Fed Chairman Jerome Powell gave his speech at the annual Jackson Hole Economic Symposium…In the months leading up to the conference, he noted the sharp run-up in inflation.However, he relaxed concerns and suggested that these high inflation figures were “transitory”.Meaning it would only persist in the short term by pointing to 5 different indicators.Based on those five indicators, Powell stated that he expected inflation to return to the Fed’s target 2% rate over time.It’s now been 3 months since Powell took his stand, and yet inflation has gone in the exact opposite direction.

- In October, the annual inflation rate in the U.S. shot up to 6.2% – the highest in over thirty years.

Opinions on Wall Street are still divided on whether or not we’ll see the return of the dread specter of stagflation that haunted much of the ‘70s.But there’s one thing that every analyst can agree on: Powell’s “transitory” isn’t going to be quite as short as most would like it to be.And to see why, look no further than the same 5 indicators that Powell referenced when he gave his speech:

SPONSORED CONTENT

Indicator 1: The Absence of Broad-Based Inflation Pressures

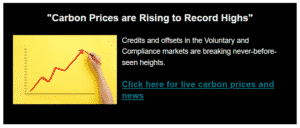

The first data point Powell pointed to when making his case against inflation being around to stay…Was that inflation was primarily being driven up by the prices of a narrow group of goods and services that were directly affected by the pandemic and the reopening of the economy.The most recent data for October, however, paints a different story.With many different types of goods showing remarkable price increases over the past 12 months:

There are now a wider array of goods driving inflation up. Beef, for instance, is up 20.1% since the same time last year.

Indicator 2: Moderating Inflation in Higher-Inflation Items

You’ve no doubt noticed that many goods and services that were impacted by the pandemic rocketed up in price.

But have since moderated somewhat in the wake of the recovery.

For example…

Used vehicles prices were up 45.2% earlier this June. But have since improved to a somewhat more reasonable 26.4% price increase.

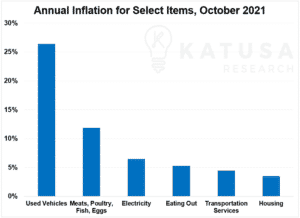

Commenting on this, Powell specifically mentioned that inflation in durable goods other than autos had slowed and was expected to fall – which would help lower overall inflation in turn.

However, the most recent quarterly data from the U.S. Bureau of Economic Analysis shows that not to be the case… with another 2.3% increase in durable goods prices from July through September.Recent increases in the prices of durable goods continue to reverse a decades-long downwards trend that began in the mid-’90s.And it’s still unclear as to when exactly this trend will resume as Powell expects it to.

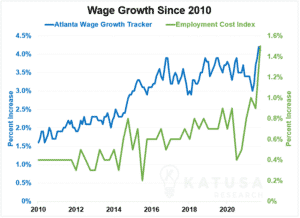

Indicator 3: Wages

At the time of Powell’s speech, there was little evidence of wage increases that would threaten excessive inflation.Citing broad-based wage measures like the employment cost index and the Atlanta Wage Growth Tracker, Powell noted that the increases in wages matched the Fed’s long-term inflation objective.

More recent data from the same sources Powell was referring to shows that wage increases have only continued to grow.The quarterly Employment Cost Index saw a record jump in the quarter ended September 30th.

- The Atlanta Wage Growth Tracker (3-month moving average) also broke past the 4% mark for the first time since just prior to the Global Financial Crisis.

At this rate, it’s quite likely that rising wages will continue to act as an inflationary pressure for the months ahead.

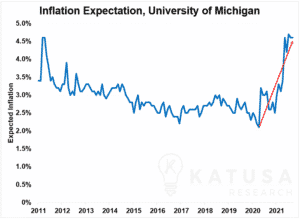

Indicator 4: Longer-Term Inflation Expectations

It may sound like a self-fulfilling prophecy of sorts, but what people think about inflation can be just as impactful as the rate of inflation itself.When people think high inflation is on the horizon, they’ll stock up on durable goods and look for higher-paying jobs.On the other hand, companies will look to trim costs and raise prices. And these actions can lead to further inflationary pressures.So, managing inflation expectations of the people is very important to the Fed as well.

How does the Fed monitor consumers’ expectations?The University of Michigan’s monthly consumer inflation expectations survey is one of the sources of data the Fed relies upon to check what the people think about inflation.Unfortunately, for the last several months in a row, this survey has consistently shown that people are still expecting inflation in excess of 4% in their future – for the first time in over a decade.This should come as no surprise either.Inflation is driving up prices across a broader base of goods and services, and hence becoming much more visible.

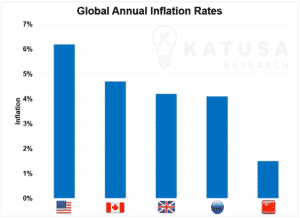

Indicator 5: Global Disinflationary Forces Over the Past 25 years

Powell closed out his segment on inflation saying in the last 25 years, most advanced economies in the world – not just the U.S. – had kept their rates of inflation at or below the 2% waterline.He attributed this to a number of global disinflationary forces, driven by:

- Changes in technology,

- Globalization,

- Demographics, and

- Central bank policy

But things aren’t exactly rosy elsewhere in the world either.Canada saw a near 20-year high inflation record in October. And it was a 10-year high in the UK.Over in the Eurozone, inflation hit levels not seen since the GFC.

And while China may look like it’s doing fine, that 1.5% rate is a 13-month high for China’s CPI.China’s numbers also hide a more concerning figure…

- China’s Producer Price Index (PPI), which tracks the cost of goods when they leave their factories jumped to 13.5% for October, up from 10.7% in September.

It’s a warning sign that rising prices might soon be getting passed on to consumers both domestic and abroad.As inventories get depleted and replacement costs rise, China might soon be seeing the exact same inflation woes already dogging Western economies.It’s hard to say whether this will significantly weaken the global disinflationary forces that Powell spoke of.But the cost of imported goods going up certainly won’t help lower inflation.

How Short is “Transitory”?

With most of Powell’s indicators now going the wrong way, it’s clear that the inflation we’re seeing isn’t going to go away by itself anytime soon.Plus, policymakers and economists tend to view monetary and fiscal policy on the timescale of years.So, “soon” to them probably isn’t the “soon” you’d like to hear.Many commodities around the world are still suffering from supply and demand imbalances, in many cases brought on by the coronavirus pandemic.But as the Chinese would say… you can’t spell “crisis” without “opportunity”.(For those of you who aren’t in the know – the Chinese word for “crisis” includes the character for “opportunity”).While the coming months of high inflation might mean more expensive groceries and fill-ups at the gas station…It might also mean the chance of a lifetime for your investment portfolio.To learn more about the market forces at work in our global economy…As well as the best way to leverage your portfolio to profit in both good times and bad…

- Consider learning more about my premium newsletter, Katusa’s Resource Opportunities.

Every month, I outline market sectors that are flashing signals to pay attention to. Including companies that I’m buying.And where I’m putting my own money.Regards,Marin