This story has never been told in print beyond my paid subscribers.

But there is a big reason I am sharing it now.

Back in 2006 and 2007, I spent a lot of time in an area of southeastern Europe known as the Balkans.

In 2006, I set up a mining company in Kosovo (the second officially registered company of its kind in the young country).

I spent a lot of time in Serbia, another Balkan country. The Bor mining district in Serbia is an incredibly famous mining region that dates back centuries.

In fact, copper mining in Europe started in the Balkans in pre-Roman times, and the largest copper mine in the world pre-1950 was the Bor Mine in Serbia. I hired a team of geologists that could read the local language (Cyrillic Serbian) and I literally drove the group across the two countries to visit all of the old mining towns to conduct due diligence.

There was very little competition. And I believed I would find the next big mine in Europe.

A year later, mining entrepreneur Miles Thompson was in Serbia also. Because of our common belief that there was another major deposit hiding within the terrain of Serbia near the giant Bor copper/gold mine, Miles and I met and we quickly became very close friends.

Back then, Miles was the Chairman, President, & CEO of a small junior mining company exploring in Serbia called Reservoir Capital. I quickly learned that Miles was much better at running an exploration company than I was.

So I decided to back him financially.

Ironically, we came close to a deal for me to sell the assets I had accumulated in Kosovo to Reservoir Capital in return for an equity share in Reservoir Capital (this was over a decade ago).

But we both agreed that the optics of a Canadian company having assets in both Serbia and Kosovo at the time weren’t ideal.

However, Miles and I bonded with time. And we’re still close friends to this day.

Along with a few others, I financed Miles’ Reservoir in the early years for two reasons: I liked and believed in Miles, and I believed Serbia had more elephant-sized deposits to be discovered.

In the summer of 2008 Miles spent two weeks at my waterfront property in Croatia and when we weren’t drinking, we mostly talked mining. He did so again in 2009 and Doug Casey, Olivier Garrett, David Galland and a few others also joined us and stayed over during the summer, at my place. We had a few investment bankers, brokers, and executives swing through during that time.

So, in essence, I took Miles’ money in poker, but he took a lot more from me in his exploration companies.

While at my place, Miles received a phone call from his largest shareholder.

He was asked to explore selling the exploration of copper/gold assets in Serbia. Some members of his board and largest shareholder wanted the company to focus on the run-of-river energy projects in the Balkans and sell off the mineral exploration projects.

Miles and I both thought that there was far more value in the exploration of copper/gold assets than the run of river green energy projects. Nevertheless, we spent a whole week calling everyone I knew in my Rolodex. We pitched the merits of the exploration assets in Serbia until we ran out of breath.

Out of hundreds of calls – only one serious meeting resulted. The meeting ended as a complete waste of time.

The valuation? CAD$1,000,000 for 100% of the whole mineral package in Reservoir Capital.

Miles and I looked at one another and said no way.

Miles refused the marching orders from his largest shareholder, and everyone should be thankful he did.

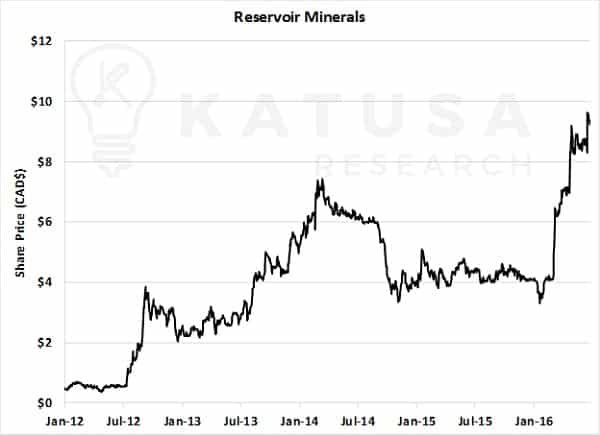

In October 2011, Miles spun out the Serbian mineral exploration portfolio into Reservoir Minerals. Every shareholder of Reservoir Capital received shares of Reservoir Minerals as a dividend, including myself.

Shortly after, Miles was able to attract Freeport McMoRan, arguably the world’s best copper producer, to farm into the mining assets in Serbia.

In the summer of 2012, Reservoir Minerals hit pay dirt in a big way. The following exploration drill programs demonstrated some of the best copper grades I have ever seen in my life. Holes such as 43 meters of copper grading 13.74% and 11.28g/t gold were prolific (and these numbers work out to 20% CuEq).

