Gold has been on a tear this month.

Earlier this week, the European Central Bank Chief Mario Draghi – or as I like to call him “Super Mario” – outlined a possible fiscal stimulus plan in Europe. Gold rapidly moved higher off the news.

On Wednesday, U.S. Federal Reserve Chairman Jerome Powell released his own cautious statement on the economic situation. The U.S. dollar headed lower and gold popped.

Even gold sentiment among investors has spiked this month.

But for the last 5 years gold has been range bound in the U.S. Dollar… waiting for a catalyst to propel itself back towards previous high of $1,900 per ounce.

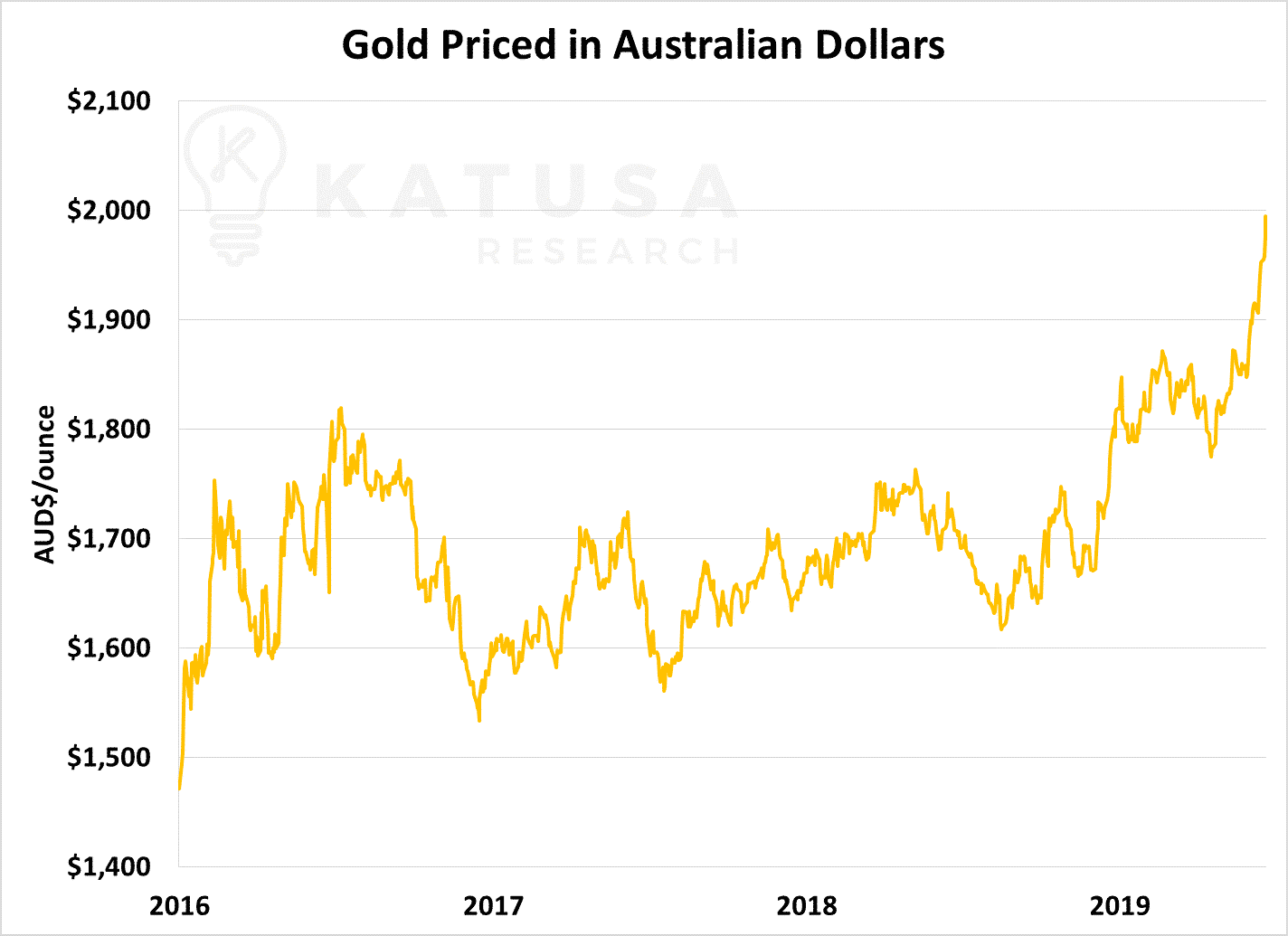

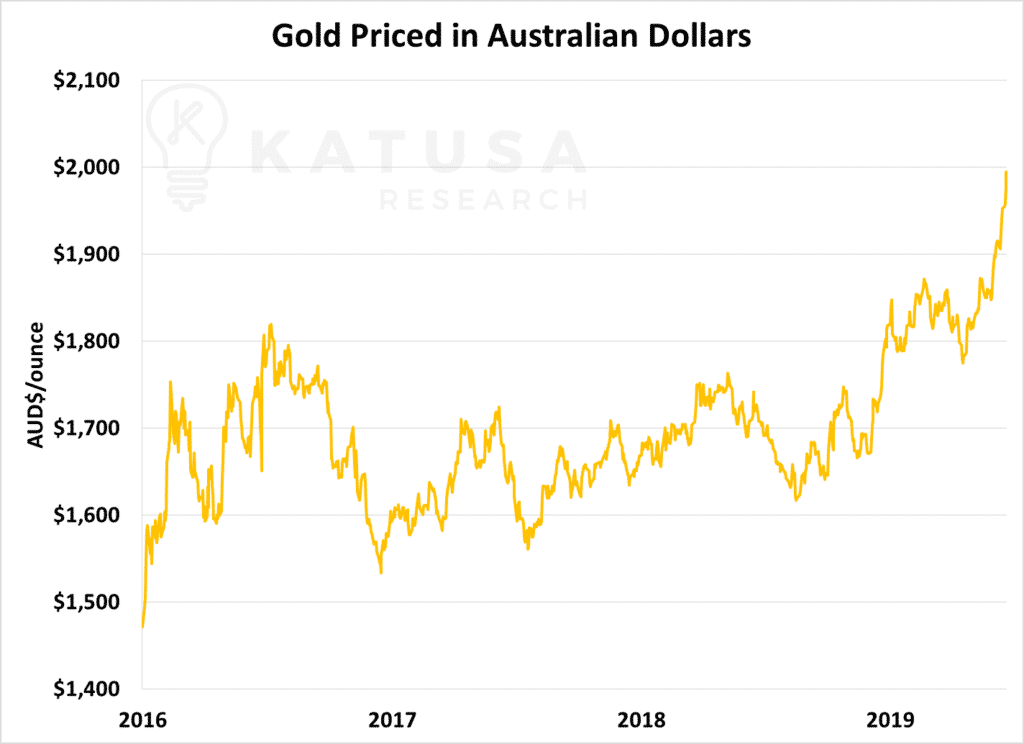

Many of you are prudent to note that I’ve published many articles showing how $2,000 gold is already here. You don’t need to look any further than gold priced in Australian dollars which continues to march to all-time highs….

As I’ve said before…

The reason for this out-performance in Australian gold pricing is due to U.S. dollar strength versus Australian dollar weakness.

Lots of media outlets will lead you to believe there’s a race to the bottom in currencies. And while this may sound dire, it’s great for resource companies in the right jurisdiction.

But for most gold producers, it’s been a grind. Anyone that tells you otherwise is lying to you.

I’ve had hundreds, if not thousands, of meetings with companies over the last 5 years.

A small percentage of the mining companies are run by top-tier management teams with skin in the game (meaning a considerable amount of their money and net worth invested in the company). However, most are not.

With gold showing some strength, are we through the valley of darkness?

Or are expectations and confirmation bias getting the best of us?

