This is the second issue in The Rise of America, a series about the future of the United States as the global superpower. For the first, which predicted Trump’s new $2T infrastructure push just days before he tweeted about it, click here.

Dear Reader,

When all of this began, it wasn’t supposed to be for very long.

“Fifteen days to slow the spread,” they told us.

But now we know differently. It’s obvious we’re going to be holed up in our homes much longer than that.

It wasn’t Easter 2020. Could it be Christmas 2020? Easter of 2021?

Of course, you’re painfully aware of why we’re social distancing: it’s to “flatten the curve.”

Only if we flatten the curve, that means it lasts longer. So just how low and long does this curve need to be?

In other words, how long will we be standing six feet apart at the grocery store… will gatherings of more than three people be illegal… will we see our best friends as biohazards?

It’s not just important to know for our sanity. It’s vital in order to understand how much damage this will have on the economy—and what the timeline looks like for getting it back up and running.

The toll it’s already taking is astronomical. For example, BMW has decided to shutter its single North American plant for at least a few weeks; that will cost it more than $36 million a day.

And then there’s unemployment, which is already at 10%… and rising at rates not seen even during the Great Depression.

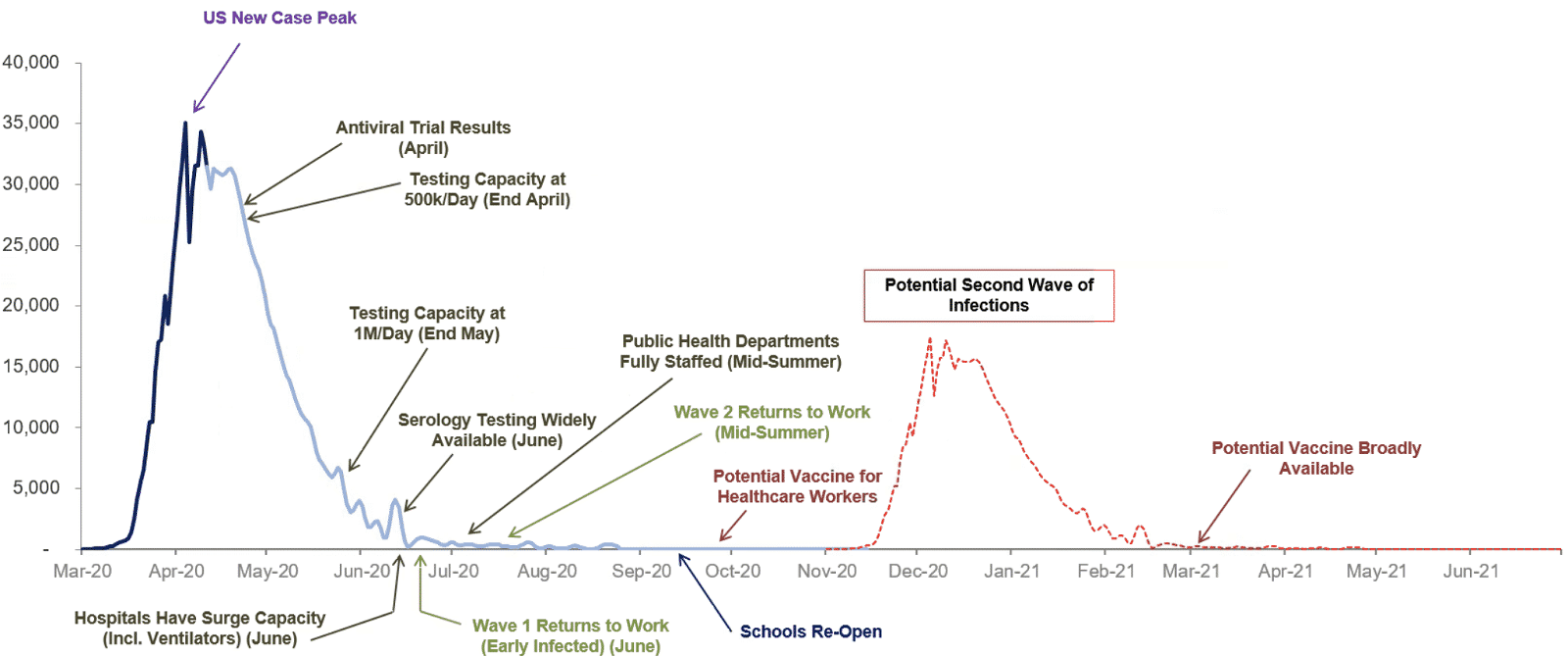

Lots of models have already been created to try to predict when we’ll ease up on lockdowns. Morgan Stanley, for instance, created the following potential timeline:

Exhibit 1: Projected timeline and milestones for a return to work in the US

Source: Morgan Stanley Research

Now before you start getting your hopes up, the bad news first: social distancing will not be gone any time in the near future.

