I have one goal for all my subscribers: Personal Freedom via Financial Independence.

I want you to have the ability to enjoy all that life has to offer – travel, family, and adventure. And the only way to do that is to grow your portfolio and become wealthy enough to be free to do as you please through financial independence.

Even though I have achieved my financial goals, I still love coming to the office early and staying late. People always ask me, why? Why do you still work so hard?

Simple. Three reasons:

- I absolutely love what I do;

- I love being the first to break a story;

- By having such a large following, I can structure and negotiate deals that benefit my own portfolio and all of my subscribers at the same time.

A couple of weeks ago, I sent out an alert to paid members of my research service. They were the first people in the world to hear about a ground-breaking new royalty company in the beaten down uranium sector.

I caught all the stock “sleuths” off-guard with my Independence Day Royalties promotion. Not a single one got the stock right. I love messing with the peanut gallery pundits.

Katusa subscribers heard it before investment bankers, brokers, and all other newsletter writers. I invested millions into the company at the same terms as my subscribers. I plan on making it a core holding in my portfolio for exposure to uranium.

Subscribers had the opportunity to buy at the same prices and terms as me and company insiders.

The last time uranium took off, uranium stocks soared 500%, 1,000%, and even 5,000%. The people that made those types of gains (me included) were invested in the metal well before the rocket ride – back when it was hated and a contrarian speculator’s dream bet.

Fast forward to 2018 and the amazing setup in uranium continues. But sometimes you need to question your confirmation bias and go through a detailed counter-argument. This makes sure your convictions (and your money) are bet on the right direction.

No, Katusa has not become a doomsday analyst. I’ll leave that for the newsletter writers at Stansberry Research!

For the record, I’m a long-term uranium bull. And I believe it plays its part in the future of every nation’s diversified energy matrix.

But today, I’m going to dump a truckload of gasoline onto the fire that is one of the most hated investment sectors – uranium.

Since I have so many followers who write short reports, I decided to go about this report in the same way as how the “short report” groups do their work. And I’ll prove that even in the worst case scenario, uranium’s future is bright if you know how to play it.

And I’m painting this bleak picture to show you why I just wrote a 7 figure check for a uranium company.

The Uranium Sector has all the Hallmarks of a Perfect Setup for a Contrarian Investor.

The point of this week’s letter is to paint the uranium sector in as bad a light as possible.

And then if our investment can thrive in that environment and also thrive even more in a great uranium market, then we have a winner on our hands.

Uranium is hated.

It’s cheap.

It’s out of favor.

For the past few years, uranium mines have been shutting down all over the world. This year, Cameco’s Key Lake and McArthur River mines shut down. They are two of the lowest cost, highest grade producing mines in the world.

Cameco even came out on July 25th and extended the McArthur River shut down.

Think about that for a second.

If an operating mine that happens to be one of the highest grade and largest mines in the world cannot break even, then either the price of the commodity is too low, or the world doesn’t need the commodity anymore. The built and operating nuclear reactors negate the latter. So, we can all agree that the price of uranium is too low to produce.

I can visualize Robert Friedland, who is the ultimate resource stock promoter, pause during his talk on stage. He’d tilt his head, look into the crowd while squinting his eyes and calmly whisper into the microphone. He’d make it feel like he’s only giving the talk to you. As if you are extra special. Like some sort of secret wisdom that is passed on from generation to generation of billionaires:

“The share price is going to go so high, that you will need a telescope to see it”

Yeah, not so fast.

Unfortunately, life is never that easy. And speculation is even harder.

So, rather than writing a feel-good piece on uranium and all the reasons it’s cheap and should have a massive price appreciation, I want to try something different.

What if I built a short case for uranium?

And what if you can find a uranium stock that could do well in a bad uranium market (meaning the stock has value creation in a bad market). And what if it even has even more upside in a decent uranium market?

You’d have a massive win on your hands.

That was the task I gave myself 18 months ago. And I think I delivered. Here’s why.

DISCLAIMER: PLEASE READ THIS WHOLE REPORT:

Remember that this is an exercise of creating the equivalent of a “short report” on uranium.

A short report is painting the sector or company in the worst possible light, and it’s the opposite of being optimistic.

I am doing this as an exercise only, to prove something in a realistic light:

That if I can lay out the negative thesis for uranium and find a company that will prosper in the bad environment, then we are on to something big if the company also has big upside during a good uranium market.

Now, let’s nail down all the counterpoints of my uranium thesis to the core.

The Anti-Uranium Argument

I am going to present the worst-case scenario for nuclear energy and what that means for uranium.

