In the wake of Donald Trump’s surprise win, investors sold off many stocks in the green energy sector. At the same time, they bought coal stocks, believing they would enjoy an extended Trump rally.

The thinking is that Trump is pro-coal and pro-oil and might roll back laws that are friendly to solar, wind, and geothermal energy.

My position on this is clear: The best green energy stocks will perform very well during a Trump presidency. The reality is solar, wind, and geothermal are now economic and competitive with natural gas and coal. Plus, the cost of producing green energy will continue to fall. I’m as bullish on green energy as I was before the Trump win.

I believe the ultimate tool for investing in this era is Katusa’s Green Barrels of Energy Equivalent (GBOE). Below, I describe how it works… and I’ll show how it reveals some incredible things…

Why We Use Barrels of Oil Equivalent (BOE)

Right after you start learning how to analyze oil and gas securities, you meet something called “barrels of oil equivalent.”

It’s a common term in the industry… and a critical tool for evaluating oil and gas businesses.

This is because when we drill for oil and gas, we can find different forms of fossil fuels. You can find crude oil, which we use to make gasoline and diesel fuel. You can find natural gas, which we use to heat homes and power factories.

You can also find deposits that are rich in hydrocarbons called “natural gas liquids.” You’re likely familiar with one such liquid, propane. It’s a common fuel for gas grills.

All of these fossil fuels are valuable. But they are all different. They have different refining requirements. They have different transportation requirements. They have different end uses. They have different market prices. A single hydrocarbon deposit can contain a variety of these fuels. An oil and gas company can have a variety of them on its balance sheet.

The “barrels of oil equivalent” (or “BOE”) metric was created so we can compare the value of oil and deposits with each other… and so we can compare the value of oil companies with each other.

BOE is a unit of energy that is equivalent to the energy released from burning one barrel of crude oil, or 42 gallons.

By combining the BOE values of all kinds of reserves, we can get an idea of what an energy company is worth. In other words, BOE is as close to an “apples to apples” comparison as you can get when evaluating oil and gas companies.

While BOE is a useful tool, it’s important to know about its limitations.

In the oil business, a well’s production is measured in how many barrels of oil per day (bopd) it produces. Each well produces oil at a certain rate; oil producers are evaluated based on the total volume of oil produced by all of their wells during an average day. It is still important to consider a few other factors, like the grade of the oil, but in general bopd is a reliable yardstick for comparisons in the oil sector.

That reliability starts to go out the window when natural gas enters the picture. Gas volumes are measured in cubic feet, not barrels, and the energy contained in a certain volume of gas is markedly different than the energy in the same volume of oil. But oil and gas companies needed a way to describe their combined daily production. Thus was born the concept of barrels of oil equivalent (BOE).

As mentioned, BOE is a unit of energy, defined as the energy released when one barrel of crude oil is burned. Since different grades of oil burn at different rates the value is an approximation, set at 5.8 x 106 BTU or 6.12 x 109 joules. The BOE concept allows us to combine different forms of fuel reserves and production rates in a standardized manner. Using the BOE concept, one barrel of oil is equivalent to 5,800 cubic feet of natural gas because both produce approximately the same amount of energy on combustion. Pre shale revolution, oil generally traded six times the price of natural gas.

The concept would be great if we valued companies based on the energy contained in their reserves, but we don’t anymore (fracking changed that) – we care about the money they can earn from those reserves. And that does not depend on contained energy but on the market prices for oil and for gas, which are very different.

One barrel of oil is equivalent in energy to 5,800 cubic feet of natural gas. Historically, that meant oil traded at about 5.8 times the price of natural gas.

Hence, 1 barrel of oil was both equivalent in energy and price to 5.8 times a barrel of oil equivalent (boe).

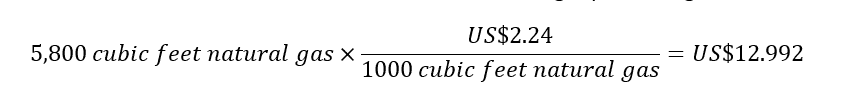

Feel free to skip the math, as all I am showing is how proof that explains those numbers. Here’s what I mean: Using an oil price of US$45 per barrel and a natural gas price of US$2.24 per thousand cubic feet, let’s calculate the ‘value’ for a BOE of natural gas priced as gas.

