Anyone that owned stocks and bonds knows the pain of 2022.If you were a passive investor, no doubt your financial advisor or bank teller told you that it was among the worst ever years for the 60/40 portfolio.Few sectors left the year unscathed, but several sectors are catching my attention for 2023 and beyond.And today I’m going to share what sectors I’m keeping an eye on and why…

Carbon

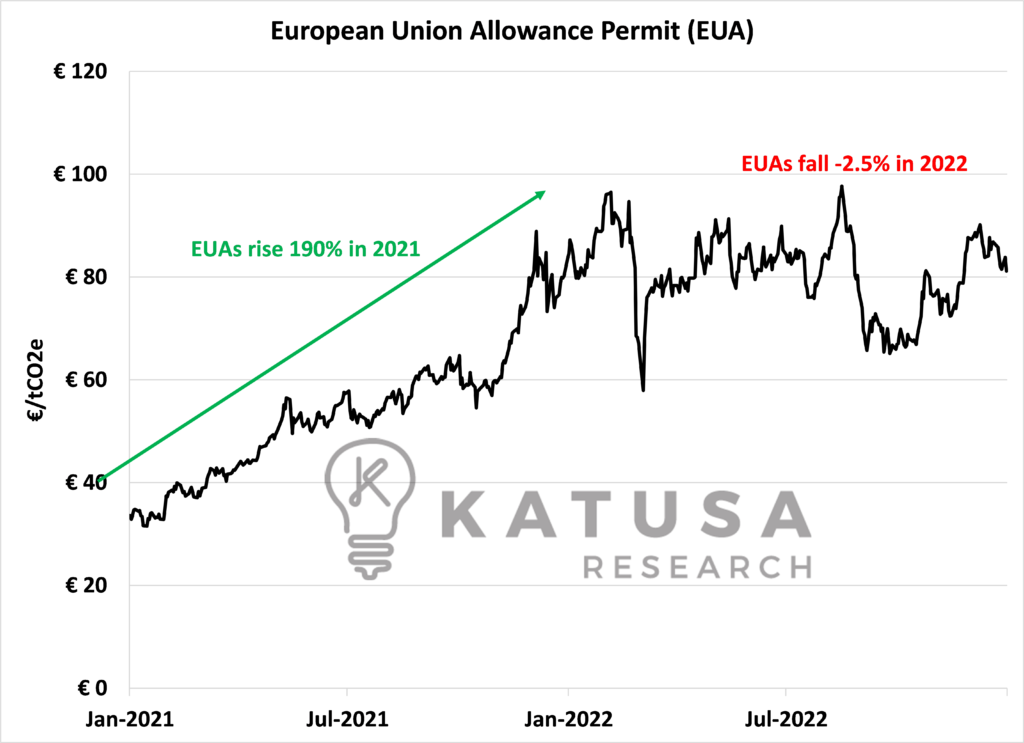

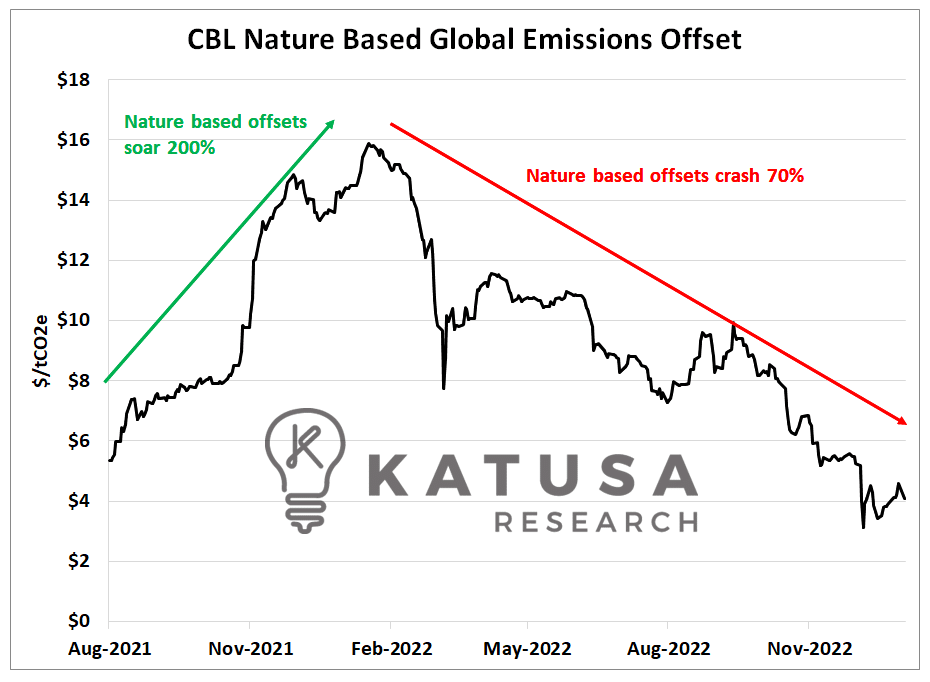

The carbon markets (and investors) enjoyed their first taste of what returns will be like in a real bull market in late 2021 and early 2022.Voluntary and compliance market prices reached record high after record high, only to come back down to earth.

