To watch this week’s article in video format, click here.

Today I want to share what I call “The Jimmy”.

One of my favorite people in the world is Jim O’Rourke.

He is great in every way and my earliest mentor in the business.

He’s someone I’ve learned a tremendous amount from.

I admire everything about this great man. A true Canadian Living Legend.

But he is the world’s worst seller of stocks.

Even worse than Doug Casey who is the world’s second-worst seller.

I’ve been close to Jimmy for over a decade—and he literally never sells.

For example, Jimmy was on the board of one of the stocks we held in the early days of Katusa’s Resource Opportunities – my premium research letter. He owns a lot of this particular stock.

We were chatting one day, and he said…

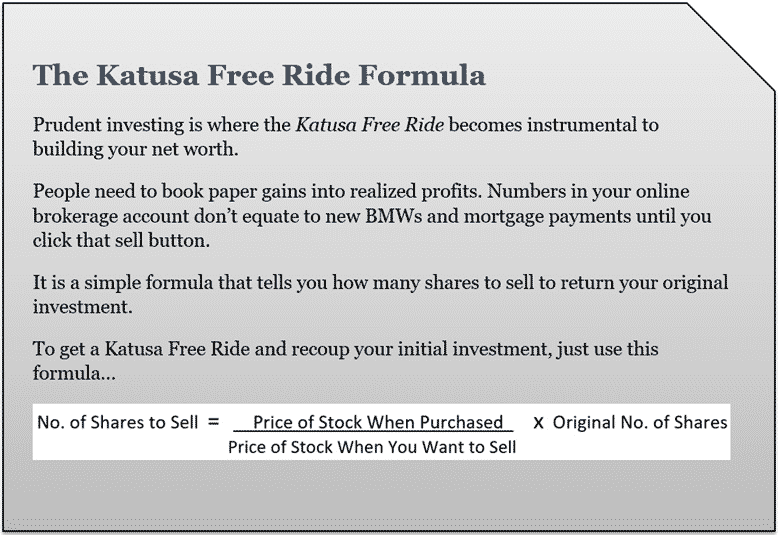

“Marin, you said to take a Katusa Free Ride above $15.50. It’s a lot higher now. Should I sell?”

“Yes Jimmy, it’s what I said and what I did personally just like I wrote in the KRO.”

Jimmy is a subscriber to the KRO and is reading this right now.

Did he sell? No.

He said he wanted to be supportive of the deal.

Now I want everyone reading this to know that not selling stock means you aren’t supportive. The opposite is true.

By selling a stock the market is pricing above fair value… or pricing in future value you can have cash on the sidelines to buy when the market discounts the stock and actually support the stock.

One of my major rules of investing is this: Do not fall in love with a stock or a position.

Your role is to make money.

Don’t do “The Jimmy”

The irony is that an investor is supportive when they buy the stock when it’s cheap and when nobody wants it – not when its “popular”.

The stock Jimmy was asking me about was one of the best gold performers in the world in 2020. Gold was rocking and the share price hit all-time highs.

Taking a Katusa Free Ride does not in any way mean you are not supportive. It’s the smart thing to do.

And now you can be supportive when your favorite resource stock breaks under its support lines… and buy it when gold, silver, copper, or any commodity is out of favor.

Stocks are not your kids, grandkids, or friends.

- Do not fall in love—and guess what—the stock doesn’t even know if you love it or not.

Management teams know I am VERY supportive of the companies that I own.

But they know my style and they know I’ll be there when no one else is.

That’s how I made my money.

It is the Alligator Way.

So, Marin, Where is Gold Going?

If you go back to previous missives and read my premium research…

You will notice I analyze companies a lot differently than your standard broker, banker, or fund manager.

For example, I always limit my Net Present Value (NPV) valuations using $1,550 gold and usually use $1400 in most cases.

Think of Net Present Value as the value today of all the expected future cash flows using a discount rate and the price of the commodity to value that cash flow.

I think there is a good possibility that gold gets a whipsaw pullback over the next 24 months to test the $1400-$1550 per ounce price range.

Why?

