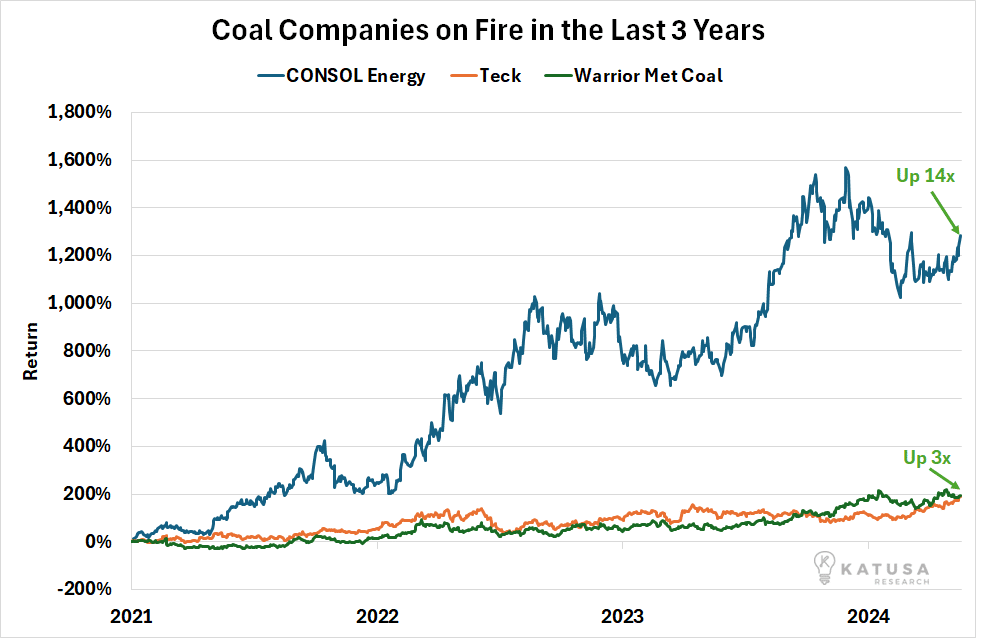

Coal stocks have been on fire the last 3 years.

Companies like Teck, Consol Energy and Warrior Met Coal have seen their stock rise, big time…

Coal stocks are rocking, despite the fact that coal is the single largest source of carbon dioxide (CO2) emissions, and nearly every western country wants to phase out coal.

But demand keeps climbing and is expected to reach a fresh demand record in 2024 according to several forecasts. All despite the anti-coal coalition.

Let’s get into what you need to know…

Countries Against Coal Fire

At the end of April, ministers from the G7 nations – Canada, France, Germany, Italy, Japan, the UK, and the U.S. – came to an agreement to ban coal power by 2035.

While an exception to the phase-out does exist in that “abated” coal plants, such as those utilizing carbon capture technology to remove their emissions, will be allowed to continue operating past the target date, the net result is still the same:

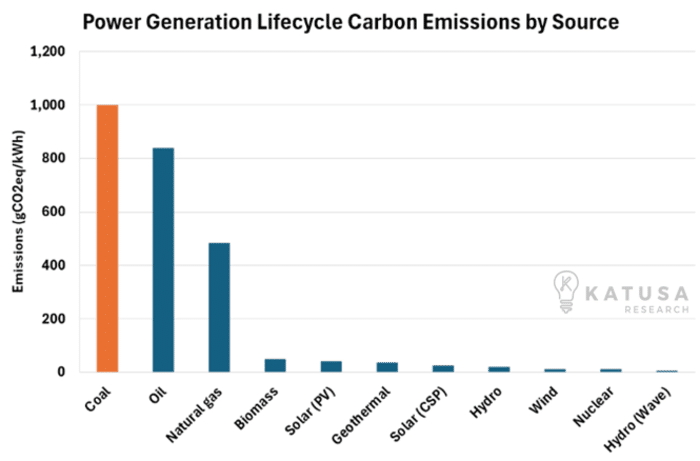

Coal, long the dirtiest of all our power generation options, is finally on its way out…

… or is it?

Not All G7 Members Are Starting from the Same Line

In the ongoing fight against climate change, coal is one of the targets that usually gets the most flak – but rightly so.