Compliance markets fared better, with the European Union Allowance permit rocketing up in 2021, but closed 2022 with a dud.Though it performed better than its voluntary market cousin.

It feels like a distant memory, but at the time investors were caught up in meme stocks, SPAC frenzy, cryptos and trading gorilla and rock jpegs.No one paid attention to the official start of Carbonomics.Yet, dozens of major U.S. and Canadian banks and investment brokerages issued major analyst reports for the very first time on the sector, throughout the year.

- Major UK banks like Barclays and HSBC pledged USD $2 Trillion for investment in renewables and decarbonization.

- JP Morgan Chase ($2.5 Trillion) and Citigroup ($1 Trillion) just pledged the same at the end of December.

This is the opposite of a crowded trade, unlike crypto and tech stocks in 2022. No one’s paying attention – meaning the biggest gains are yet to come.With the calendar changing to 2023, most net zero 2030 commitments will accelerate faster than most investors realize.Why I Like the Sector:More and more investors are coming into the sector every day. This includes major pension funds, sovereign wealth funds and other “big money”.

Tesla is making major headlines, having just released its Q4-2022 financials and revealing its 2022 carbon credit sales hit $1.78 Billion.

Few outside Katusa Research are talking about it yet.But some major outlets are planting the seeds…

Carbon is not going away. It’s going to grow exponentially, and higher prices will be needed.

- Did I mention that the voluntary carbon market is growing at an obscene rate and finished with record transactions and dollar volumes in 2022.

There’s only one way to go over the coming years – up.How I’m playing it:The first half of 2023 will see continued pain in the carbon markets. However, companies in the carbon sector that were private and raised funds between 2020 and 2022 will need to show their investors the return on investment.For those who have done the right moves, more capital will follow them as they attract more capital to deploy into 2023 and 2024. For the rest, they will be on their way to money heaven.I am a major investor in many projects and I will have more on my strategy in the exciting carbon sector in the coming months.Time will tell if I’m right.But I’m betting a significant amount of my net worth into the sector – real, hard dollars.

Cybersecurity

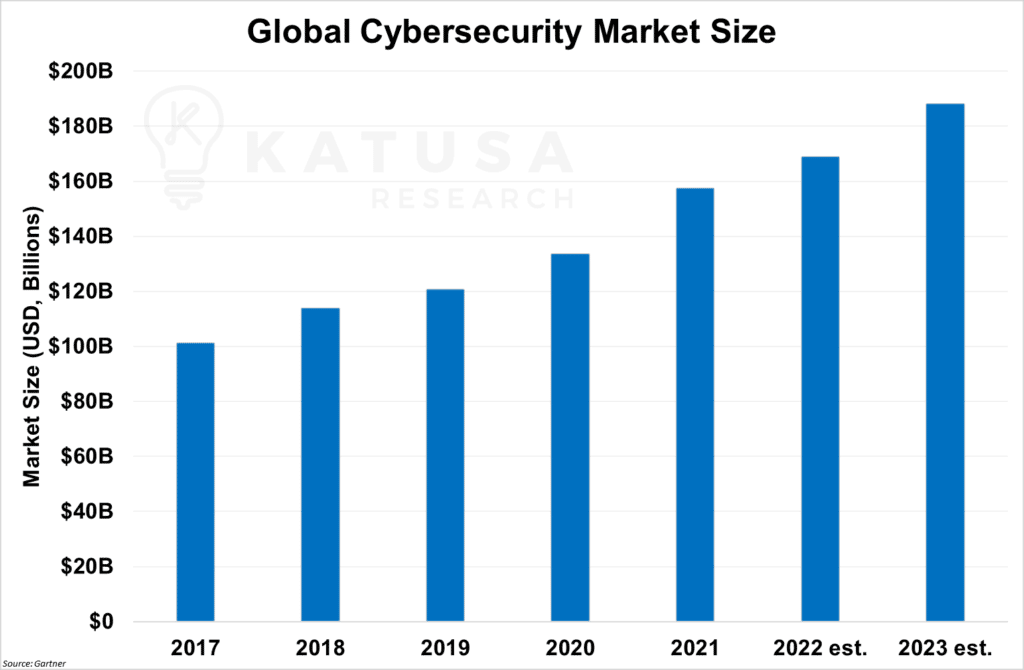

Warren Buffett called it “The number one problem with mankind.”In 2021, cybercrime accounted for $6 trillion in damages. And according to cybersecurity experts at Cisco, that number is expected to grow to $10 trillion by 2025.

