As we close a year of market rebounds in the broad market, the commodity market lagged behind the Mag 7 tech darlings.

But now, with signs of market aggressiveness returning (risk on)…

That could pose for some face-ripping rallies in certain resource sectors.

Normally, markets and stocks catch my attention when they’re down significantly from their highs – or at multiyear lows.

That’s when my team and I will pull apart company financials, question every move, asset purchase, comp package, and company communication – and look for companies that have high reward, for the high risk.

It’s hard to buy things out of favor, which is why most investors give up.

But that’s exactly what I’ve done for two decades as an alligator investor…

The Electric Elements: Lithium and Copper

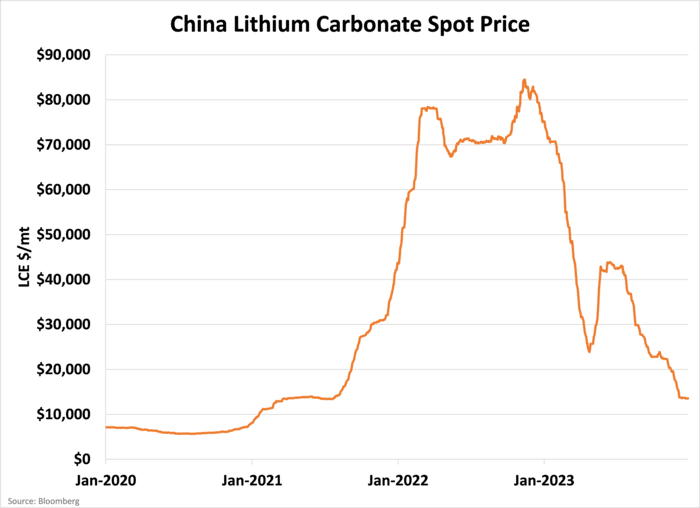

It’s time to pay closer attention to Lithium, and here’s why…

Despite a significant price drop, the opportunity in lithium is more electric than ever.

Tesla just announced its cybertruck deliveries and their new batteries are a major holdup…

- Road and Track reports Tesla “will need to raise its production tenfold to meet the quarter million units target”

In fact, Tesla sales in China have skyrocketed. And EV’s are becoming more and more popular.

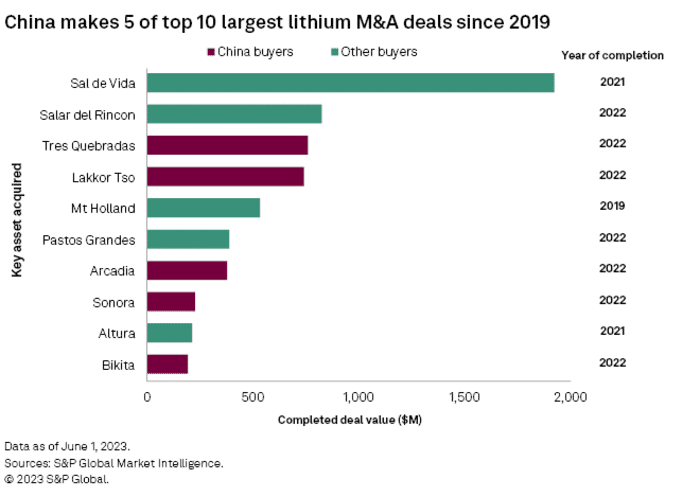

This isn’t a chess match China will fall behind on, either. So they’re starting to take over entire lithium mines…

China has started the “Ore Wars” and will flex its muscle to secure its supply. It just announced a cut to critical raw materials tariffs, and you guessed it – lithium was top of the list.

North American EV manufacturers are quickly realizing that they will need to procure subsidy-safe, non-China lithium for themselves.

The Copper Conundrum

Copper is not just a metal; it’s the backbone of our electric future – THE electric element if you will.

The past year saw many copper explorers and developers fall 50-80% – even while copper prices remained range-bound for the most part.

But, the copper price has jumped in recent weeks, gaining momentum on supply concerns, a potential soft economic landing, and a weaker dollar.

Here’s what’s happening that’s got my attention I’ve written about behind the paywall…

On the supply front, First Quantum’s Cobre Panama mine had its activity suspended due to disputes with the Panamanian government. The mine was responsible for 1.5% of world supply.

There were also strikes at the Las Bambas mine in Peru and pauses in BHP’s Chile operations.

Add in a slowdown for copper drilling activity in 2023 compared to the year previous and things are setting up quite nicely for copper.

