Disseminated on behalf of SolarBank Corporation (SUUN.Nasdaq)

Picture this: While most solar companies are racing to build the next megawatt, one NASDAQ-listed developer just decided to convert cash flows into Bitcoin.

The Geddes Project Goes Digital

SolarBank Corporation (NASDAQ: SUUN) made waves this week with an unusual announcement. Their 3.79 MW Geddes Solar Project—transforming a closed landfill into a revenue generator—will channel every dollar of net cash directly into Bitcoin holdings.

Here’s what makes this fascinating: SolarBank already operates over 32+MW of solar capacity, maintains partnerships with Honeywell, Qcells and Royal Bank of Canada, and has a development pipeline exceeding 1 GW. They’re established players making a genuinely unexpected move.

Solar’s Exponential Moment

To understand why this matters, you need to grasp what’s happening in solar right now.

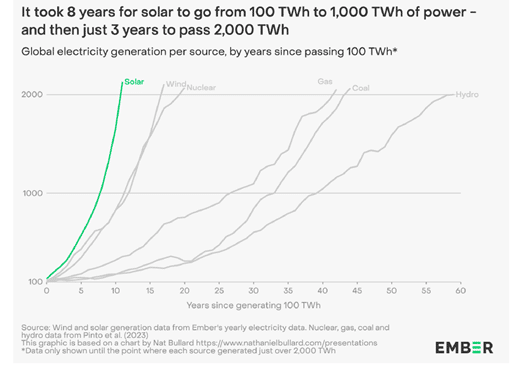

According to Ember’s latest global electricity data, solar generation doubled in just three years to over 2,000 TWh.

That’s enough electricity to power all of India.

The acceleration is staggering. Solar added 474 TWh of new generation in 2024 alone—more than any other energy source on the planet.

We’re watching exponential growth in real-time, with capacity doubling every 36 months.

Even more compelling: solar installations hit 585 GW in 2024, more than double what was added in 2022.

The cost curves have crossed. Solar plus battery storage now beats fossil fuels on both price and reliability.

The expansion of solar power is a worldwide phenomenon, with 99 countries doubling the amount of electricity they produce from solar power in the last five years.

- KATUSA EXCLUSIVE: A New Opportunity in Energy

The Bitcoin Strategy Decoded

So why would a solar company want Bitcoin? The logic is actually elegant.

First, there’s the treasury challenge…

With inflation crushing cash reserves and bonds yielding negative real returns, corporations need alternatives. Bitcoin offers something different—uncorrelated returns and a hedge against currency debasement.

But here’s the clever part: SolarBank flips Bitcoin’s biggest weakness into a strength. Critics slam crypto for energy consumption.

SolarBank’s response?

“We’re creating clean energy that offsets crypto’s carbon footprint.”

They’re mining digital gold with sunshine and consider the arbitrage opportunity this presents…

Solar electricity typically sells for pennies per kilowatt-hour on the grid. But what if those same electrons could fund Bitcoin purchases at today’s prices?

It’s a fascinating form of energy-to-value conversion.

Global Solar Dominance Accelerating

The timing couldn’t be better. Solar adoption is exploding worldwide:

China installed 277 GW in 2024—more than America’s entire solar fleet. Brazil’s generation jumped 45%, overtaking Germany as the fifth-largest solar producer. Even Pakistan imported 17 GW of panels last year, doubling their previous record.

The pattern is unmistakable. Countries embracing solar gain energy independence and lower costs. Those clinging to fossil fuels face volatile prices and supply chain risks. The economics have flipped permanently.

How They’re Actually Doing This

Management laid out a pragmatic approach. Bitcoin purchases will flow from actual cash generation after covering operating costs and debt obligations. They’ve applied for institutional custody through Coinbase Prime, ensuring professional-grade security.

The Geddes Project serves as their pilot program. If successful, they’re evaluating expansion to other projects in their portfolio. It’s measured, not reckless.

The Investment Angle

For investors, SolarBank presents a unique value proposition: ride two exponential trends simultaneously.

- You get exposure to solar’s continued growth plus potential Bitcoin appreciation through a single equity.

Yes, risks exist. Bitcoin volatility could create quarterly earnings chaos. Regulatory shifts might complicate execution. Solar projects always carry development risk. Finally, the actual timing and value of Bitcoin purchases, under the allocation strategy will be determined by management in its discretion based on the net cash produced by the Geddes.

But the asymmetry is compelling. If solar maintains its growth trajectory and Bitcoin solidifies as digital gold, early adopters of this model could see exceptional returns.

