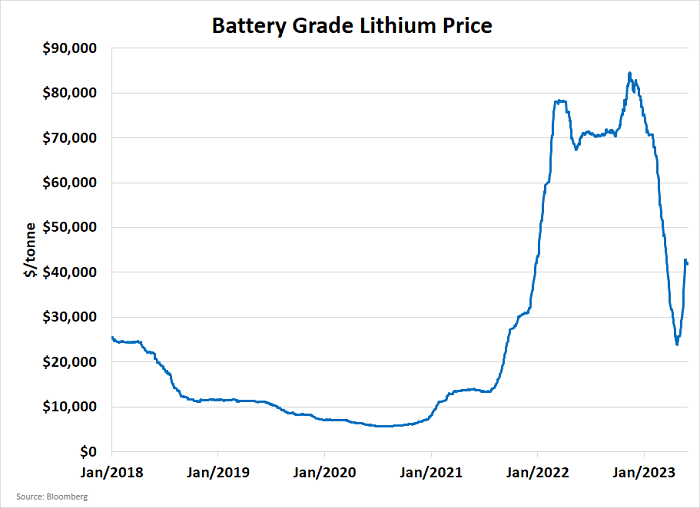

Lithium prices soared to an astounding USD$80,000/tonne last year, only to plummet in recent months.

But don’t be deceived. This rollercoaster is gearing up for another thrilling climb, and you’ll want to grab a seat.

The cause of last year’s surge?

A potent mix of battery demand and COVID-19 supply chain disruptions. Now that prices have settled back to late-2021 levels, you may think the excitement is over.

Think again.

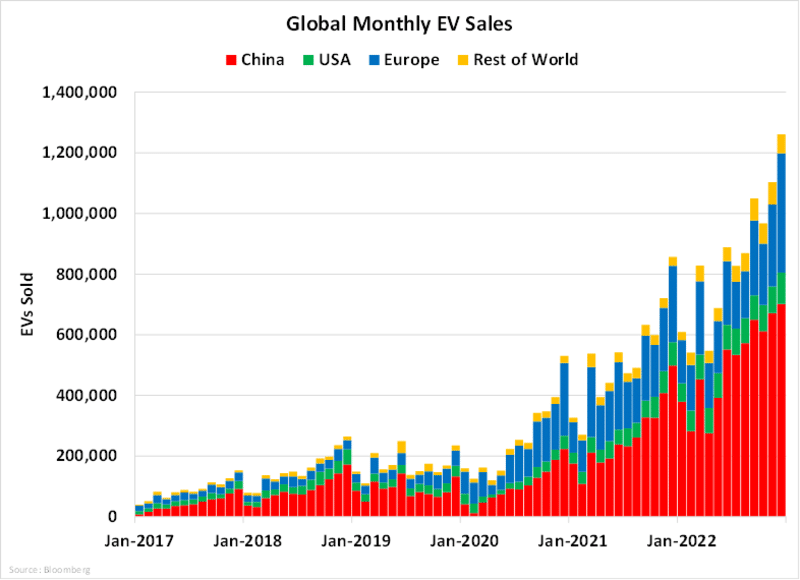

The lithium game is about to change, driven by an insatiable appetite for electric vehicles (EVs). As countries battle climate change and phase out gas-guzzling cars, EV sales are skyrocketing – and so too will the demand for lithium.

As more and more countries take up the fight against climate change and push for bans on the sale of gas-powered vehicles by the end of the decade, this trend in new EV sales will only accelerate.

- Electric vehicle sales are projected to triple by 2030… and lithium demand with it.

