.

Be careful of following a dated “framework” by a dated guru.

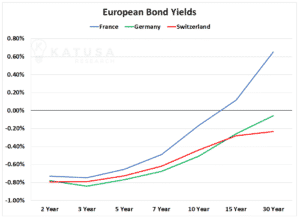

For example, did you know that if you bought a French or German 10-year bond, you’d lose money?

Yes – yields on those 10-year government bonds are negative.

Let’s turn to their neighbor, Switzerland. It’s a pretty safe country so you’d think it would be hard to lose money there right?

Wrong. Lock your money up for 30 years and earn -0.192%.

Yes, you’re reading that right…

- You give the Swiss Central Bank your cash for 30 years, and in 30 years they give you back less than you started with.

The chart below shows the current yields for bonds in France, Germany, and Switzerland. Everything short and medium-term duration is below zero…

- By keeping interest rates negative, the central banks are trying to create an environment that encourages consumer spending.

Or at least that’s the hope. Given EU inflation can barely get above 2% which would be considered healthy in a normal market, things are not even close to back to normal across the pond.

Financially Transmitted Diseases (FTD’s)

The United States has kept with its Zero Interest Rate Policy (ZIRP), even in the face of skyrocketing monthly inflationary numbers.

What was once perceived as an ultra-loose monetary stance is now a disciplined approach compared to Japan and the EU. And ZIRP and NIRP are critical to keeping the economy going.

Big fiscal stimulus packages and ultra-low interest rates are the new normal both in the US and abroad.

The combination of ultra-low interest rates and inflation leads to negative real interest rates. It is simply the yield on a non-inflation-indexed bond minus the inflation rate.

As you might guess, in today’s world of zero or negative interest rates, once you subtract inflation, you are left with a negative “real” rate of return.

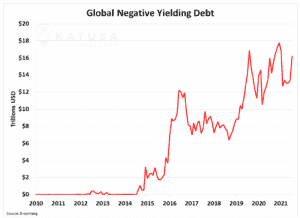

Incredibly there is over $16 trillion in negative-yielding debt these days. The number is almost unfathomable. But that number will increase.

As inflationary pressures on certain sectors of the economy pick up, more and more debt will go negative yield.

In this situation, investors are incentivized to either

- Spend the cash immediately, so it doesn’t lose value.

- Or buy physical assets which are stores of value (like real estate, art, and gold).

Gold Price vs Real Yields

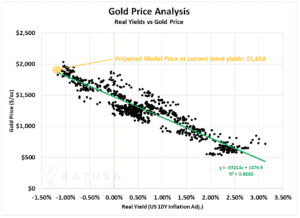

The next chart paints a very clear picture of the relationship between “real” interest rates and the gold price. This data goes back to 2006, where each dot represents the weekly gold price and associated real interest rate.

While this is only one metric, the relationship is starkly clear…if negative real rates continue, it is likely supportive of strong gold prices.

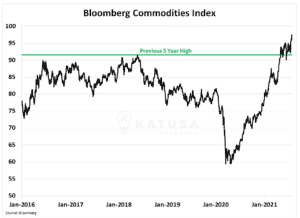

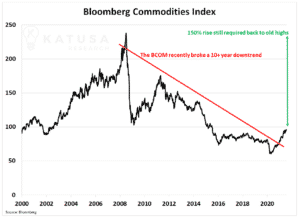

It’s not just gold that is doing well these days. The commodities boom is at full throttle, recently taking out the old 5 years high in the Bloomberg Commodities Index.

Where it gets exciting is when you take a longer-term view…

Here is the same index back to 2000. As you can see, we are still miles away from old highs.

- In fact, the index would need to rise by nearly 150% to get back to the old highs.

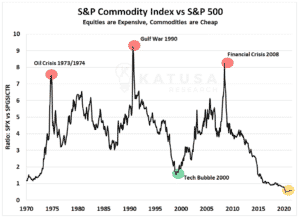

Commodities investing requires a contrarian strategy. It’s one reason why many on Wall Street shun the sector. Jumping on the meme FOMO bandwagon is a lot easier. These days, commodities relative to stocks, have never been cheaper.

The Chart 60 Years in the Making…

Below is a chart which shows the ratio of the Bloomberg Commodities Index vs the S&P 500 on a total return basis.

It’s a ratio that illustrates the incredible cyclicality of the commodity space. When it’s on you better be involved, and when it’s off, it’s best to keep the powder dry.

I’ve dedicated my entire 20-year career as a professional fund manager to the commodities space, traveling the globe multiple times over. All while building one of the best Rolodexes in the game.

The natural resource sector is as much an investment into the people running the company as it is a bet on the commodity.

I don’t take finders fees, kickbacks, or stock options, and no company can pay to be in my portfolio.

My subscribers and I just started loading up on several of my favorite gold stocks.

Subscribers to Katusa’s Resource Opportunities get to find out exactly what prices I’m willing to buy and sell at before the trades occur.

If you want to give your portfolio an edge, consider becoming a member and giving it a try for yourself.

Regards,

Marin Katusa