I can already see the hate mail coming in.

But, it’s true. Americans, living in the U.S., shouldn’t buy physical gold right now.

First, let me start by saying that I believe we’re in the early innings of a spectacular gold bull market. And I hold physical gold myself.

But I’m not an American living in the U.S.

And this coming bull market is one where I believe the right gold stocks will do very, very well.

So why shouldn’t Americans rush out and buy physical gold at today’s prices, or over the next 12 months?

Simple…

The U.S. Dollar will continue its newfound strength alongside the price of gold.

Contrary to your recommended YouTube video feed and $1 million ad budgets to buy “America Dollar Crash 2020”, the U.S. Dollar just isn’t going to zero anytime soon.

Well, in the current global environment, that argument is just flat out stupid.

But there is one-way Americans can use their string dollar to outperform physical gold immensely. I’ll get to that later in this missive.

The U.S. Dollar is Still the King of Currencies – Physical Gold is Queen

And I don’t see the USD being knocked off the throne anytime soon. Not by Bitcoin, not by gold and not by silver.

Let me explain.

Physical gold makes sense right now for citizens in most countries except the U.S.

If you live in Canada, Russia, China, Australia, Turkey and many other nations outside of the U.S….

Then yes, buy and store physical gold because your currency will devalue significantly to the U.S. currency. Gold is an easy way to “store” or hedge your wealth from being devalued away.

Remember that gold producers in those countries are selling gold in USD but paying for operations in a cheaper currency. And that means more profit on the bottom line.

I see this trend continuing for the next 12 months.

What About Individuals in Those Countries?

Those same individuals could convert their foreign currencies into U.S. Dollars and do just as well.

I think for the people in countries outside the USA, the correct answer is to own both U.S. Dollars and gold.

U.S. Dollars are way more liquid than gold and the exchange fees are much less (because it’s so liquid in most of the world). So be careful in buying physical gold.

And if you do buy gold, remember to buy government issued gold where you can convert (meaning sell) the gold coins quickly.

If you buy non-government issued gold, you’ll be receiving some serious discounts in addition to the selling commissions.

By now, you’ve probably figured this out…

I Expect Both Physical Gold and the U.S. Dollar to do Well – But Gold Stocks Will Top Them Both

Americans should have exposure to gold through equities of foreign producers of gold. That’s the best way for Americans living in the U.S. to convert their strong U.S. Dollars into undervalued gold stocks and optimize their returns on the best performing gold stocks.

Convert your U.S. Dollars into shares of a mining company that have significant upside at current prices because they’re producing gold in a currency that’s weakening.

The best way for Americans is to leverage their strong dollar and take advantage of significantly discounted producers who are producing in a weak currency.

Here’s a quick example:

If you are producing gold in Brazil today, your cost to operate (after building the mine) is literally 30% cheaper today than 5 years ago. So, what’s the reason?

All because of the depreciated currency in Brazil.

Canadian and Australian gold producers are also benefiting from weak domestic currencies.

What’s Next for Gold?

Gold and gold stocks had a strong run here in 2019 and it’s true that a rising tide lifts all ships.

