Junior gold stocks are high-risk and high reward.

In a strong gold bull market, you can throw darts at a board and come out a winner.

But the absolute monster returns that add extra digits to your net worth will only come from the top companies.

How High Can Junior Gold Stocks Go?

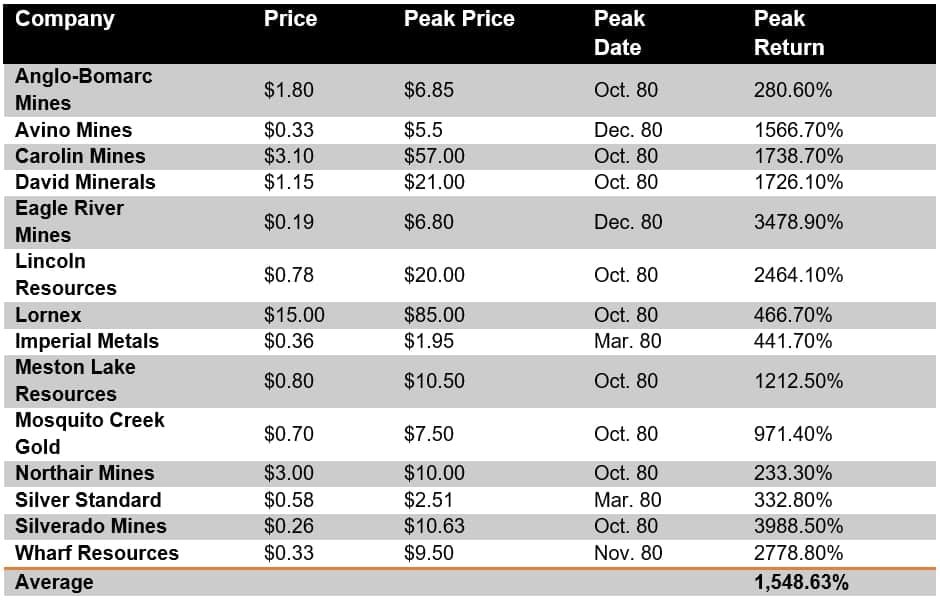

The table below shows the returns from junior gold stocks during the 1979-1980 gold bull market. You’ll note that we removed a 13,000% outlier (Copper Lake) to keep from skewing the results.

Junior Gold Stock Returns, 1979-1980

- The investment would have grown by 15 times its original size in under two years.

Here’s what that looks like in an actual account…

Let’s say you have a $100,000 portfolio. And you speculate in resource juniors with 10% ($10,000).

If we are at the beginning of another typical gold boom cycle…

And you capture just 75% of the gain…

Your speculations would end up being worth more than the rest of your portfolio combined.

Famed author James Michener once wrote that sometimes,

“… along come these differential experiences that you don’t look for, you don’t plan for—but boy, you’d better not miss them.”

The chance at +100% to +1000% portfolio gains by catching gold stocks at the right time is an incredible experience you don’t want to miss.

Now you might be thinking, “You’re just using a single gold rally to prove your point.”

Here’s the thing: This holds true for every gold boom in the last century.

And while we’re proving that, we’ll also give you an even better reason to use juniors to invest in gold. That is, if you can stomach the high-risk nature of the speculations.

Juniors can skyrocket… even when gold doesn’t.

The Hemlo Rally of the 1980’s

From 1981-1983, the gold market underwent what came to be known as the “Hemlo Rally.” It was named for a huge gold discovery near Ontario, Canada.

In the last thirty years, the Hemlo mine has produced more than 21 million ounces of gold.

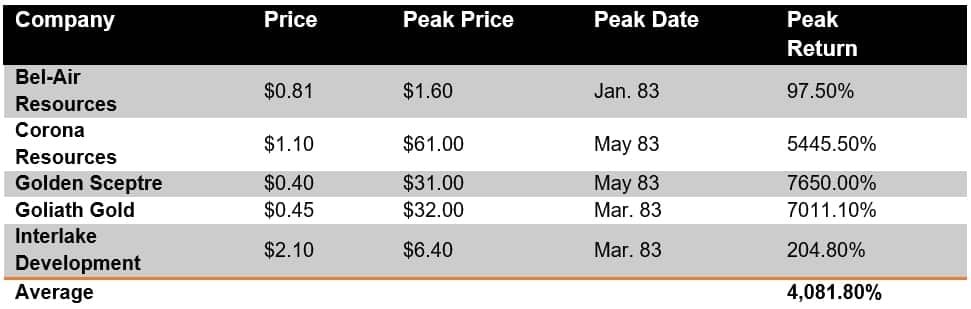

During the ‘Hemlo Rally’, gold dropped from $513 to $413. That didn’t stop the juniors within the area play of Hemlo to skyrocket.

In the table below you’ll see the 1983 returns from the companies that had exposure to the Hemlo mining complex.

Junior Gold Stock Returns, Hemlo Rally

- The average return in under one year for these stocks was more than 4,000%, during a period when gold was down.

Let’s look at one more gold stock rally. Again, this one happened while gold was almost completely flat.

