You never see it on the front page of the Wall Street Journal… and it’s not covered in MBA courses…

But I believe “balance” is one of the most important business and investment concepts anyone can possibly learn. In fact, I can make a good case that balance is the most important personal quality you must have to achieve long-term investment success.

If you don’t have balance, you have no business running your own money… or anyone else’s.

When I say “balance,” I’m not talking about the ability to stand on one foot and juggle. I’m talking about balance of the mind. The ability to walk the tightropes that run between opposing sides of the human brain.

For example, we know humility and objectivity are characteristics of truly smart people. The man who thinks he knows everything knows nothing. However, to succeed in business and the stock market, you must have the courage to act… the courage that comes from self-confidence.

If you don’t have self-confidence, it’s very hard to succeed in the market. But taken too far, healthy and productive self-confidence can become dangerous and destructive hubris.

Balance is also an issue when it comes to the strategies and tactics we use. One of the surest paths to success is to do more of what’s working and less of what’s not working. Say you own a dress shop. If blue dresses are selling well and red dresses are not selling well, order more blue dresses and less red dresses. Doing more of what’s working is something that has created great wealth for centuries.

Yet, taken too far, “doing more of what’s working” can easily get you stuck and make you vulnerable. It can prevent you from looking around, staying intellectually curious, growing, and taking calculated risks on new ideas. In the 1990s, the iconic photography company Kodak insisted on doing more of what’s working – selling old fashioned camera film – and dismissed digital photography. Kodak’s decision to stick with the tried and true led it straight to bankruptcy.

I strive for balance in my analysis process as well. When I analyze an industry or a company, I’m fanatical about studying every detail I can get my hands on. However, I also believe mastering any subject or skill almost always comes down to understanding just three or four critical ideas. The rest is usually unimportant noise. If you spend too much time on small details, you can overthink yourself right into failure or inaction.

And how about patience vs. demanding results?

Patience is a great virtue. Men like super-investor Warren Buffett have shown us how patience can help us compound wealth for decades. Businesses are like children. It takes them time to grow and succeed. On the other hand, some investments flat out don’t work. Patience can turn into denial and cost you a lot of money. If you stay in a loser for too long, it costs you both financial capital and mental capital. We must be patient and impatient at the same time.

Humility Vs. Supreme self-confidence… Using proven formulas for success Vs. Being open to new ideas… Thorough analysis Vs. Focusing on the few, critically-important ideas… Patience Vs. Tossing dead weight overboard.

It’s tough to stay on top of these tightropes every single day. I certainly can’t manage to do it all. I’ve never met anyone that can. But I try very hard to do it. I hope you do as well.

If this all sounds like I’m lying on a couch in a psychiatrist’s office, don’t worry. I haven’t lost my mind. But I have been thinking an enormous amount about balance over the past year. I’ve certainly had some positions that have tested my balance more so than any time in my entire career. But as you may know, my patience with one position paid off massively recently… and I believe we will see more massive payoffs soon.

Confession Time: My Biggest Test and Biggest Investment

Of the hundreds of investments I’ve made over the past 15 years, none of them have tested my balance and caused me stress like Alterra Power.

As regular readers know, I’m very bullish on green energy. It’s one of the biggest investment opportunities of our lifetimes. And Alterra has been my number one way to invest in green energy for a long time. The company was one of the cornerstones of the launch of Katusa Research.

However, Alterra wasn’t always my top idea.

In September 2009, I moderated a green energy panel at a large investment conference. Barack Obama was in his first year, subsidies were flying to green companies, and the green companies were much like the crypto companies or marijuana stocks of today. Joining me on stage were top investment minds Rick Rule, Ross Beaty, Doug Casey, Bob Bishop, and Lukas Lundin.

The panel was very bullish on geothermal energy. I was the only bear on the sector. I believed it had potential but was overpriced. I said the companies being discussed on stage were “priced to perfection.”

Avoiding geothermal was the right call. Over the next 36 months, the share prices of geothermal companies such as Ram Power, Magma Energy, and many others went down as much as 80%. Many went bankrupt.