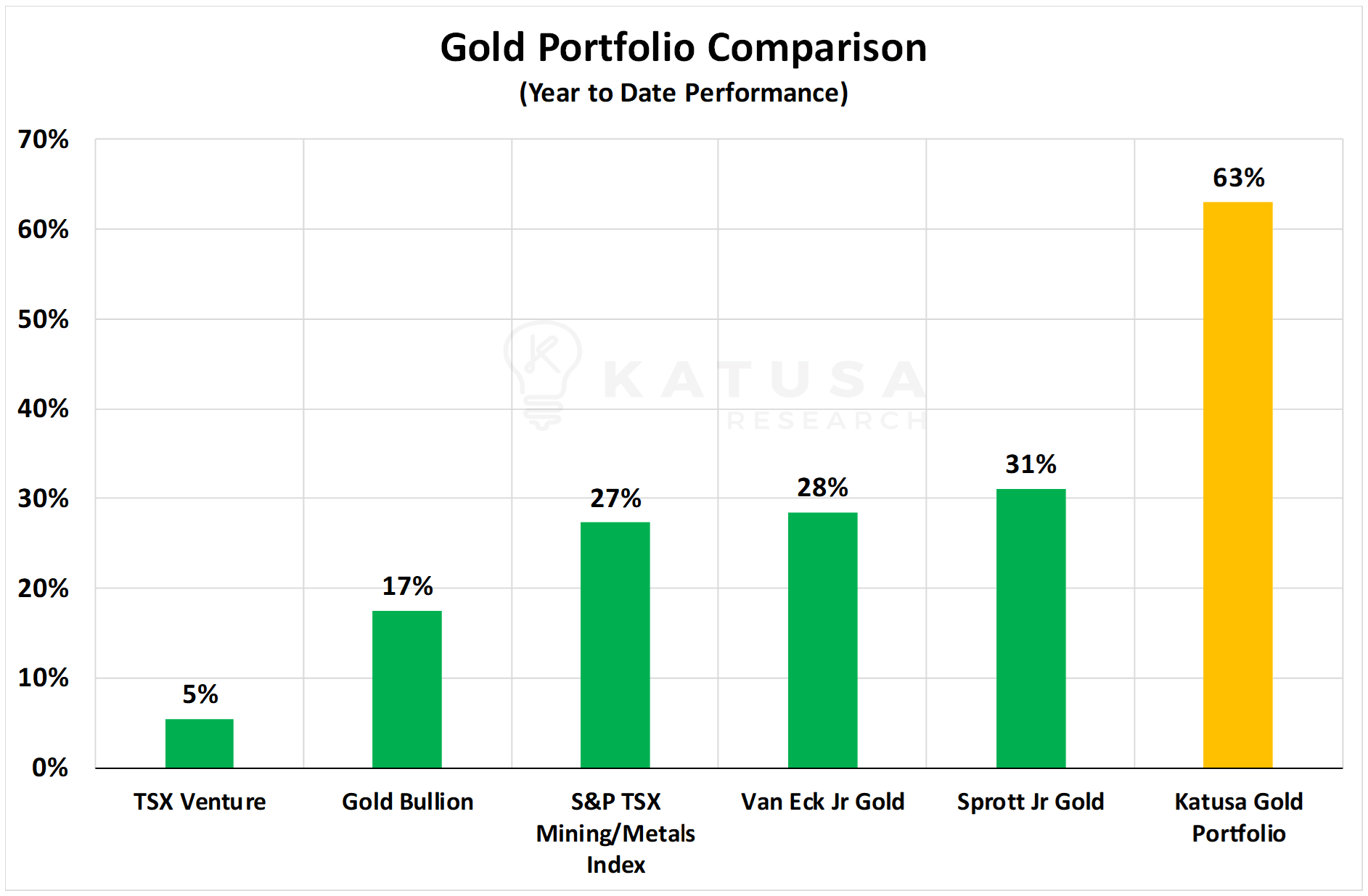

But how are your favorite money managers doing on an apples to apples comparison? Let’s find out…

One of the smartest financiers in the resource sector is Rick Rule who is the head honcho at Sprott. And one of the largest players in the gold sector is Van Eck, who run the junior gold ETF, GDXJ.

In our recent October issue of Katusa’s Resource Opportunities, we stacked all of our gold/silver picks next to the best in class.

And here are the results…

But I do want to congratulate all subscribers and my team for believing in us to be able to deliver results where Katusa Research more than doubled our nearest competitors in the resource sector on returns.

Remember, it never hurts to take a Katusa Free Ride to take profits off the table and let your winners ride with no risk.

We’ve done that with:

- A junior gold/copper explorer that gained 270% in just under 2 months…

- A natural gas company for a quick gain of 171%

And most recently, one of my core gold stock holdings is up a nice 273% YTD and heating up with increasing volume.

So what’s next on my radar? After 2 years of due diligence…

I am just finishing the final pieces of my next Major Gold Take out which I will publish for all my KRO subscribers.

I haven’t bought the stock yet, and KRO subscribers will have 3 business days after publication to buy before I start buying.

This is a gold stock I believe will be bought out by a major—and I plan on making somewhere between 50-150% gains on this low risk bet.

I’m already waiting patiently like an alligator to stack the odds even further in our favor – by investing on pull backs in the gold price, to get shares of my favorite gold stocks even cheaper.

Regards,

Marin