I’ve had people from all walks of life ask me questions on this sector in the last 2 months.

And the number of questions, along with the number of people asking them, is astounding.

“Have you bought Bitcoin, Ethereum, Doge, Cardano…?”

These are people fixing my hot water tank, that work as elementary school teachers… some I haven’t even talked to in years.

Even the barista in the coffee shop below the office is talking cryptocurrency.

And that’s never a good sign.

Is Crypto Mainstream Now?

On the topic of going mainstream, crypto is well on its way.

You’d be hard-pressed to find someone under 60 that doesn’t know about it now.

But would you go long the digital Chinese yuan?

China’s digital currency is controlled by its central bank. It will give the Communist Party even more tools to monitor both its economy and its citizens.

- It also removes one of the key selling points of cryptocurrencies, which is anonymity.

Beijing is positioning the digital yuan for international use and it’ll be untethered from the global financial system. It’s a bold maneuver by the Chinese as the nation’s thirst for global power continues.

Meanwhile, in North America, the walls are being broken down for crypto more slowly.

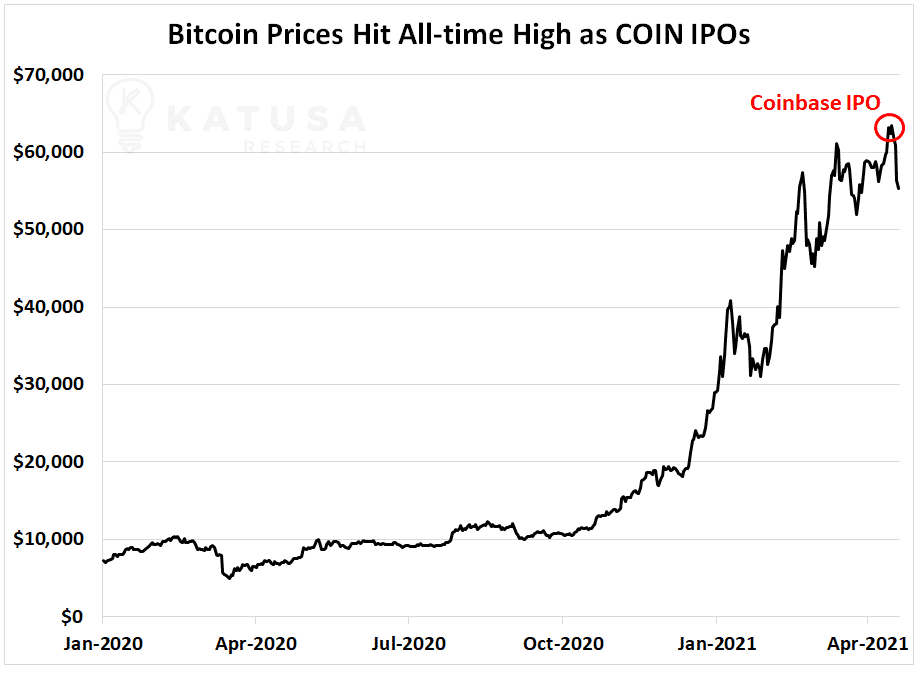

Coinbase, one of the world’s largest cryptocurrency businesses, went public last week trading at a valuation of $100 billion. Is it just a coincidence that record highs came just as the company went public? Look at this chart very carefully – is it a coincidence that BTC reached its ATH (all-time high) just as Coinbase was going public?

Bueller?

Bueller?

“Ah, he’s sick.” LOL

I’m no crypto hater. In fact, as I disclosed publicly in early 2017, I invested a lot of money into a close friend’s fund that invests directly into various cryptos.

I made that decision because I wanted exposure but didn’t have the bandwidth to put any time into the sector myself. So, I found the best to manage my exposure to the crypto market.

If you must ask for numbers or receipts, it’s well above 7 digits. And it’s an allocation I’ve set aside for 10 years. Does that make me a HODL’er? No, I’m an alligator investor—that’s all.

If people want to invest in a store of value that can either appreciate or fall by 5-10% a day, that’s their call.

Call me old-fashioned, but I like to be able to see and physically hold my stores of value. Apparently, so do China and Turkey.

Because China just approved a MAJOR amount for import to the country.

- China is importing 5.2 million ounces of gold ($8 billion worth) over the next 2 months.

And in -SWAP Line news…

Turkey is doing it the old-fashioned way and importing gold from its citizens.

Just earlier this week, Turkish President Tayyip Erdogan told Turkish citizens to convert foreign currency and gold holdings into Lira.

You want what the government wants—real money!

