An Open Letter to David Einhorn: Technical Reasons why you are Wrong about your “Mother Fracker” Short

Dear David Einhorn,

I like you.

I have great respect for your work, your work ethic, and your balance of career and family.

I’ve read your book, ‘Fooling Some of the People All of the Time’, and enjoyed it. You may want to read mine, The Colder War. A New York Times Bestseller, it will give you a good background on the geopolitical aspects of the energy sector.

You have made some great calls in the past. The largest short of your career, in Lehman Brothers, impressed the world. However, in my opinion your public comments and research regarding Pioneer Natural Resources, and what you call the “Mother Fracker,” is dead wrong.

Like you, I have spent most of my career as a fund manager. My sole focus has been on the resource sector in North America and internationally. I was very early to the shale oil and gas sector in 2006.

In 2007, for example, I was the financier and largest individual investor in Cuadrilla Resources, the most successful European unconventional energy company, with a market capitalization valuation today in the billions of British pounds. Lord Brown (former CEO of BP) is the Chairman of Cuadrilla and Riverstone is a major shareholder.

David, full disclosure, I have no skin in your “Mother Fracker” fight. I am neither long nor short Pioneer. I do not own a position on either side. My purpose with this letter is to present an unbiased perspective for all the investors and speculators who are following your call on Pioneer, which I think is misguided.

Challenge me if you like, but let me say where, in my opinion, you went wrong, David.

