The average citizen’s knowledge of uranium and nuclear power comes from disaster movies or soundbites about accidents like Japan and Chernobyl. Or watching an episode of the Simpsons where Homer screws things up at the Springfield Nuclear Power Plant.

It’s easy to paint nuclear energy as the boogeyman.

The reality is that nuclear energy has provided – and continues to provide – the world with stupendous amounts of clean, safe, emission-free electric power.

Coal, which is also used to generate electricity, has killed far, far more people than uranium.

But the “other yellow metal” is back in the news in a major way. It just staged a massive move to the upside.

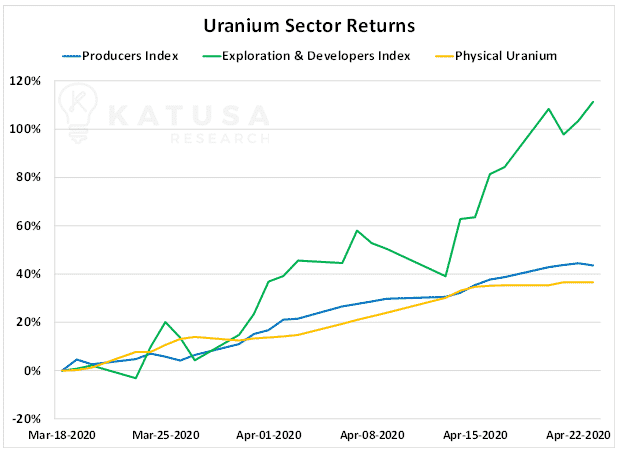

Uranium prices are up over 30% in the past few weeks and the Katusa uranium indexes are up even more. See for yourself below…

When this resource sector moves, it creates much larger returns than gold stocks… much larger returns than oil stocks… much larger returns than just about anything, really.

But uranium stocks are extremely volatile. (If I could underline that 3 times, I would).

And the metal price moves based on government intervention, policies and production.

Let’s Get You Up to Speed on Uranium…

The average citizen also doesn’t know nuclear power’s vital role in the American economy.

- America gets 19.5% of its electricity from nuclear power

- It powers about 23 million homes, or about twice the amount of homes in California

Without nuclear power, the lights would go off for many Americans.

Nuclear energy is responsible for about 10% of global electricity production. If the world wants to cut carbon emissions and keep the lights on, nuclear energy’s share of production must grow.

Nuclear energy provides “base load” power.

Base load power is consistent, dependable power. It’s always there and always on. It is the foundation of a healthy electric power grid.

Base load power contrasts with solar and wind power, which can fail to produce power during the night (in the case of solar) and during periods of calm (in the case of wind).

The energy content of uranium is approximately 3 million times greater than that of fossil fuels.

- To put it in perspective, realize that one tenth of an ounce of uranium contains the equivalent energy of 6,613,868 pounds of coal.

If you’re a country with little fossil fuel resources like South Korea or Japan and you want safe, secure energy to keep your economy running, nothing beats uranium.

Is Uranium Going Prime Time? Not So Fast…

Let me make it very clear (I believe I have for the last four years), that uranium isn’t a supply issue—it’s a demand issue.

Again, there is no shortage of uranium.

On the mine supply side, the central Asian country of Kazakhstan (yes, where Borat is from) is currently responsible for 38% of global mining production.

Canada was a distant second at 22% (but no uranium is mined in Canada currently due to the virus and low prices of uranium) and Australia is a distant third (12%).

A handful of countries produce modest, but meaningful, amounts of uranium.

- Key Takeaway: Kazakhstan production dominates the mined uranium market. (Kazakhstan to the uranium market is what Russia, Saudi Arabia AND the United States would be combined to the oil market)

The Coronavirus has impacted 2020 uranium production. But a bigger question is how will this affect future uranium production?

We are watching potential Kazakh supply chain issues in sulfuric acid and well casings for clues to long-term production issues.

Cameco will need to buy 11 million pounds in the market to meet its sales contracts.

In addition, I believe production out of Kazakhstan in 2020 will be lower than expected, due to the forced shutdowns and maintenance.

This will eat through some of the above ground inventories and could result in utility companies locking in higher long-term contracts in late 2020 or early 2021.

This is all bullish for the price of uranium.