Today a BOE is priced at US$12.99, hence BOE’s are not priced like actual oil.

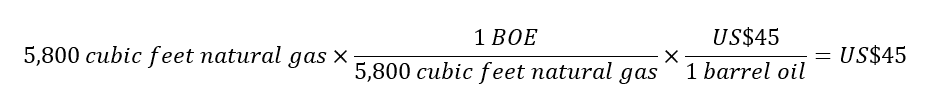

Now let’s calculate the ‘value’ of that BOE of natural gas if we price it as oil, since the two are supposedly equivalent.

Not so equivalent after all! The barrel of oil is actually worth 3.46 times more than the ‘equivalent barrel’ of natural gas.

I will now explain why this is so important and why I bored you through some math.

Despite this major discrepancy, analysts regularly value BOE production and reserves as though all of the barrels are worth the same amount. The result is that natural gas BOEs are given 3.46 times their worth in the valuation of an oil and gas company, and on the balance sheet and this is acceptable according to accounting practices today.

So we have to be careful with BOE numbers. The BOE concept is useful because it lets us compare the energy production and potential of companies producing two different kinds of fuel, but we should not use BOE data in evaluating companies financially.

Even though the BOE system has limitations, it is without a doubt the main parameter analysts and investors use to compare energy companies.

Everybody in the resource industry stopped at fossil fuels when using BOE. But not me…

I thought, why use BOE with just oil and gas? Why not use it to evaluate and compare any and all energy companies?

I’m talking about solar energy, wind energy, geothermal energy, and hydroelectric energy. If we want investors to start seriously considering green energy producers as energy investment options, we have to be able to compare the green energy producers with oil and gas companies on an apples-to-apples basis.

After all, energy is energy. It either makes your lights turn on or it doesn’t. It either makes your car go or it doesn’t. It’s either worth something or it isn’t.

Renewable energy often gets a bad rap with investors. But hydro, solar, and wind projects can be fantastic investments. In just the past five years, the cost of wind energy and solar energy have dropped so much that they’re as cheap as fossil fuels in many countries.

That’s why I created something called “green barrels equivalent,” or GBOE.

How Katusa’s GBOE Works

GBOE is essentially a BOE metric for renewable energy sources like geothermal, solar, wind, and hydro. It allows me to take any solar farm, wind farm, or geothermal plant and put it into terms I can use to value the assets.

I once taught a very smart, very rich energy entrepreneur how to perform the math behind GBOE. He was floored. He didn’t think anyone would understand it. That’s fine with me. My GBOE equation has become a huge edge for me as an investor. I can use it to accurately value any green energy asset. I can use it to see things other investors do not.

Here’s how it works…

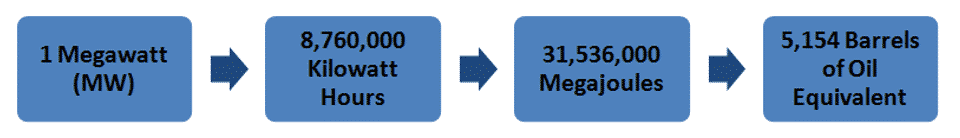

Green energy production and reserves are counted in megawatts. Officially, the unit is a megawatt year, which just like a kilowatt hour is a rate: the number of megawatts produced in a year. Since the megawatt hour is a unit of energy and GBOEs are based on energy, we just need to do a little unit conversion to transform megawatts into what we like to call green barrels of oil (GBOE).

For example, let’s say we have a geothermal power plant. Geothermal energy production works by sinking wells into the ground, allowing steam to rise to the surface, and using the steam to make turbines spin.

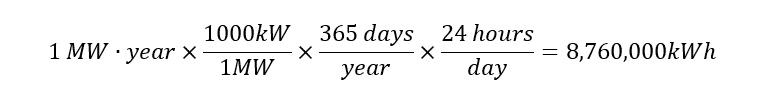

We have to assume that our geothermal power plant operates at 100% capacity, 365 days a year, 24 hours a day. Then we can take a megawatt year (remember, this is how electricity is measured) and convert it into kilowatt hours. Here’s the math for math lovers (others can skip it).

