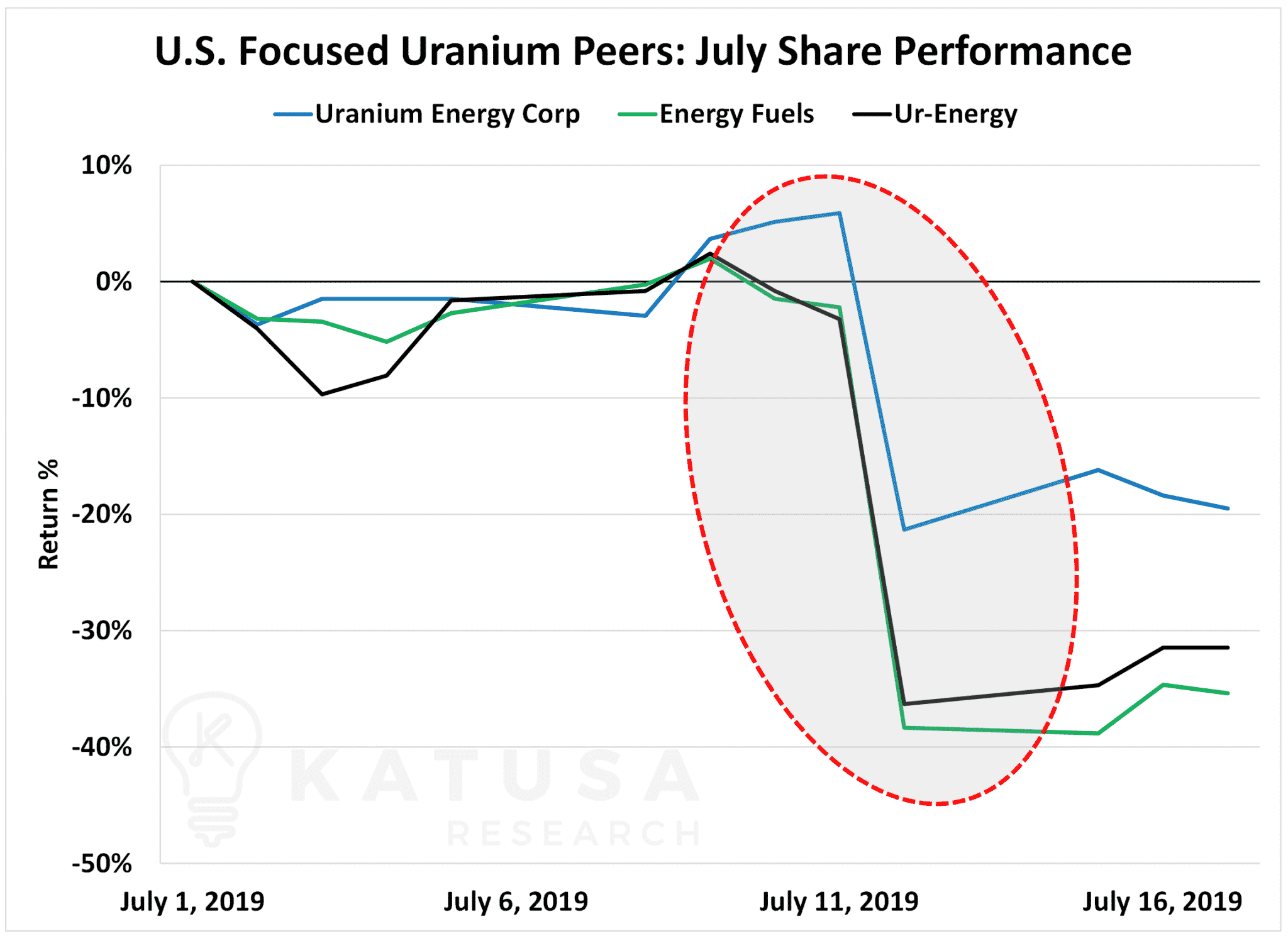

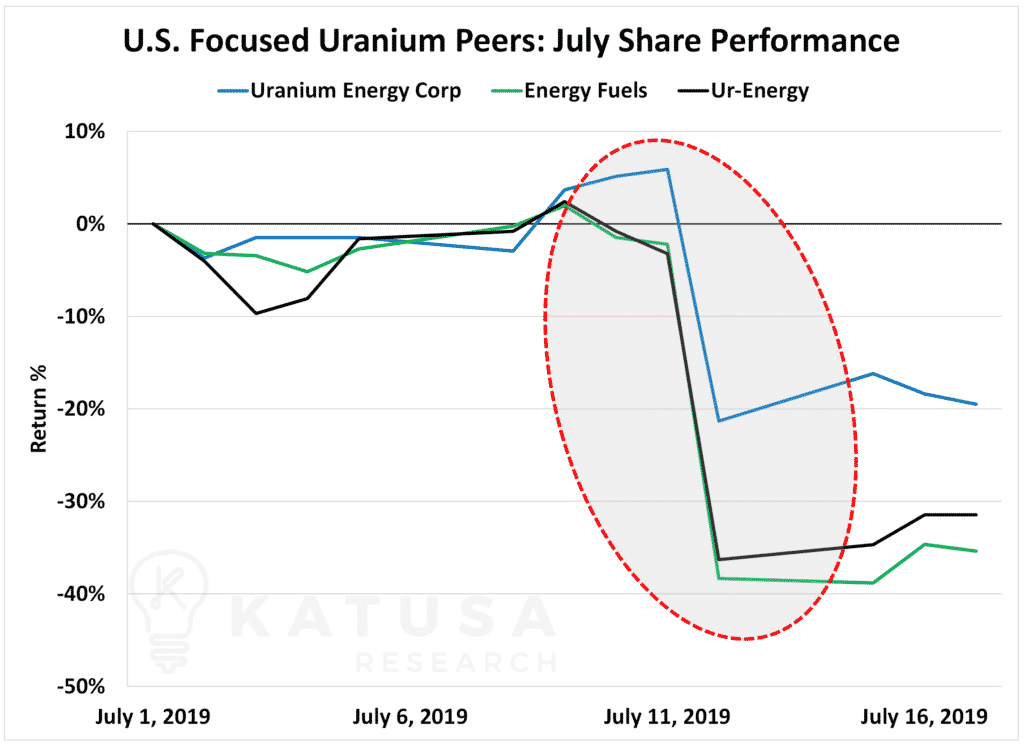

On July 12th, it was Black Friday for uranium companies.

Many uranium stocks had a severe meltdown…

The cause of the midday crash was an information leak from the White House.

It’s a Matter of National Security…

If you’ve paid attention to Donald Trump and his government over the past three years, you’ll notice his top priorities have a common theme…

…Independence and national security.

He doesn’t mind battling China on trade wars. And he’ll even impose steel tariffs on friendly allies like Canada.

The administration is taking a no-holds-barred approach to negotiations.

Next to its military, one could argue that the American energy sector is the nation’s most important sector.

Without it, hospitals aren’t powered, airports don’t work and defense systems are inoperable.

Uranium energy is baseload power. It’s crucial in keeping the lights on. A fifth of all households in the United States are powered by uranium.

And if you weren’t aware, the U.S. imports over 90% of the uranium that it consumes.