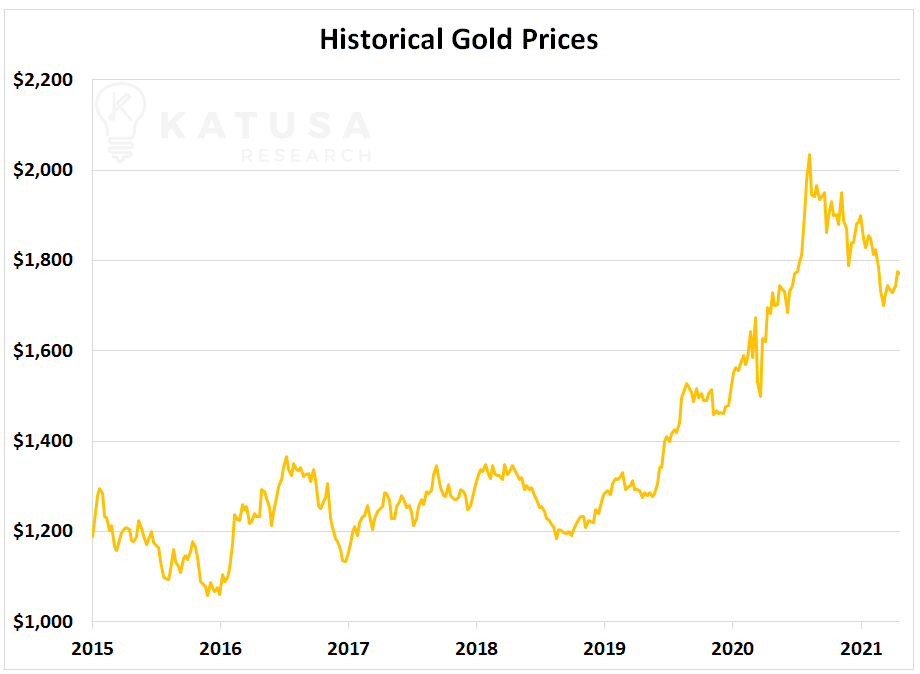

Given the unrest around the world these days, it should come as no surprise that gold and silver prices remain elevated even in the face of rising bond yields.

- At current prices of $1,770 per ounce, high-quality gold producers are free cash flow machines.

- But they’re trading at historic lows—which make my Alligator senses tingle… and it’s time to get ready.

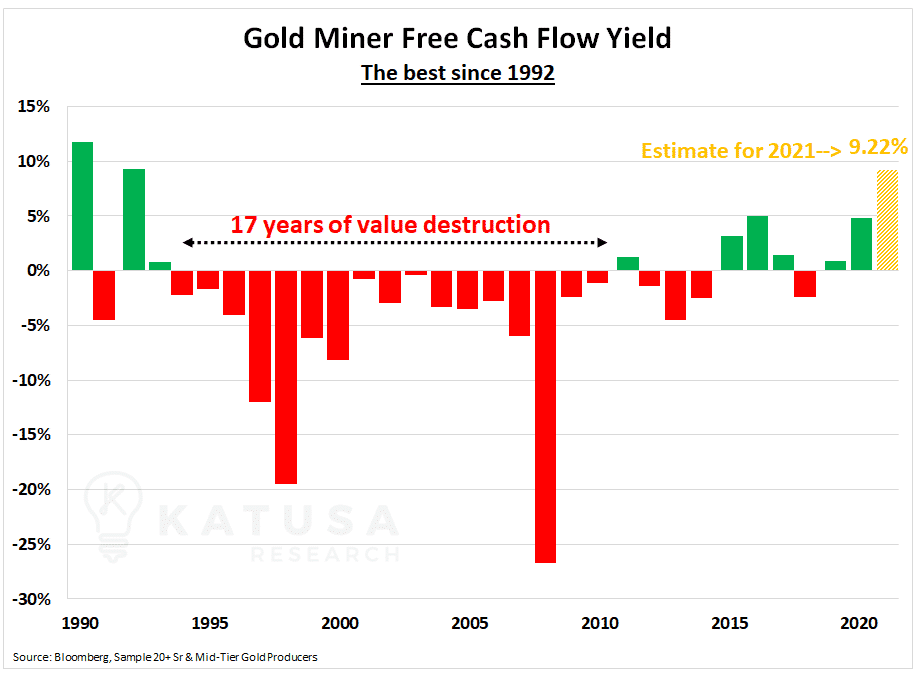

Free cash flow yield is the ratio of Free Cash Flow to Market Capitalization.

The higher the ratio, the better.