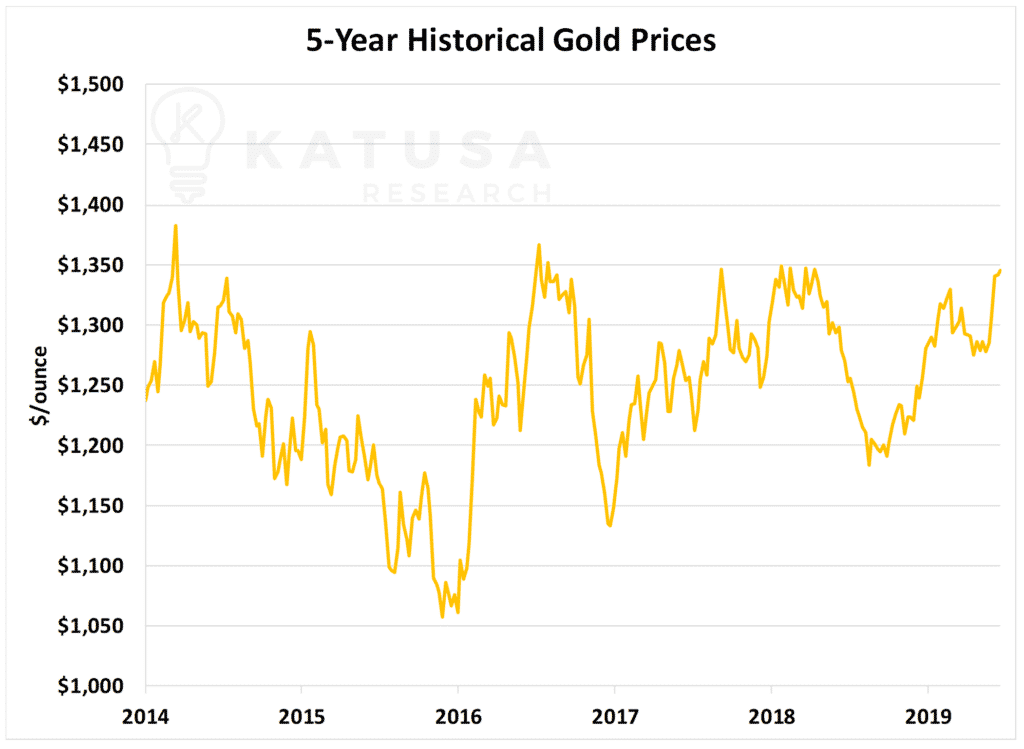

Below you’ll see the price of gold over the past 5 years. You’ll see it’s very close to breaking above $1,350 on a weekly time frame. As I write, gold is $1,380 per ounce.

The $1,380 price point represents a pivot point for the commodity. This point is known by market technicians as “resistance”. Below this price point, bears have control. Above $1,380 the bulls are in control.