Which begs the question…

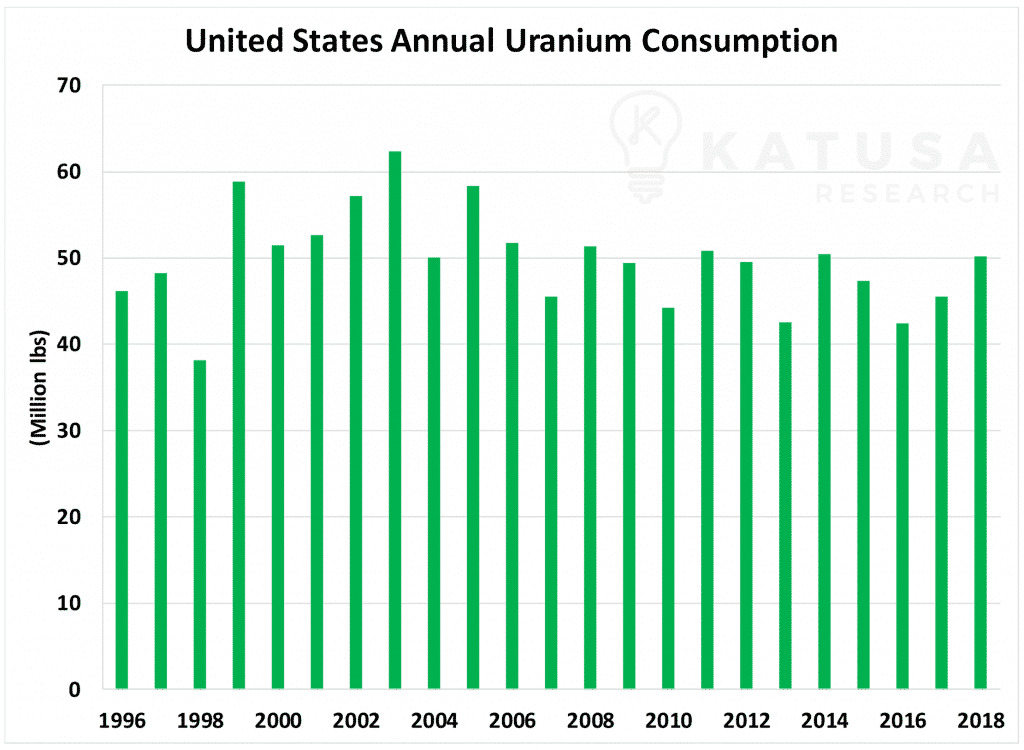

How Much Uranium Does the United States Consume?

The United States has consumed between 40 and 50 million pounds of uranium every year since the mid-90s. Below is a chart that shows annual U.S. uranium consumption.

And this leads us to the next logical question…

…Which is the one that will get a lot of attention from President Trump.

Where Does the United States Get Its Uranium From?

