I believe I speak for most people when I say the world wants peace in the Middle East.

With the continued power struggle between Israel and the surrounding Muslim countries and the inter-Muslim battle between Sunnis and Shias, it’s hard to be optimistic.

I have travelled throughout the Middle East and it’s a beautiful place with beautiful people.

It is unfortunate that the region remains unstable, for the obvious best interests of humanity, but also as a speculator because there are great investment opportunities in the Middle East.

When I visited Iraq and Kurdistan, I saw firsthand how much oil there is in the ground. In one region the oil was oozing onto the surface and collecting into naturally occurring oil seeps.

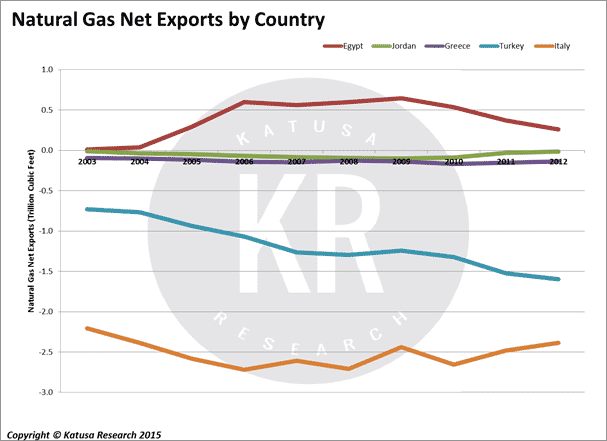

Oil is abundant in the Middle East, yet to power these countries takes more than just oil. Combined, the Middle East countries import over 1 trillion cubic feet (Tcf) of natural gas every year. The only Middle East gas exporters to date are Iran, a Shia-run country, and Qatar, a Sunni-run country.

Israel in the “Middle” of the Middle East

All we need now is for Israel to start exporting gas and then we will have a religious power struggle playing out in the gas market in real time.

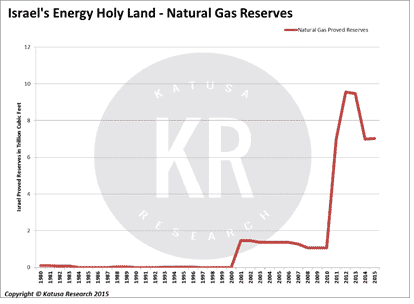

In 2010, the discovery of the Tamar natural gas field offshore in the Mediterranean Sea, and subsequent larger natural gas deposit called Leviathan, combined to change Israel’s energy destiny. These discoveries resulted in recoverable natural gas resources of 35 Tcf and proved reserves of 7 Tcf. These are world class deposits.

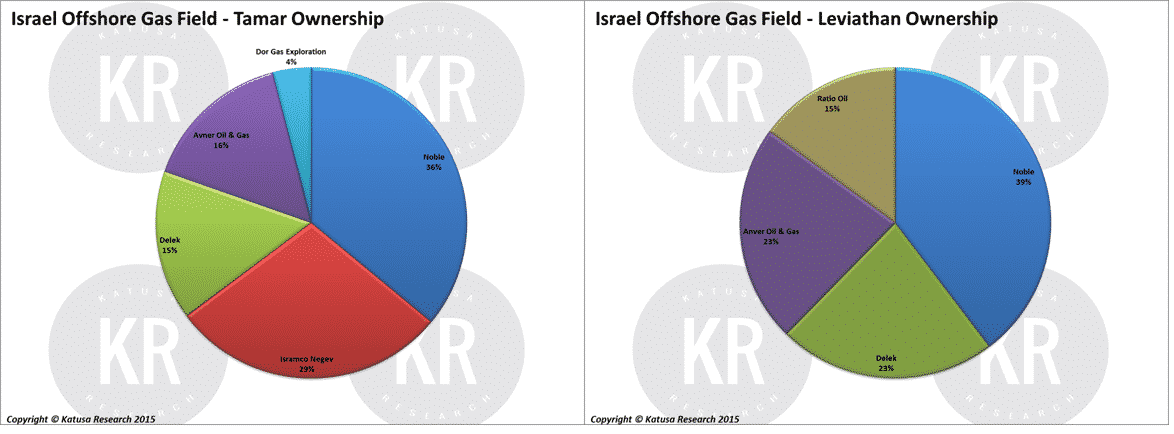

Don’t hastily assume that because of this discovery Israel will become the next energy powerhouse in the Middle East. The gas discovery off Israel’s coast really belongs to the US; in particular, a Texas based natural gas producer called Noble Energy (NBL). Tamar and Leviathan are Noble Energy’s largest gas finds. How significant? Let’s put it this way, it’s enough to for the Israeli government to try to pressure Noble to sell stakes in both fields.

