Intellectual Property… “IP” for short.

IP is the secret sauce of capitalism. It’s the legal realm protecting things like proprietary recipes, formulas, and computer programs. Think Coca-Cola’s secret recipe for Coke… Google’s proprietary search algorithms… and Kentucky Fried Chicken’s famous recipe. It’s all IP.

Have a great idea? Patent it. Trademark it. Do everything you can to keep it out of your competitor’s hands. Get your IP protected by law, threats, or secrecy – or all three.

A thousand years ago, IP wasn’t worth much. There were no systems in place to protect creators, entrepreneurs, and investors. You were more likely to die from a bad meal than to patent the creation of a good one.

But these days, the right IP in the right hands is worth hundreds of billions of dollars. Consider that in 2016, Google was worth 10 times more than Ford. It is worth that much because of its IP, which allows Google to present useful Internet search results.

IP is common in the food and beverage businesses. Secret recipes can be worth a lot. IP is common in the technology industry. But it’s not so common in the natural resource business. After all, one ounce of refined gold is the same as another ounce of refined gold. A barrel of Brent crude oil on the commodity exchange is the same as millions of other barrels on the exchange.

That’s why I rarely write about IP. Resource firms differentiate themselves by other means, like production costs, geological expertise, and management.

However, there is a unique kind of IP in the natural resource business that is far more valuable than Coke’s secret formula or Google’s search algorithms. This IP is one of the real keys to power and wealth in our modern world. I’m talking about power on a global scale.

If this IP and the power it brings didn’t already exist, the U.S. government would happily pay more than one trillion (with a “t”) dollars to possess it.

I’m talking about the proprietary technology and expertise – the IP – possessed by Western oil companies that allows them to inject pressurized fluid into deep rock formations, fracture them, and extract huge quantities of hydrocarbons. This process is more commonly known as “fracking.”

And knowing how to use it is one of the most valuable sets of IP in world history.

Why Oil is Power

Do you know who the world’s largest consumer of oil is?

It’s not Walmart, whose massive truck fleet hauls products all over America. It’s not McDonald’s, which trucks extraordinary amounts of food to its restaurants globally.

The world’s largest institutional consumer of oil is the U.S. military.

During the fiscal year 2014, the U.S. military consumed over 87 million barrels of fuel at a cost of almost $14 billion.

Although some aspects of war and power projection have become high-tech, militaries still run on old-fashioned diesel fuel, jet fuel, and gasoline. A modern war machine has a very large, very thirsty engine.

That’s why having access to massive quantities of oil is a requirement for being a world power. Trying to be a major player on the world stage without having access to oil is like trying to win the heavyweight boxing title with both arms tied behind your back.

Oil is power. And power is oil.

That’s why the U.S. government created the Strategic Petroleum Reserve in 1975. It’s the largest emergency fuel supply on Earth. At one point, it held over 700 million barrels of oil.

The fact that oil is power is also why Western militaries have been a fixture in the oil-rich Middle East for more than 80 years. After all, the acquisition of power is the end goal for any true politician. So politicians must always be concerned with oil.

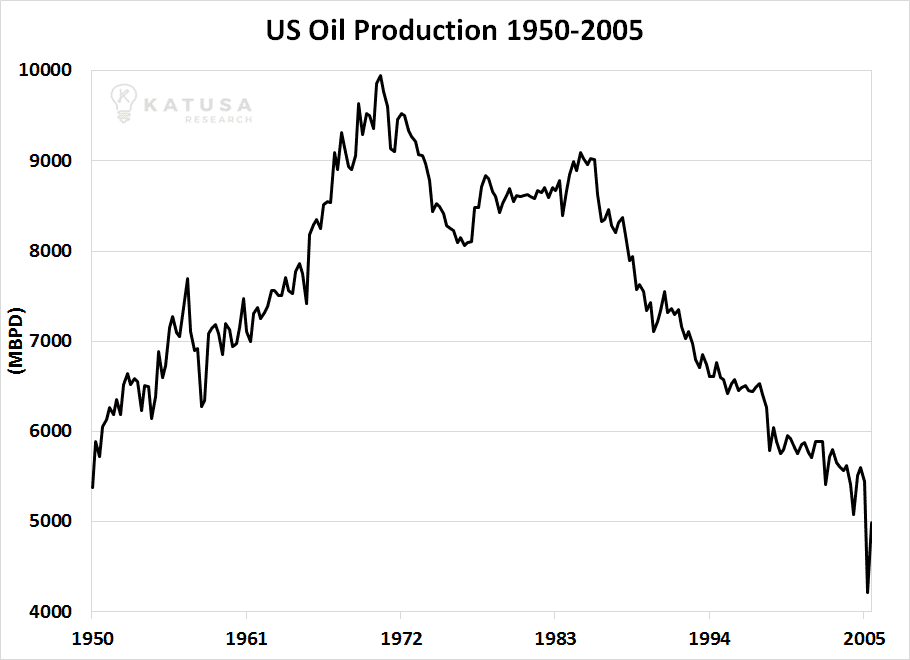

In 2005, these concerns were very high in the U.S. In the early 1970s, U.S. oil production reached nearly 10 million barrels per day. At that point, most of America’s “easy oil” had been tapped, and production entered a long decline. In 2005, U.S. oil production hit a 50-year low. Meanwhile, U.S. oil demand was near its all-time high.

