Do you have FOMO yet?

If you didn’t put your cash to work in 2020, then you’re fighting the tide ignited by the Fed.

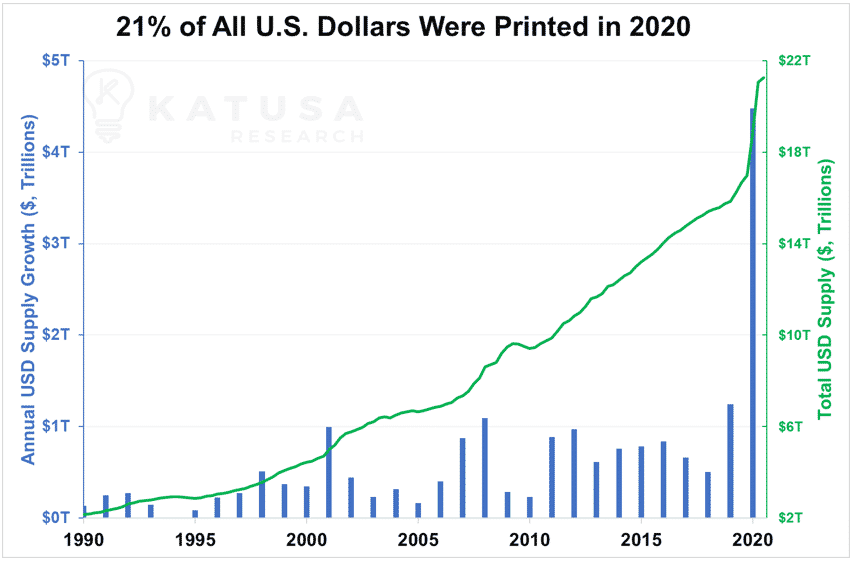

Never in the history of the world has so much money been printed.

Plus, if you’re an accountant and love seeing balanced books, you’ve likely never had your eyelids twitch more than this year.

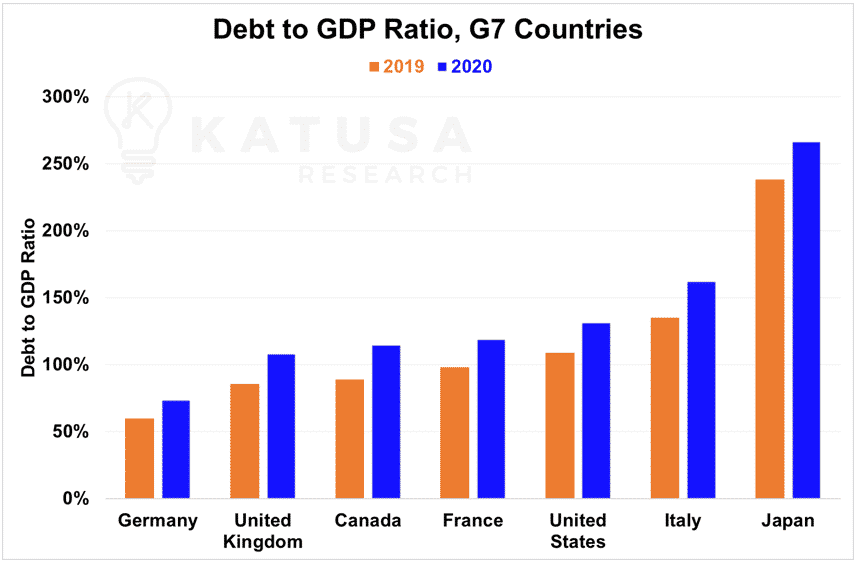

The reason is simple: countries have seen their balance sheets decimated deep into the red this year.

Countries like Canada have seen their Debt-to-GDP ratios jump from 89% to 115%.

The European Union is forecast to hit 102%. And the United States is currently at 131%.

The New Era of Helicopter Money

During the 2008 global financial crisis, Fed Chairman Ben Bernanke famously earned the nickname “Helicopter Ben” as the federal asset relief programs set the course for enormous money printing and fiscal aid.

In 2020, helicopter money took on a whole new meaning.

This past year alone, the United States printed 21% of all U.S. Dollars in existence. Look at the unprecedented surge in fiat currency…

Economies and global trade went to a complete standstill.