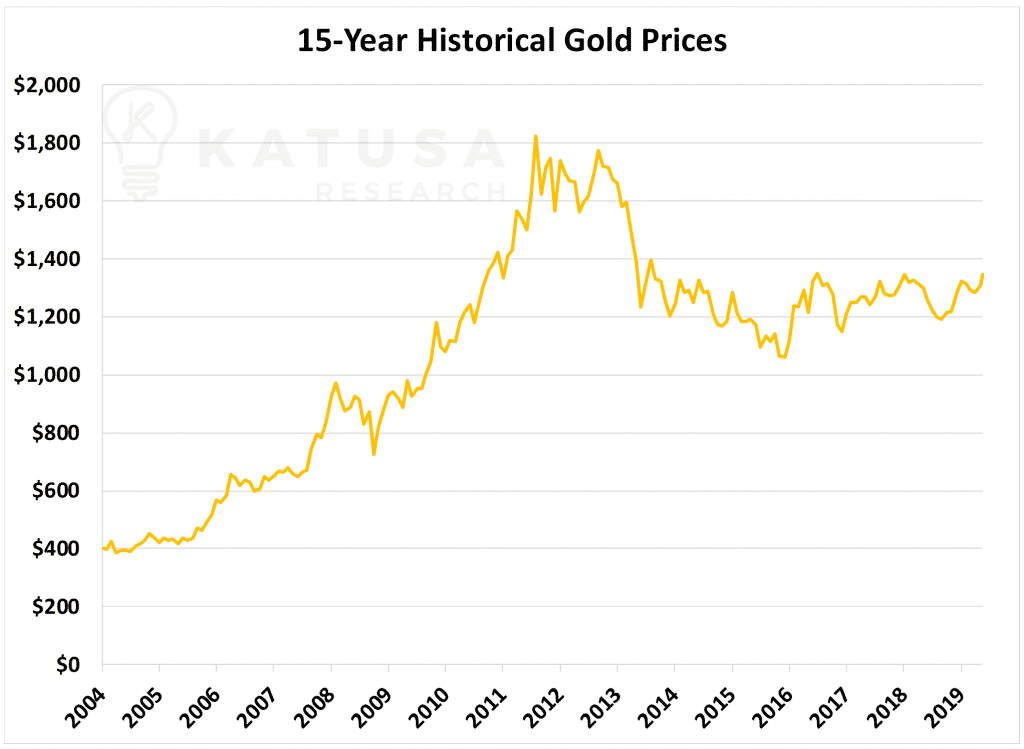

In the chart below you’ll see the historical gold price since 2004. You’ll see gold has been very range bound since 2013.

You’ll also see in the chart that when gold goes up, it trends very well.

In 2004 the price of gold was $400 per ounce. Over the span of 8 years, gold trended higher and surpassed $1,800 per ounce. That’s an increase of 350%.

During that time, gold stocks performed incredibly well. Many companies saw their shares significantly outperform the gold price.

I’m not saying gold is going to new highs tomorrow.

I can’t predict the gold markets, and neither can anyone else. All you can do is prepare and educate yourself, and then when the time is right, you pounce.

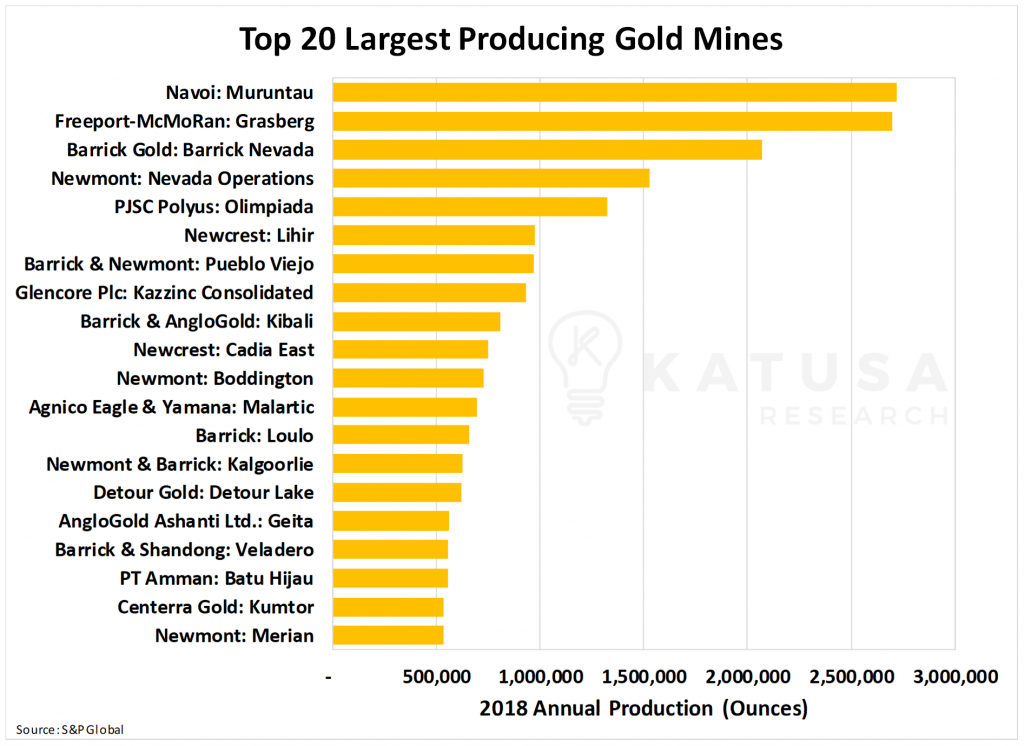

The Top 20 Gold Mines

Below is a chart which shows the top 20 largest producing gold mines in the world and their major owner.