Israel-US Conflict: Noble Energy

On December 23, 2014 Israel’s Antitrust Authority, David Gilo, decided to test the waters to see how much control of the two fields it could get back. Gilo informed the two largest owners of Tamar and Leviathan, Noble Energy and Delek Group, of the government’s plans to try to force a sale of part of their positions. The move was to ensure competition in Israel’s gas market; additionally, Israel did not want its energy security in the hands of outside interests.

The US foreign policy geopolitical interests saw Noble’s ownership of Tamar and Leviathan as stabilizing to Israel’s surrounding Muslim neighbours. The Muslims did not take the Israeli stance on Palestine lightly, but Egypt, Jordan, and Turkey, were in dire need of stable and secure natural gas supplies.

The President Obama’s foreign policy advisors saw this as an opportunity to ease tensions between Sunni Muslims and Israel. (Well…a President can dream, can’t he?)

Public opinion about the Middle East correctly assumes that an Israeli Jew and Sunni Muslim would never agree on terms for such a large deal. Which is why Noble was so important. A private company, not affiliated with either side, would be the perfect proxy for Muslim governments to accept Israeli gas with public backing.

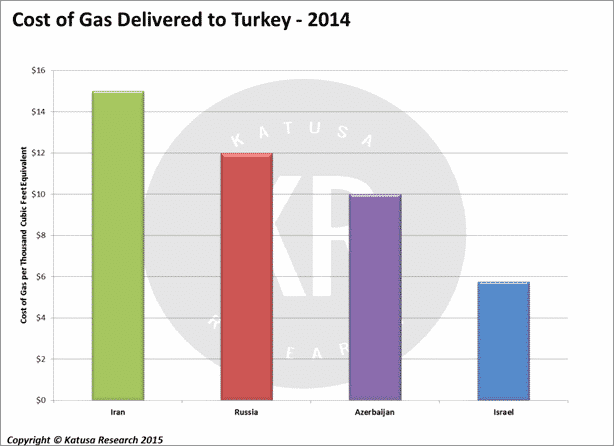

With countries like Turkey paying hand over fist for gas (paying prices +400% higher than what natural gas sells for in the US), Israeli gas imports make economic sense.

Noble suspended any further work on Tamar and Leviathan and was not willing to negotiate its position with the Israeli government.

Noble Gets What Noble Wants

Noble wanted Leviathan–as mentioned earlier, it’s a world class gas deposit—and it continued to reject Israeli proposals to split its positions in both fields. Noble’s hard line stuck, and when the new Israeli government was formed this past year, they softened their position.

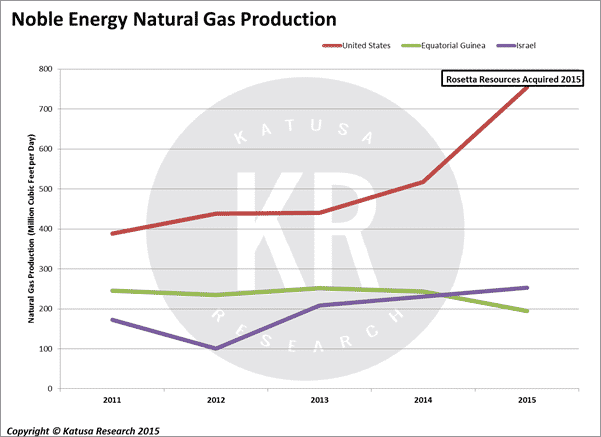

Noble’s final move to cement its position as the ultimate entity controlling Israel’s gas market was to buy a Texas based oil & gas producer, Rosetta Resources (ROSE), for $3.7 billion on May 11, 2015.

What was the purpose of buying Rosetta Resources?

Rosetta Resources does not have the best acreage in the Permian Basin and Eagle Ford, so it wasn’t just for their shale assets. (In fact, David Einhorn would have had a much more credible presentation using Rosetta as his example, rather than Pioneer, during his “Motherfracker” presentation.)

Noble’s acquisition will not be the catalyst for US shale consolidation; it was merely a check-mate to the Israeli government.