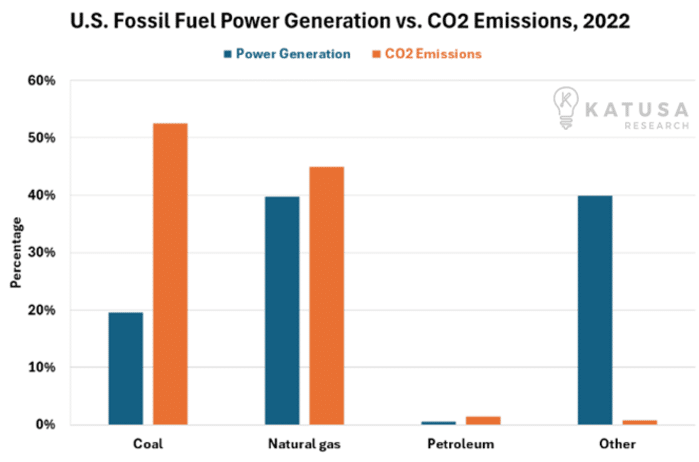

For instance, in 2022 coal accounted for over half of all CO2 emissions from electric power generation in the U.S., yet only produced just under 20% of its electricity.

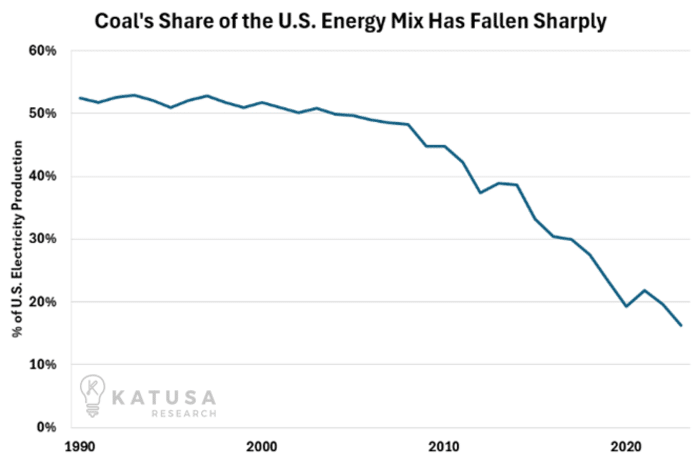

As recently as the turn of the millennium, coal still accounted for over half of the U.S. power mix.

A concentrated effort to transition away from coal power has seen that proportion drop by nearly 70% in just two decades.

That’s a clear sign of what America’s industrial complex can achieve if the willpower, and the funding, is there.

- If the U.S. can sustain that same pace of replacing coal plants for the next decade, they’ll be right on track to eliminate coal from the power generation mix by 2035.

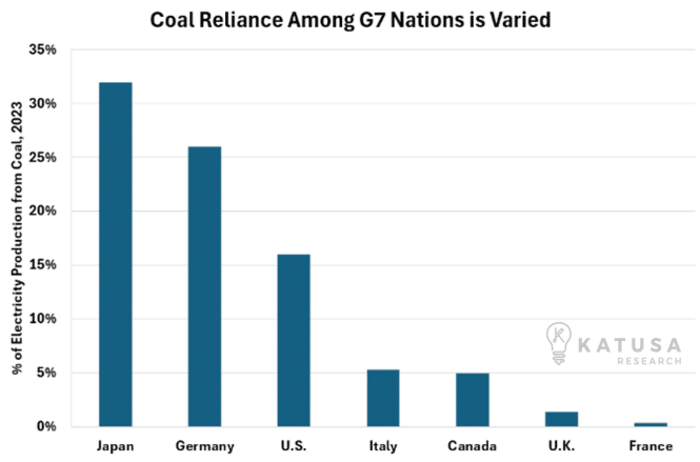

Of course, the U.S. is just one of the G7 members. How does coal power stack up amongst the other nations?

It turns out that there’s actually quite a spread across the G7 members…

While some like France and the UK are basically already there (the UK’s last coal plant, Ratcliffe-on-Soar, is scheduled to close in September), you have Japan and Germany on the other end of the spectrum.

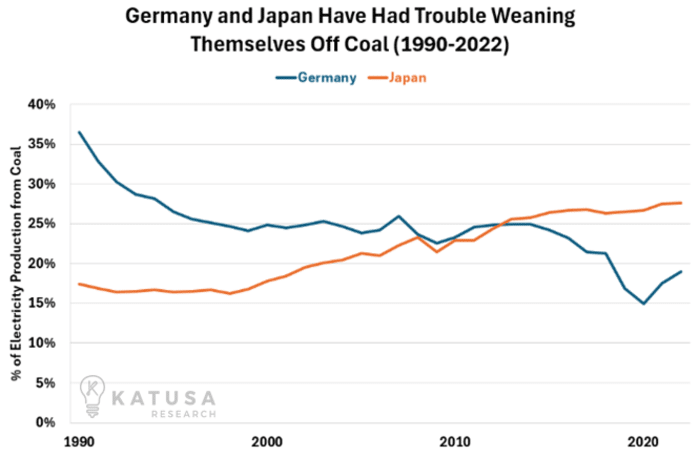

- It’s particularly worth noting that Japan and Germany were the two countries that reacted most harshly to the 2011 Fukushima incident, with both seeing marked shifts in energy policy away from nuclear power immediately following the disaster.