And as you can see in the next chart with the bar at the very right, central banks aren’t the only ones printing money hand over fist…

As you can see…

- 2021 is set to be one of the best years for gold producers in the last 2 decades.

It’s why I remain long and strong the best gold developers and producers.

Recently I bought millions of dollars worth of my favorite gold stock. So did my very close friend who recently did a full interview for my KRO subscribers. Our subscribers were able to get in at the same time and price.

It’s one thing being close to a smart billionaire in the precious metals sector, that you make a lot of money with for both yourself and for your subscribers. But when that billionaire is a true gentleman and a nice guy, it makes the experience even more precious—no pun intended.

Not to mention…

My favorite way to play the electric vehicle boom is inching closer towards our buy under price.

Subscribers know exactly which companies I’m targeting and what prices I’m willing to buy at.

- If you’re looking for an edge in this crazy market, consider learning about my premium research service, Katusa’s Resource Opportunities.

Copper Prices Soar – Pay Attention to Why

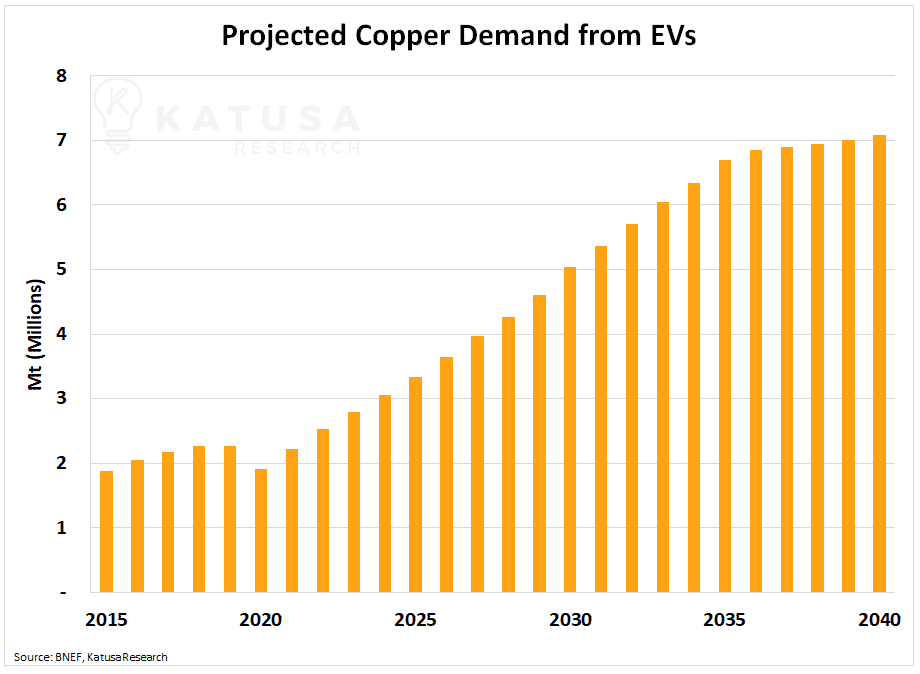

On the subject of the electric vehicle (EV) boom, there’s yet another commodity besides gold that’s also set for a historic run.

It would be remiss of me not to mention Doctor Copper, the base metal that’s long been known to keep its finger on the pulse of the global economy.

As the world electrifies, it’s going to need more copper. It’s that simple, but nobody will be getting it for $3 per pound.

It was a controversial idea I put forth a few years ago…

To incentivize new mine supply, copper prices needed to rise.

I highlighted the growing adoption of electric vehicles and the requirements of the green energy sector as potential catalysts for the copper industry.

All-in, growth well above 2-3% a year was feasible if electric vehicles took off.

Below is a chart which shows projected demand for copper coming from EVs. Within the decade, copper demand from EVs will represent an incremental 30% increase in global copper consumption.