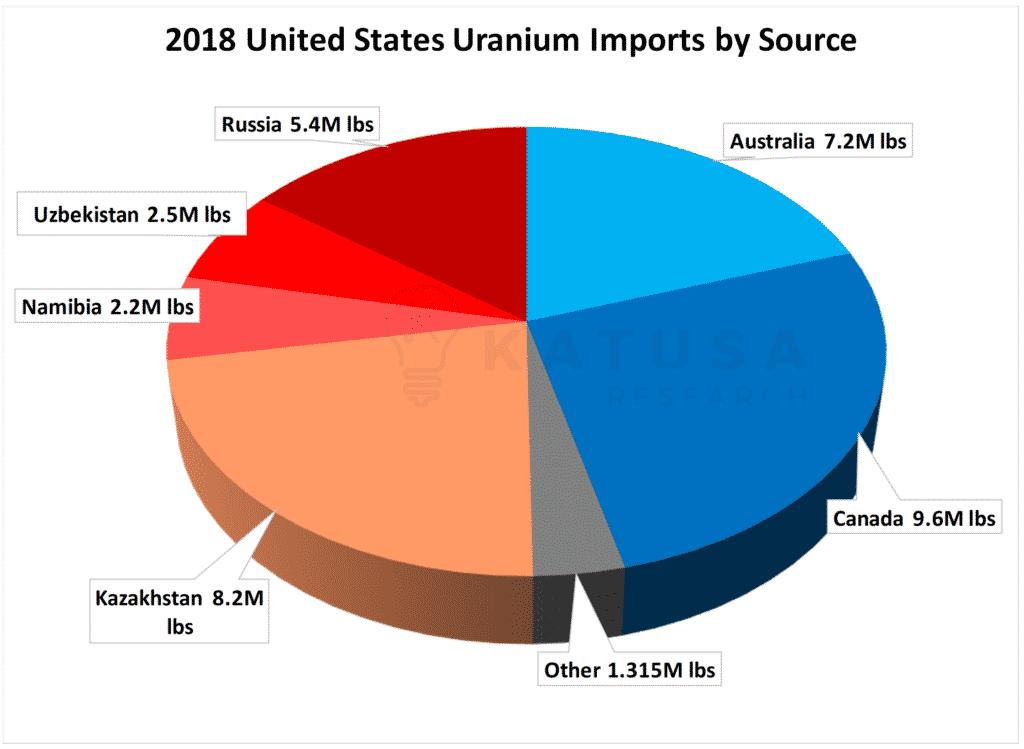

According to the United States Energy Information Association, in 2018 the United States purchased 36 million pounds of uranium from foreign sources.

Over 50% of the uranium imports came from Russia, former Russian states and Russian influenced sources. That’s 18 million pounds.

The other half comes from Canada and Australia. Below is a chart that shows the United States uranium imports by source.

American uranium production has stagnated over the past decade.

Last year, Americans produced less than 2 million pounds of uranium on American soil.

The Uranium Producers of America (UPA) Let America Down

I’ll explain.

But first, I have a simple question for you.

Do you think Russia, China or, for that matter, any major country in the world would allow foreign-controlled corporations to have direct access and input to all the various branches of government on a national strategic item like energy?

Is there a UPR (Uranium Producers of Russia) that allows U.S. producers to have direct access to all the various branches of Russian government?

Of course not.

Well, the UPA, which stands for Uranium Producers of America, did just that. The Russians not only had direct access to the various branches of government in the U.S. but also had input and influence on the outcome.

Not to mention a Russian company sits on the NEI (Nuclear Energy Institute) also.

I believe foreign-state-owned enterprises that were on the UPA – who had an equal voice as the U.S. owned producers – had a different incentive than what was in the best interest of the American industry. Uranium One, which is essentially a Russian government-owned company has a major voice on the UPA. As does Cameco, which basically buys uranium sourced from the former Soviet Union and sells to the U.S. utilities as uranium coming from Canada.

And add in the lobbying by the U.S. utilities, which enjoy the current fractured environment. They do not see the coming Cut to Kill strategy by Kazatomprom that I have written about (more to come at C2KU.com).

I see the UPA losing members. There’s just no point for the association to exist – as seen by the results of the Section 232 investigation, which I’ll explain further below.

The utilities do not believe relying on foreign sources is the definition of a national security issue.

You can see how this has the attention of the White House. Especially when considering half of the countries who export to the United States would be anti-American, if push came to shove.

Reliance on imports is a serious storyline and issue. American uranium companies petitioned the government to conduct an investigation into the matter.

The goal was to convince the White House that such significant import reliance was a matter of national security.

The ultimate win would be if the White House mandated a specific portion of uranium production within the United States (think Trump’s Buy American Strategy).

And that’s how Section 232 came to life in the uranium markets.

What Is a Section 232 Investigation?

The purpose of Section 232 investigation is to determine the effect of imports on national security. This is the angle the American uranium companies played.

The investigation wanted to determine whether the reliance upon importing 93% of uranium demand was a matter of national security.

The issue was raised several months ago. And then the President released his initial remarks and recommendations.

What Does Donald Trump Think About Uranium?

Donald Trump has significant concerns about the impact of uranium imports on national security with respect to domestic mining.

Here’s what President Trump said in his memo released on July 12th:

Although I agree that the Secretary’s findings raise significant concerns regarding the impact of uranium imports on the national security with respect to domestic mining, I find that a fuller analysis of national security considerations with respect to the entire nuclear fuel supply chain is necessary at this time.