It’s these types of events that alligator investors like myself and other major financiers with capital – waiting for the moment to deploy en masse – salivate at.

Long-time readers saw this coming…

Governments are not shying away from negative rates and printing money. I call these Financially Transmitted Diseases and it’s something that I’ve pounded the table on for a long, long time.

- How much of that money is making it into bank accounts and circulation, you ask?

Good question…

Below is a chart which shows the increase in the M2 money supply. M2 is a broad money supply measure which includes cash, checking deposits and easily convertible near money.

And there’s no going back.

The Death of Fiat and Rise of Assets

This new world backed by Modern Monetary Theory (MMT) will fuel a bonanza of ultra-cheap money.

And we’re seeing it in real time.

A stock like Tesla seemed expensive at $80 (post-split) at the beginning of 2020. But two factors led to speculative excess on a scale that no one’s seen before:

- The entry of a massive new generation of investors (Millennials and Generation Z) thanks to platforms like Robin Hood, and

- Trillions of new dollars and currency units chasing a home.

With most people working remotely and stuck in their houses, that money went into online shopping and stocks. And there are no signs that this is slowing down.

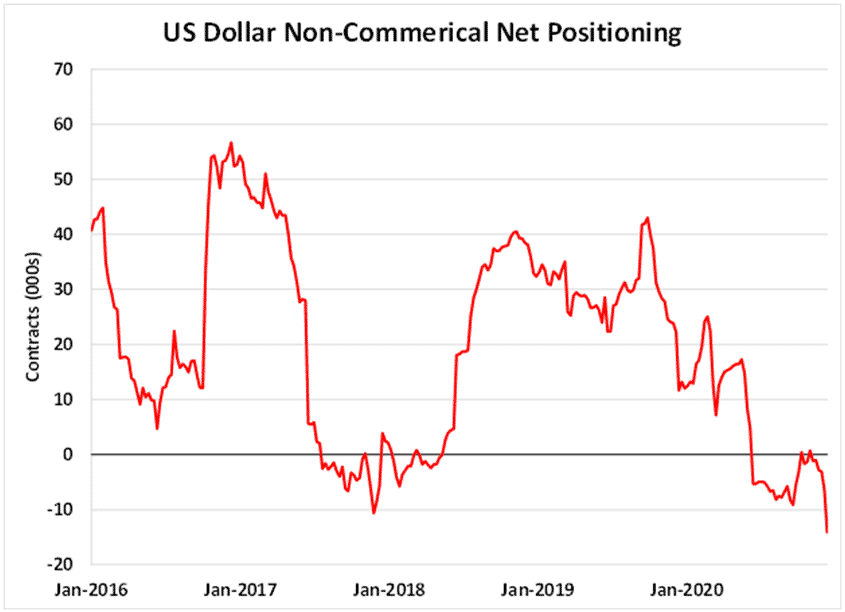

- As a result of this incredible money printing in the United States, the U.S. dollar is under siege. It currently faces its largest short position since 2014.

This means that investors are betting against the US Dollars at levels not seen in years.

Below is a chart which shows the net positioning of non-commercials from the CFTC’s Commitment of Traders (COT) report. The wall of shorts has been aggressively piling on all year.

Explosive Gold and Silver Breakouts

I cut my teeth for 2 decades in the resource sector and let me tell you, there is absolutely no mania like a gold and silver mania.