Growth and power are all integrated digital now…

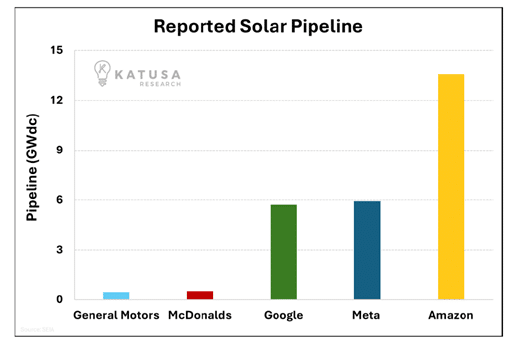

Tech companies are going full speed on solar to power their AI and data center projects…

- The top four corporate owners of solar in the U.S. are all tech companies: Meta, Amazon, Google, and Apple.

Amazon alone maintains a solar pipeline of 13GW, dwarfing every other company.

Even if the Bitcoin strategy disappoints, you still own cash-flowing solar assets in an energy-hungry world.

Where This Leads

SolarBank’s move signals something bigger than one company’s treasury strategy.

We’re watching the convergence of energy production and digital assets. Two of the most disruptive forces reshaping the global economy.

The companies that thrive in the next decade will be those recognizing that energy and money are becoming one interconnected system.

Traditional boundaries between power generation and financial innovation are dissolving.The future runs on electrons and algorithms.

SolarBank is betting they can master both.

Regards,

Marin Katusa and the Katusa Research Special Situations Team

IMPORTANT DISCLAIMER & DISCLOSURES

Investing in stocks is HIGH RISK. You could lose all of your investment.

Katusa Research, as a publisher, is not a broker, investment advisor, or financial advisor in any jurisdiction.

Please do not rely on the information presented by Katusa Research as personal investment advice.

If you need personal investment advice, kindly reach out to a qualified and registered broker, investment advisor, or financial advisor.

The communications from Katusa Research should not form the basis of your investment decisions. Examples we provide regarding share price increases related to specific companies are based on randomly selected time periods and should not be taken as an indicator or predictor of future stock prices for those companies.

SolarBank Corp. is a paid sponsor of this report.

The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted Securities, in the United States or to U.S. Persons. Securities may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and applicable U.S. state securities laws or pursuant to an exemption therefrom.

Any public offering of securities in the United States may only be made by means of a prospectus containing detailed information about the corporation or entity and its management as well as financial statements. No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter. Katusa Research nor any employee of Katusa Research is not registered with the United States Securities and Exchange Commission (the “SEC”): as a “broker-dealer” under the Exchange Act, as an “investment adviser” under the Investment Advisers Act of 1940, or in any other capacity. Katusa Research, its owners, directors, and employees are also not registered with any state securities commission or authority as a broker-dealer or investment advisor or in any other capacity.

HIGHLY BIASED: In our role, we aim to highlight specific companies for your further investigation; however, these are not stock recommendations, nor do they constitute an offer or sale of the referenced securities. Katusa Research partner company, New Era Publishing Inc. has received cash compensation in the amount of nine hundred thousand dollars from SolarBank Corp. for a 6 month marketing agreement starting January 1, 2025, and is thus extremely biased. SolarBank has paid an additional $450 thousand dollars for an additional 3 month marketing campaign on June 1. It is crucial that you conduct your own research prior to investing. This includes reading the companies’ SEDAR and SEC filings, press releases, and risk disclosures. The information contained herein regarding SolarBank Corp. has been derived from its SEDAR+ and SEC filings, including scientific and technical information. Information regarding the projects underlying SolarBank Corp.’s interests has been derived from the publicly available disclosure of the underlying operators and owners, including where referenced herein.

Katusa Research, and its directors, employees, and members of their households do not own shares of SolarBank Corp (SUUN.Nasdaq). However, Katusa Research is extremely biased since this is a sponsored editorial.

HIGH RISK: The securities issued by the companies we feature should be seen as high risk; if you choose to invest, despite these warnings, you may lose your entire investment. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures.

NOT PROFESSIONAL ADVICE: By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. While Katusa Research strives to provide accurate and reliable information sourced from believed-to-be trustworthy sources, we cannot guarantee the accuracy or reliability of the information. The information provided reflects conditions as they are at the moment of writing and not at any future date. Katusa Research is not obligated to update, correct, or revise the information post-publication.