In the latest December edition of Katusa’s Resource Opportunities, we profiled an early-stage company looking to change that exploring a copper asset…

With a team that’s done it before and made us money.

Carbon: The Dark Horse of Tomorrow

In the carbon market, the winds are changing.

Carbon’s split personality in 2022-23 – a bust in voluntary markets but a boom in compliance markets – is just the prologue.

Voluntary market carbon credits have all but plunged from elevated levels – while compliance prices continue to move higher and higher.

- The UK just announced “carbon import levy”, where the UK benchmark carbon contract is $46 per tonne.

- Germany jacked their carbon price by 50% with the stroke of a pen, from 30 to 45 Euros.

- Canada’s carbon price is set to increase yet again in 2024.

This is only the start. You don’t even see the carbon price on your Bloomberg screen, MSNBC or Twitter. But you will in the coming years, and look back wishing you were involved much earlier.

Here’s where the money is going right now…

Major financial investments are pouring into carbon capture technology.

This isn’t just about corporate profit; it’s about making decarbonization lucrative, attracting both corporations and the brightest minds.

In Q3 2023, climate tech startups, especially those in carbon and emissions, secured a record $7.6 billion in venture capital.

Despite low nature-based carbon prices, there’s a surge in interest and investment in carbon capture…

This includes significant ventures by major companies and startups, for example, 2 major deals recently:

- ExxonMobil’s $5 billion acquisition of Denbury Resources and strategic investments in startups like Avnos.

- Carbon Growth Fund just announced a $200M investment into Entropy. This growth fund is managed by the Canadian federal government. In addition to the $200M investment, it agreed to buy up to 1 million tonnes of carbon credits per year for 15 years at an initial price of $86.50 per tonne.

With carbon capture essential to reducing emissions, over 573 projects are underway globally, and the industry is set to grow exponentially.

I’m keeping a close eye on both the compliance and voluntary markets. And you should too.

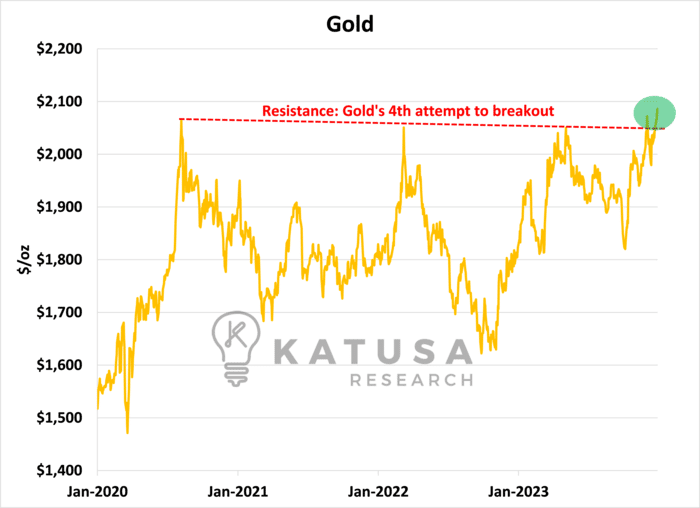

Gold: The Silent Giant Awakens

While the world was busy elsewhere, gold quietly breached and torched its all-time high in an epic and fast run. And now, gold has quietly made a solid run during the Christmas period.

Could a Santa Claus rally set the tone for 2024?

As shown below, this marks the 4th attempt for gold to burst out above $2,100 with force.

If that move was a sign of things to come, then a flash move up or down could happen very fast. Any decisive and sustained price move up, you’ll wish you owned more gold stocks, because we could be on the cusp of a gold rush like no other.

Look for gold to cross $2,200 for any period of time, then hold onto your hats.

There is a “feeling” out there that gold could be exiting its “Echo” market cycle.

And if that’s the case, you’ll want to stay away from gold companies with sexy stories in –SWAP line nations. You’ll definitely see a LOT of them coming out of the woodwork. Or you’re playing with elevated risk, as seen with Franco Nevada and First Quantum.

When in doubt, use the Katusa AK-47 Indicator to help narrow down your stock selection.

And if the gold price corrects further, you can scroll down to the bottom here and find some of the highlights of my gold stock checklist.

With that, I wish you and yours a healthy and prosperous 2024!

Regards,

Marin Katusa

P.S. I’m working on publishing a brand new recommendation in one of these sectors next week… the stock is up over 20% over the last week and I believe has much more to run. Get the name and full details in the January edition of Katusa’s Resource Opportunities.

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.