- 1 out of every 10 firms experience a cyberattack each year. And a ransomware attack occurs every 14 seconds.

This has companies all over the planet spending major money on cybersecurity and threat prevention. And there’s big money in it.Why I Like the Sector:According to a study performed by Deloitte in 2020, the average company spends roughly 10% of their annual IT budget on cybersecurity.Microsoft alone spends $1 billion per year on cybersecurity.Cybersecurity is a massive industry with revenues slated to accelerate growth year over year.

How I’m Playing It:It’s not commodities, but this sector has my attention because it’s growing rapidly, and the company valuations (buyouts) are incredible.Even in a depressed market.For example, in Q3-2022 there were 62 deals for $8.9B in value according to Houlihan Lokey, the world’s leading cybersecurity analyst firm.That’s the quarter where the markets made major lows. And yet M&A was unfazed as private equity firms were scooping up cybersecurity firms for 12-16x earnings.Sectors like that always have my attention.

- Katusa Research will release a special situations report on cybersecurity sometime soon.

This is something you’ll want to pay attention to.

Gold (and in a small way, Silver)

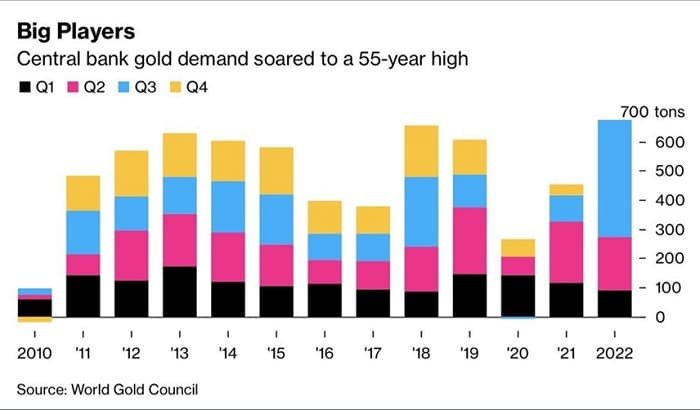

Central banks purchased A LOT of gold last year. It was the most active buying by central banks since 1967.

Big banks like Goldman Sachs are coming out with bullish forecasts on commodities, including gold.Stories are coming out from places like Austria and Canada where dealers can’t keep up with the physical demand.If you’re new here, there is a big disconnect between the paper price and the physical price of gold (and silver). Often as high as 40% markup.And in recent news, the US Govt is enacting law banning the purchase and transactions involving Russian Gold. The Gold Wars could be coming soon.Why I Like the Sectors:There’s no rush quite like a gold rush (and silver too). It’s a sector that offers explosive upside but is fraught with gut-wrenching downside.I’ve been to countless projects around the world, know all the major players and deposits.

- The commodity supercycle will come – and it feels like we’re coming very close.

How I’m Playing It:I have zero interest in pie-in-the-sky junior companies or typical rounders that peddle the same projects with different names in –SWAP Line Nations.Or countries that don’t pass my AK-47 Indicator Test.I want big, needle-moving projects that make sense even at depressed gold prices. And I want companies on major-league (U.S. exchanges).There are a handful of favorites I like in the gold sector and a select few of which I have large amount of capital in and holding on to for much, much higher prices.Could I be wrong? Of course.But you don’t get to live the dream by staying home. Fortune Favours the Informed and Bold.Paid subscribers to Katusa’s Resource Opportunities know the exact two Golden Elephants I’m riding, and why.

3 More Sectors I’m Watching

We’re getting longer than we originally planned with this edition.You can tell by the words and facts committed in this missive that these sectors have me excited for several reasons. And these aren’t just words.My excitement is met with significant bets in these sectors in the 6, 7 and 8 figures. Not a $5,000 swing trade.With that…Next week I’m going to release part 2 of my “What to watch in 2023” series.Stay tuned,Marin Katusa and Katusa Research

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.