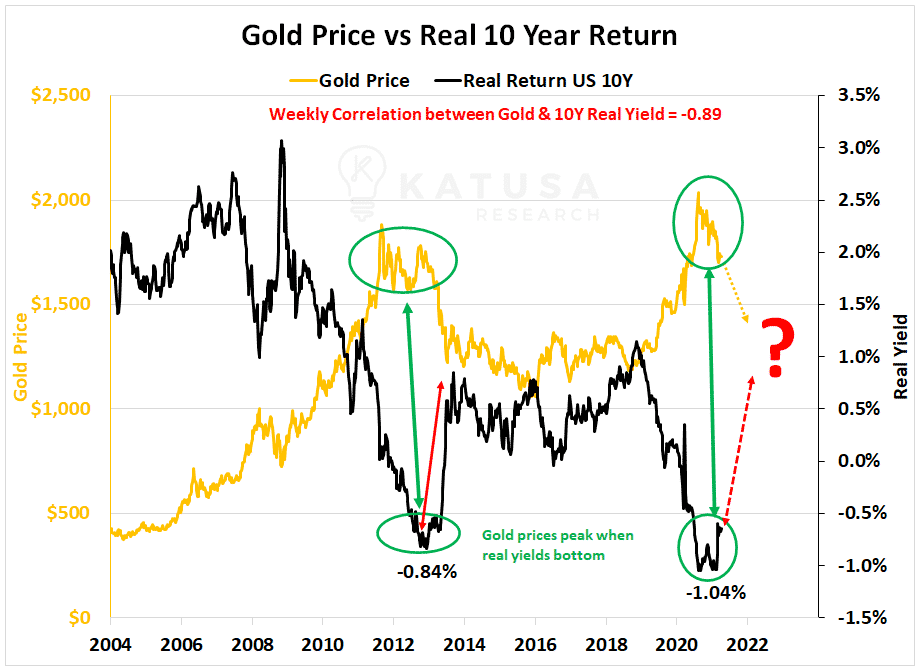

- A very strong correlation I use for trying to see where gold prices will go is to track gold against the 10-year real returns on treasury bonds.

The real yield for the US 10y calculated by the US Fed started in 2004 and has a correlation of -0.89.

- Hey Marin, “what the hell does negative 0.89 correlation mean?”

Well, in street lingo it means that if one goes up, there is a very strong possibility that the other will go down.

In 2013, when rates were negative and then bounced from -0.84% to over +0.50% gold fell over $250/oz ($1580 to $1230) or roughly -22%.

If we took the same harsh correction, a correction using the current move in 10-year yields would show a target of ~$1440/oz for gold within 12 months.

It’s worth noting that the move in 10-year real rates from -0.84 to +0.50 took less than 6 months.

Even after that as real yields trended back towards zero and even went negative, gold did nothing for a few years (2013-2016).

GET READY – Alligator Time is Coming

So, what’s different?

If the rates get too much higher, the global markets will collapse again – that is a fact.

So, do I see gold falling to $1400/oz?

I do not. But my opinion doesn’t matter, and I am prepared accordingly.

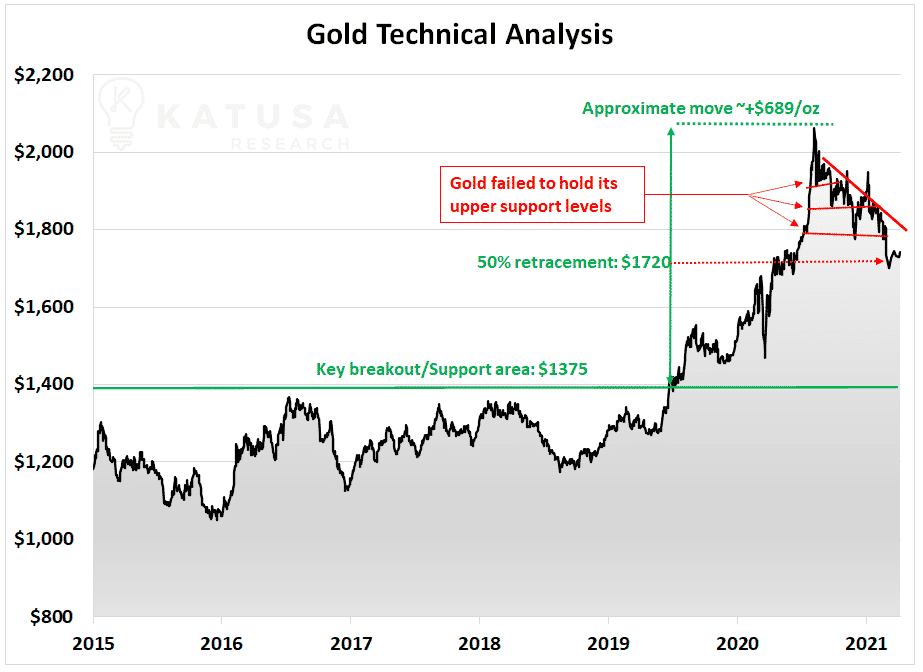

Now, we have published this next chart many times in past KRO letters, which is the updated Technical Analysis on gold.

We have consistently said that gold needs to consolidate above the major breakout from $1,375. As you will see in the next chart, mini consolidations in the upper ranges between $1,800-$1,950 have failed to hold.

A key area to watch is the 50% retracement level.

The 50% retracement level represents a 50% decline from the high, measured from the beginning of the breakout to the peak. In this case, the level is approximately $1,720.

If $1720 breaks the next support level is $1685.

- If you forced me to make a decision, I do think gold could break below $1685 and we will have an incredible buying opportunity.

It’s important to note that gold is driven by underlying economic factors more so than technical analysis.

Drivers like…

- real yields on bonds, both in the United States and abroad,

- the money supply, and

- the US dollar

…All have a significant influence over gold price movements.

Another little metric I use to see is the amount of “leveraged” gold positions and coin premiums.

- Right now, the gold market has more leveraged positions, meaning funds and investors who have used leverage to buy gold and gold stocks, than at any point in the last 5 years.

So, what does that even mean?

It means people are on margin and borrowing money to buy gold and gold stocks.

When the price goes down, people will either increase their margin (add more money to the trade) or sell.

I think most will sell as they will fear the price going lower.

That will cause more selling pressure to the gold spot market and gold equities.

And that would be music to my ears because my subscribers and I are well cashed up from taking Katusa Free Rides last summer on many large precious metal stock wins.

If you want to see where I’m putting my money – click here to learn more about Katusa’s Resource Opportunities.

Regards,

Marin Katusa