In May 1999, the Bank of England announced it would sell 415 tons of Britain’s gold reserves.

Gold was $282 an ounce. Gordon Brown, then Chancellor, called it a “restructuring to more productive assets.”

They sold at the absolute bottom.

Today that gold would be worth $48 billion. They received $3.5 billion from the gold sales in 1999.

The British press still calls it “Brown’s Bottom”, the worst trade in central banking history.

Here’s why I’m telling you this: Today, central banks are doing the opposite. China, Poland, India, they’re buying record amounts at $3,600 an ounce.

Either they’re making the worst trade since Gordon Brown, or they know something the market doesn’t.

They know gold’s price is wrong.

Why Central Banks Know What You Don’t

Gold isn’t tired and it might not be peaking yet. Even if at $3,700 an ounce, the headlines say, “all-time highs.”

But zoom out and you’ll see the real story. Investors are looking at the wrong number, and central banks might see something entirely different.

Gold is still cheap when you adjust for money supply, and the setup for much higher prices is staring us in the face.

Since March 2020, the Federal Reserve created $6 trillion in new money.

- That’s a 40% increase in M2 money supply and more dollars created in four years than in the previous decade combined.

Yet gold, the asset that’s supposed to protect against currency debasement, hasn’t even kept pace.

It should have, but it hasn’t. And the gap between what gold costs and what it should cost is $800 per ounce.

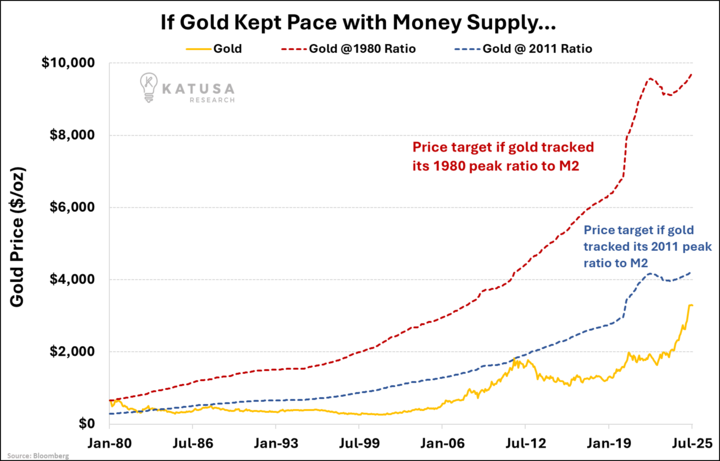

We’ve created a chart that reveals something most investors miss:

Gold is actually cheap relative to the global currency fiat money supply.

Despite hitting nominal all-time highs, gold is actually cheaper relative to money supply than during previous peaks.

At $3,600, everyone knows that gold is at nominal all-time highs. But relative to M2 money supply, it’s well below historical peaks.

This suggests significant upside potential if the market catches up to monetary expansion.

- If gold matches its 2011 money-supply ratio, you’re looking at about $4,400 per ounce.

- If gold matches the 1980s ratio, it’s about $9,700 per ounce.

The divergence is massive. Gold has been playing catch-up since 2020 when money printing went vertical, but it still hasn’t closed the gap.

Central banks know it. They’re buying at record levels. The general public is still looking at nominal prices and missing the real story that investors are starting to pick up on.

The Professionals Are Loading Up

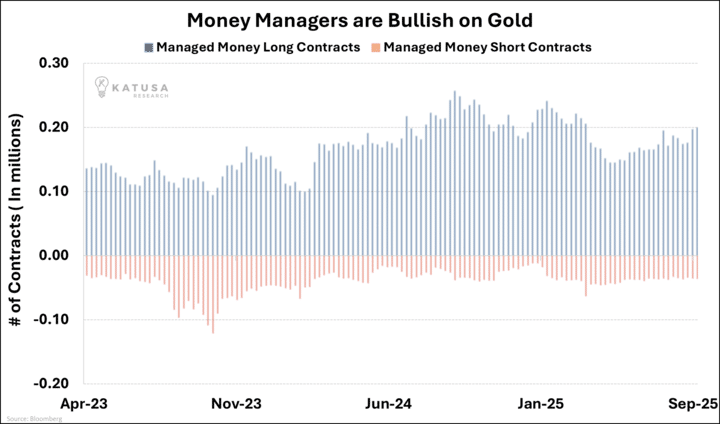

Now look at how the big money is positioned.

Since early 2024, managed money long contracts have absolutely crushed shorts. Those blue bars dominate the red ones by a factor of 5-to-1.

September’s net long positioning is the strongest we’ve seen since April.

Translation: the pros are leaning hard into gold. Hedge funds, traders, money managers, are not fading this rally. They’re piling in and think this will continue, with good reason.

Rates are bending lower, deficits are ballooning, tariffs are flying, and the geopolitical issues continue to be a tinderbox. Smart money knows it.

The 50% Profit Jump Already Happening

Forget everything you know about gold miners from the last decade.

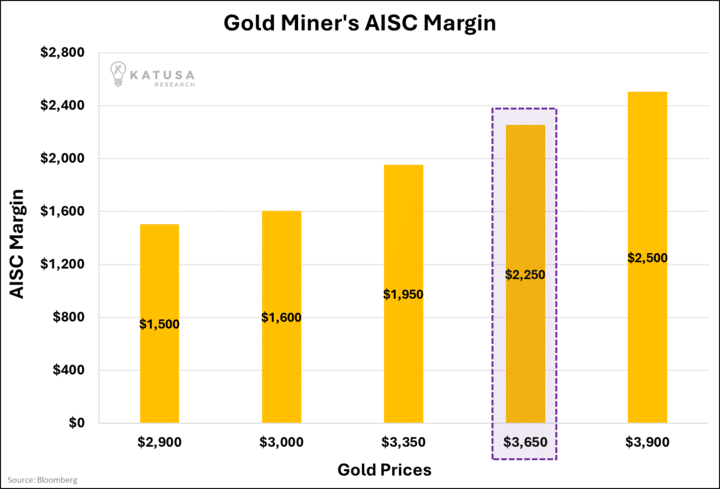

At $3,600 gold, the average North American producer generates $2,200 per ounce in margin (assuming $1,400 all-in sustaining costs).

Here’s the math:

- At $2,900 gold, the top miners were pocketing about $1,500 per ounce.

- At $3,650 gold, the top players are pocketing $2,250 per ounce.

That’s a 50% jump in profits on just a 26% rise in gold. Operational leverage at its finest.

And this time, miners are better positioned than in past cycles. Balance sheets are stronger, debt is lower, and discipline is higher.

The free cash flow pouring in now is funding dividends, buybacks, and growth without the reckless dilution of old.

This isn’t 2011 when miners destroyed capital chasing growth. Balance sheets today carry minimal debt. They’re returning cash via dividends and buybacks. Barrick alone bought back $1 billion in shares last year.

Simply put: gold miners are running printing presses of their own.

The Math Doesn’t Care About Headlines

Gold at $3,700 isn’t expensive, it’s mispriced.

Central banks aren’t waiting for confirmation and nowhere is that more evident than China adding 225 tons in 2024 and continuing in 2025.

The $6 trillion in money supply created hasn’t disappeared anywhere, it’s sloshing around the system, looking for scarcity.

And there’s nothing scarcer than an asset that hasn’t been printed since the Big Bang.

Gordon Brown sold at $282 thinking gold was dead money. Today’s central banks are buying at $3,600 knowing it’s cheap relative to the currency they’re creating.

One of these trades will define the next decade.

Regards,

Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.