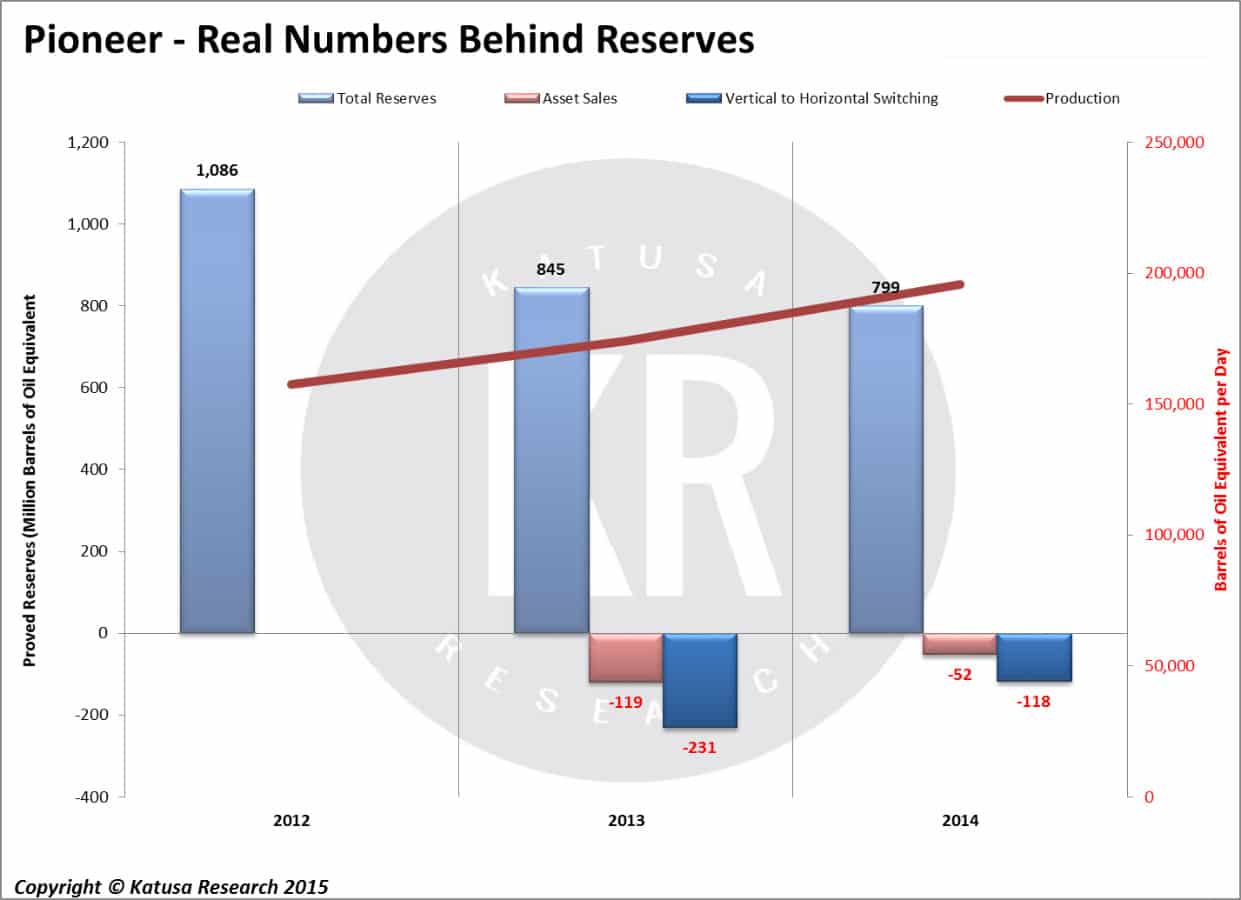

- Your depiction of Pioneer’s declining reserves over 2012 to 2014, while capital expenditures continued to climb, was biased and incorrect.

- You (or your analysts) need to pay closer attention to price realization due to the dynamic environment within the US oil & gas landscape. Pioneer is expanding its US Gulf Coast and international exposure, something did not take into account.

- Using the wrong financial model: You need to think of Pioneer as an asset manager, not a perpetual oil producer.

- Innovation. Never underestimate innovation in the oil patch. Pioneer has a great team. They were key to unlocking the Eagle Ford, and have now moved on to unlocking the Midland Basin.

Let me explain each of these.

- Your depiction of Pioneer’s declining reserves over 2012 to 2014, while capital expenditures continued to climb, was biased and incorrect.