It made the high-grade copper mines in the Congo look like low-grade moose pasture. At the time, I couldn’t have been happier for Miles and his team. I even called my parents (who Miles spent time in Europe those two summers) to let them know our favorite English geologist made a big score!

The exploration assets in Serbia were valued at CAD$1 million in 2009, and today the project is valued at CAD$1 billion.

That is a 99,900% gain. It’s one of the greatest case studies I’ve ever seen first-hand of how you can make massive returns in the natural resource sector.

Over the next few years, the company continued to hit incredible drill holes with high-grade copper mineralization. In 2016, the company was the target of a bidding war between Nevsun and Lundin Mining.

This sent the stock of the spinout company, Reservoir Minerals, soaring…

It was one of the few times that the legendary Lundin family has lost a takeover attempt.

Nevsun Resources emerged as the buyer of Reservoir Minerals.

In Play – The Battle for Nevsun is Heating Up

In my June 2017 issue of Katusa’s Resource Opportunities, I published a detailed analysis and a breakdown of a great way to play the electric vehicle revolution and soaring demand in copper.

And that was through Nevsun (NSU.TO).

Here was my investment thesis on Nevsun and why I became a big buyer of shares. In that June 2017 letter I wrote:

I believe Nevsun is the target of a buyer. I believe Lundin Mining will buy out Nevsun.

Let me tell you why.

First off, Lundin Mining is flush with cash, with over USD$1 billion in cash from its recent sale of its interests in the Tenke Fungurume copper mine.

Secondly, few people know that the Lundin family actually owns a mill from a previous mining operation in Spain, which would be ideal for the Timok project in Serbia that Nevsun owns (more on this asset in a moment).

The Lundins have a long successful track record of working with Freeport, which also sold its interest in Tenke Fungurume at the same time as the Lundins, and is Nevsun’s partner in Serbia.

The Balkans are different than the rest of Europe. I’ve done business in every region of the Balkans. It’s a different mindset. It’s a frustrating place to do business if you don’t know how to navigate the Balkan way.

The government of Serbia is very well aware of what this project means to the region with respect to jobs and putting Serbia in a positive light internationally. That said, the lawyers the government has representing the Serbian interests are smart, and tedious and will outsmart any consultant who has no previous experience in the Balkans. This is where I think Nevsun has done a poor job thus far.

I know the Lundin family very well personally. They would thrive in Serbia. And the Serbs wouldn’t mess around with someone like Lukas Lundin.

Another little-known fact: Lukas Lundin was a major investor in Serbia in the early- to mid-2000s with a longtime family business associate and advisor. I know this because in 2004, the advisor asked me to visit their assets and report back on my findings (I speak Serbian). The Lundins know how to do business in Serbia.

But there is a big “but” to this thesis.

I do not believe the Lundins will go into Eritrea, which is the country where Nevsun’s producing mine (called Bisha) is in. Therefore, I believe we have some time on this speculation. Why? Because the banker that puts this deal together will need to do a three-way deal. The Lundins will buyout Nevsun while instantly selling off the Eritrean mine.

Why would the Lundins not want the Eritrean mine?

Two reasons. First, the mine is just too small for Lundin Mining. The second reason is political. The Bisha mine is the largest foreign mining operation in Eritrea, and I don’t think the Lundins would want to bother with all the political backlash that would come from their shareholders for going into Eritrea.

But I know of many Chinese mining companies that have zero issues going into Eritrea. In fact, I know of many that would love to have an operation like the Bisha mine.

What do I Think Will Happen With Nevsun Going Forward

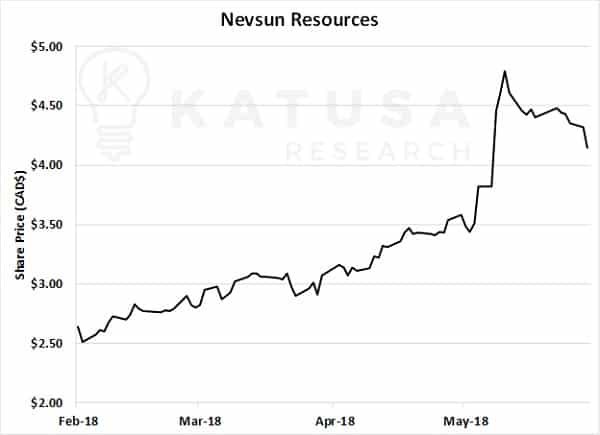

Nevsun stock has been on a tear in the past 3 months. At one time it was up nearly 100%…

Nevsun’s CEO, Peter Kukielski, wants to develop the Timok Property in Serbia into a mine. And I do believe he can do it.