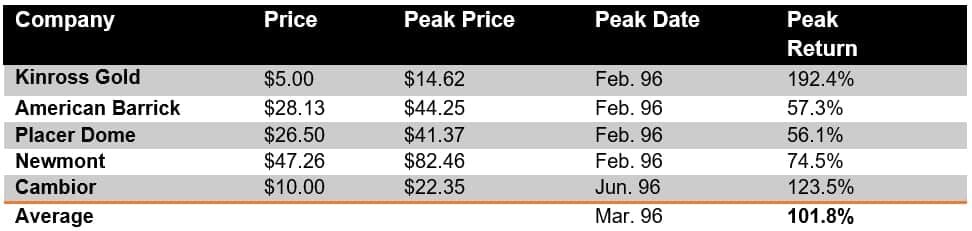

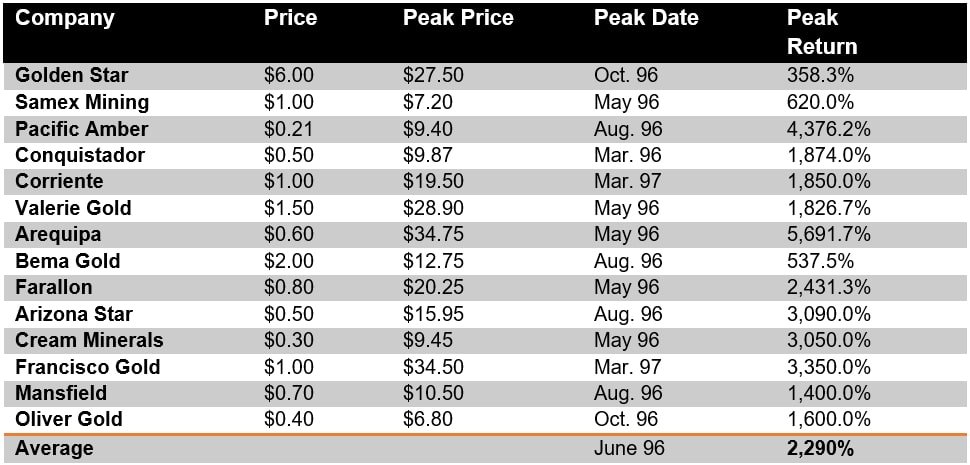

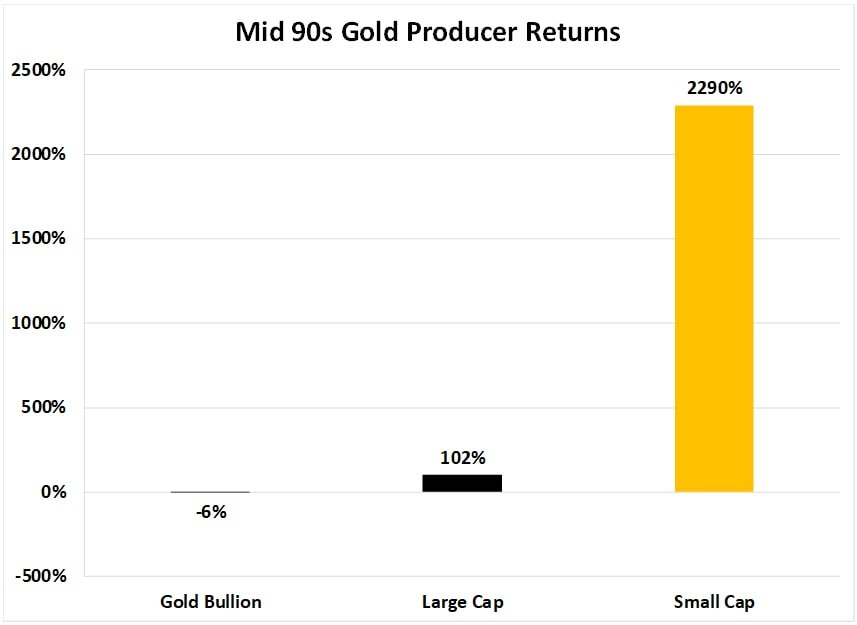

A string of gold discoveries in the mid-‘90s ignited an incredible bull market.

The table below shows producer returns during the rally. As usual, these returns struck fast—an average of 100% in less than two years. We’ve even removed a 766% outlier to avoid skewing the data.

Producer Returns, 1990s Rally

Notice again the dramatic difference in return. The nerve to buy when gold is completely flat—and the courage to hold on during extremely wild swings—can be worth millions.

(One company we didn’t include in the table, Cartaway, achieved a literally off-the-charts 26,040% return.)

Junior Gold Stock Returns, Mid-90s Rally

So you need to target the right junior stocks to ensure your portfolio is prepared for the next, massive gold bull market.

I’m Betting Big on These 3 Gold Stocks

We just wrapped up the prestigious VRIC 2020 (Vancouver Resource Investment Conference).

It’s one of the world’s premier gatherings of resource financiers and companies. Its where the world of exploration comes under one roof.

I’ve just prepared an exclusive report on the absolute best junior gold stock recommendations from this year’s Vancouver Resource Investment Conference. I expect to make multiple times my money in some of these stocks… just as I’ve done in the past.

And my report reveals the top 3 stocks I consider Best in Show from the 2020 conference.

These are all deals I have significant amounts of my own money in. And if you’re not in the room, you’re not in the deal.

Here’s how to get the names and full research on these companies (and many more)…

My exclusive post-conference “Best in Show” report reveals my 3 favorite junior resource stocks to own.

Each is a big part of my core gold holdings, which is why I believe they will all be huge winners… and could generate gains similar to my previous conference wins of 101%, 267%, 48% and 1,053%.

I realize that’s a bold statement. But after you learn the amazing details and my analysis on these stocks, I believe you’ll agree with me… and join over 90% of subscribers that return to read my research year after year through boom, bust and echo markets alike.

Not to mention, you’ll already be at the ready for the next big deal I publish on behind the pay wall.

If you’re interested in profiting alongside me and subscribers and seeing what I’m investing in with my own money, read my Best in Show details right here.

Don’t hesitate – the special offer I’m making closes shortly.

Regards,

Marin