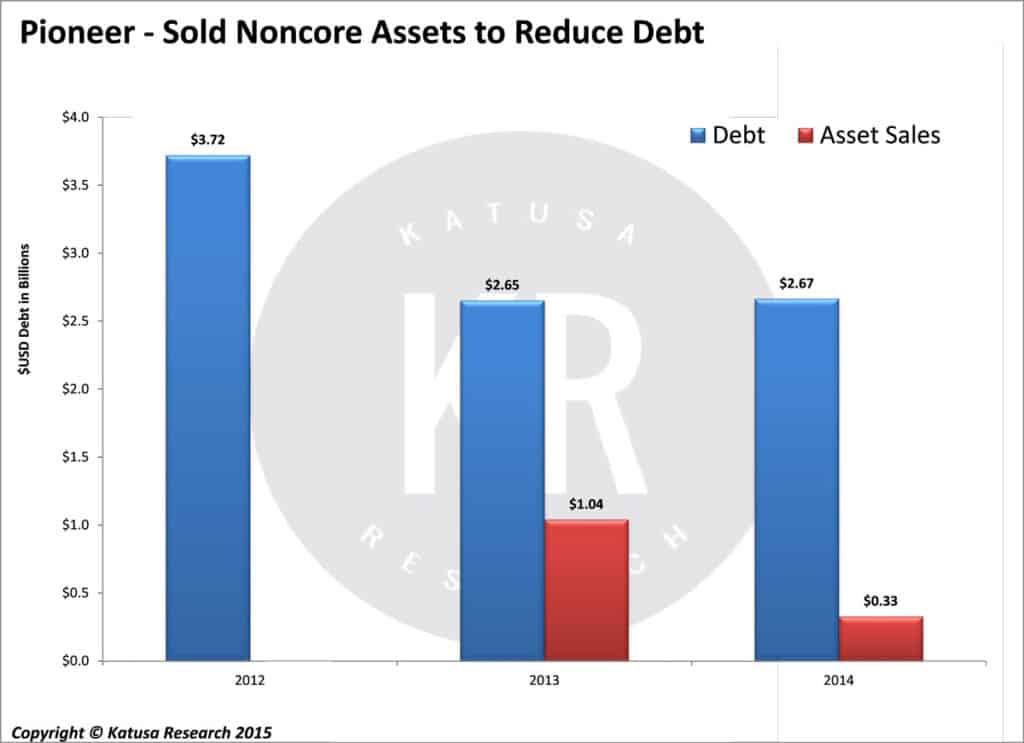

David, you completely ignore and fail to address the amount the asset sales contributed to the declining oil reserves. Those sales were from costly fields in the Barnett, Hugoton, and Alaska. Pioneer sold those assets in a hot oil and natural gas market and as a result was able to reduce debt. This is critical.

Another serious omission in your reserve analysis was a failure to incorporate vertical drilling write-downs.

Pioneer wrote down 500 million barrels equivalent in proven reserves due to shut-ins of 10,000 vertical wells. According to the SEC regulations, shutting in vertical wells that initially prove up barrels in the acreage, yet having no intention to bring those wells back into production, warrants a write-down of those reserves.

So what does this mean?

Pioneer continues to drill new horizontal wells in the same area that they shut in vertical wells, but they are unable to book any oil reserves after the area has been written down. Though the reserves are gone on paper, they still exist in the ground, because of the horizontal wells that will unlock that value.

If you were to incorporate the vertical well reserve write-downs, reduction in debt due to asset sales, and increased production of over 10% over the last two years, the overall conclusion, contrary to your belief, would be net positive.

- You (or your analysts) need to pay closer attention to price realization due to the dynamic environment within the US oil & gas landscape. Pioneer is expanding its US Gulf Coast and international exposure, something that, again, was not taken into account.

Companies don’t simply receive WTI pricing on oil and NGL-pricing on natural gas liquids. Because of the US ban on crude oil exports, different regions in the US price crude differently. Depending on availability of crude, the differences or spreads vary from $5 to $15 per barrel.

Natural gas liquids (NGLs) are not one product, NGLs are made up of several liquids at varying prices.

Ethane is the cheapest of the bunch and Pentanes, also known as condensates, are the most expensive. Mexico and Canada import US condensates, mainly from formations such as the Eagle Ford, to blend into heavy oil for pipeline and train transport and refining. Recently a select group of US oil producers has been granted federal authority to export condensates to Asia and Europe that are refined into naphtha, diesel, and jet fuel.

Approximately 40% of Pioneer’s Eagle Ford production is condensates, and it is one of few producers with the right to export.

In 2015 Pioneer expects to ship 13,000 barrels per day of condensates to places where pricing premiums have been as high as $10 per barrel.

This equates to transport of 50,000 barrels per day of its Permian crude oil to Gulf Coast markets instead of markets in the Midwest. It is important because Gulf Coast pricing of crude oil is much higher than prices in the Midwest.

The lack of pipeline access to the Gulf Coast forces refiners to import international crude oil to meet refining demand. This is why Gulf Coast crude, priced as Louisiana Light Sweet (LLS), trades at a premium to West Texas Intermediate (WTI).

Figure Source: PXD Q1 2015 Presentation

With 65% of Pioneer’s Permian crude heading to the Gulf Coast, the company will benefit from the price differential. This is something your analysis failed to incorporate into your thesis.

With higher realized pricing from Eagle Ford condensates, combined with Permian crude oil and hedges in place for 2015 and 2016, Pioneer has sheltered itself from downward pricing pressure.