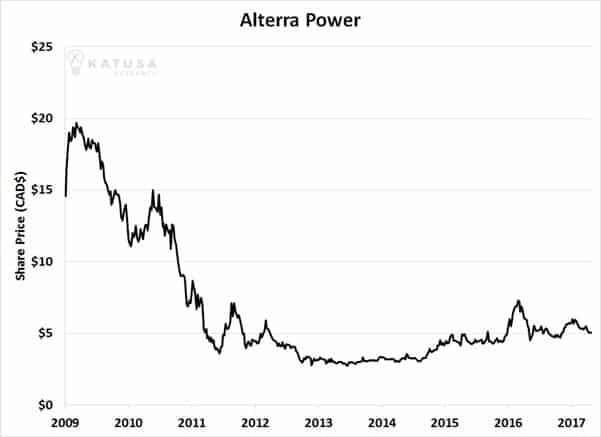

In late 2014, I got very interested in Alterra Power because the company was in great shape, had very high-quality assets, and its share price had plummeted from CAD$15 on IPO day to a low of CAD$2.65 per share. You can see Alterra’s bear market in the chart below.

I began buying large amounts of Alterra stock. I believed I’d make multiples on my money within three to five years. I put my neck on the line and told people Alterra was an extraordinary opportunity. In the summer of 2015, I was quoted in Canada’s largest newspaper about my largest energy position, Alterra Power, and how it was so undervalued.

And then, my patience, my strategy, my ego, my confidence, my determination, and my testicular fortitude – everything I use in my investment career – were called into question. I wanted the world to see what I saw in Alterra. But it doesn’t always go like that.

Two and a half years later, Alterra stock hadn’t done much. During this time, family members, business associates, and subscribers have started thinking and asking, “Marin, did you get this one wrong buy you’re too stubborn to admit it?”

But, here is where the confidence, testicular fortitude, and psychology comes in. Whether you like my style or not, few will argue with my analytical ability. But, after you sing the same song for so long, people start questioning your skills. They say you’re the boy who cried wolf, or in this case “Alterra.”

After all the frustration and questions, I started questioning myself… “Did I get this one wrong?” I checked and rechecked my numbers. I went through large Excel files cell by cell, looking for mistakes. I rebuilt my financial models over and over again. I kept coming to the same conclusion: Alterra is the world’s cheapest high-quality green power producer.

I have found myself explaining my GBOE theory (Green Barrel of Oil Equivalent) that I invented to executives and directors of large oil producers trying to get their firms interested in buying the best low-cost green power producers (Alterra Power). The goal would be for them to become carbon net neutral, which I believe will be the trend in the years ahead for large carbon producing oil and gas companies, such as those in the Canadian Oil sands or LNG companies.

Every time Alterra shares broke out to new highs and seemed like they would prove me right, they pulled back. I kept buying on those pullbacks. And I’ll be frank with you: My position size in Alterra exceeded the normal limits I place on myself. That’s because I believed in this position so strongly.

Recently, the large green power producer Innergex Renewable Energy announced it was buying Alterra for CAD$8.25, roughly a 63% premium over the share price at the time of announcement… And a 50% premium over this publication’s entry price in mid-2016.

It is ironic that the November issue of Katusa’s Resource Opportunities was going to be about the culmination of effort in Alterra Power. I had put together a highly detailed 7-page report outlining both my psychological and investment thought process for Alterra Power.

I outlined my frustration with the investment, how I believed I was right but no one else believed me, how I spent thousands of hours researching every company in the sector over the years to make sure I had the right one. I had 5 pages of peer comparisons showing how Alterra was ridiculously undervalued. And then on a Monday afternoon, my analyst interrupted my meeting in my Vancouver office to tell me Alterra was being acquired by Innergex Renewable Energy for CAD$8.25 per share.

I immediately blew off the rest of my meetings to analyze the transaction and listen to the joint-company conference call and alert subscribers of my next move with the acquisition.

I will continue to closely monitor the Alterra/Innergex transaction as it unfolds.

Once again, congratulations to all readers who purchased stock in Alterra Power.

I referenced balance and patience in this missive because it is a key skill to hone as you navigate the investment markets.

The next time you’re dejected about your investments, check and re-check your numbers and your investment thesis. And stay true to your gut instincts and the reason you made the bet in the first place.

Because you never know when you’ll make the next huge “overnight windfall.”

And when it does, you’ll be hungry for more.

Regards,

Marin

Ps. I just wrapped up two days at the sold-out San Francisco Gold and Silver Summit. I met with every management team and market mover on my list. If you want to learn my top 3 investment opportunities from the show poised for triple-digit gains, you’ll want to view this presentation right here. Keep in mind, this offer will close on Sunday, Nov 26th at midnight.