I kept the modeling realistic and very conservative. If a potential nuclear power site was questionable in regards to its financings or permits, we assumed the financing would not happen. And also that the plant would not be built. Only the power plants that are operating and currently under construction (and fully financed to completion) were included.

The point of the exercise is to paint the worst possible scenario for the uranium sector, and if we can find an investment opportunity that will thrive in that case—we will do very well.

Why?

I’ve learned in life it never gets as bad as we ever think it will, nor as good as we ever hope it will. The reality is somewhere in between. And if we can do well in the worst case – then we should do quite well in a good case.

I want to walk you through my case study—so invest 5 minutes with me that I believe could be a big winner for you in the coming years.

The Worst-Case Scenario for Uranium

My team and I created a very comprehensive database of every nuclear power plant in the world. It includes:

- How much uranium each plant consumes annually,

- What the economics on each MW (Megawatt) produced is,

- Where in the lifecycle the plant is (how old the plant is and when it will be decommissioned).

The harsh reality of the nuclear sector is that many power plants are too old.

Some may get retrofitted to keep them running a while longer, but most will be shut down. This is mainly because the capital cost to upgrade them is too high for the current rate of electrical power.

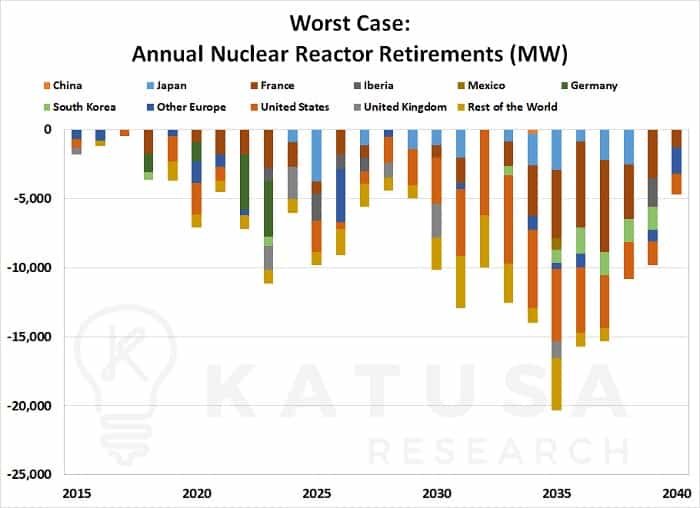

The chart below shows the amount of megawatts that, in a worst-case scenario, will come offline in the nuclear sector by 2040.

This is when you should ask “Marin, what the hell does the MW decrease mean in pounds of uranium per year?”

Good thing I figured you would be asking that question.

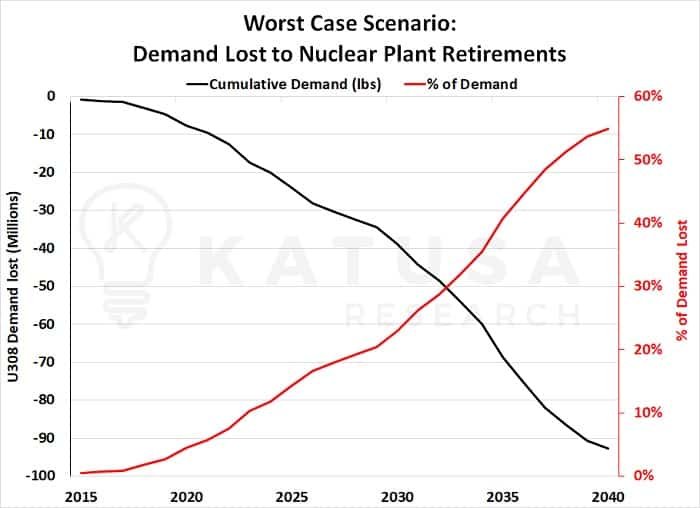

Below is the chart in terms of pounds of uranium demand lost and the impact on global uranium consumption. We used the most aggressive shutdown scenario:

From the graph above you can see that there will be just under 95 million pounds of global uranium demand (almost 60% of the total demand) lost by 2040. Remember, this is in the most negative planned shutdown scenario,

But to be fair, logical, truthful, and balanced, we need to include the “new” demand for uranium, in pounds.

