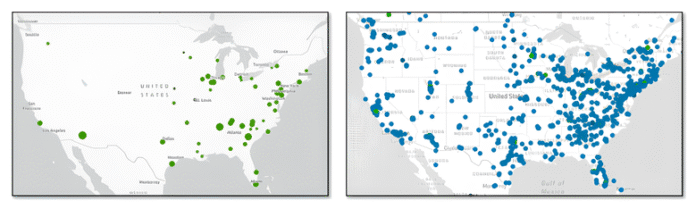

Take a close look at these two maps.

The left shows America’s 94 nuclear reactors, built decades ago and scattered across empty land.

The right shows America’s 2,847 data centers, the beating heart of the AI revolution.

By 2030, both maps will look like the one on the right.

Every major data center will have its own nuclear reactor. Not miles away. Not connected by transmission lines.

Built directly on-site, like having a personal power plant in the parking lot.

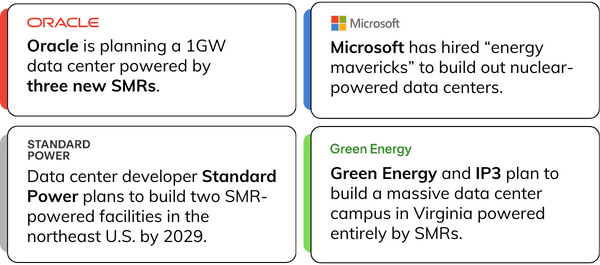

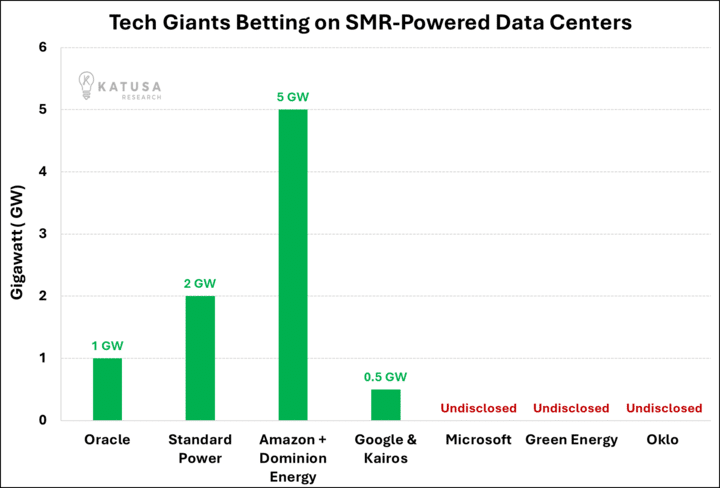

Oracle is already building a 1GW facility powered by three reactors. Microsoft has teams designing nuclear-powered data centers. Google just committed to 500MW of on-site nuclear by 2030.

This is an inevitability because AI has hit a power wall that only nuclear can break through.

“We need another 90 gigawatts of power in America.”

– Former Google CEO Eric Schmidt

That’s the equivalent of building 90 more nuclear reactors. By 2030.

But tech companies aren’t waiting for sluggish utilities to build. They’re doing something unprecedented: installing reactors AT their data centers.

Small modular reactors (SMRs) can be deployed in 3-5 years, stack like Lego blocks, and provide the exact power profile AI demands:

- Concentrated: No transmission losses, no grid dependence

- Compact: Critical when data center land costs $2M/acre

- Constant: 24/7 uptime, no weather dependence

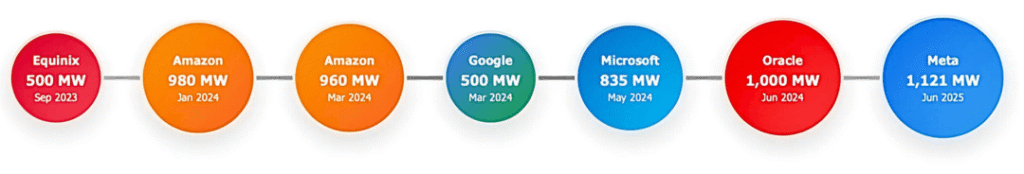

The scramble for SMRs began with Silicon Valley “barging the queue” to lock up nuclear capacity…

The U.S. only has 94 operating nuclear reactors total.

And a full one-third of them have already sold their power or are in talks with tech companies to provide them with power.

