It’s the system that keeps on spitting out money.

And it’s not just limited to the gold and silver sector. It works for all resource companies.

But to make money using this system you need to have conviction, patience, and the right investment thesis.

Not to mention, the company you hold shares in has to have a management team that’s not comprised of a bunch of useless troglodytes (I.e. they own a rich asset but don’t know what to do with it and will destroy shareholder value).

As you build your position in a company, your exit strategy is almost more important than your buying strategy.

And one of the main exit strategies for many juniors is the buyout.

The Power of the Stock Buyout

Of all the ways to make money quickly in the resource markets, few can match the power of “the buyout.”

Own a small stock on Monday… then, suddenly, overnight, you’ve made double or even triple-digit gains by Tuesday.

A buyout occurs when a larger company sees an opportunity to grow and buys all the shares of a smaller company – often at a large premium. The result is an overnight windfall for the smaller company’s shareholders.

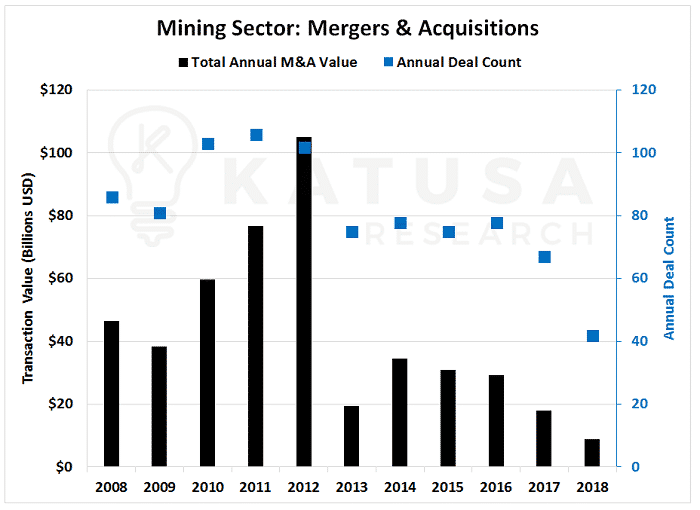

Over the last decade, there has been over $400 billion worth of transactions in the precious metals and base metals sectors. The chart below shows the mergers and acquisitions in the mining sector along with the total number of deals completed since 2008.

This past week, the large-cap Australian miner, South32, paid CAD$1.8 Billion to acquire the zinc focused company Arizona Mining (AZ.TSX-V).

This sent Arizona shares rocketing higher “overnight” by 49%.

Even better, this was a MASSIVE liquidity event for the junior stock. Over 54 million shares traded hands. That represents over CAD$330 million of activity in a single day.

And early Thursday morning, I got a news release sent to my phone that another small gold company got bought out.

In an all-cash offer, Dalradian Resources (DNA.TSX-V) was acquired by Orion Mine Finance in a deal worth $537 million.

This company was profiled in our Market Intelligence Center as a gold stock buyout candidate. Congratulations to you if you recently picked up shares and are enjoying the nearly 60% “overnight” windfall.

So was this a one-off transaction?

According to Bloomberg, this might not be the end, but rather the beginning of more blockbuster buyouts in the resource world…

South32 CEO Graham Kerr said,

“We are still very much active in searching for deals. People want us to put their cash to work.”

This echoes the sentiment of other big and well-cashed companies like the Lundin Group (and many, many others) that are looking to put cash to work in a takeover.

Glencore, BHP, and Rio have all stated they are looking for world-class assets.

This is good news for you and me as investors.

We could just be in the early stage of a bull market in takeovers.

Cracking the Code of Stock Buyouts

Despite the incredible wealth-building power of the resource buyout, the process behind it is a mystery to many people…even to supposed “experts” that follow the sectors.

For decades, people have tried to crack the code behind buyouts…the qualities large companies look for when they shop for smaller companies. Their efforts have largely resulted in failure and frustration.

For every stock someone named as a buyout target, there were twenty-five “run of the mill” companies that went out of business.

As you probably know, I’ve devoted my professional life to investing in natural resource projects. I’ve flown more than one million air miles to visit over 400 resource projects in over 100 countries.

Along the way, I’ve become friends with some of the world’s top gold executives, mining engineers, and geologists.

Take the incredibly successful and pure gentleman of the mining industry, my friend Ian Telfer, Chairman of gold mining giant Goldcorp who even went out of his way to write a blurb for my New York Times Bestselling book, The Colder War. I’ve published exclusive interviews with gold mining legends like Pierre Lassonde (founder of mining royalty firm Franco-Nevada) and Rob McEwen (founder of Goldcorp).

I’m referencing my experience to show you that I have insight into the world of gold buyouts that most people do not.

Through friendships, due diligence, and my status as a top financier, I’ve learned exactly what the guys making buyout decisions are thinking when they pull the trigger.

Why Gold Buyouts Are So Attractive to Gold Majors

Buyouts occur in the resource markets for a simple reason…

Take a gold buyout for example…

Every time a gold miner pulls an ounce out of the ground and sells it, it depletes their reserves a little.