Being a very large gold mine is great, but unless the mine is a low-cost producer, the size of production is irrelevant. It’s all about Free Cash Flow.

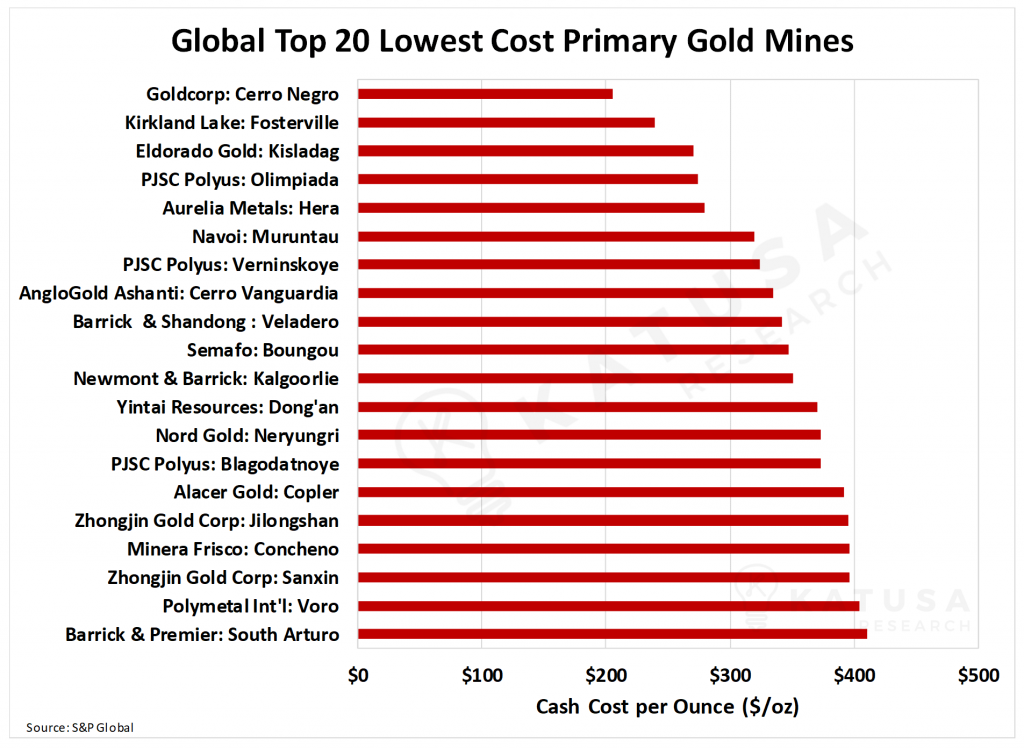

Below is a chart which shows the top 20 lowest cost gold mines which produce over 100,000 ounces per year.

If you like what you’ve seen so far, I’ve got a ton of additional free research on my website.

I suggest you check out my gold buyouts list. It’s 100% complimentary for you. Just the other week yet another company on my list got bought out for a hefty premium.

If you want to spend thousands of hours creating your own financial and geological models, go for it. But my team and I have done the easy work for you. It’s all free. Why? Because I can.

The Katusa Resource Opportunities newsletter has also been on fire lately. Our May 2019 recommendation exceeded our own expectations. This past week we sent out an alert to sell and close the position to all Katusa subscribers for a +170% profit in just over a month.

And one of our favorite gold juniors just spiked on drill results to a 52-week high and is up 70% YTD. I believe there’s plenty more upside to come.

If you want to make life simpler for yourself and invest alongside me, consider becoming a member to Katusa’s Resource Opportunities. With a membership, you’ll get immediate access to companies that I am personally investing millions of dollars into.

Regards,

Marin