For the full memorandum from the White House, click here.

What Is the Impact of Section 232 on Uranium?

The White House is going to establish a working group, which will study the full effect of the entire nuclear fuel supply chain on national security.

I believe I was the only person in the public markets who stated that the final decision would be delayed. That’s exactly what this announcement is.

And I can see it being delayed again, and again, and again.

In a way, Trump’s doing what’s best for Trump. He’s taking the pragmatic approach and not alienating anyone here. Regardless of if the result wasn’t what the uranium producers and speculators wanted to see.

He has thrown out a lifeline to the uranium producers with the working group initiative.

If the government had just slapped a quota on without complete due diligence, it would likely have been repealed by the next administration.

This working group will give both the producers and the utilities a voice in the decision-making process.

Here’s what I think is going to happen…

I expect the utilities to drag their feet on any quota. I believe there will be a major power struggle at the UPA.

I see the smaller U.S. producers within the UPA abandoning the UPA.

Here’s what Energy Fuels, Uranium Energy Corp and Ur-Energy should do…

They should all leave the UPA and create their own AOUPA—American Owned Uranium Producers Association.

The current largest members of the UPA; Cameco is run out of Saskatchewan and Uranium One is run out of Russia.

I also think Energy Fuels, Uranium Energy Corp and UR-Energy should sit down in a room—without bankers—and Mark, Amir and Jeff should work out a plan to merge.

A single American owned uranium producer will have much more leverage with Trump than a UPA where the #1 and #2 uranium producers in the world, neither operated out of the U.S., have control of the mandate.

Who is the biggest benefactor of the current U.S. uranium situation?

Uranium One (a Russian company) and Kazatomprom (Kazakhstan-Former Soviet Union State. And don’t forget, the Russians control 50% of the uranium production in Kazakhstan).

Hence Russia 1 – U.S.A 0.

The Russians are in total control of the price. And they will continue to ‘Cut to Kill’ until they complete their strategy.

Cameco won’t fair well. Especially once Kazatomprom completes their ‘Cut to Kill’ strategy.

Remember, there’s no shortage of uranium.