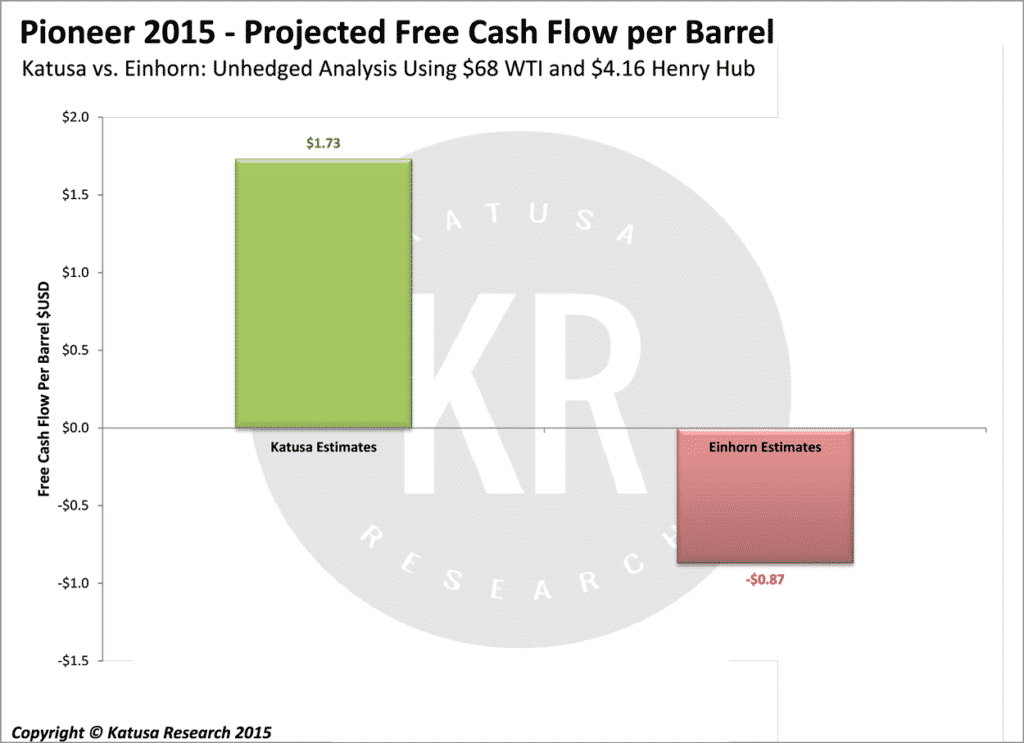

In fact, in 2015 Pioneer has hedged 90% of its oil & gas production. Hedging and higher price realization will result in more realistic numbers compared to your unhedged estimates.

This is a big gap. Failing to account for hedges and benchmarking to WTI pricing, according to your analysis, Pioneer could lose $67 million. However, adjusting for the hedges already in place, Pioneer is on track to earn $117 million in free cash flow.

That leaves me stumped when you mention a $200 million cash burn in 2015. David, your analysis here is simply incorrect.

“Development Costs”

That back-of-the-napkin all-in cost you calculated on a $68 WTI oil price and $4.16 Henry Hub gas has some shortfalls.

For one, you simply incorporate 10 years of net capital expenditures as total development costs. That isn’t telling the whole story, and it’s the wrong way to go about analysis in the oil sector.