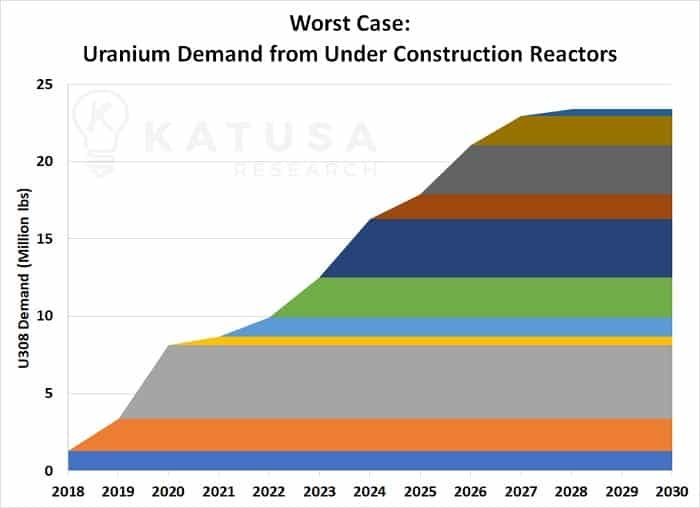

We only included the approved and financed plants, and plants under construction. We didn’t include any plants that have been approved but have no financing in place. In the chart below, you’ll find the “worst case” for new demand.

A little over 20 million pounds of uranium per year will be required to meet the new global reactor demand by 2030. And the beauty of spreadsheets is that we can overlay the global uranium reductions to global demand increases.

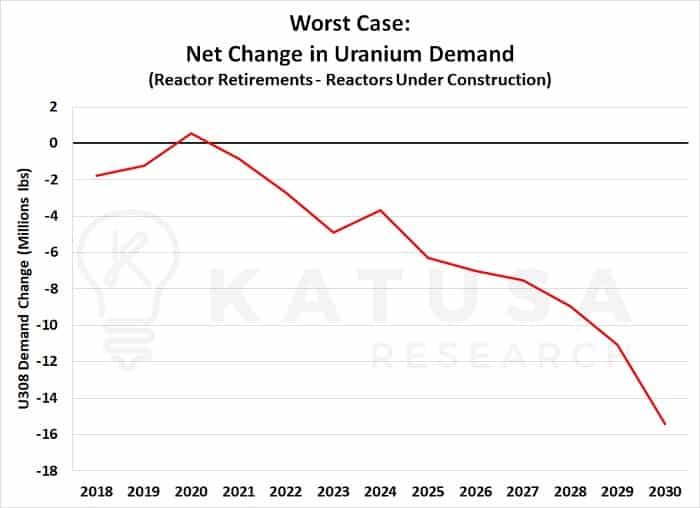

Below you’ll see what you get per year in “net change” uranium demand through a worst-case scenario, up to 2030:

The red line shows the decline of annual uranium required globally.

So, in a worst-case scenario (the most negative scenario I could come up with), there will be a reduction of 16 million pounds of uranium consumed in 2030.

Currently, there are 169 million pounds of uranium (U3O8) consumed globally each year. That means, in a most bearish case, there will be a 9% reduction in the uranium demand in 2030.

Let’s take this framework even further…

If this is the case – you want to be in the lowest cost of production quartile in the world. So, if you need $50/lb uranium to build your project – you’re SOL (Shit Outta Luck).

I can go on and on about how many projects are a complete waste of time (I’ve visited enough uranium projects in my career. The fact is most will never go into production. Remember this when the bull market comes and 200 new uranium explorers are formed.

I get a chuckle seeing a lot of recycled projects that couldn’t fly at $137 uranium. And those projects are now being repackaged as the next greatest thing by a bunch of useless promoters and geologists. But I don’t really care to get into debates with management teams that are either too stupid to know better or are trying to be deceiving.

With Uranium Staying Below $50 Per Pound, How Do We Play Uranium Stocks?

Personally, I’m avoiding any exploration and development stories in Africa.

Why? Let me use a case study from another commodity, copper.

The copper mines of the Democratic Republic of Congo (DRC) have ultra-high copper grades of over 4% copper. However, these mines have roughly the same cost of production as the low grade big open pit Canadian porphyry copper mines with grades which are 10% of those in the DRC.

Yes, you read that right. The 0.4% head grade mines in Canada make as much money as 4% copper mines in the DRC.

Your eyes should pop out right now. I have shared this data with many industry professionals (analysts, bankers and fund managers). And after they go through the data, they are all surprised yet inclined to agree.

Why do the DRC mines make the same money as mines in Canada?

Several reasons: The lack of infrastructure, high electrical costs, high-cost of importing all supplies and maintenance, underground vs. open pit, and higher government takes are all factors that contribute.

Now, would the DRC copper mines be competitive with the Canadian mines if they only had 5x the grade?