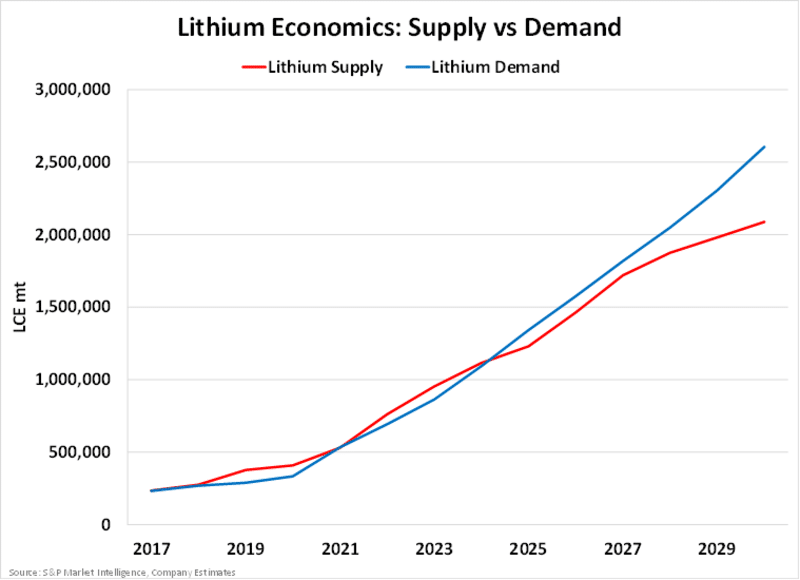

There is one problem though: as things are now, supply won’t be able to keep up.

The simple fact of the matter is this: it takes years for a new mining operation to start up, and lithium is no exception.

On the other hand, building a new electric vehicle factory is no different than building any other car factory. Tesla, for instance, has gotten building new gigafactories down to a science:

- Their Shanghai Gigafactory was completed in just 11 months. The first assembled Model 3s were delivered a month later.

- Tesla recently announced the construction of a new gigafactory in Mexico with a slightly longer construction timeline of 12-15 months, due to a new production line for their upcoming compact car model.

In fact, if you were to retool a pre-existing car factory from gas vehicles to electric vehicles, you could be looking at a timeline measured in weeks rather than months.

So, while lithium supply has an uphill battle to fight… lithium demand is going to explode the closer we get to 2030. And when they do, it’s quite likely that lithium prices will be impacted as well.

If Lithium Prices Go Up, A Few Will Become Big Winners

Although a surge in lithium demand doesn’t guarantee a corresponding rise in prices, it’s undeniably a potential outcome.

Consider this: heightened EV sales, which drove lithium demand, played a crucial role in creating last year’s lithium market frenzy.

If there’s even a hint of lithium prices escalating, look no further than the lithium miners—the bedrock of the lithium industry.

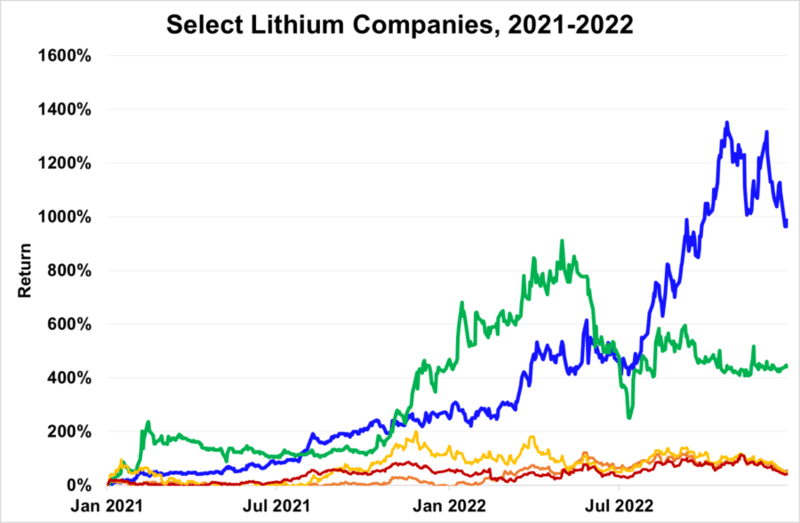

Take a look at what happened to lithium mining companies during the big runup in lithium prices between 2021 and 2022:

As you can see, each company at least doubled (delivered over 100% returns) at some point during the cycle… but that’s just for starters.