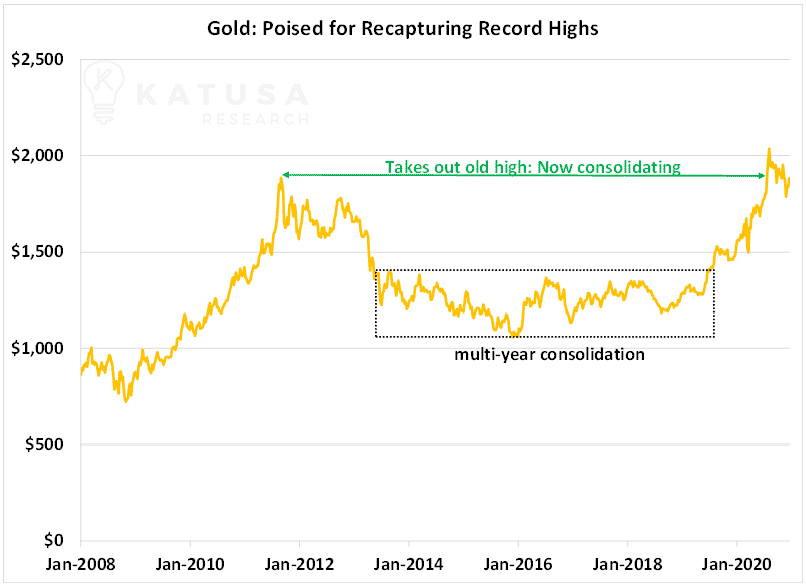

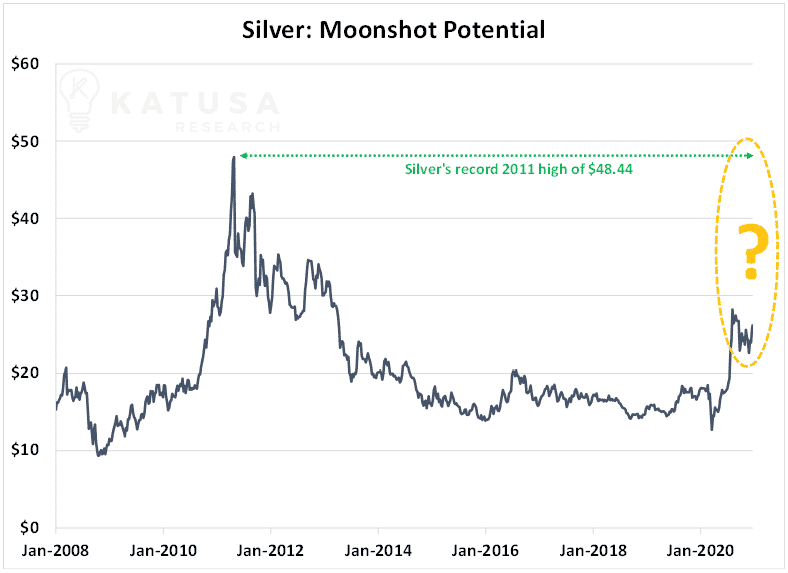

- What we saw in 2020 is just a prelude to what I see coming in the Gold and Silver markets.

After a multi-year consolidation period, gold took the world by storm in 2020. This year gold took out its old high from 2011, and briefly surpassed $2,000 per ounce.

You think Bitcoin returns are huge?

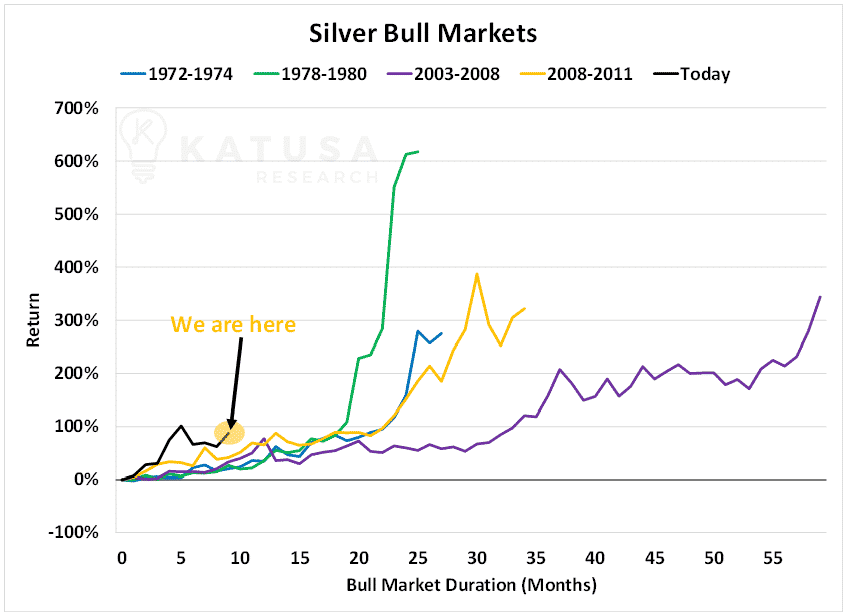

You’ve never seen a junior silver stock explode higher in a silver bull market.