Nope.

What if they had the same grade? Not a chance.

The point is, with the way the geology works in most African uranium deposits, the grades are nowhere near the high-grade Athabasca basin uranium projects. Nor do they have the infrastructure in place when compared to equivalent grade projects in the U.S and Australia.

The fact is – the economics required to make most of the undeveloped uranium deposits economic are 3-4 times the current spot price.

I know I will have so many haters argue this point. That’s fine. You go do it. I’ve been there, done the site visits. It was true ten years ago and it will be true ten years from now.

How You Can Make Serious Money by Leveraging an Increasing Uranium Spot Price

If uranium touches previous highs, there is no doubt those African projects will do well with the uranium leverage angle.

Unfortunately, unless you’re a large holding company or utility, you can’t buy and sell uranium in the market without the storage fees crippling your speculation. It is not a tradeable commodity for retail investors like gold, silver, or oil are.

Personally, I’ll stick with the highest grade, lowest quartile cost uranium deposits in politically stable jurisdictions. And I’m adding another investment to the two I already have in my Katusa’s Resource Opportunities portfolio.

In the last major uranium bull market over a decade ago, there were hundreds of uranium companies. And their rocketing share prices were giving speculators astronomical returns.

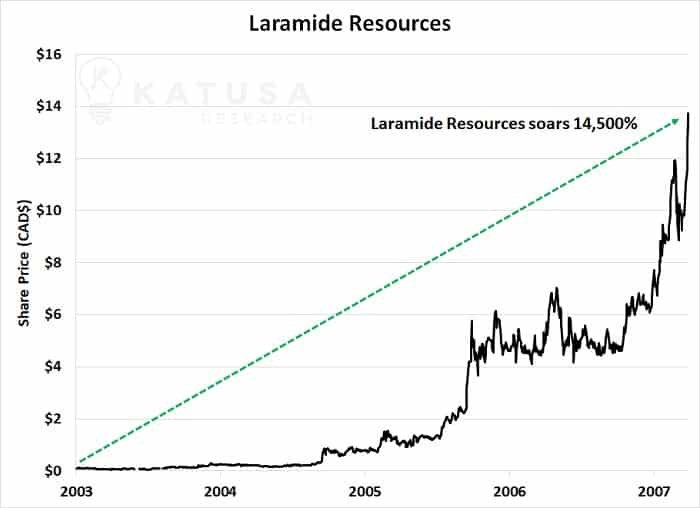

Like Laramide Resources, which soared over 14,000%.

There was also Denison Mines, which soared 5,000%.

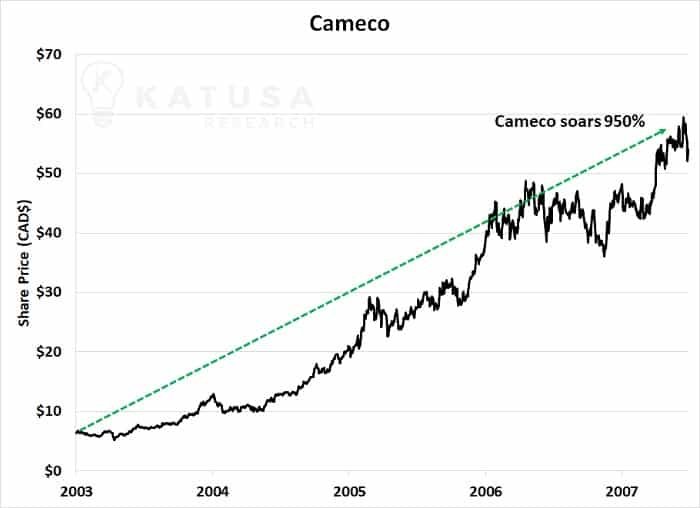

Even the “Exxon Mobil” of the uranium sector, Cameco, soared 950%.

Could we see returns like this happen again? In a word, yes.

But just because I think my thesis is right, doesn’t mean a uranium bull market will happen today. The momentum has started to build—and 2019 will be the most interesting year for uranium since Fukushima. If you’re an alligator and you’re patient, you will position yourself very well.

We might be early, but prepare your speculative portfolio accordingly and the returns just might move your needle like they did for me in the last uranium bull.

Regards,

Marin

P.S. If you want to be first in line to get all the details about the most exciting IPO to hit the mining world in over a decade, then you will want to get all the details from our uranium special report. To sign up and get the report immediately, click right here. Katusa Research was the first to the story and beat the big fund managers at their own game. Winning, it’s what we do. Personal Freedom through Financial Independence.