But, I do not see a need to buy early-stage, undeveloped uranium resources in negative swap line nations (-SWAP) which I will detail this major importance in the very near future (keep your eyes on an alert).

In a moment, I’ll discuss why you want to focus on “Made in USA” uranium.

How Much Does It Cost to Produce Uranium?

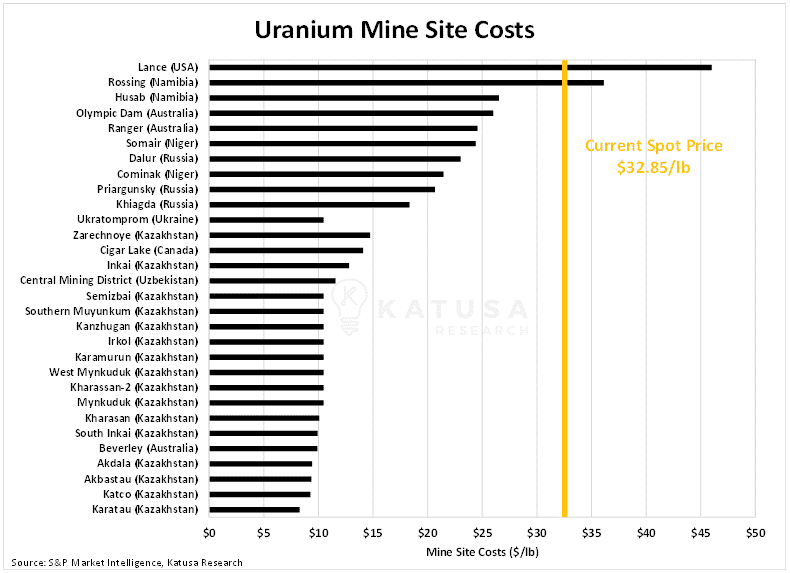

Here are the top 30 producing uranium mines in the world, and their mine site cash costs.

But it’s quite evident from the chart that even if you include a 50%–100% premium on the mine site cash costs, there is a lot of uranium that can be produced below the current spot price.

This brings me back to my rationale behind buying U.S. permitted and built uranium production.

- I believe Trump and his advisors will announce some form of U.S. Department of Energy–mandated “U.S. Uranium” purchase program.

Trump has his hands full right now dealing with the virus, the economy, the oil patch disaster, and a re-election campaign.

Unfortunately for all the uranium bugs, uranium isn’t very high on his priority list.

That said, Trump will do whatever he can to save the oil patch in the U.S.

After that, the U.S. uranium sector will get some assistance with the expected Department of Energy purchase of U.S.-produced uranium at a fixed price between $45–$55 per pound.

I expect this to be announced later this year, sometime around the election.

We’re exposed to a couple well positioned and highly strategic uranium companies in the Katusa’s Resource Opportunities portfolio

Understanding Uranium Demand

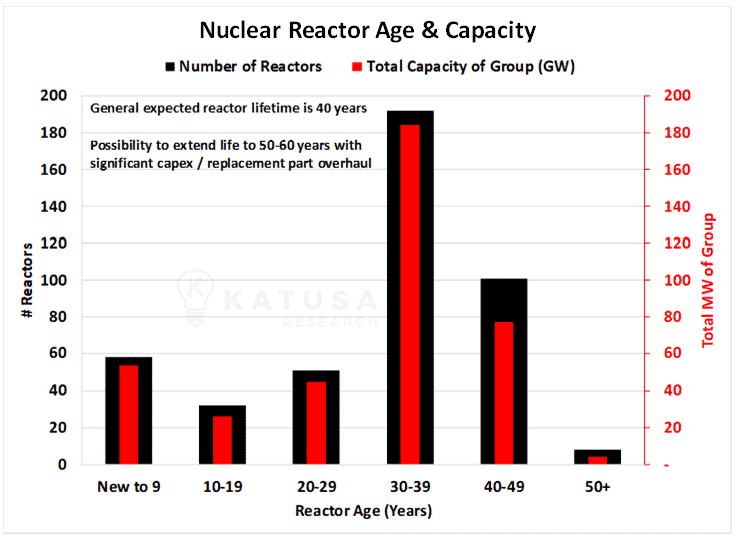

Let’s start with current operating reactors. The chart below shows the age range of operating nuclear power plants.