FORWARD-LOOKING STATEMENTS: This report contains forward-looking statements and forward-looking information within the meaning of Canadian securities legislation (collectively, “forward-looking statements”) that relate to the Company’s current expectations and views of future events. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance (often, but not always, through the use of words or phrases such as “will likely result”, “are expected to”, “expects”, “will continue”, “is anticipated”, “anticipates”, “believes”, “estimated”, “intends”, “plans”, “forecast”, ”projection”, “strategy”, “objective” and “outlook”) are not historical facts and may be forward-looking statements and may involve estimates, assumptions and uncertainties which could cause actual results or outcomes to differ materially from those expressed in such forward-looking statements. In particular and without limitation, this report contains forward-looking statements pertaining to the Company’s expectations regarding its industry trends and overall market growth; the Company’s growth strategies the expected energy production from the solar power projects mentioned in this report; the number of homes expected to be powered by the Company’s development projects; the reduction of carbon emissions; the receipt of incentives for the projects; the expected value of EPC Contracts; and the size of the Company’s development pipeline. No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this report should not be unduly relied upon. These statements speak only as of the date of this report.

Forward-looking statements are based on certain assumptions and analyses made by the Company in light of the experience and perception of historical trends, current conditions and expected future developments and other factors it believes are appropriate and are subject to risks and uncertainties. In making the forward looking statements included in this report, the Company has made various material assumptions, including but not limited to: obtaining the necessary regulatory approvals; that regulatory requirements will be maintained; general business and economic conditions; the Company’s ability to successfully execute its plans and intentions; the availability of financing on reasonable terms; the Company’s ability to attract and retain skilled staff; market competition; the products and services offered by the Company’s competitors; that the Company’s current good relationships with its service providers and other third parties will be maintained; and government subsidies and funding for renewable energy will continue as currently contemplated. Although the Company believes that the assumptions underlying these statements are reasonable, they may prove to be incorrect, and the Company cannot assure that actual results will be consistent with these forward-looking statements. Given these risks, uncertainties and assumptions, investors should not place undue reliance on these forward-looking statements.

Whether actual results, performance or achievements will conform to the Company’s expectations and predictions is subject to a number of known and unknown risks, uncertainties, assumptions and other factors, including those listed under “Forward-Looking Statements” and “Risk Factors” in the Company’s Annual Information Form for the most recently completed financial year, and other public filings of the Company, which include: the Company may be adversely affected by volatile solar power market and industry conditions; the execution of the Company’s growth strategy depends upon the continued availability of third-party financing arrangements; the Company’s future success depends partly on its ability to expand the pipeline of its energy business in several key markets; governments may revise, reduce or eliminate incentives and policy support schemes for solar and battery storage power; general global economic conditions may have an adverse impact on our operating performance and results of operations; the Company’s project development and construction activities may not be successful; developing and operating solar projects exposes the Company to various risks; the Company faces a number of risks involving Power Purchase Agreements (“PPAs”) and project-level financing arrangements; any changes to the laws, regulations and policies that the Company is subject to may present technical, regulatory and economic barriers to the purchase and use of solar power; the markets in which the Company competes are highly competitive and evolving quickly; an anti-circumvention investigation could adversely affect the Company by potentially raising the prices of key supplies for the construction of solar power projects; foreign exchange rate fluctuations; a change in the Company’s effective tax rate can have a significant adverse impact on its business; seasonal variations in demand linked to construction cycles and weather conditions may influence the Company’s results of operations; the Company may be unable to generate sufficient cash flows or have access to external financing; the Company may incur substantial additional indebtedness in the future; the Company is subject to risks from supply chain issues; risks related to inflation; unexpected warranty expenses that may not be adequately covered by the Company’s insurance policies; if the Company is unable to attract and retain key personnel, it may not be able to compete effectively in the renewable energy market; there are a limited number of purchasers of utility-scale quantities of electricity; compliance with environmental laws and regulations can be expensive; corporate responsibility may adversely impose additional costs; the Company has limited insurance coverage; the Company will be reliant on information technology systems and may be subject to damaging cyberattacks; the Company may become subject to litigation; there is no guarantee on how the Company will use its available funds; the Company will continue to sell securities for cash to fund operations, capital expansion, mergers and acquisitions that will dilute the current shareholders; and future dilution as a result of financings.

The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for the Company to predict all of them or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements contained in this report are expressly qualified in their entirety by this cautionary statement.

There are several risks associated with the development of the projects detailed in this report. The development of any project is subject to the continued availability of third-party financing arrangements for the project owners and the risks associated with the construction of a solar power project. There is no certainty the projects disclosed in this report will be completed on schedule or that they will operate in accordance with their design capacity. In addition, governments may revise, reduce or eliminate incentives and policy support schemes for solar power, which could result in future projects no longer being economic.

Please refer to “Forward-Looking Statements” in the press release entitled “ Bitcoin Purchases to be made by SolarBank Using Net Cash from Geddes Solar Power Project” for additional discussion of the assumptions and risk factors associated with the statements in this report. Please also refer to SolarBank’s filings on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov for additional information on the matters disclosed in this report.