And we’re just in the early days of a major silver bull market…

You’re going to want to fasten your seatbelt on the way up and even tighter on the steep chops down. Below is a chart showing the historical returns of silver’s bull markets.

The Death of Fiat: Rotating into Bitcoin, Ethereum and Cryptocurrency

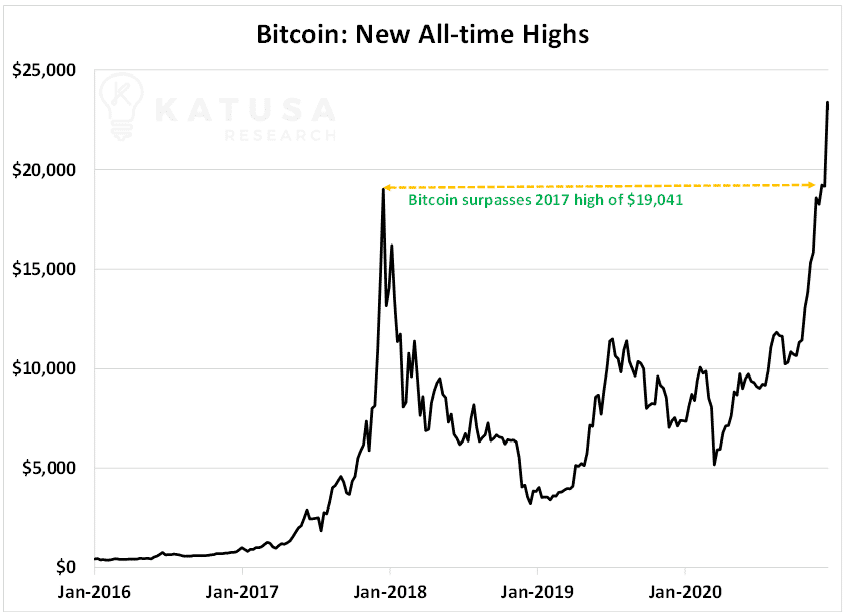

While the shorts piled on the U.S. Dollar, those looking for a global devaluation bet went not just to gold and silver, but to Bitcoin as well.

Bitcoin smashed through previous highs of $19,000, breaching $24,000…

Maybe it’s because many retail investors got burnt in the downswing and have already written Bitcoin off.

Yet the price of Bitcoin has made an incredible comeback and noteworthy funds and companies are either already buying it, or building the groundwork to buy it.

- Square, one of the world’s largest digital payment processors, bought $50 million worth of Bitcoin and have their own dedicated cryptocurrency team.

- Grayscale, the largest digital asset manager in the world, reported inflows of over $1 billion in the third quarter of 2020. Currently it has over $6 billion under management.

- And billionaire hedge fund managers like Paul Tudor Jones have made significant bets on Bitcoin as hedges against inflation.

But DO NOT Count Out the Almighty Dollar Just Yet…

The U.S. Dollar dominates as a payment currency for global trade with a 79.5% share of inter-regional currency usage, by value.

If this past March was any indication, the world still needs U.S. Dollars.

In a race to zero, the U.S. Dollar is still the best option.

- Personally, I hold a large percentage of my cash position in U.S. Dollars.

I always call myself a profit bug because I’m not tied to a single asset, currency or mandate.

My job is to find unique investments that have incredible upside potential.

The nominal price rise in assets is continuing a trend set in motion decades ago.

- Could 2021 be the start of the new commodities super cycle?

What I do know for certain is that I am actively putting my money alongside my subscribers into investments with fantastic risk-reward profiles.

These aren’t dinky, illiquid juniors that have no real assets or management without skin in the game.

These are companies that trade real volume, have world class assets and management are big time owners of their own stock.

Our hit list of stocks keeps growing and we’re always on the hunt for next deal.

Looking back 3 years from now, you might wish you owned more assets.

And for now, and the foreseeable future, all of those assets are denominated in U.S. Dollars.

Here’s to a wild year and a safe, healthy and prosperous 2021!

Marin