Germany has successfully reduced its coal dependency, pivoting sharply towards renewables post-Fukushima.

In stark contrast, Japan remains entangled in its fossil fuel reliance, with energy production from these sources soaring from 81.1% to 93.5% after the disaster.

Today, coal’s role in Japan’s energy mix is not just persisting but increasing.

Japan is so entrenched in coal that instead of phasing it out, it’s doubling down with carbon capture initiatives and co-firing green ammonia.

While Germany leads the G7 in renewable energy, producing over half its power sustainably, Japan appears stalled, likely to continue coal imports well beyond the 2035 deadline.

Forget the G7, What About the G188?

Unfortunately, while the G7 agreement is undoubtedly a step forward towards net zero, it’s just that – a single step. There are still 188 other countries in the world to worry about, after all:

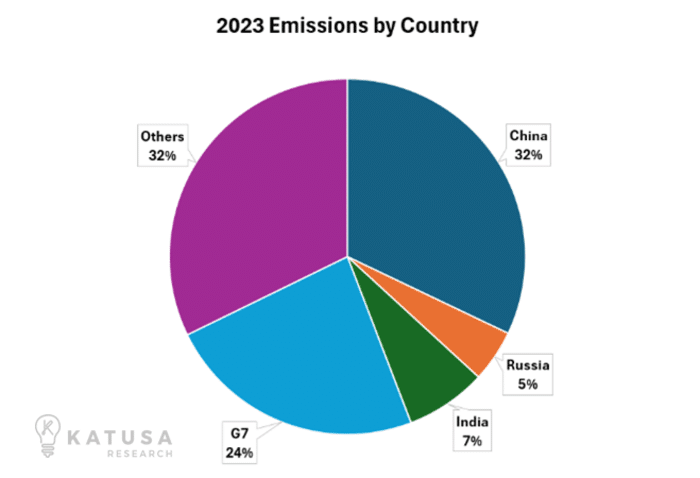

The G7 accounts for less than a quarter of global CO2 emissions, dwarfed by China’s output…

- This exceeds the combined emissions of the entire G7 plus India.

- China alone consumes one-fourth of the world’s coal for power.

Western nations, having built their economies on affordable coal, have transitioned more easily to clean energy. Meanwhile, developing countries face challenges as they’re urged to avoid similar paths.

Focusing on coal’s immediate future, note this: Despite China’s rapid construction of coal plants, their operational use is declining. Last year, while China added 96% of new global coal capacity, these plants were active only half the time.

This trend hints at a paradox where China might continue expanding its coal infrastructure yet reduce its coal consumption annually.

From Peaker Plants to Peak Coal

Long story short, while the G7’s agreement to phase out coal might not actually cover as much of the world’s emissions as you might think, things might be turning around for coal anyway.

For instance…

- Wood Mackenzie, a leading energy research firm, believes that peak coal will happen this year.

- The International Energy Agency thinks we’ve already seen peak coal – last year, in fact – and that demand will be falling annually from here on out.

Whatever the case, though, it’s not as if demand for coal is going to suddenly vanish overnight.

In fact, it won’t even vanish by 2035.

It’ll be a long and slow decline as countries like China continue to build out cleaner sources of power.

All the while keeping coal as the emergency option in their back pocket – just as Germany had to do in 2022 following the Russian invasion of Ukraine.

But coal still accounts for roughly 36% of total global power generation.

So there’s still billions of dollars of investment that needs to be made in renewables, nuclear, and even natural gas… before we can finally do away with coal for good.

And that means there’s plenty of opportunities left to make money on coal.

Even if it’s from the transition away from it, and not directly off coal itself.

Regards,

Marin Katusa

P.S. Our KR Special Situations Team is working on uncovering an interesting and fast-moving opportunity in the precious metals sector.

With Gold touching record highs again early this week – this is an emerging story worth monitoring.

More on this next week.

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.