And if it is: It will be brought back. Quickly.

Countries like Singapore, Taiwan, South Korea, and even China are seeing this happen. The cases return to zero, the lockdown orders are removed, and the spread starts anew.

Even though China has underreported their case counts (and has revised their own death count due to the virus in Wuhan by over 50% higher), their official daily new case count on Sunday, April 12th was 108 – the highest since March 5th, showing that it’s likely they’re facing the beginnings of a second wave.

In other words, suppressing the virus is not a temporary battle. Foreigners and travelers will just begin the cycle over again.

So shelter-in-place measures are not happening to eliminate the virus. Their sole purpose is to buy time.

And that precious time is necessary for three things:

- Give hospitals time to adjust and handle the influx of patients

- Testing nearly the entire population (and subsequent involuntary isolation of infected individuals)

- Development of an effective vaccine

The first makes sense. Do whatever we can to help out our health care workers. The second also at first glance sounds good… at least in theory. But the chemicals used to manufacture tests are expected to run out within a month.

And the third will take at least twelve to eighteen months for limited clinical trials to prove the vaccine is safe and that it works. Only then will the manufacturing process of hundreds of millions of doses begin. Even in the best case, this places vaccine availability starting in the first quarter of 2021 at the earliest.

Until either of those happen on a near-global scale, staying at home and complete corporate shutdowns are our new way of life.

Soon, the global economy will effectively need life support of its own.

So what does the absolute best case scenario for reopening for business look like?

The History That’s Impossible to Ignore

Most projections place a potential second wave of infections around November or December of this year. And while experts hope that successive waves are less severe than the current peak, there’s no way to know for sure.

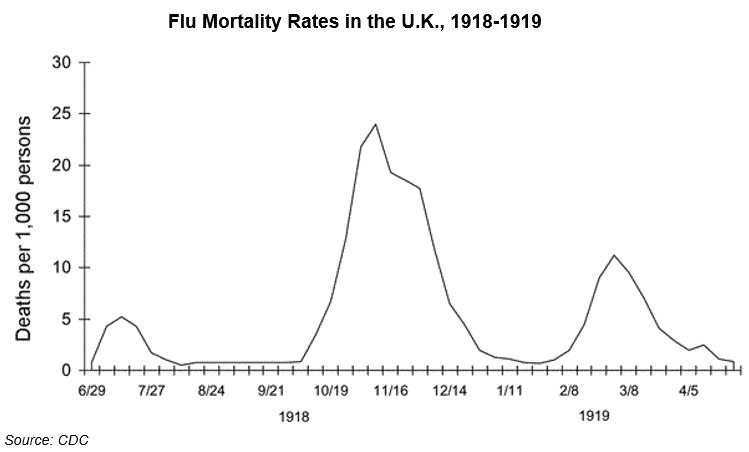

The Spanish Flu of 1918 provides a sorely needed history lesson:

It came in three deadly waves, as isolation regulations were relaxed, then strengthened again. Notably, the second wave occurred around November of 1918 and was far deadlier than the first initial wave.

Given how our understanding of the science behind infectious diseases has progressed since then, however, it’s unlikely that this will be the case for COVID-19.

All in all, the Spanish Flu began in the spring of 1918… and it was the fall of 1919 before the deaths had levelled off. And we’re actively prolonging that process.

In line with the Spanish Flu’s timeline, economists estimate that the U.S. economy won’t return to pre-pandemic levels until the end of 2021.

In other words, we’re going to be here awhile.

There Will Be No Return to “Business as Normal”

And that brings us to the good news. As Thomas Wright from the Brookings Institution wrote:

“The longer the pandemic goes on, the more the world will change.”

For the United States, that means change in a very good way.

Because when it comes down to it, times like these are what the United States was made for.

We’re going to see massive changes in society… in policy… in politics… and especially in business.

Which is even more good news:

- The more the world changes, the more investment opportunities there are.

You see, investment opportunities arise when there is a difference between value and perception.

And when rapid change happens, those differences are all over the place.

It gets even better.

Many changes that were already underway when the pandemic hit are going to be dramatically accelerated.

- The faster the world changes, the greater the investment opportunities are.

… and right now, we’re watching history on 16x fast forward.

Huge companies will buy out little ones. Companies will bring their supply chains home to the United States. Companies head over their heels in debt will quickly fade away.

And you will have the opportunity to get rock-solid companies at rock-bottom prices.

Eventually, as the director of the NIAID said, “We will get over this, and this will end.”

When that happens, you’ll want to be ready.

Because maybe not today, and maybe not by Christmas 2020—but soon, and for the rest of your life, America will rise.

Regards,

Marin Katusa