The chair didn’t bring a victory banner to Jackson Hole. He brought a shovel.

In one speech and one framework update, the Fed quietly buried the 2020 experiment—no more “let it run hot to make up the past.”

What’s left is simpler, sharper, and friendlier to real assets than most investors realize.

The Four Lines That Changed Everything

“We continue to view a longer-run inflation rate of 2 percent as most consistent with our dual-mandate goals,” Powell said.

Sounds boring? It’s not.

That sentence, backed by the new Statement on Longer-Run Goals, just killed the Fed’s 2020 “make-up” strategy. No more averaging. No more “shortfalls” language on employment.

Just a clean, hard 2% target.

Reuters confirmed it plainly: the Fed returned to flexible inflation targeting. The make-up approach is gone.

Why now? Powell flagged the new reality: tariff shocks, slower labor-force growth, and policy shifts. That means more inflation risk than the pre-2020 world.

PCE sits at 2.6%, Core at 2.8%, both stubbornly above target. Powell himself flagged it: goods deflation is fading, services stay sticky.

The Fed just told you deflation/disinflation as the default is over…

The objective is 2%—not under, not “averaged.”

Here’s the mechanism:

- If growth softens → cuts come to protect employment

- If inflation re-accelerates → no tolerance for “let it run” overshoots

This is a Fed facing supply-side frictions, fiscal dominance, and structural labor shortages. In practice, this reduces tolerance for fresh overshoots and raises the odds of earlier rate support if jobs wobble but without abandoning the 2% anchor.

The net result is a dovish-leaning, inflation-aware setup that historically favors gold and real assets when real yields ease.

But Powell’s 2% religion faces a bigger test than inflation data…

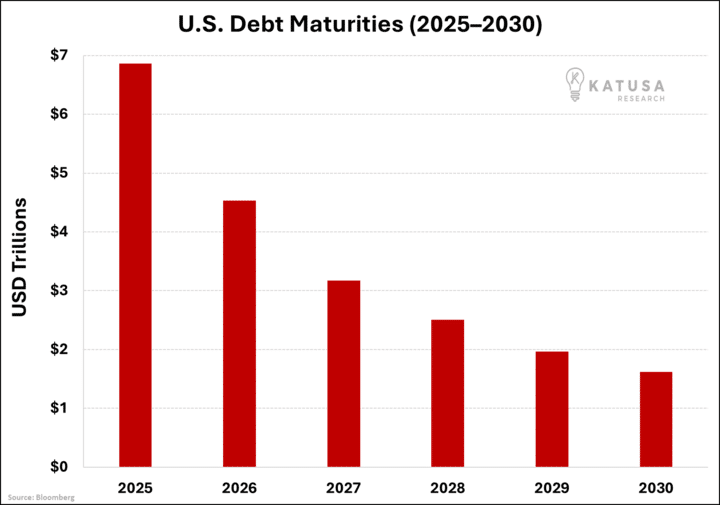

Washington needs to roll $7 trillion in debt this year, and the math only works at lower rates.

Is Trump Quietly Wishing for a Market Crash?

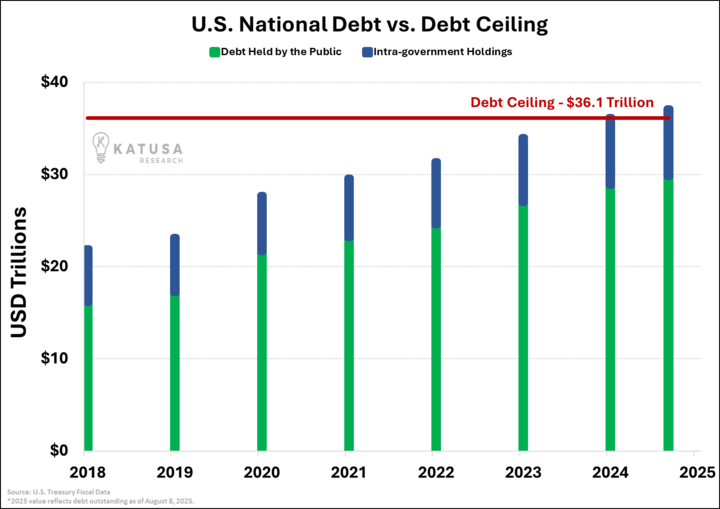

The debt ceiling used to mean something.

Between 1917 and 2015, Congress lifted it fewer than 80 times, mostly for wars or recessions. Since 2016? It’s an annual circus, as predictable as pumpkin spice lattes.

Here’s the kicker: the ceiling sits at $36.1 trillion, but debt already hit $37.14 trillion on August 8. We’ve blown through the guardrail by over a trillion dollars.

The government is literally spending money it’s not authorized to spend.