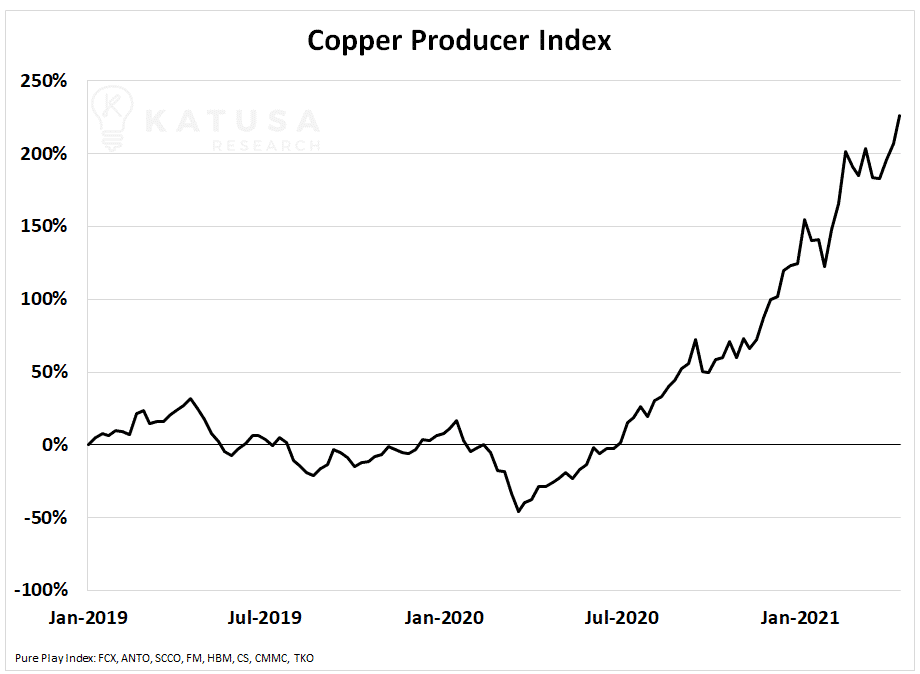

Today, copper is $4.25 per pound, up well over 30% since I wrote that article in late 2017.

Many producers have doubled or tripled since then as well, as copper demand growth became “priced in”.

But copper isn’t the only metal that’s getting a lot of attention due to the green energy and EV booms…

A New Lithium Giant is Emerging

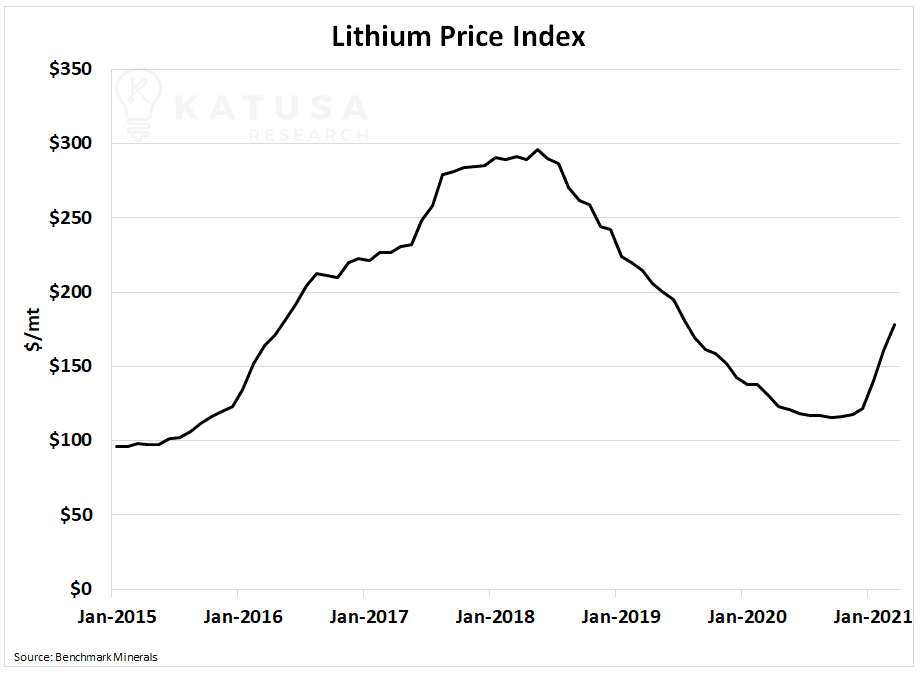

A $3.1 billion merger between two Australian miners is set to create one of the largest lithium producers in the world.

The deal between Orocobre and Galaxy Resources sent share prices of both miners to 3-year highs. The deal comes as lithium prices have begun to pop again, and they’re up 25% year to date.

An epic transition away from dirty electric power to clean electric power is coming.

And the seeds have been planted for an epic bull market in commodities over the next decade.

These are two major themes that we’re focusing on in my premium research service.

And when one industry is on its way out the door, there will be a surge in new industries taking its place…

But the best part?

We’re going to make a boatload of money being fashionably early in a couple of coming bull markets…

To see the sectors that I’m watching and companies I’m buying, click here to learn more about my premium research with Katusa’s Resource Opportunities.

Subscribers just saw two stocks in our portfolio jump to new multi-year highs.

Money is moving and rotating sectors.

Are you preparing your portfolio for what’s coming?

Regards,

Marin