However, I disagree with him on this. And I met with Peter in late 2017 and stated to him that I believed Nevsun would be acquired by a larger company. Simply because the world-class assets in Serbia were very cheap because of Nevsun’s stocks price at the time.

When I met with Peter personally, I asked him to sell Bisha and use the cash to advance Timok, so that the company would go into play delivering shareholders significant gains. Peter didn’t like my strategy. He wants to build Timok in order to create significant cash flow.

Is Peter wrong? NO. But rarely does this plan get executed to benefit shareholders. I’ve seen it fail for one reason or another many times before.

Peter wants to build a world-class mining company. I respect that. However, my interest is only to make money while limiting my downside risk. And with Nevsun now in play – it’s a catalyst that any large shareholder would want to take advantage of.

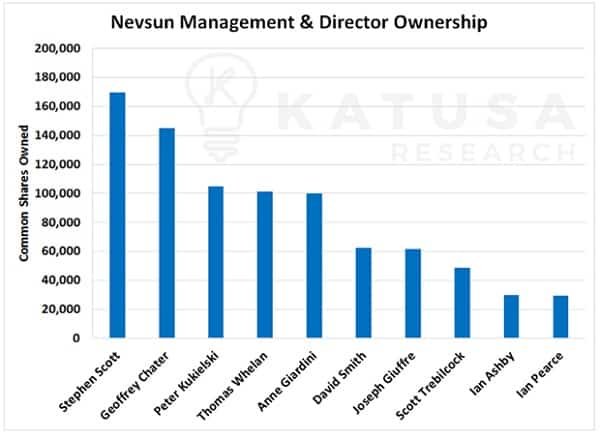

That said, I owned more shares than any of the insiders of the company, and I believe my invested amount of capital is greater than all of the insiders combined.

Peter doesn’t own enough shares (even combined with the rest of the insiders) to fight off any hostile bids if one comes.

Based on the number of shares that management owns (skin in the game), they’re more geared toward Nevsun succeeding in the long term than a buyout windfall.

Several years of high six and seven figure salaries that could amount to millions of dollars over the years are lucrative to management teams. It’s more lucrative than a one-time six-figure payout based on management’s shareholdings and a two-year golden parachute clause buy out.

This is why skin in the game is an important factor to consider.

So, what do I see happening?

First off, me and all my subscribers have already locked in a Katusa Free Ride. I have taken all my risk capital and more off the table alongside my subscribers.

It was a nice gain, not a 10 bagger, but a respectable win in a tough resource market.

I believe Peter and the Nevsun team will try to bring a large investor in at the Timok asset level in addition to an offtake agreement. To make matters more complex, the Serbian government is looking to sell the Bor Mining and Smelting business this summer. Given the proximity to Timok, Bor would be the likely smelter. It’s feasible to think that a company like Zijin, Glencore or Rio Tinto could buy into both Nevsun while simultaneously acquiring the smelting complex.

Peter will probably get his way and will build the mine. Time will tell if it was the right choice—either way, Katusa Research subscribers have a risk-free way to play Nevsun—which is by far the prudent way to play the current situation.

Nevsun was a core copper holding in my portfolio. Me and my subscribers did very well on that pick.

Two days ago, I published my thoughts on two more takeout candidates that I believe will see Nevsun type returns (or better). And I have my money where my mouth is.

Regards,

Marin

P.S. We’ve had thousands of responses to our challenge from last week. As expected, about 10% of the responses (of which came from junior mining IR employees) were of companies that didn’t even qualify. Those IR guys are now put in the moron list forever. However, there was one individual who presented a company (one I knew), but with a thesis, I did not think of myself. Our team is already working on deep due diligence on this company and working hard to see if it’s worthy of our subscriber’s attention. If it is, my subscribers will be the first to find out.

Note: I just published my June report nearly a week earlier than scheduled. I want subscribers to know the details behind my next two take out candidates that could deliver 100-200% in short order. It’s all featured in the June edition of Katusa’s Resource Opportunities – which is one of my most in-depth to date – click here to learn how to get access to the report.