The diversification of Noble’s assets and production caused Israel to worry about the future development of Leviathan, should Noble decide to just sit on its Middle Eastern positions and turn its attention to its new Texas assets.

So the Israeli government basically conceded to Noble’s demands, allowing the company to keep its Leviathan stake, keep most of its Tamar stake (25%), jointly sell Leviathan and Tamar gas (avoiding competition), and allow more gas exports.

Prime Minister Benjamin Netanyahu and the new Israeli government’s deal with Noble Energy has forced the Antitrust Authority, David Gilo, to resign, due to his opposition to the new deal. Mr. Gilo stated, “The government, especially the Prime Minister’s Office and the finance and energy ministries, will do everything they can to promote the outline that is being drafted for the natural gas market, an outline I am convinced will not bring competition in this important market.”

Israeli Gas and Noble Energy: Making Peace in the Middle East

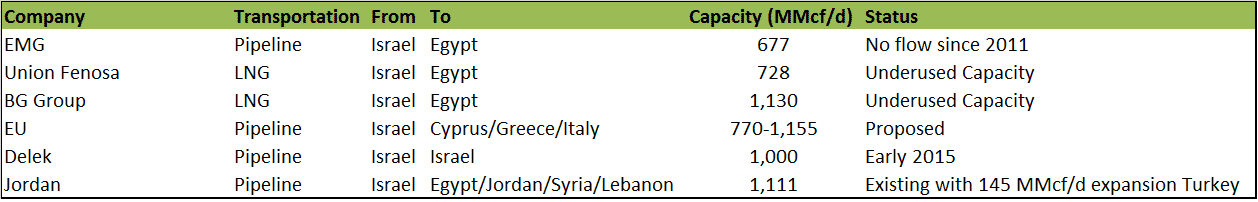

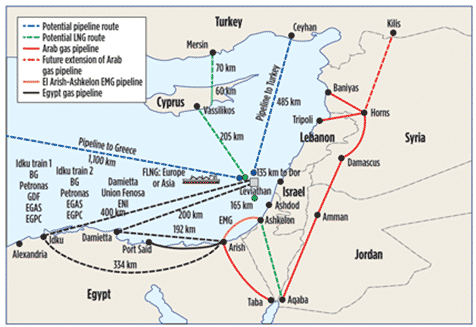

Both Noble and the Israeli Delek Group have signed export deals with Jordan, Egypt, and Palestine to export gas for power usage and LNG exports. Currently, there are several existing midstream projects that will fill the upcoming export capacity to Egypt and Jordan.

As production doubles from Tamar to 2 Bcf/d, and Leviathan commences 1.6 Bcf/d of production in 2017, there are more planned projects that would deliver gas to Syria, Lebanon, Cyprus, Italy, and Turkey.

So far, the largest gas importers of Israeli natural gas will be the LNG facilities in Idku, Egypt, controlled by Britain’s BG Group, and in Damietta, controlled by Spain’s Union Fenosa, with estimated imports equivalent to over 1 Bcf/d beginning in late 2017.

Israel’s relaxed export restrictions to countries like Jordan bode well for the accelerated development of Leviathan. Noble has always stated that Israeli demand was too small to warrant the development of Leviathan; now that export restrictions have been relaxed, Noble can securely develop Leviathan.

The upcoming deal reached by Noble and the Israeli government is a cornerstone to cooling hostility between Israel and Sunni-Muslim countries. Although terrorist organizations such as Hamas and Hezbollah aren’t thrilled about the new Israeli-Sunni gas alliance the fact is, the Sunni-Muslim leaders of Egypt and Jordan are on board with the deal.

Egypt has benefited the most from a secure gas supply and is seeing its economy and energy industry pick up. Companies like Apache, Eni SPA, BG Group, and Transglobe have noted the government’s return to stability as Egypt continues to pay down debts owed to these companies at a record pace.

Katusa Research keeps a close eye on potential energy investments in the Middle East. Right now, we see Noble as fairly valued. We have analyzed the metrics of investing in Egypt through Apache and Transglobe but currently have not made an investment in either company.

Geopolitical risk is a crucial assessment in our analysis, and we’re encouraged to see things improving on the Sunni-Muslim/Jewish front. We may not be at a kumbaya moment yet, but Noble Energy and the development of Tamar and Leviathan could turn once-strident rivals into silent allies in the Middle East.