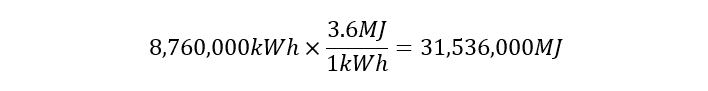

Our megawatt year of green power is now 8.76 million kilowatt hours (kWh). Now we convert kilowatt hours into megajoules using the defined ratio:

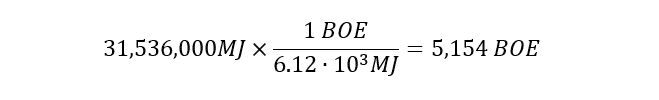

Now we can convert to green BOEs, using the definition of a BOE as 6.12 x103 MJ.

All cleaned up, the conversion goes like this:

Now we know that 1 megawatt of green power produced over one year is equivalent to 5,154 barrels of oil per year or 14 barrels of oil per day.

Comparing US green energy assets: Looking long term

Using our math to use green power modeling to turn green megawatts into equivalent barrels of oil per day.

Let’s use our concept of green BOEs to compare the full potential of green energy production with that of an oil well.

Oil wells have decline rates. That means the initial production of an oil well will definitely not be the same production in 6 months. Production declines significantly on unconventional wells.

A “decline rate” is a huge issue in the energy business because oil and gas wells typically produce a lot of volume right after they are tapped and fracked, but then produce a lot less as the months and years go by. Decline rates must be factored in when evaluating oil and gas assets.

Conventional Oil and gas wells decline at an average 14% annually. Unconventional wells have decline wells as high as 75% annually, and its generally accepted the average decline of an unconventional well is about 35% (and that is being optimistic).

That means the oil wells need further EOR (enhanced oil recovery) or refracking the wells or they will run dry.

Oil and gas companies have to constantly establish new wells just to maintain their production levels.

Green energy, such as geothermal wells, on the other hand, decline at roughly 2% each year, solar and wind farms don’t decline.

For example, a hundred years after a geothermal well is tapped it will still be producing some 35% of the power it kicked out in its first year – that is a seriously long-term asset. So in the geothermal world new wells do not just replace production that is drying up; they add new, long-term production. Same can be said regarding wind and solar farms (or fields—if we are going to compare apples to apples, we should say wind fields or solar fields like we say oil fields).

Let’s crunch some numbers on overall well potential. If you don’t like calculus, don’t worry about all of the equations below – just skip them and read the text below for the conclusions. I’ve included the calculus for all my alligator mathematicians!

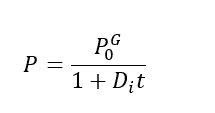

To model the production from a geothermal well we use a harmonic decline rate. In the equation below, P represents the well productivity, represents initial geothermal well productivity, and Di represents the constant harmonic decline rate.

We took three realistic decline rates and modeled the 100-year production from a geothermal well that started at 175 MW or 901,950 gBOE per year. If we want to do the same for a wind or solar farm, just replace the MW amount.

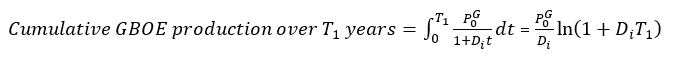

This is the key part of Katusa’s Green barrel of Oil Equivalent production. We need to make the production comparable on an apple to apple basis. To do this, we have to bring in some calculus. To calculate the cumulative production over the first T1 years we use an integral:

The key question is: what would a comparable oil well look like?

The question we have to ask ourselves is, “what initial production rate would an oil well need if it were going to produce the same cumulative number of BOEs over its much-shorter lifespan?”

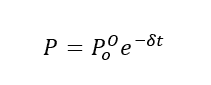

To calculate that we need to model the production from an oil well. The equation below does just that, with as initial oil well productivity and as the exponential decline rate, which we set at 14% because of the average conventional oil well decline rate.

