There is money for resources on the sidelines.

A lot of it.

It’s been sitting there for a while, and now it’s coming in.

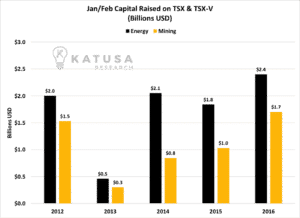

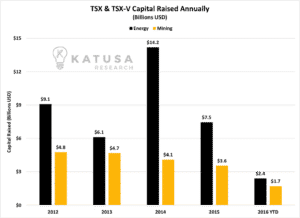

In fact, the first 55 days of 2016 have already seen almost 50% of the capital raised in the mining sector during all of 2015.

With resource majors like Freeport McMoRan up over 120% in less than 5 weeks, Barrick Gold Corp up over 75% and Kinross Gold Corp up 50%, investors are itching to get money into this gold market.

For the last few weeks, I’ve been receiving at least six calls or emails per day from bankers, inquiring about potential Private Placements and bought deals. I have not seen this level of interest since the market top of 2011.

In fact, 2016 has seen 50% more financings for the Canadian publicly-listed miners than 2013 and 2014 combined during the first two months of the year.

What does it mean?

A few things.

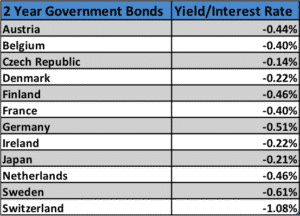

First off, with (NIRP) Negative Interest Rate Policy becoming a harsh reality for most of the developed world, a tax on wealth and savers is happening now.

Thirty-five percent of the EU nations have negative interest rates. The other 65% are basket cases. This trend will only get worse.

Meanwhile, many media pundits and newsletter writers are calling out the Fed’s ability and intelligence in a NIRP world. Sorry to pop your bubble, but the fed hires smart people. The writers who bash Yellen and all the other central bankers couldn’t last a week at the fed. So ignore the cattle calls from the cheap seats in our sector. Focus on the facts.

So what’s a smart speculator to do?

Gold is one of the few places where you can allocate money for the purpose of capital preservation and the hope of some return via price appreciation. Though there is a large group in the market who disagree and believe gold is still a negative carry and has down side risk.

A negative carry is what happens when holding an asset costs you more money every year than you gain from it. So for example, if you hold gold bars, then you need to pay for the storage and safety of your asset while those bars don’t pay you anything in return, like interest or dividends. That’s called a negative carry.

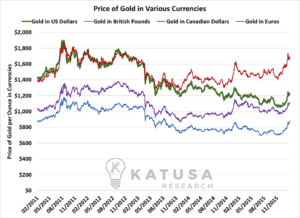

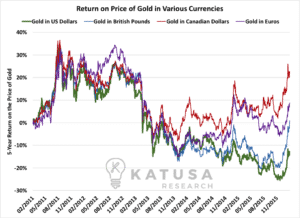

But what the pundits don’t understand is, with the currency depreciation around the world, gold has been the safest form of money to be in.

Gold is now up in every global currency. This is a bullish sign.

Thus it’s no surprise that, so far in 2016, the price of gold has appreciated around 15%. In the Canadian markets alone, we have also seen over $1.7 billion dollars raised for mining equities in the first 55 days. This is a huge amount of capital for that type of time frame. Take this for comparison purposes: $3.6 Billion was raised in total in the first two months in the last four years.

As you read this, I am meeting with the top executives who make the decisions at the world’s largest gold producers. I’ll be at the BMO Capital Markets’ 25th Global Metals & Mining Conference from February 28th-March 2nd. I’m here to figure out what all the producers have to say about their own future.

I have meetings booked with over 30 producers in a span of 4 days.

Shortly, I will report whether this Golden Bull is for real or if it’s merely a Skinned Bull.

Marin Katusa