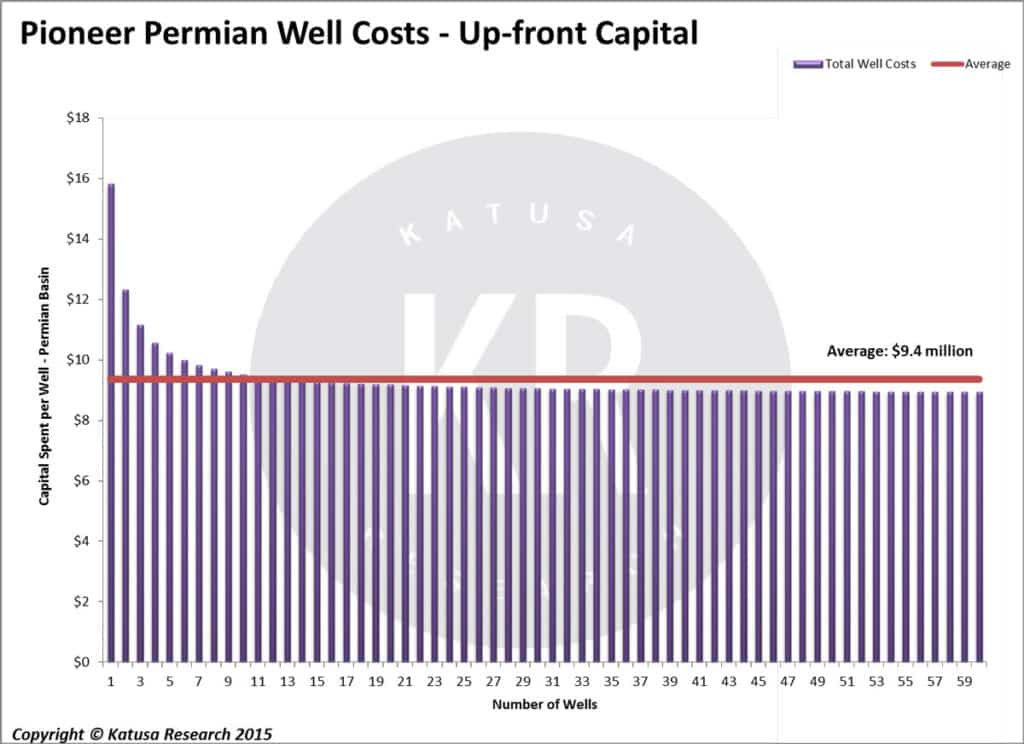

Oil & gas companies front load their capital costs as they build midstream assets to transport, hold, and distribute their oil & gas production. Thus, you are equating costs that result in tangible assets with development costs. That is like saying that Coke incurred $5 million cost per bottle for the first 10 bottles it produced, including the cost of a $50 million factory.

For Pioneer, a 60-well program in the Permian would require capital to build tank and battery facilities that would cost $7 million. According to your calculations, wells could cost up to $15.8 million per well. But those costs should be spread out over the 60-well program. That yields a figure around $9.4 million per well, not $15.8M. You’re adding 40% to what the real costs would be. You should know better. Shale oil wells must be looked at as an assembly line, and you must incorporate many wells, not just the first few wells, to get an accurate cost base. Otherwise, you’re ignoring the developmental wells in the field.

As Pioneer increases well counts you will see the average “development costs” fall. In addition, Pioneer can sell those tangible midstream assets, which they plan on doing with EFS Midstream.

With decline rates lowering production from the average Permian well, the $9.4 million cost per well will result in a positive return on capital of just under 25%. In the oil patch, that is very respectable.

We calculated this number by using your assumptions of $30 per barrel cash flow before capital expenditures. Thus, when you exclude costs associated with midstream assets, the economics of $68 oil and $4.16 gas are positive.

- You need to think of Pioneer as an asset manager, not a perpetual producer.

You value Pioneer as a perpetual growth producer. That is wrong.

Whether it’s EOG, Pioneer or other US E&P’s, they must adjust spending or adjust production growth during sustained lower oil prices.

Think of Pioneer’s core acreage in the Eagle Ford and Midland Basin as the blue chip companies in the S&P 500 and the surrounding acreage as growth stocks in various cyclical sectors. You rely on blue chips in a market downturn, but in better times and with constant innovation, many growth stocks evolve into large and stable blue chips. Not all, but some. The innovative companies are the ones you want.

David, you pulled a Homer

Thus, to draw on your Simpsons analogy, the chocolate never goes away. Companies dip into the chocolate stash when times get tough and they need to feel much better. And when hard times return? Marge has already stockpiled more chocolate ice cream from the Kwik-E-Mart.