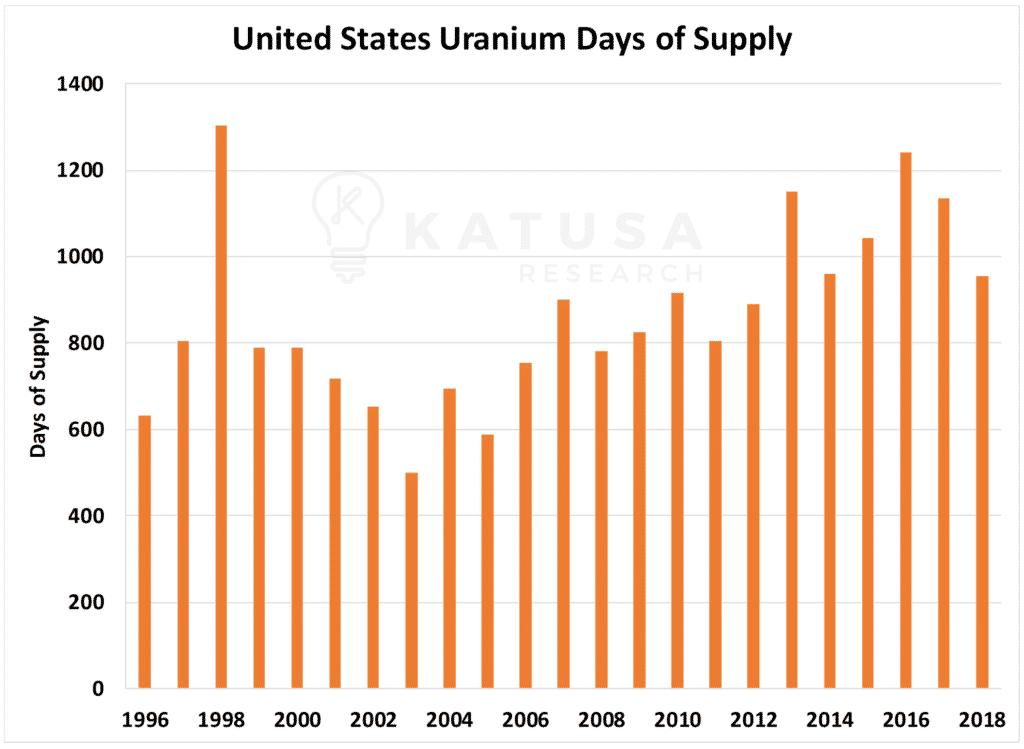

That statement is going to ruffle feathers, but the chart below doesn’t lie.

It’s one that nobody other than Katusa Research produces. It is the days of supply monitor for uranium. It is calculated using U.S. uranium supplier inventory levels and inventory levels at nuclear power reactors along with annual uranium consumption.

The end result of Section 232 will likely be a quota.

I’ve said many times that I don’t think the switch will flip and nuclear reactors will immediately be forced to use 100% American produced uranium.

I think it’s much more likely that we start with a 5% quota that will gradually increase over time.

It gives the utility companies time to rotate their contracts and American producers time to ramp production.

How Is Marin Katusa Speculating in Uranium?

For the last two years, I have publicly stated that the uranium price will stay under pressure.

There’s a lot of speculation regarding the uranium price. I remain conservative and expect prices to remain lower for longer.

When a deal with the American utilities does work out, we’ll eventually see prices rise towards $45 per pound. That may take a couple of years.

If prices go higher, terrific.

My subscribers and I are well-positioned. But we are not banking on prices of $75 per pound or more.

Our big bet on how to play the uranium sector has us sitting at a 50% gain right now. And I’m happy with that. It’s going to go a lot higher because of the current uranium market.

I have no interest in early-stage uranium projects in AK-47 nations.

I get so many negative emails from believers in moose pasture in AK-47 nations. I wish them well, but not with my money.

This is why we bought a uranium “hedge”.

My concept was simple: A royalty company picks up royalties and streams in a depressed market, which will last longer than most expect (including the companies that require capital to advance their assets).

And the company cherry-picks the best uranium assets in the world at historic low uranium prices. Then lets the cure for low prices, low prices, take care of itself. And profits when prices start to rise.

This company will do well in a poor uranium market, and it remains very leveraged to rising uranium prices. It’s the best of both worlds.

Last Words on Uranium…

There are a lot of so-called experts in the uranium market.

Many of them have never been to real processing facilities or met with the best management teams in the world. Nor do they have millions invested into the sector.

I have spent the better part of two decades heavily involved in the sector. If there’s a world-class management team or project, you can bet I’ve met with them and been to the project.

Please be wary of those “gurus” who get paid by shitty companies to promote their stock—yet hide behind podcasts and anonymous blogs talking garble.

Take it from me, this is a very tough and highly speculative market. It means there’s a very high risk, but also a very high reward.

Be prudent with your money. And as July 12th proved, you can stalk your favorite stocks like an alligator and scoop them up for 40-50% off.

Uranium and venture stocks in general, are some of the most volatile stocks on the planet. If you’re prepared for the volatility, you can make a significant amount of money.

But if you’re over-invested, you’ll lose more than just your shirt.

Regards,

Marin Katusa

P.S. For all things uranium, including my current holdings and breaking research on Section 232, consider becoming a subscriber to Katusa’s Resource Opportunities.

You’ll also find the ticker symbol of one of my top silver holdings, which is up 24% in the past 2 months AND you’ll also get the name of one of my top gold holdings that’s up 101% so far this year. This gold junior just announced major drill results on the heels of a major asset sale and the stage is set for this story to explode much higher.