Donald Trump wants to make America great again.

His energy plan is full of clever slogans and big claims. It’s clear “The Donald” wants to get his message out to the masses.

Trump says his plan will create jobs and lead to American energy independence. It’s a familiar tune. Many politicians before him have sung it.

So how does The Donald’s energy plan break down?

First off, he wants to breathe life back into the coal industry. Long-time readers are familiar with the call I made in 2011 to stay away from coal. I’ve stuck with it for years.

Avoiding coal investments has been the right move. The U.S. coal index is down more than 90% since 2011. Many coal companies have gone bankrupt. Coal mining is an industry in a steady decline for many reasons. There are many better bets to make with your capital. The Donald knows this also.

While promoting coal will win him votes in coal states like West Virginia, the simple fact is that coal is now one of the most expensive power plant fuels in the United States. Promoting coal is flat out “bad business.”

Here is something that Trump totally ignored in his energy plan (Hillary, you can thank me later—as I am sure your strategists will benefit from this also)… The cost of electricity from coal fired plants has doubled since 2009.

The other clean energy alternatives, which are favoured by the masses, actually make much more sense economically and environmentally.

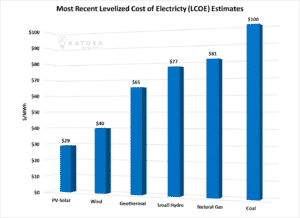

The energy industry measures fuel costs with a metric called LCOE. It stands for “Levelized Cost Of Electricity.”

LCOE is a measure of how much it costs to produce one megawatt hour of electricity with a given fuel source. It’s a comprehensive, “all in costs” figure.

You get it by tallying up all the costs related to building and operating a power-generating asset like a coal-fired power plant or a wind farm… and dividing that number by the expected output of the asset over its lifespan.

LCOE is a vital measure these days because it allows for direct comparisons across different types of power plant fuel, like coal, natural gas, and solar energy.

The lower a fuel’s LCOE, the cheaper and more attractive it is for consumers like you and me. As you can see from the chart below, solar power and wind power are much cheaper than coal power.

Even states like Texas are seeing a green revolution completely change the price of electricity. That is how you make America great again Donald, by reducing electricity costs. Not increasing them for a few votes from the canaries in the coal mine.

Rather than restrict free trade, use technology (including lower electricity costs) and undercut the emerging market nations who have cheaper labour. But I digress. Back to Trump’s energy plan.

Wind prices are getting very cheap with federal tax credits, inexpensive land, decreasing costs of installation and improvements in technology. This will be a huge benefit to the all-powerful US consumers (retail, commercial and industry).

Why? Utility electricity rates will decrease, leaving more money in consumers’ pockets.

Trump mentions the “Millions of jobs and trillions of dollars” of wealth that would be destroyed under the climate change policies of Hillary Clinton. Trump’s policies would also cause massive losses if he were to subsidize the coal industry and its expensive fuel.

Coal industry workers stand to benefit from a transition to green energy. They would begin learning valuable new skills that will be relevant decades from now.

And that’s perhaps where Trump’s analysts failed to remind him of the projected spending guised under the climate change policies of world governments.

According to every climate change think tank and NGO, there is a drastic lack of spending to fight increases in carbon emissions. They want trillions of dollars of investment. They’re going to get it.

Now, for as much controversy as Trump gets in the mainstream media, it’s important to separate the truth from his prolific statements. And this goes for any political candidate.

Trump’s promises will resonate with a large unemployed audience. He will get votes. Don’t underestimate The Donald. But at the same time, Hillary will do anything to win.

This is going to be a dog fight—and there will be a lot of money to be made from this election.

I’ve been positioning my investments accordingly, so that I can leverage a Clinton or even a Trump victory.

Should Trump win, I know exactly the kind of investments that will see capital favoring. I call it the ‘Trump Trade’. This is going to be a close race until the end. And the smart hedge funds will start to position themselves into the Trump Trade.

However, my money is not on a Trump presidency. Doug Casey who is a dear friend and partner believes Donald Trump will defeat Hillary. So, as I always do, I put my money where my mouth is and we bet 100 ounces of silver.

But I like positioning my portfolio in such a way that heads I win, and tails I win also. That is exactly what I will be publishing shortly in the “Trump Trade Portfolio”.

Next week I will publish an in-depth research report on all of the factual errors in Donald Trump’s energy plan. It’s part of understanding the Trump Trade.

And Hillary, you’re not off the hook either. I will publish all of the factual errors in your energy plan also, after I read it.

– Marin