Source: Einhorn Sohn Conference Pioneer Presentation

To assume perpetual production and cost growth while pricing remains static oversimplifies the cash flow from a producer like Pioneer. Analysts often project short term cash flows based off current reserves as a proxy for future cash flows with current production techniques and costs. This isn’t a bank stock and you can’t apply a similar model when analyzing the oil patch.

- David, where does Marge Simpson get all the chocolate ice cream for Homer? The answer: Innovation.

Exploitation of the Permian basin goes back a long way. A really long way, actually: oil from the Permian helped fuel the American war effort defeat the Nazis in World War II.

But it was not until 2010 that the Permian Basin’s deep formations were tapped commercially. This was a result of trial and error from companies locating sweet spots in acreage and using advanced drilling & completion technology.

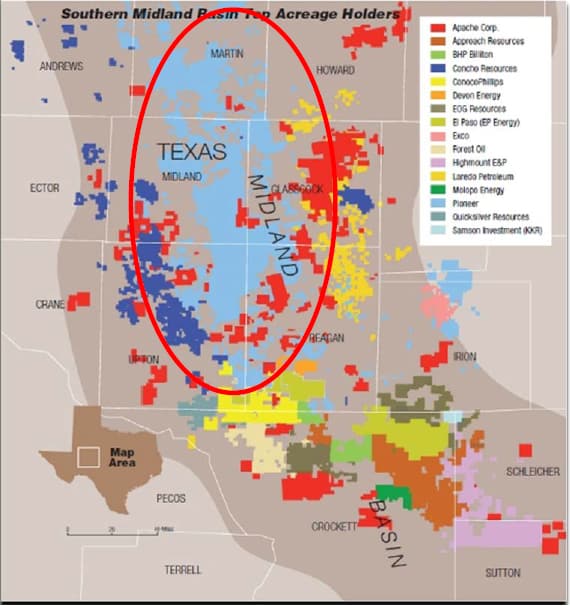

Pioneer found the ultimate sweet spot in the Wolfberry trend of the Midland atop more than 2,000 ft. of pay in the Spraberry and Wolfcamp formations.

Being a first mover, Pioneer has secured prime acreage right in the middle of the Wolfberry trend. In 2010, Pioneer was in the seed stage of having another elephant oil formation by the tail. Five years later, Pioneer is experimenting with innovation to lower costs and increase efficiencies (as EOG has done in other formations).

Source: EOG Presentation 2015

The Re-Frack Revolution

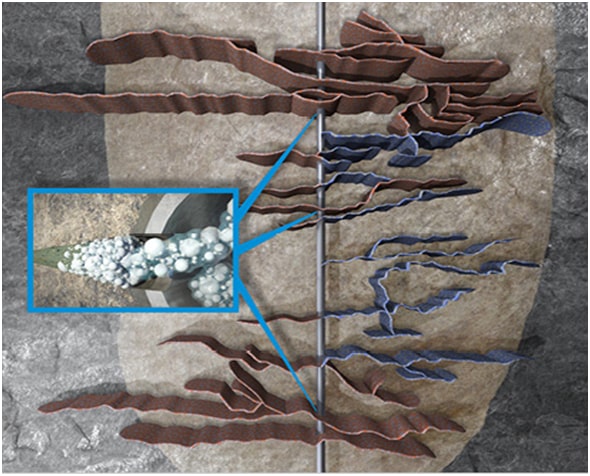

Interestingly, I had been analyzing re-fracking opportunities by Pioneer and others earlier this year, and I became aware that Pioneer is using part of this technology to fracture new Permian wells.

Fracturing US shale formations requires a plug technique where a fracture stage is followed by the plugging of that stage and another fracture stage follows. Fracturing, plugging, re-entering the well, and then drilling out all the plugs is time-consuming. Pioneer moved to dissolvable plugs, which brought drilling and completion times down by 50%—to 15-16 days—in the last two years.