If a gold miner doesn’t direct some of its revenue into the acquisition of new gold reserves, it will mine itself out of existence. It will consume its asset base and cease to exist. And that’s why “buyouts” frequently hand gold investors massive overnight gains.

You see, when it comes to increasing gold reserves a big gold miner has two options…

Option #1: The Hard Way

It can spend hundreds of millions of dollars on the risky business of mineral exploration. It can spend a fortune wandering around deserts, jungles, and Arctic regions looking for gold deposits.

When you consider that less than 1 in 3,000 mineralized anomalies ever becomes a mine, you realize that exploring for gold is a “long shot” activity.

Also consider: If by some fortunate event the miner actually finds gold, it is now looking at 5 to 10 years of development headaches. In its quest to build a gold mine, the miner will wrestle with crooked politicians, red tape, lawyers, environmental activists, and bankers.

And then you have…

Option #2: The Easy Way

The gold company can bypass the headaches that come with Option #1 and simply buy another company.

That’s it.

No long shot drilling programs in the middle of a desert. No swatting mosquitos in South American jungles. No hacking through miles of red tape to get mining permits.

Just one simple transaction, executed from the comfort of an office….and the gold miner adds a lot of gold to its balance sheet. Now put yourself in a gold executive’s place…

Is it worth paying a premium to buy proven, productive gold assets…and sidestepping the expenses and risks of Option #1?

You’re darn right it is.

In some cases, it’s worth paying double a gold company’s stock market value.

That’s why high-quality operating and development stage gold mines are some of the most highly coveted assets in the world. It’s why buyouts can hand you overnight windfall gains…

…And it’s why knowing exactly what kind of gold projects large miners want to buy is an incredible “blueprint” for making money in gold stocks.

But as I mentioned, nobody has been able to unlock the secrets of gold buyouts and know in advance when gold windfalls will likely occur…until now.

My team and I recently performed an enormous amount of work in this area. We studied 35 years of data and 340 individual gold buyouts of at least $50 million since the early 1990’s. We’ve determined exactly what large gold miners are looking for.

We compiled the 6 most important qualities a gold producer must have in order to attract a premium buyout offer. Below, I describe each “key” for a buyout.

I’ve prepared a large report that goes into these qualities, but in the interest of keeping this piece relatively short, I’ll name the qualities and go over them quickly…

Key #1 Big Enough to Move the Needle:

Big miners are only interested in significant deposits that can make it worth their time to acquire and develop.

Key #2: Ability to Grow:

Big miners aren’t just looking for mines with sizable current production. It’s expensive and time consuming to move people and equipment around the world. That’s why a big miner wants to acquire properties it can mine that also have the potential to yield new gold discoveries.

Key #3: Low Costs, High Margins:

Big miners want to buy deposits with good economics. Enough said.

Key #4: Short Payback Period:

Big miners want to see their investment get paid back in a relatively short amount of time, like less than four years.

Key #5: Simple Recovery:

In the mining world, as in life, simple is always better. The more complicated a project’s geology is, the, the more difficult it will be to extract the metal from the ore, the more it will cost to mine it, and the lower your profits will be.

Key #6: Excellent Mine Safety Record:

An underrated and rarely discussed – but very important – quality a mine needs to have to be a buyout candidate is a good mine safety record.

A Gold Formula Worth Millions

I know reviewing our criteria is a lot to take in.

But really, it’s all just common sense.

Major companies want to acquire assets and mines with substantial current gold production or the likelihood of future production.

They want assets that can grow in the future, have good economics, and in the case of an operating mine, are operated with the safety of workers in mind.

Based on our extensive study of 340 mining deals over the past 35 years that have generated overnight windfalls like 150%, 108, and 96%, we’ve developed the specific criteria above based on those simple principles.

Do we miss some? Yes, you can’t dance with all the girls at the prom.

But using just the six keys listed above will put you ahead of 99.9% of your fellow resource investors.

I believe monetary and political instability will drive the price of gold much higher over the coming years. And I’m positioning my personal portfolio to capture big gains at the current gold price, and especially if the price rises in the future (like I think it will).

By using our Stock Buyout System, I plan to make a series of large capital gains with my readers during that time. Just like the one my subscribers and I recently had investing in Nevsun Resources and Alterra Power just a few months prior.

We’re not going to be buying the flavor of the day stocks, or the ones that get all the promotion. We’re going to be buying truly elite assets that the biggest miners in the world want to buy.

Regards,

Marin

P.S. My team and I recently put together a special report called, “Blockbuster Buyouts: 300% Gains from the Best Gold and Oil Juniors of 2018”. In it, we break down the analysis that makes these two junior stocks excellent candidates to be taken over by a major.

Last year, I outlined my investment thesis for Nevsun, and we made a big score. I’m putting my money where my mouth is with these picks – and I believe they will get bought out sometime this year. To get immediate access to my report and a year of my research with Katusa’s Resource Opportunities, click here.