Mark your calendar, by the end of September, Congress will have already started their song and dance to legitimize what they’ve already done.

Welcome to Washington’s new normal: break the rules first, ask permission later.

The Real Problem: Refinancing at High Rates

Debt at this scale doesn’t just sit there. It comes with a bill.

- Washington now spends over $840 billion a year on interest payments alone, more than it spends on defense.

That’s what happens when rates rise, and the pile of IOUs gets taller. And the wall of maturities is brutal.

In 2025 alone, nearly $7 trillion of Treasuries are set to mature. Think of it like a homeowner with a giant mortgage facing a reset at double the interest rate. Uncle Sam has to roll that debt over, but at today’s yields, the costs are staggering.

No wonder Trump is hammering the Fed to cut.

Every percentage point off the yield curve saves the government hundreds of billions over time.

Why Treasuries Look Like Yesterday’s Trade

To refinance, the government needs investors to line up and buy Treasuries.

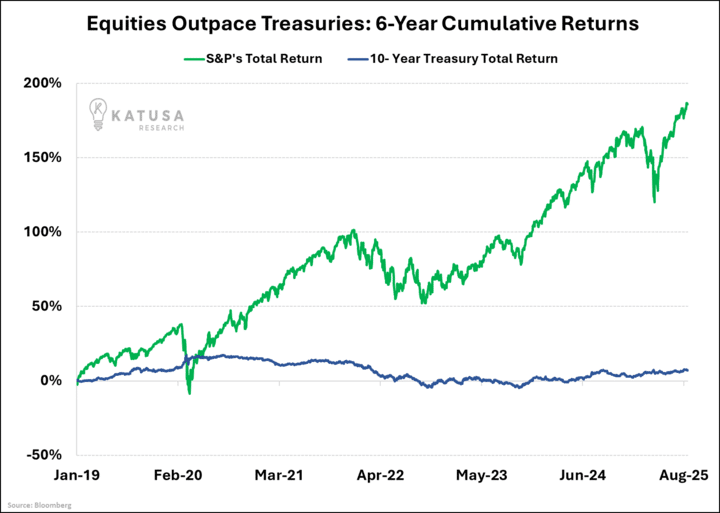

But ask yourself: why would anyone rush into bonds yielding 6-7% when the S&P 500 has been crushing Treasuries for years?

Look at the scoreboard… Since 2019, stocks have left bonds in the dust.

- Even with the 2022 correction, the equity bull run has outpaced the safety trade.

If you’re running money, do you want equity upside or a Treasury coupon that barely covers inflation? Exactly. That’s Washington’s problem.

Enter Trump’s Master Stroke: Scare Money into Safety

This is where it gets interesting because the government needs buyers for its bonds.

The Fed won’t be the sugar daddy forever, and foreign buyers (China, Japan, Saudi Arabia) aren’t as eager as they once were. So how do you drive demand?

You make Treasuries look appetizing again.

One way is a rate cut, lowering yields so bond prices rise and attract capital. Another way is more chaotic: engineer an environment where investors run away from risk.

Think tariffs, recession fears, labor market weakness, or even a market crash.

In chaos, safety wins. Investors dump stocks and crowd into Treasuries.

A market correction plus rate cuts equals cheaper refinancing for $37 trillion in debt. Trump gets his lower rates and a Treasury bid. Problem solved until the next crisis.

Problem solved, at least for now.

If Trump Gets His Rate Cuts…

It’s not just about cheaper government debt, lower rates are rocket fuel for certain sectors:

Infrastructure plays suddenly make sense again. When money gets cheap, those capital-intensive projects with 20-year payoffs start looking attractive.

Think utilities, toll roads, airports, boring stuff that prints money when financing costs drop.

Cash flow kings become the new growth stocks. Companies sitting on real earnings and fat dividends? They’ll look like gold when the speculative froth gets blown off.

I’m talking about the pipeline operators, the REITs with locked-in leases, the consumer staples that keep churning out cash no matter what.

What about speculative markets? That’s where it gets interesting…

Rate cuts usually mean party time for risk-free assets. But if we get cuts because of a crisis, not strength, all bets are off.

The last time we saw emergency cuts was 2020, and we know how that played out, massive volatility first, then a face-ripping rally.

Mark These Dates…

- PCE (July): Friday, August 29

- FOMC + SEP: September 16-17

The September meeting brings fresh dot plots.

If the dots confirm what Jackson Hole started, a Fed ready to cut for employment but allergic to overshooting 2%, the funeral becomes a memorial service.

The Fed hinted of rate cuts at Jackson Hole. Trump’s about to bury the old playbook.

And with that, gold is shining bright.

That’s exactly the kind of shift I track for my subscribers in Katusa’s Resource Opportunities, where the real signals, not the headlines, show where capital is flowing next.

Regards,

Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.