Pioneer is also further improving wells by using the divergent chemical provided by Schlumberger (the world’s largest energy service provider) that originally plugged existing Eagle Ford wells in a re-frack.

It is using this diverting agent on new wells in substitution for plugs, to keep pressure within the well. That lowers costs and increases recovery.

Whether it’s innovation out of necessity, or the natural learning curve of the unconventional companies such as Pioneer, this growth curve cannot be ignored.

Pioneer continues to improve, not only in production growth, but also in a better understanding of its oil resources and reserves. And that will only lead to better exploration success and lower cost development of its wells.

Warning: Hedge Fund Legends like David are not always Right

I run a hedge fund.

I have a lot of my own net worth in my hedge funds. I have done very well, but I make still make a lot of mistakes. I wish I was perfect, but I am not.

The best managers in the business have exemplary track records with blemishes usually only coming when they stray too far from their comfort zone and areas of expertise. I have suffered from that myself in the past, so I endeavor to stay focused on my wheelhouse of expertise, the resource sector.

It is a very complicated, very cyclical sector—a dangerous area for investors who blindly follow big-name hedge fund managers.

Even the best hedge fund managers, like you David, are wrong at times.

You are a media darling.

You’re a favorite at the Sohn Conference, and rightly so. You have made some incredible calls in your career.

But you are wrong on this one.

If you wanted to short a “fracking” oil company, there are many better candidates than Pioneer.

Over the last decade, I have done extensive research on the innovators in the shale sector, such as EOG and Pioneer. I am now providing my analysis for free at katusaresearch.com.

Why? Because I can. I love what I do, and have fun posting and sharing my analysis.

I have financially modelled short-term scenarios in which all the producers must adjust to changing oil prices. My team and I track the innovations and spending as oil prices fluctuate. I have been doing this for years.

Now, what is Pioneer worth?

Based on its short-term cash flows, net asset value, midstream and service assets, and peer comparisons, I believe a fair value for the Pioneer is somewhere between $128-$142 per share.

Yes, I share your view that as a whole shale producers’ equity values are a bit ahead of themselves. I publicly stated in mid-2014 that the energy markets looked shaky and it was time to lock in profits and to be careful. But your analysis exaggerates the situation.

If Pioneer’s share price falls to $78, as you project in your presentation, that’ll be our good fortune. I believe it will mark a great time to accumulate shares in the largest producer in the most prolific play in the Midland.

I recently picked a great entry price for EOG near the bottom. I am sure it was partly luck, but it was luck supported by my best analysis.

Source: Yahoo EOG 2-Year Chart

Both Pioneer and EOG are companies you want to own in a downturn, especially if the selloff occurs because of a short battle.

Both companies are innovators with great land positions. I also believe that both will benefit from other frackers’ fiscal mismanagement.

Cash is King

We are in a serious commodity deflation. As I have said many times, in such circumstances cash is king and debt is deadening. Pioneer and EOG have much cleaner balance sheets than their peers. Where others don’t, they have the ability to endure the current deflation in oil prices. This graph shows how Pioneer stacks up against some of its competitors:

Continental, Devon and Concho are all big oil US producers. Pioneer has much lower debt to market cap than its peer group. That is just one of many examples I can use to illustrate my argument.

David, no disrespect intended. As I said earlier, no fund manager can be in business for long without making his share of mistakes. I’ve made mine, and I believe that this is one of yours. My only intent with this letter is to present the perspective of one who has immersed himself in study of the oil patch for many years.

Regarding Pioneer, I just hope to give you something to think about.

Help a Friend

If you have a friend or family member who plan on following David Einhorn’s lead and plan on shorting Pioneer, be a good friend and send them this article. Help your family member or friend from making a serious mistake following Einhorn and forward this technical report on the reasons why David Einhorn is wrong on his Pioneer short.