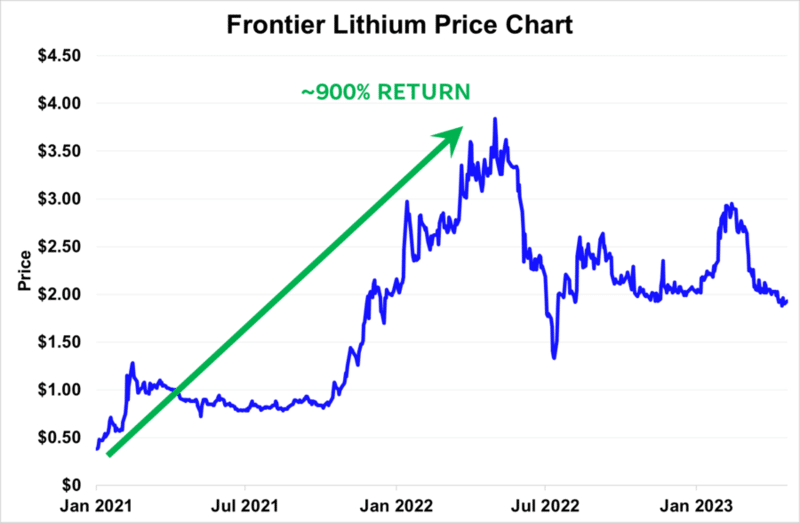

Frontier Lithium delivered in excess of 900% returns…

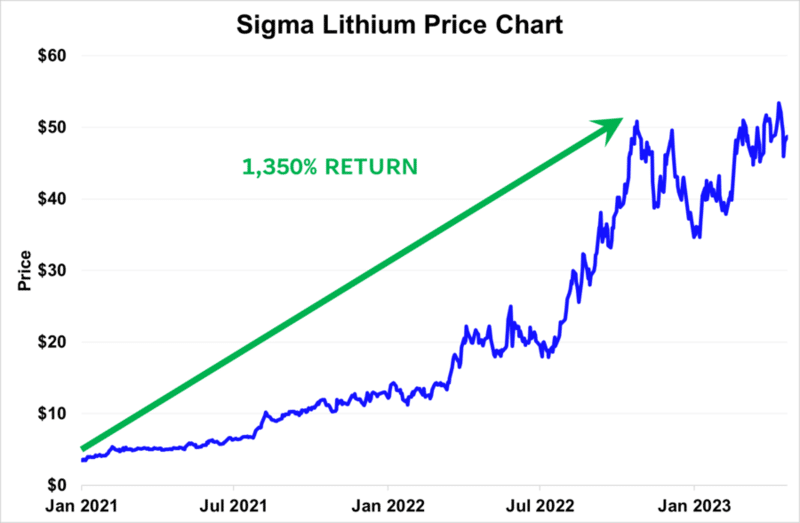

And Sigma Lithium even went up by a whopping 1350%.

Another company, Millennial Lithium, was trading under 60 cents in the wake of the COVID-19 pandemic…

- It was bought out at a valuation of USD$3.72 per share at the height of the lithium price runup early in 2022… over 500% returns for investors who picked the right time to buy.

Things may be quieting down for the moment in lithium… but don’t count on it to stay that way for long.

All signs point towards a massive influx of lithium demand over the coming years, and the supply to keep up with it will have to come from somewhere.

This is a fact the founder of Millennial Lithium knows all too well… which is he’s also the of a different lithium company.

And he plans to do exactly the same thing that he did with Millennial Lithium, with this new company.

The lithium markets are set for massive growth in the years ahead. And if the markets take off again, you won’t want to pass up the opportunity for another ride.

Regards,

Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.