This meant the U.S. had to import more oil than ever from foreign sources… which left it more vulnerable than ever to supply disruptions. You could say access to oil was becoming America’s Achilles heel. And you can be sure its enemies noticed.

Around this desperate time, a gift from the heavens landed in Uncle Sam’s lap. Or more accurately, a gift from Texas…

In the 1980s and 1990s, a small group of Texas oil drillers led by a man named George Mitchell pioneered the use of shale fracking technology. The technology allowed Mitchell to drill into oil-rich rock layers, fracture them, and extract large amounts of oil and gas. The technology showed promise back then, but it was in its infancy.

By 2005, the technology was advanced enough to be phenomenally successful. Mitchell became a billionaire, and fracking was applied across the country to great effect. Through the application of this incredible technology, the bear market in U.S. oil production turned on a dime.

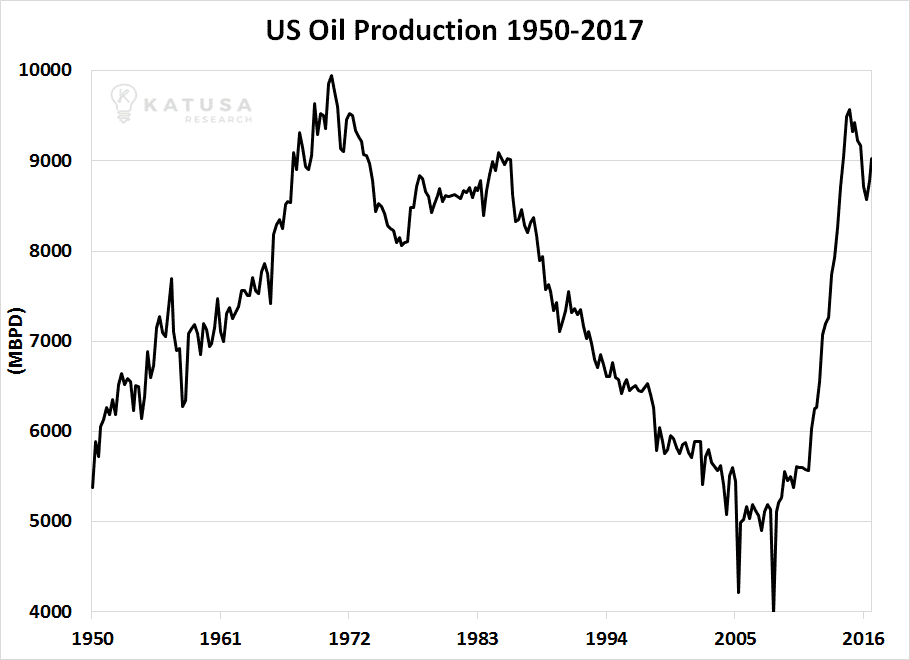

In just seven years, U.S. oil production soared from its low of 5 million barrels of oil per day to 9.4 million barrels per day. It was stunning production growth… the fastest growth a major oil-producing country had seen in decades. You can see this incredible change in the chart of U.S. oil production below:

As U.S. production soared, its vulnerability to foreign sources plummeted. U.S. imports from OPEC (aka “the Middle East”) declined 57% in seven years. In less than a decade, America’s dangerous weakness turned into a virtually endless supply of fuel and power.

Keep in mind that in terms of geopolitics, 10 years is a very short time. To return to the boxing analogy, it was like an over-the-hill fighter getting slower and weaker into the late rounds of a fight… but suddenly recharging between rounds to come out fighting like a 20-year old.

Although the public focused its attention on fracking’s impact on oil prices and the environment, the people who run the world were focused on America’s stunning and rapid increase in power. It’s the big fracking story you didn’t hear about.

I’ll say it again: The goal of any true politician is the acquisition of power. Every power-hungry politician around the world – from Russia to China to Iran to Mexico – knows the incredible story I just told you. They know that fracking massively increased America’s power in a short period of time. They want to see that happen in their country, on their watch.

However, a fracking-created abundance of wealth and power won’t happen in their countries soon. Once fracking was sufficiently advanced, it changed America’s fortunes in short order. However, it took decades of experimentation and hundreds of billions of dollars in capital investment to develop. You could say fracking needed years of practice to become an overnight success.

This long road of fracking development was traveled only by American companies. Other powers like China and India are more than 20 years behind in this race. But they desperately want to play catch-up.

That’s why North American firms that possess cutting-edge fracking technology and expertise are like Google in 2003… or Coke in 1950.

They hold the keys to the world.

Those keys are worth billions – even trillions – of dollars. Countries like China, Saudi Arabia, India, Australia, Brazil, Mexico, and Iran are lining up to spend hundreds of billions of dollars with the owners of the world’s best fracking IP. Everyone wants a repeat of the “American Shale Miracle” in their country. Meetings at the highest levels of government and business are taking place right now. They will lead to a huge, worldwide fracking boom over the next 20 years.

During this boom, massive new shale formations will be found. Shareholders in the right companies will make fortunes. This goes for “pick and shovel” suppliers of technology and drilling services as well as exploration and production (E&P) firms that use this technology to find oil and gas.

I believe this is one of the biggest investment themes of our time. Even if you’re not a dedicated resource investor, you should follow this story. It will massively influence financial markets and geopolitics for decades.

As a Katusa Research reader, you’ll receive constant coverage of this trend and actionable recommendations to play it for a long, long time.

Regards,

Marin