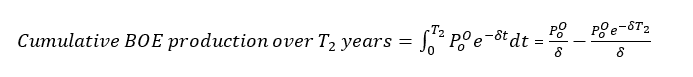

Again, to calculate cumulative production over the first T2 years we use an integral:

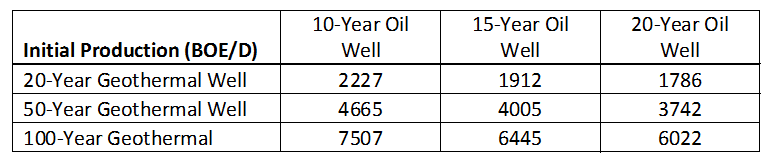

Now we set our cumulative production equations equal to each other, insert decline rates (1.75% for the harmonic geothermal decline and 14% for the exponential oil decline), and run through our well life spans (T1 = 20, 50, and 100 and T2 = 10, 15, and 20).

Initial production rates necessary for oil wells to match geothermal wells in BOEs produced over producing life spans

So for a conventional 10-year oil well to produce the same amount of energy as a 49.5 MW geothermal well kicks out in its first 20 years, it has to start producing at over 2,200 barrels per day. There are no conventional wells in North America even close to producing anything near that number. It would take a dozen conventional wells to produce such numbers.

Really, though, there’s no need to cut the geothermal well, solar field or windfarm off at 20 years; if we want to get the same energy from a conventional 10-year oil well field as we expect to get from a geothermal well field over 100 years it has to start off by producing more than 7,500 barrels of oil a day!

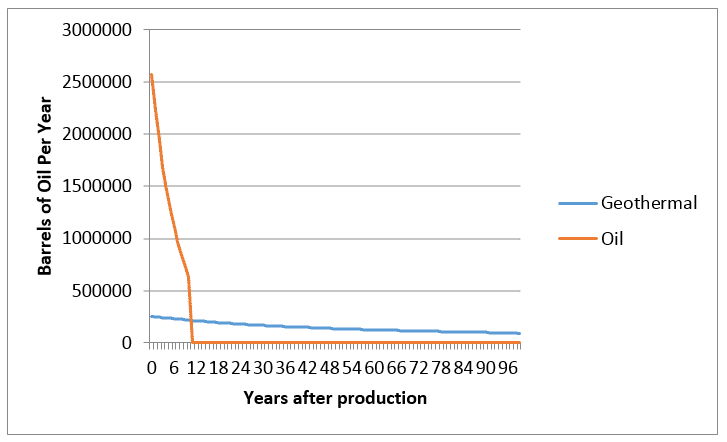

It’s often easier to understand these things graphically.

The graph below shows the 49.5 MW geothermal well modeled at a harmonic decline rate of 1.75%, contrasted with a 10-year oil well declining exponentially at 14%.

The constancy and longevity of geothermal power is very evident. And note that the geothermal well still has plenty of production left at the 100-year mark.

Conclusion

For investors to start seriously considering green energy production under a Trump Presidency, investors, fund managers and Trump himself will need to be able to compare the power of a green energy field with the barrels of an oil or gas well.

Now they can, thanks to the Katusa Calculus Class

By putting oil and gas and green energy companies on common ground, we can compare production, reserves, and valuations…and finally prove what we have been saying for some time now: that green energy companies are undervalued in the energy sector.

Clean energy will constitute a major part of our future, even with Trump as president.

Oil and gas producers will soon realize that the perfect way to neutralize their carbon emissions is to also produce green energy.

I believe over the next decade, we will see the mid-tier and large oil and gas companies will start consolidating and buying out North American green energy producers.

But before any of that can happen we need investors to wake up to the fact that green energy is economic in the present energy matrix.

The math I’ve presented is completely sound and correct. The math that allows natural gas to be included on the financial books as BOE (barrels of oil equivalent) also allows for green energy produced from a solar, wind, geothermal field.

I am surprised nobody has done this yet, but I am sure the folks at Goldman Sachs will read this report, repackage it as their own concept, and make billions from consolidating the undervalued green energy sector. They can, apply the GBOEs (Green barrels of oil equivalent) concept and get bankers to accept the GBOEs on the balance sheet as they BOEs. That’s fine, I hope they do. I have already have run all the numbers on the best and most undervalued green energy producers in the North America. Once word gets out, the buyers will pay my subscribers and I premium prices for our holdings.

Regards,

Marin Katusa