Always-Increasing Demand, Meet Dwindling Supply

Here’s how desperate they’re getting…

Meta recently signed a deal to fund 1.1 GW from an Illinois reactor. But not to use the power, just to make sure the plant stays open until they need the power.

No matter how many nuclear plants get bought up, demand keeps growing even faster.

- OpenAI says it needs 35 GW of power for just seven data centers, or 35% of the current U.S. nuclear base.

- The U.S. data center pipeline expected through 2030 would require ALL current nuclear power available in the U.S. today.

The shortage is critical. Texas now lets grid operators disconnect data centers during power crunches.

Imagine your billion-dollar AI facility going dark because there’s simply not enough electricity.

That’s what’s made the world suddenly ready for SMRs. They deliver the exact power profile AI needs: always-on, concentrated, baseload. But more importantly, they can be deployed in 3-5 years, versus 5-7 for alternative forms of energy.

Speed to power is everything.

Hyperscale Power Is Coming at Hyperspeed

Natural gas plants take 5-7 years to build. And SMRs are expected to take 3-5 years.

Not only that, but SMRs are dirt cheap, especially if you’re a tech company.

Meta, for example, expects total ’25 capital expenditure of $70B.

Oklo’s 15 MW SMR is expected to cost just $70M.

That’s 0.1% of Meta’s annual budget—and less than the contract of a single AI developer.

Google intends to be buying SMR power from Kairos by 2030. Amazon alone intends to build out 5GW of SMRs.

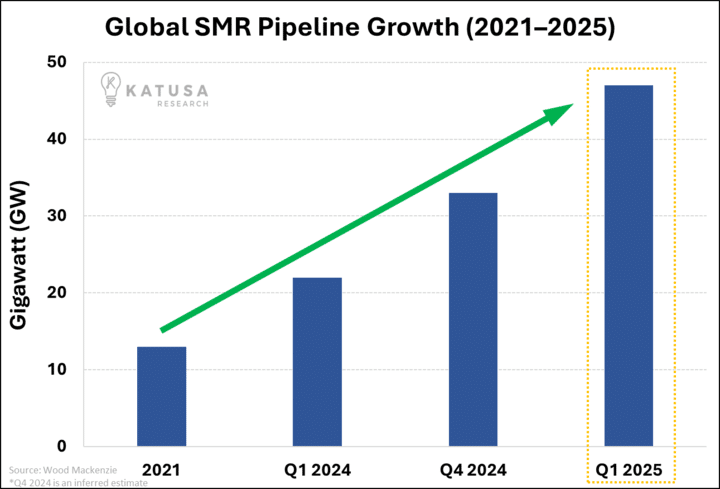

In fact, in just one year, the data center SMR pipeline exploded from 0GW to 18GW.

That’s 20% of America’s entire nuclear base—enough to power 14 million homes.

But here’s what everyone’s missing: This isn’t about SMRs powering data centers.

It’s about nuclear and data centers becoming the same thing.

The Trillion-Dollar Equation: AI = GPUs + SMR

Everyone seems to miss the middle word in SMR: “modular.” Modularity is what makes SMRs custom-fit to be used as on-site power for data centers.

They were designed from the start to be stacked to accommodate a data center’s precise needs:

Once built on-site, SMRs don’t need transmission lines. Or distribution. In other words, SMRs solve every problem with power, all at once.

Which means that “data centers” will soon refer to the fully integrated energy + compute stack.

Countless operators are already bringing the GPU + SMR dream to fruition:

In other words, any future growth in data centers will be matched by growth in nuclear SMRs.

Soon, These Two Maps Will Merge…

But while everyone’s focused on the union, they’re missing what makes it possible.

Every single SMR, all 18GW in the pipeline, representing 20% of America’s entire nuclear fleet, needs one critical input: uranium.

Yet the U.S. only produces 5% of the uranium we already consume.

The other 95% is imported from Russia, Kazakhstan, and other countries that could cut the U.S. off tomorrow.

Now imagine what happens when Google, Microsoft, and Amazon suddenly realize their shiny new reactors are dependent on Russian uranium.

The last time we had a uranium supply crisis, prices shot from $7 to $140. But that was before tech companies needed to fuel hundreds of reactors.

This time? There’s a chance any demand shock will be exponentially larger.

They’ll scramble for domestic supply.

And they’ll pay whatever it takes to secure it.

Regards,

Marin Katusa and the Katusa Special Situations Team

P.S. The demand for SMRs from AI is really the icing on the cake—albeit a lot of icing. We’ll show you exactly how to play this at the source.

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.