The developed world’s nuclear reactors are aging. On average, they’ve been in operation for 41 years.

The average nuclear reactor was designed and permitted for only forty years. Most are getting extensions.

- So, we decided to do some “mathamagic,” assuming all reactors currently operating get extended to 50 years before they are shut down.

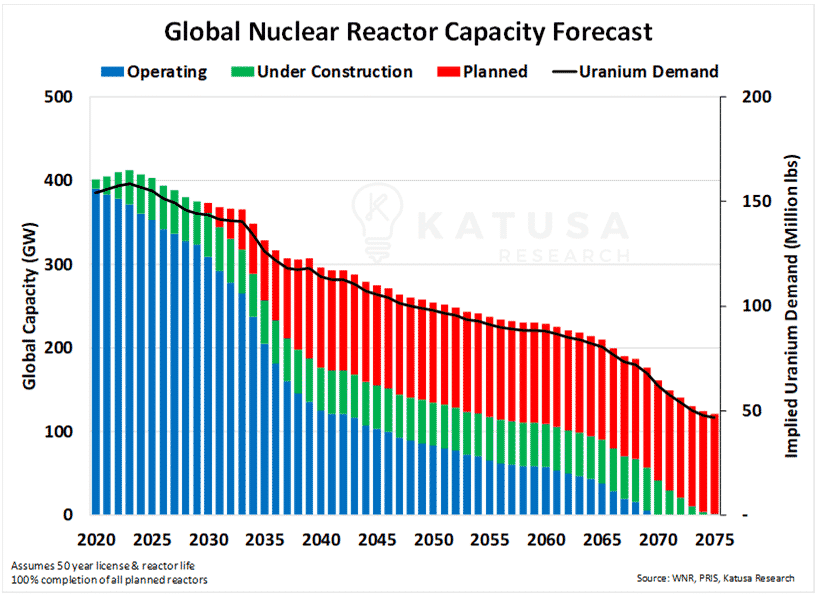

The chart below shows all operating, under construction, and planned nuclear reactors coming online and operating for fifty years before they get shut down.

This is a very optimistic chart as it assumes all “planned” reactors that are not funded or permitted actually get funded and permitted and built.

Unless further reactors are announced, the nuclear energy sector will be using much less uranium in 25 years than it does today.

Green Dream 2.0: Uranium as a Zero-Carbon Solution

Nuclear power does not produce direct carbon emissions like their fossil-fuel counterparts.

For that, it’s getting a lot of attention to be the next big “green fuel”.

Now, if nuclear gets accepted as a zero-carbon solution to the Green Dream, massive government stimulus can change the destiny of the nuclear sector.

Otherwise, the upfront costs of existing technology for generators is too steep for private industry to tackle.

Katusa Takeaways on Uranium

- There will be production cuts in Kazakhstan in 2020. They will probably end up being a bigger reduction than they state on their early May conference call.

- The real risk for uranium production is if significant delays in drilling and completions in Kazakhstan continue for more than 90–120 days. In that case, 2021 production could be significantly reduced. It’s way too early to speculate on that, but it’s something we are paying attention too.

- There is no shortage of uranium—even with Cameco using the virus to keep Cigar Lake offline and all the uranium production reductions. The result will be more of the above-ground stockpiles being consumed, which will help lift the base to the lowest-cost production.

- Don’t get caught speculating in early stage uranium projects in -SWAP line nations thinking the uranium price will get to $75–$90. It’s not going there anytime soon.

- The best place to be positioned for uranium is in the U.S., with permitted, built, and operating production.

The uranium markets are moving fast and we are staking positions in the best companies that will do very well in the next uranium bull cycle.

I have just recorded a uranium webinar with CEO’s of some of the largest uranium producers in the world to peel back the curtain for you on this secretive industry.

These are CEOs of companies who control some of the largest producing uranium assets in the world with production over 10 Million pounds annually.

More to come, very soon.

Regards,

Marin

P.S. While uranium markets are moving fast, gold is surging. But we have a very different take on some major things many companies and newsletters are missing on gold markets. We’ve been working around the clock on an important alert to send out to Katusa’s Investment Insights readers. If you haven’t whitelisted our emails, I strongly suggest you do so before Sunday.